Irs Form 886-A Explanation Of Items

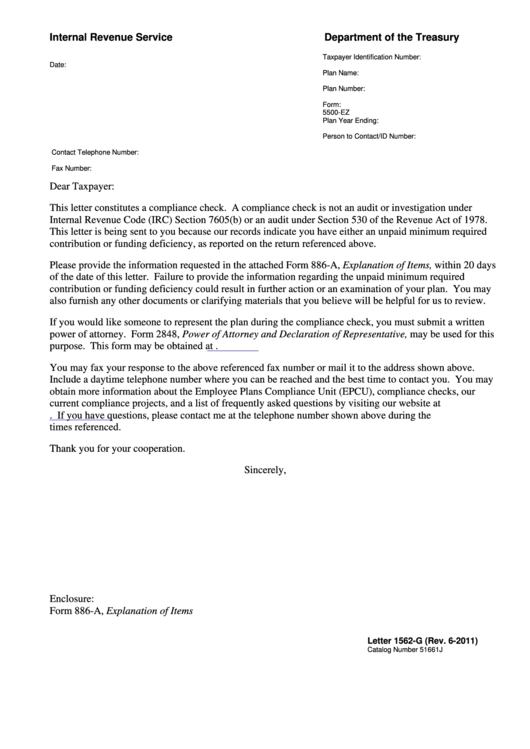

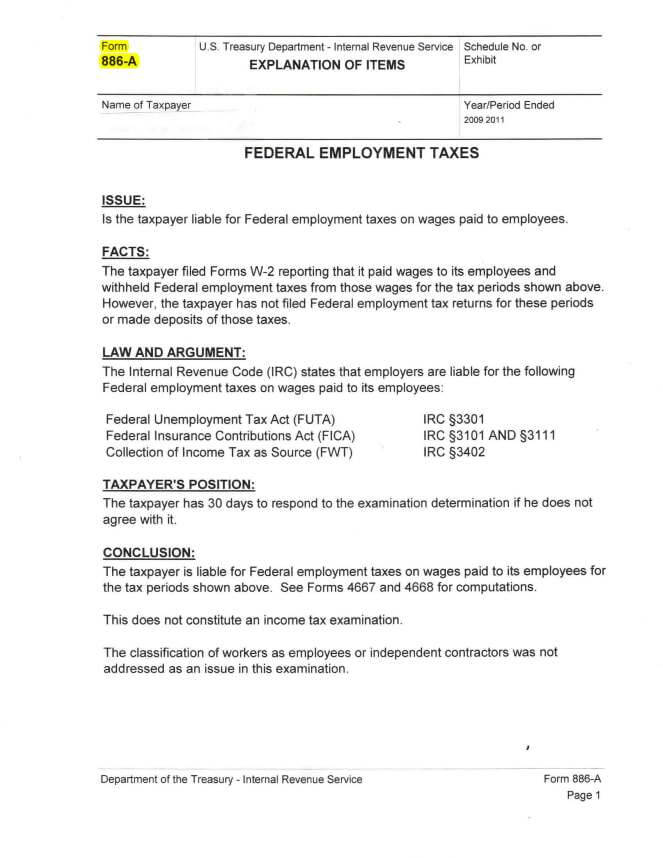

Irs Form 886-A Explanation Of Items - Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury forms and templates. Form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation. Web the title of irs form 886a is explanation of items. Web a qualifying relative is not. Ad access irs tax forms. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Most often, form 886a is. The irs may also provide you with detailed information which explains. Information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and. Get ready for tax season deadlines by completing any required tax forms today. Web page last reviewed or updated: Department of the treasury forms and templates. Please send us a copy of this determination letter (letter 1132. Web the title of irs form 886a is explanation of items. Web explanation of items please provide the following information: Please send us a copy of this determination letter (letter 1132. Web form 886a, explanation of items, is sent by the irs with form 4549 at the end of an audit. Most often, form 886a is. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. It's important that you understand. Information about form 8886, reportable transaction disclosure statement, including recent updates,. Department of the treasury forms and templates. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Please send us a copy of this determination letter (letter 1132. The irs may also provide you with detailed information which explains. Form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation. Web explanation of items please provide the following information: Ad access irs tax forms. Ad access irs tax forms. Complete, edit or print tax forms instantly. The irs may also provide you with detailed information which explains. Web the title of irs form 886a is explanation of items. It's important that you understand. Web a maximum of three standard explanations can be included in rgs. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. It's important that you understand. Explanation why this was not completed. Complete, edit or print tax forms instantly. Please send us a copy of this determination letter (letter 1132. This explains specific changes to your return and why we didn't accept your documentation. Complete, edit or print tax forms instantly. Is related to you in one of the ways shown in “qualifying child” on the last page must have lived with you for. If more than three standard explanations are needed for an adjustment, they should be included on. Department of the treasury forms and templates. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Form 886a, explanation of items explains specific changes to your return and why the irs didn’t accept your documentation. The irs may also provide you with detailed information which explains. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. If more than three standard explanations are needed for an adjustment, they should be included on a form. Web the title of irs form 886a is explanation of items. Department of the. The irs may also provide you with detailed information which explains. It's important that you understand. Most often, form 886a is. Learn more from the tax experts at h&r block. The irs may also provide you with detailed information which explains. Web page last reviewed or updated: Web the title of irs form 886a is explanation of items. Web a qualifying relative is not. Get ready for tax season deadlines by completing any required tax forms today. Is related to you in one of the ways shown in “qualifying child” on the last page must have lived with you for. Explanation why this was not completed. Since the purpose of form 886a is to explain something, the irs uses it for many various reasons. Get ready for tax season deadlines by completing any required tax forms today. Web form 886a, explanation of items, is sent by the irs with form 4549 at the end of an audit. Web a maximum of three standard explanations can be included in rgs. Ad access irs tax forms. Web the title of irs form 886a is explanation of items. Department of the treasury forms and templates. Web if you are filing more than one form 8886 with your tax return, sequentially number each form 8886 and enter the statement number for this form 8886. This explains specific changes to your return and why we didn't accept your documentation.Irs Form 886 A Worksheet Ivuyteq

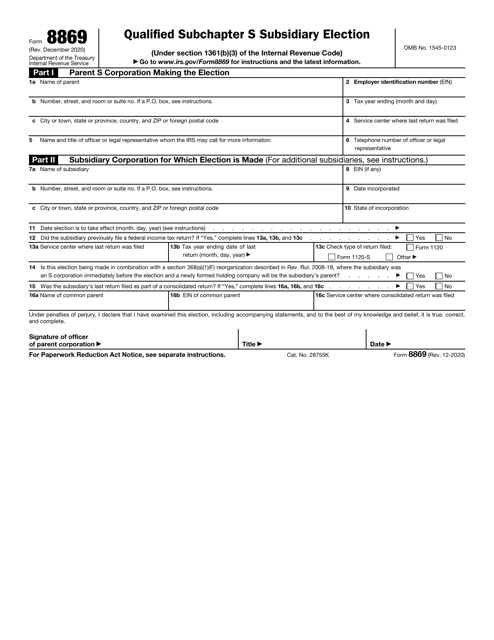

IRS Form 8869 Download Fillable PDF or Fill Online Qualified Subchapter

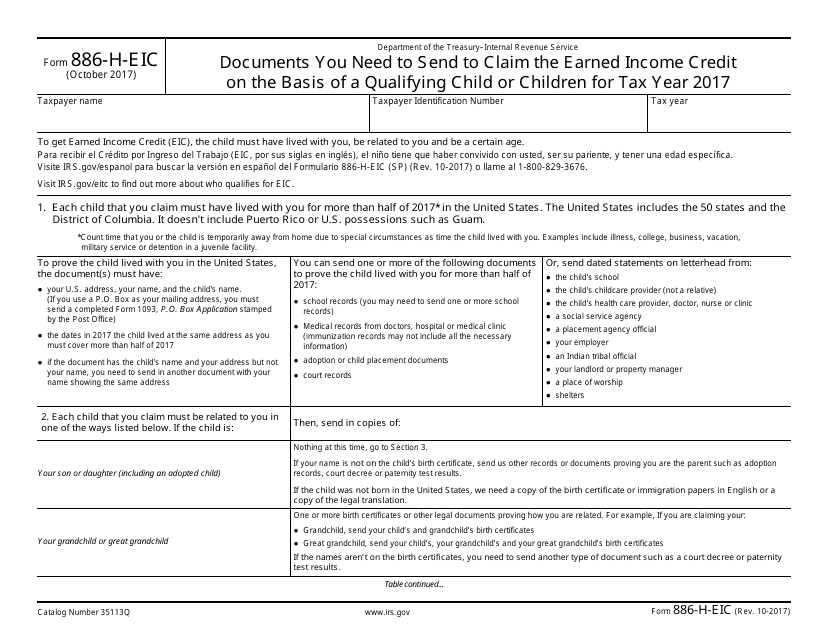

IRS Form 886HEIC Fill Out, Sign Online and Download Fillable PDF

Home Loan Joint Declaration Form Pdf

Form 886A Explanation Of Items Department Of Treasury printable

Audit Form 886A Tax Lawyer Answer & Response

IRS Form 8868 Fill Out, Sign Online and Download Fillable PDF

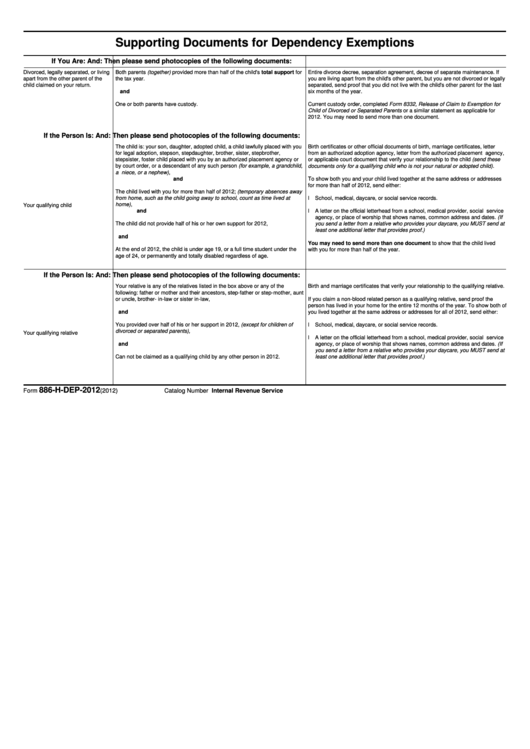

Form 886HDep2012 Supporting Documents For Dependency Exemptions

Fill Free fillable IRS PDF forms

Irs Form 886 A Worksheet Escolagersonalvesgui

Related Post: