Irs Form 8960 Error

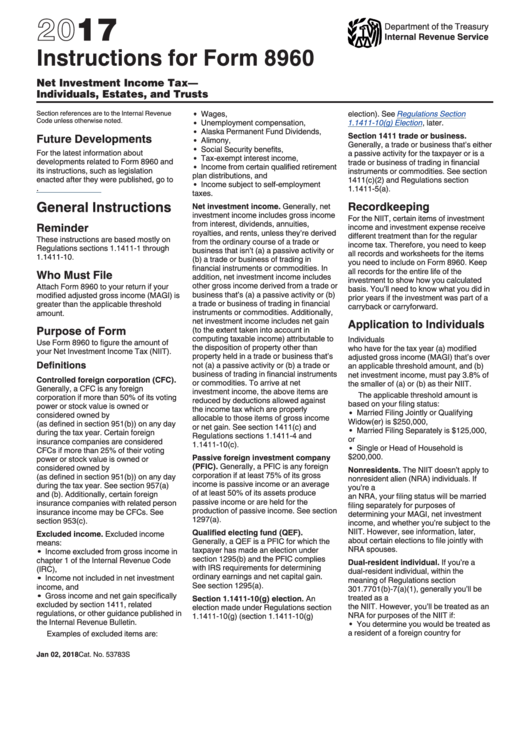

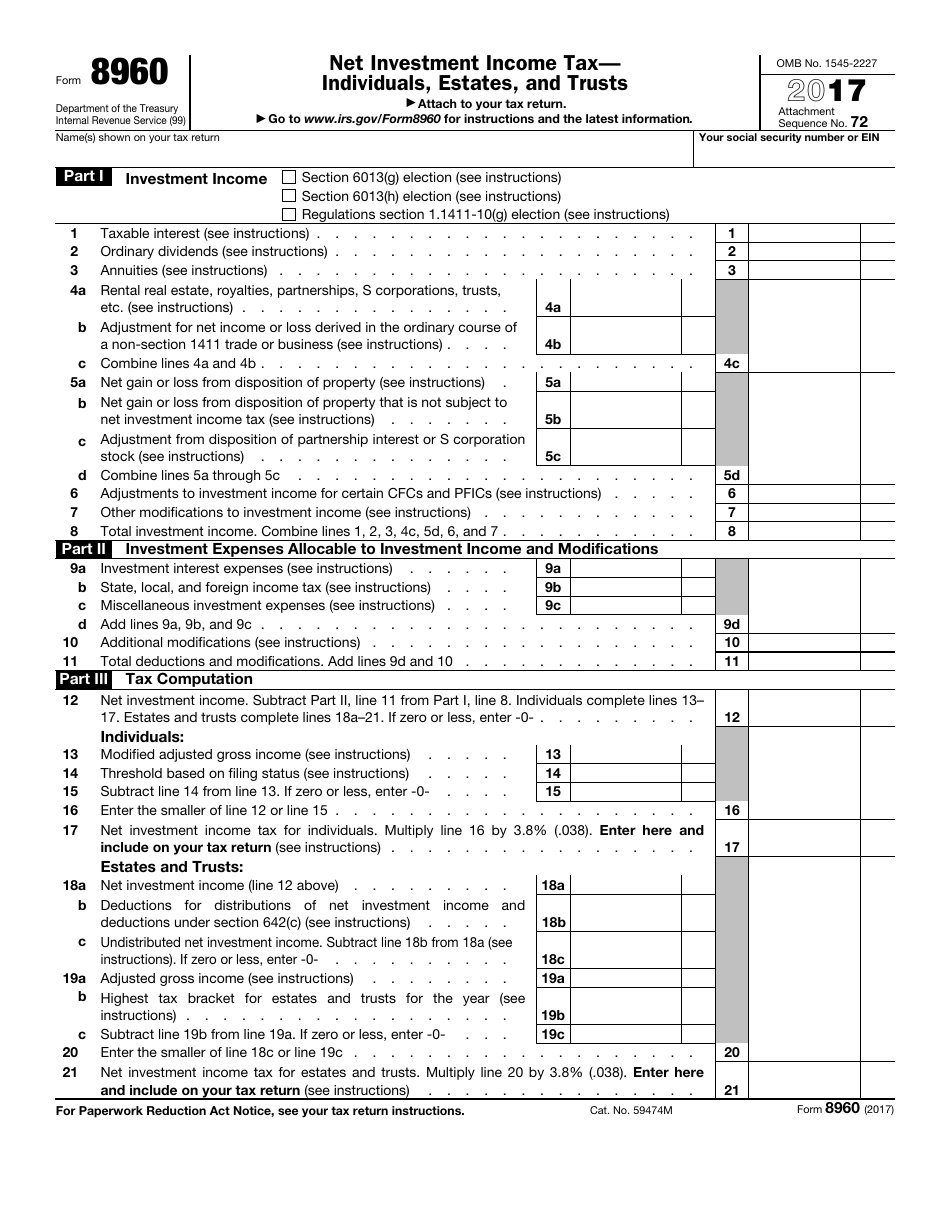

Irs Form 8960 Error - Estimate how much you could potentially save in just a matter of minutes. Web go to www.irs.gov/form8960 for instructions and the latest information. Web page last reviewed or updated: Fields 12zsd and 12zld will display as invalid if other than eight numeric digits. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. They changed the rules in 2022 to require schedule c income to be added to the form, and this change resulted in errors. Web on my 8960 works form it listed the total amount of business income (profit) on the line adjustment for business or trade income not subject to net investment tax. Web repeat, turboxtax is completing form 8960 correctly! Ad we help get taxpayers relief from owed irs back taxes. Turbotax includes your schedule c income on form 8960 line 4a because the irs instructions for line. Estimate how much you could potentially save in just a matter of minutes. These business rules need to be modified to reflect. Web go to www.irs.gov/form8960 for instructions and the latest information. Web page last reviewed or updated: Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. Web page last reviewed or updated: Ad we help get taxpayers relief from owed irs back taxes. Attach to your tax return. If its being triggered, is not needed, and. Estimate how much you could potentially save in just a matter of minutes. Web repeat, turboxtax is completing form 8960 correctly! Web on my 8960 works form it listed the total amount of business income (profit) on the line adjustment for business or trade income not subject to net investment tax. Attach to your tax return. Estimate how much you could potentially save in just a matter of minutes. Turbotax includes your schedule. Attach to your tax return. 72 name(s) shown on your tax return your social. They changed the rules in 2022 to require schedule c income to be added to the form, and this change resulted in errors. Estimate how much you could potentially save in just a matter of minutes. These business rules need to be modified to reflect. Web on my 8960 works form it listed the total amount of business income (profit) on the line adjustment for business or trade income not subject to net investment tax. Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. 72 name(s) shown on your tax return your social. Web if you download known. Fields 12zsd and 12zld will display as invalid if other than eight numeric digits. Web i believe the irs is incorrectly calculating form 8960. Turbotax includes your schedule c income on form 8960 line 4a because the irs instructions for line. 72 name(s) shown on your tax return your social. If its being triggered, is not needed, and. If the form isn't deleted, you still won't be able to file today. Web repeat, turboxtax is completing form 8960 correctly! 72 name(s) shown on your tax return your social. Web i believe the irs is incorrectly calculating form 8960. Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. Web repeat, turboxtax is completing form 8960 correctly! It appears the 2022 tax year known efile issues spreadsheet has been updated on the irs website but there is no excel file. These business rules need to be modified to reflect. Web page last reviewed or updated: Web i believe the irs is incorrectly calculating form 8960. Web repeat, turboxtax is completing form 8960 correctly! If the form isn't deleted, you still won't be able to file today. 72 name(s) shown on your tax return your social. Web on my 8960 works form it listed the total amount of business income (profit) on the line adjustment for business or trade income not subject to net investment tax.. Web page last reviewed or updated: Ad we help get taxpayers relief from owed irs back taxes. These business rules need to be modified to reflect. Web repeat, turboxtax is completing form 8960 correctly! 72 name(s) shown on your tax return your social. Turbotax includes your schedule c income on form 8960 line 4a because the irs instructions for line. Web if a field error displays and transcription is correct, overlay with nine zeroes to delete the entry. 72 name(s) shown on your tax return your social. Web if you download known issues for 2022 and search for 8960, you'll note that the irs did not update its own system and the problem is on their end. Web on my 8960 works form it listed the total amount of business income (profit) on the line adjustment for business or trade income not subject to net investment tax. Attach to your tax return. Web i believe the irs is incorrectly calculating form 8960. These business rules need to be modified to reflect. If the form isn't deleted, you still won't be able to file today. Purpose of form use form 8960 to figure the. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. It appears the 2022 tax year known efile issues spreadsheet has been updated on the irs website but there is no excel file. Web the tax explained when to use form 8960 figuring out your net investment income click to expand the tax explained the net investment income tax (niit) is a 3.8. Estimate how much you could potentially save in just a matter of minutes. Fields 12zsd and 12zld will display as invalid if other than eight numeric digits. Web go to www.irs.gov/form8960 for instructions and the latest information. Department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts. Web repeat, turboxtax is completing form 8960 correctly! Ad we help get taxpayers relief from owed irs back taxes. If its being triggered, is not needed, and.Instructions For Form 8960 Net Investment Tax Individuals

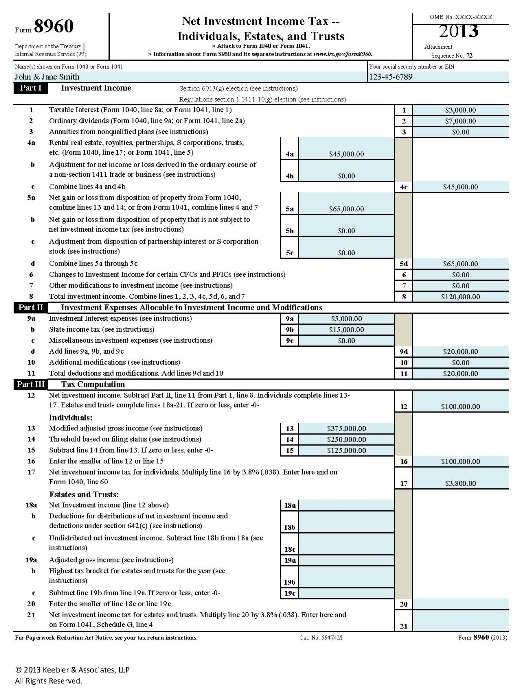

Fillable Form 8960 Draft Net Investment Tax Individuals

Fillable Online Instructions for Form 8960 (2019)Internal Revenue

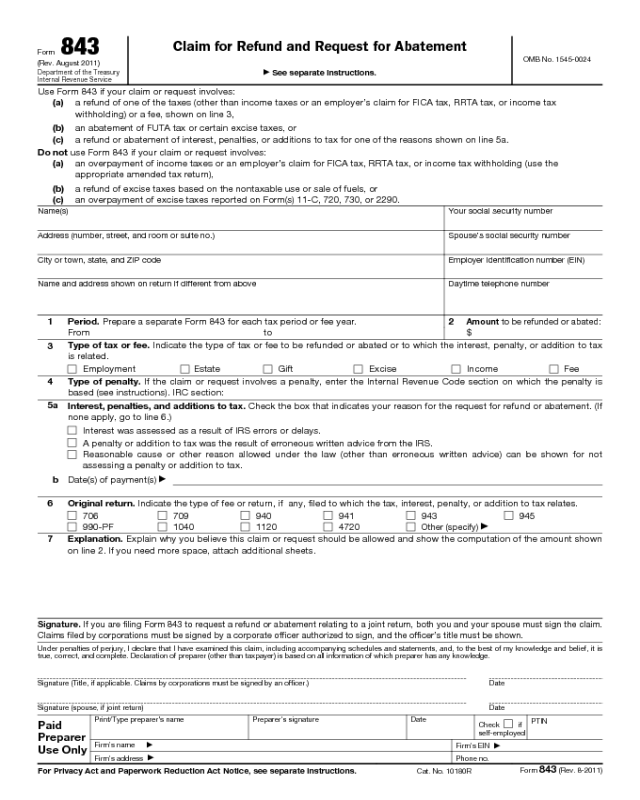

2020 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Is an Anomaly in Form 8960 Resulting in an Unintended Tax on TaxExempt

How to Complete IRS Form 8960 Net Investment Tax of 3.8 YouTube

IRS Form 8960 Download Fillable PDF or Fill Online Net Investment

Fill Free fillable Form 8960 2019 Net Investment Tax PDF form

Form 8960 Instructions Tax In The United States S Corporation

Net Investment Tax Calculator The Ultimate Estate Planner, Inc.

Related Post: