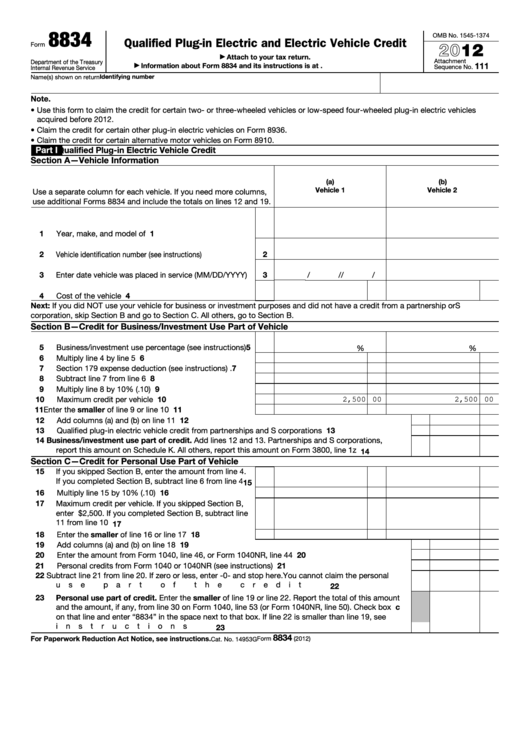

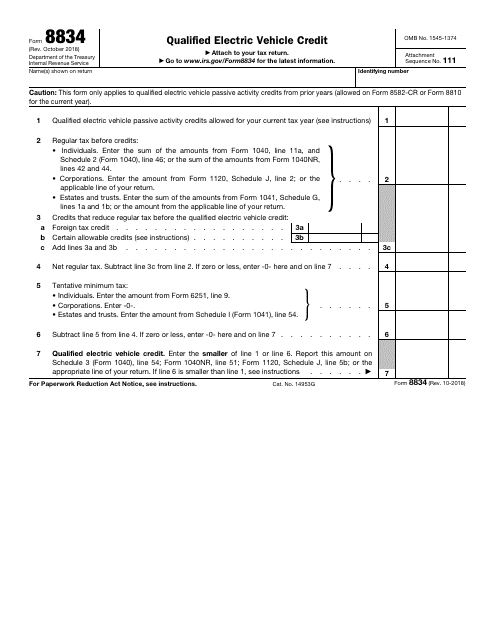

Irs Form 8834

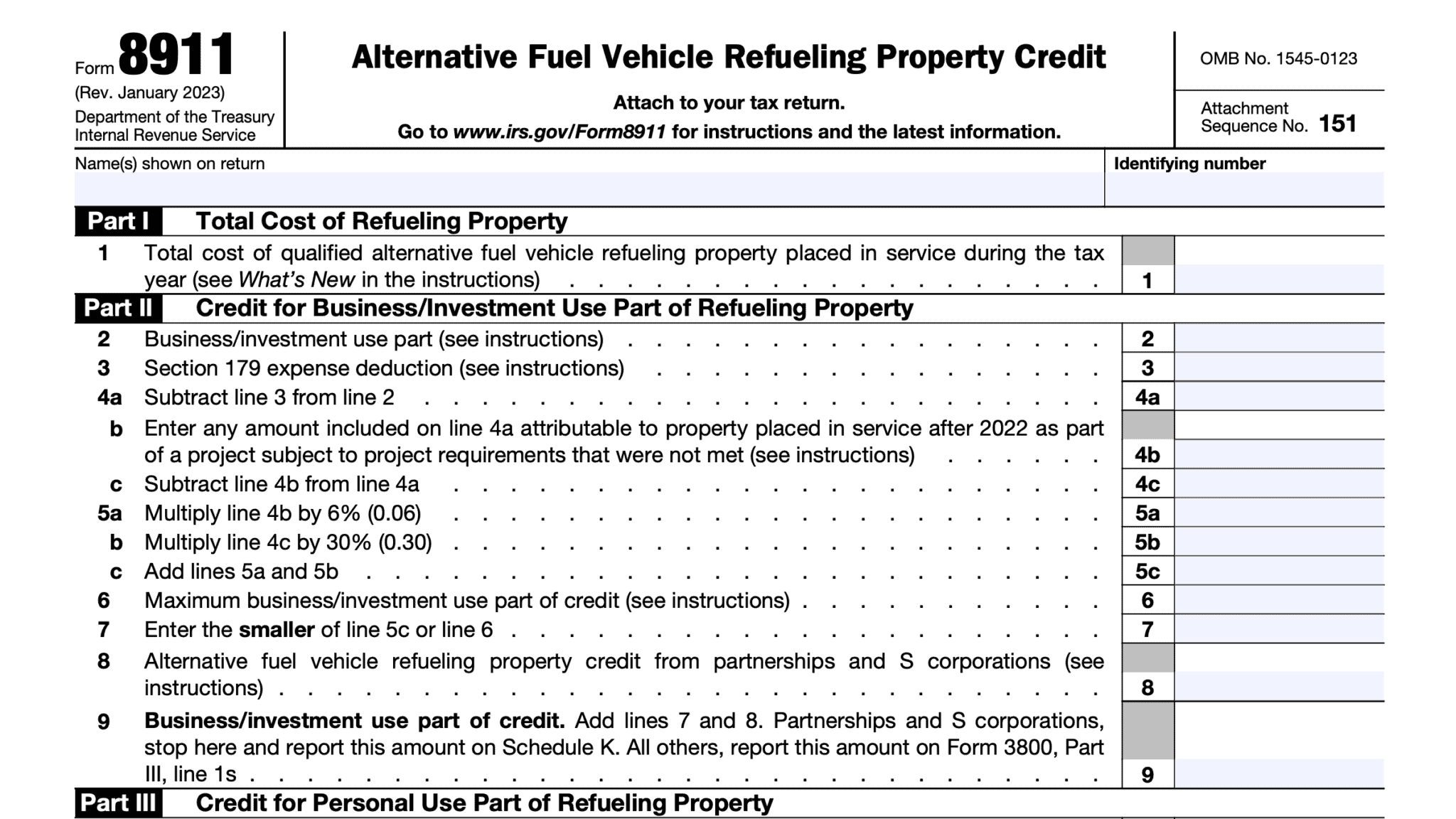

Irs Form 8834 - Web minimum tax from form 8801, or any credit to holders of tax credit bonds from form 8912). Use this form to claim any. Ad thecountyoffice.com has been visited by 100k+ users in the past month How to access the form: Estimate how much you could potentially save in just a matter of minutes. Web we last updated the qualified electric vehicle credit in february 2023, so this is the latest version of form 8834, fully updated for tax year 2022. This is a guide to entering the qualified electric vehicle credit carryforward into the taxslayer pro program. Form 8834 is used to claim any qualified electric vehicle passive activity credit allowed for the current tax year. Ad we help get taxpayers relief from owed irs back taxes. Is the form supported in our program? Web page last reviewed or updated: Web information about form 8834, qualified electric vehicle credit, including recent updates, related forms and instructions on how to file. November 2021) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Web do you qualified for the electric car tax credit? This is a guide to entering the qualified electric vehicle credit carryforward into the taxslayer pro program. Ad we help get taxpayers relief from owed irs back taxes. You must complete and attach form 8834 to your tax return to claim the. Information about form 8910, alternative motor vehicle credit, including recent updates, related forms and. This form only applies. How to access the form: Web you can use form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current tax year. Web do you qualified for the electric car tax credit? Qualified electric vehicle passive activity credits allowed; This is not intended as tax advice. This form only applies to qualified electric vehicle. You can download or print. Form 8834 is used to claim any qualified electric vehicle passive activity credit allowed for the current tax year. Form 8834 (2009) page 3 if,. Web use this form to claim qualified electric vehicle passive activity credits for the current tax year. Web go to the search box in the upper right hand corner. Web to figure the credit limit, complete form 8834 and attach it to your tax return. Use form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current tax year. Form 8834 (2009) page 3 if,. Web minimum tax from form 8801, or any. Enter the total of any credits on lines 47 through 51 (not including any. You must complete and attach form 8834 to your tax return to claim the. How to claim the credit. This is not intended as tax advice. Web minimum tax from form 8801, or any credit to holders of tax credit bonds from form 8912). Fast, easy and secure application. You can download or print. Attach to your tax return. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web do you qualified for the electric car tax credit? Attach to your tax return. This is not intended as tax advice. Web you can use form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current tax year. Is the form supported in our program? You can download or print. Web minimum tax from form 8801, or any credit to holders of tax credit bonds from form 8912). Web to figure the credit limit, complete form 8834 and attach it to your tax return. Ad thecountyoffice.com has been visited by 100k+ users in the past month Use form 8834 to claim any qualified electric vehicle. This form only applies to qualified electric vehicle. Web information about form 8834, qualified electric vehicle credit, including recent updates, related forms and instructions on how to file. Use this form to claim any. Qualified electric vehicle passive activity credits allowed; Form 8834 (2009) page 3 if,. Web how do i complete irs form 8834? Use form 8835 to claim the. Web page last reviewed or updated: Information about form 8910, alternative motor vehicle credit, including recent updates, related forms and. Web information about form 8835, renewable electricity production credit, including recent updates, related forms, and instructions on how to file. Fast, easy and secure application. Web information about form 8834, qualified electric vehicle credit, including recent updates, related forms and instructions on how to file. Use this form to claim any. You must complete and attach form 8834 to your tax return to claim the. Web you can use form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current tax year. Get ready for tax season deadlines by completing any required tax forms today. Type form 8834 and then click the jump to form 8834. Qualified electric vehicle passive activity credits allowed; You can download or print. Ad we help get taxpayers relief from owed irs back taxes. Web taxact does not support form 8834 qualified electric vehicle credit; Use form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current tax year. How to access the form: November 2021) department of the treasury internal revenue service. This form only applies to qualified electric vehicle.IRS Form 8834 Instructions Qualified Electric Vehicle Credit

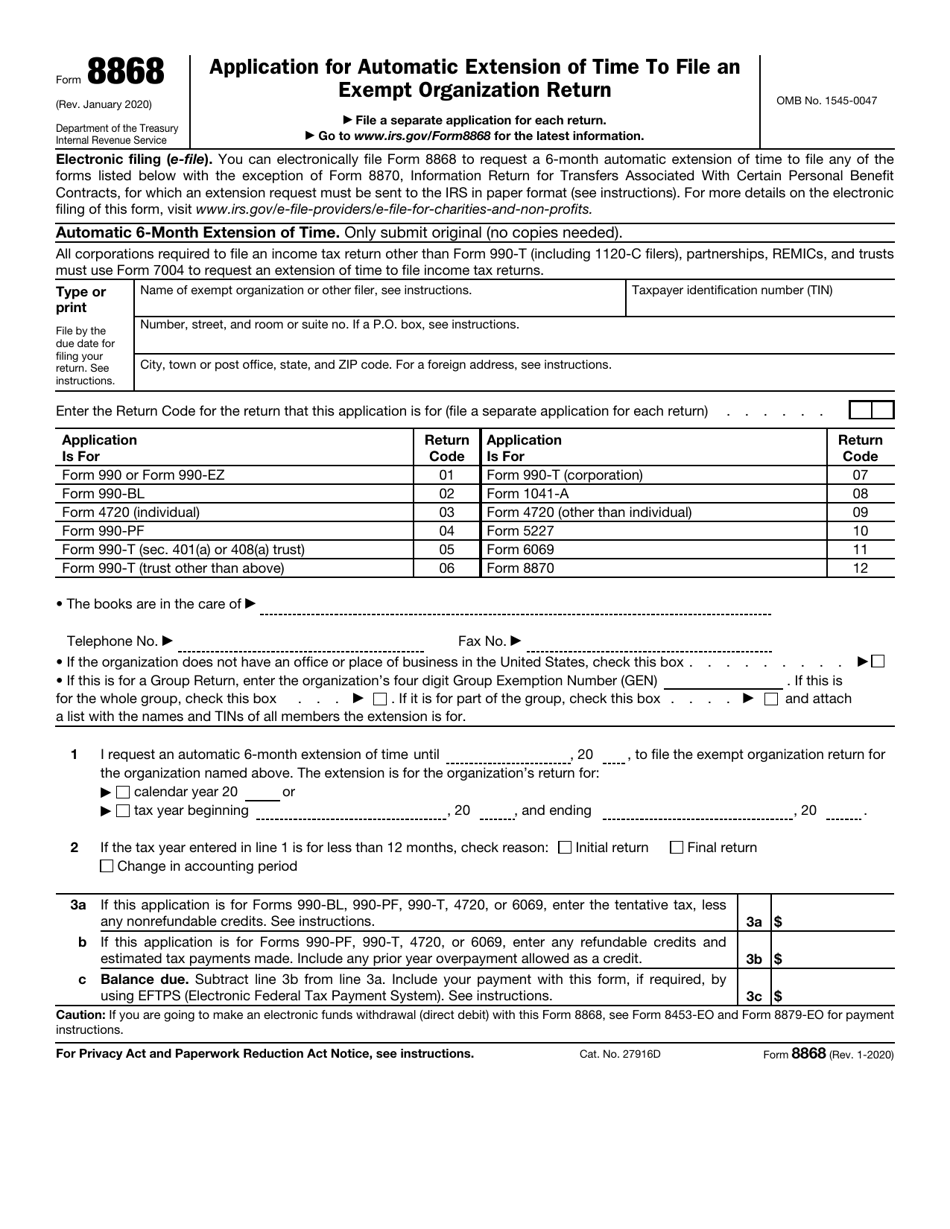

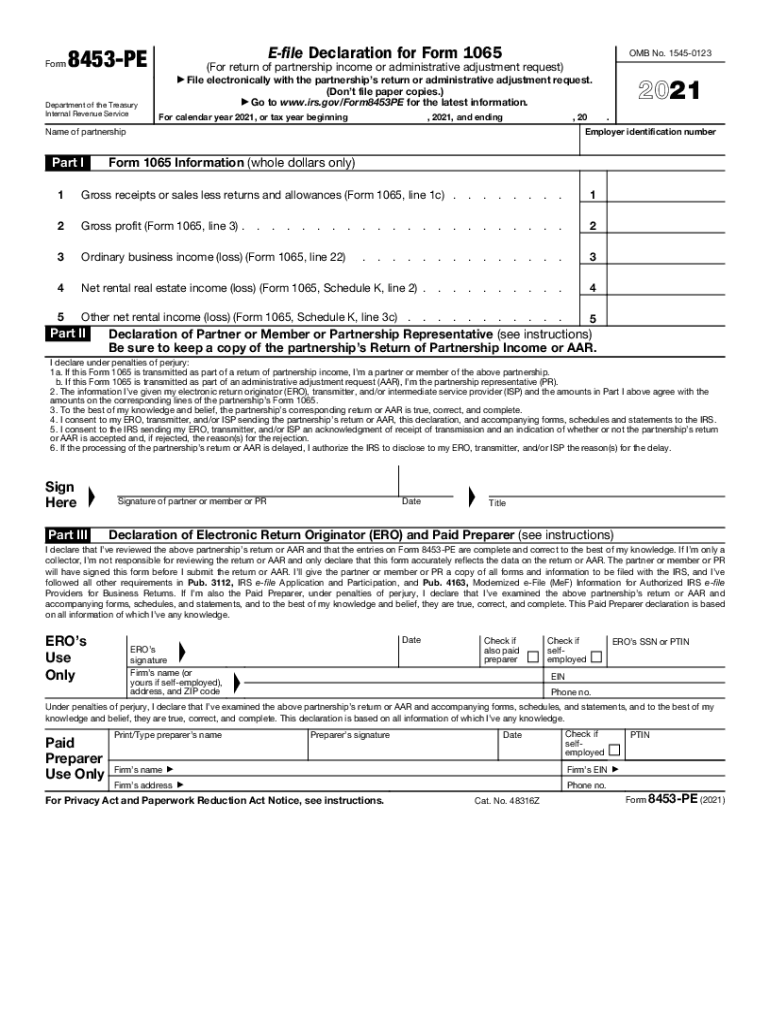

IRS Form 8868 Fill Out, Sign Online and Download Fillable PDF

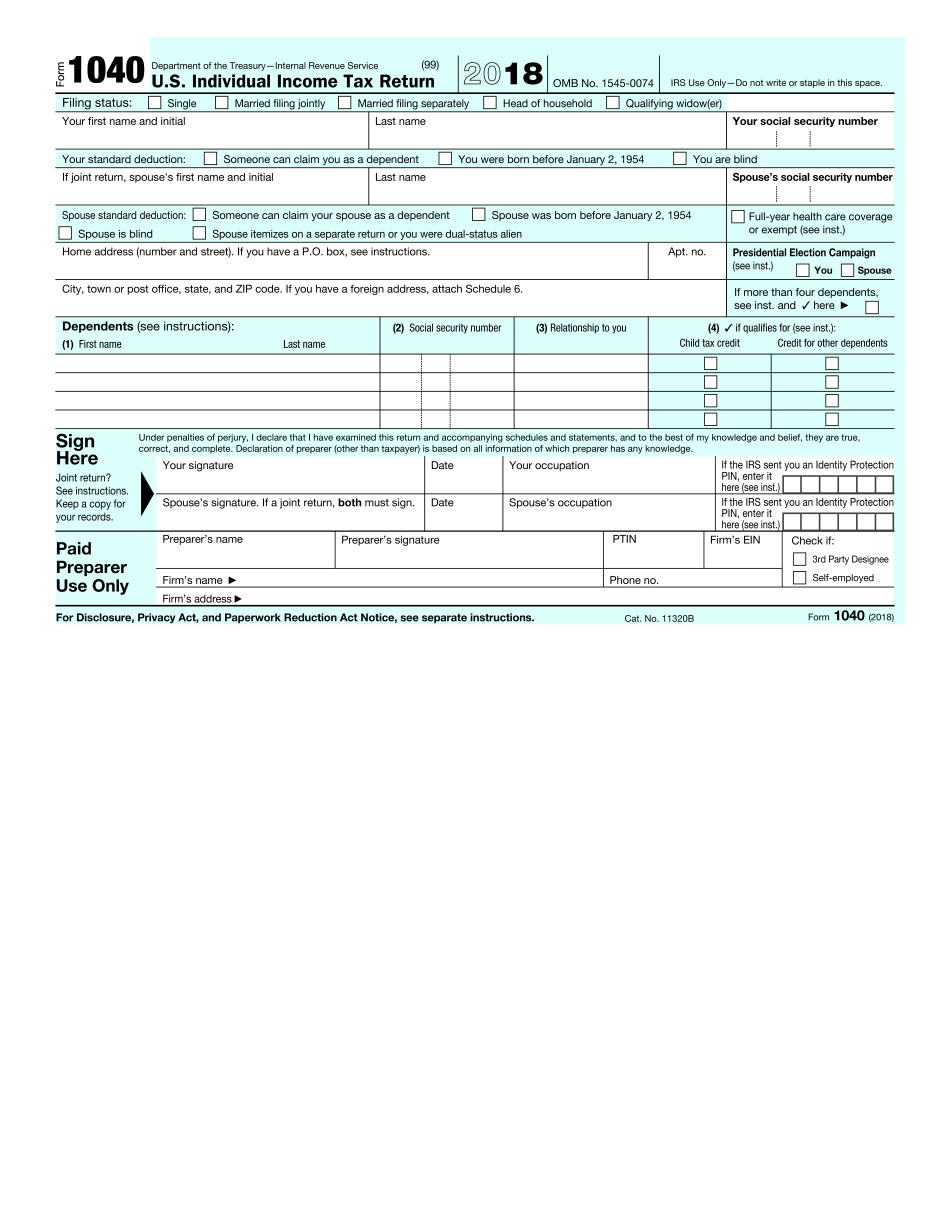

IRS Forms Fillable Printable Free

Irs Government Printable Forms Printable Forms Free Online

IRS Form 8834 Instructions Qualified Electric Vehicle Credit

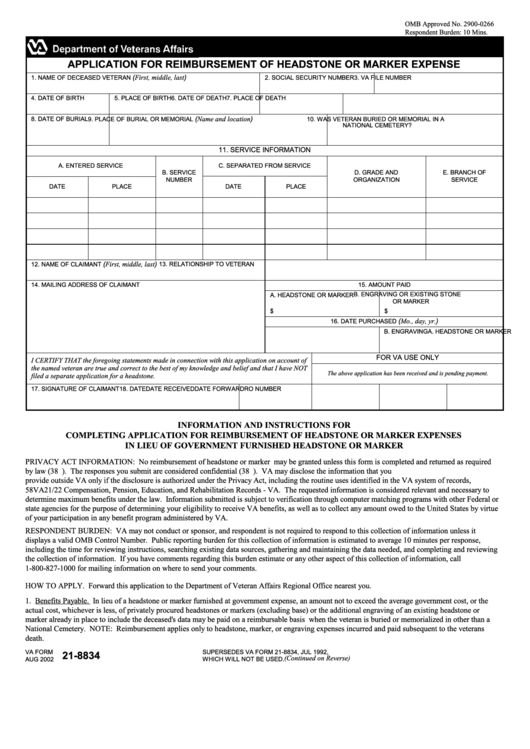

Fillable Va Form 218834 Application For Reimbursement Of Headstone

Fillable Form 8834 Qualified PlugIn Electric And Electric Vehicle

2021 Internal Revenue Service Form Fill Out and Sign Printable PDF

Internal Revenue Fill Online, Printable, Fillable, Blank pdfFiller

IRS Form 8834 Download Fillable PDF or Fill Online Qualified Electric

Related Post: