Irs Form 8615 Instructions

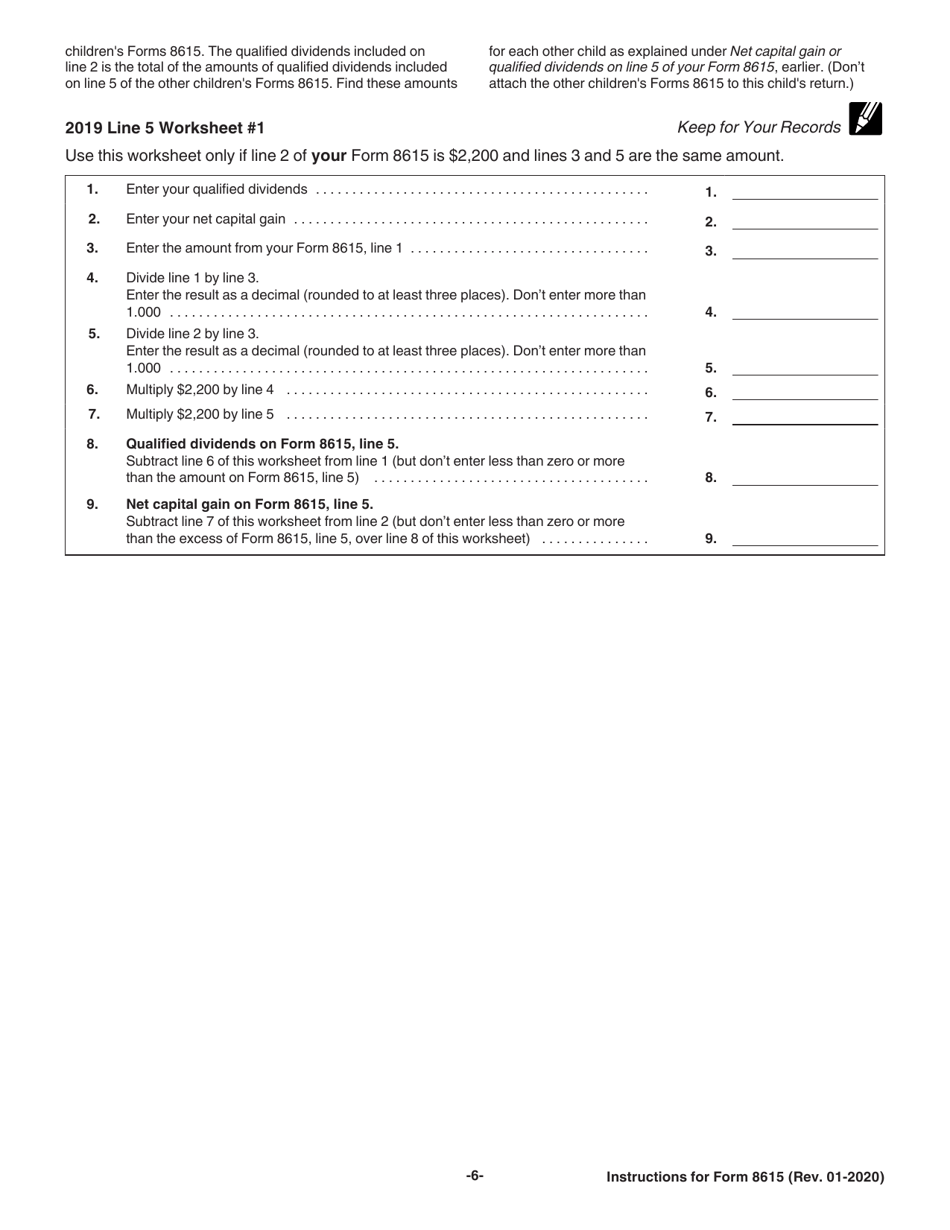

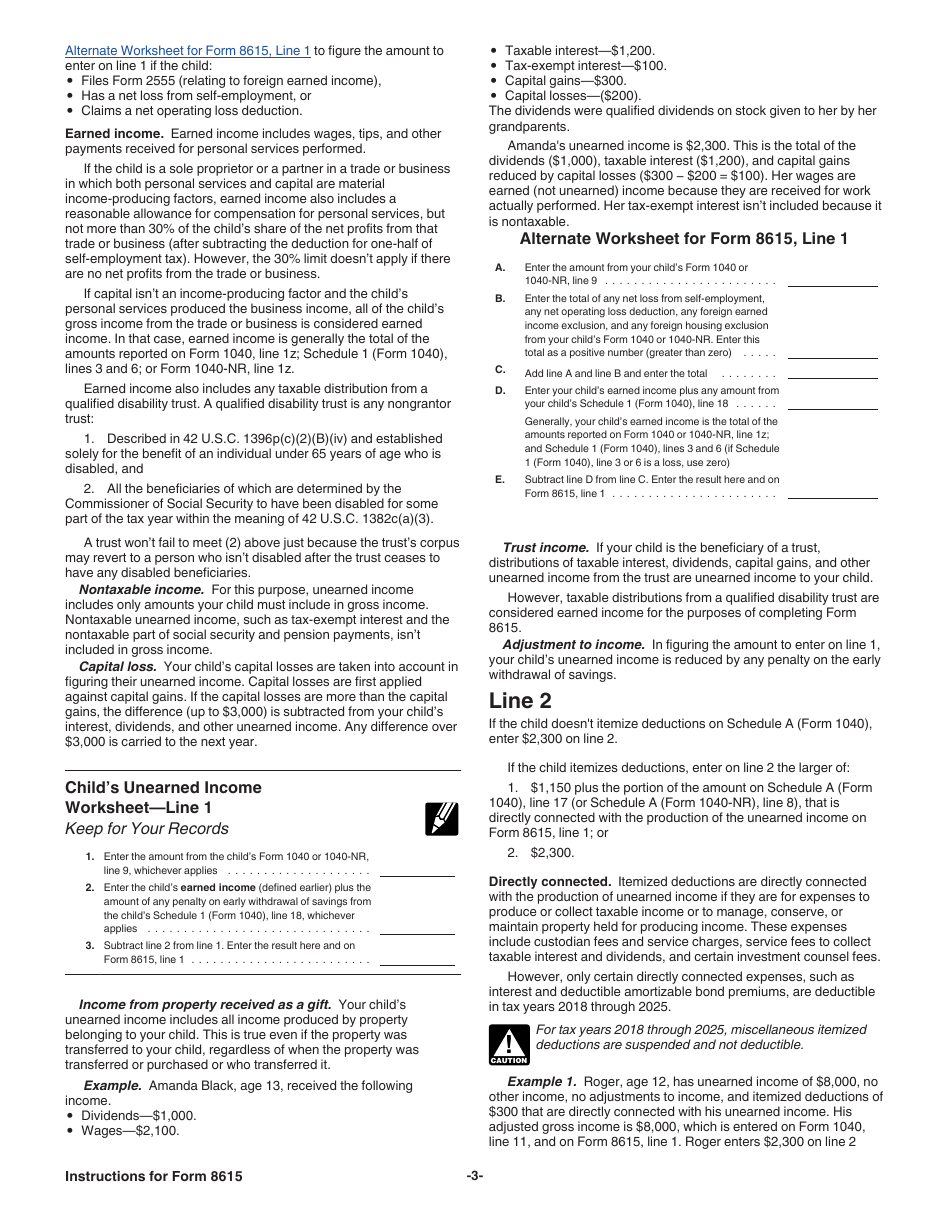

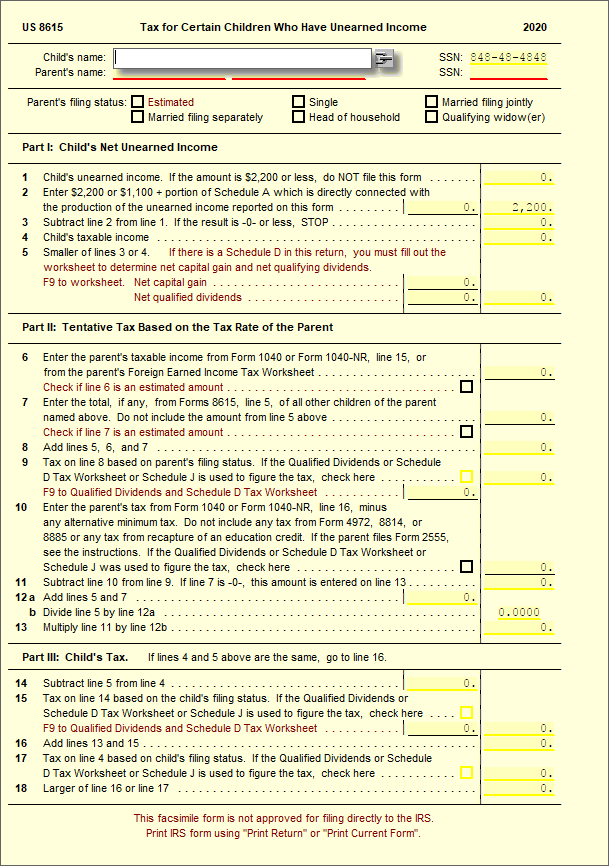

Irs Form 8615 Instructions - For 2023, form 8615 needs to be filed if all of the following conditions apply: If the qualified dividends and capital gain tax worksheet, schedule d. Below, you'll find answers to frequently asked questions about tax for certain children who have unearned income on. For children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's. 553 tax on child’s investment and other unearned income;. Web corrections to the 2020 instructions for form 8615, tax for certain children who have unearned income, that has two incorrect line references to the qualified. Web solved•by intuit•12•updated april 26, 2023. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Tax for certain children who have unearned. Web see the form 8615 instructions and irs publication 929, tax rules for children and dependents for more information. This article will help determine if your client is eligible to use form 8814 or form 8615 to report a child's income. Web if you file form 2555, see the instructions. Web form 8615 2021 tax for certain children who have unearned income department of the treasury internal revenue service (99) attach only to the child’s form 1040 or form.. If the qualified dividends and capital gain tax worksheet, schedule d. Web who's required to file form 8615? Web see the form 8615 instructions and irs publication 929, tax rules for children and dependents for more information. Use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain. Web corrections. Web irs form 8615, tax for certain children who have unearned income, is the tax form that parents may use to report their child’s unearned income on their federal. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's rate is. Complete, edit or print tax forms instantly. Web if you file form 2555, see the instructions. Web per irs instructions for form 8615 on page 1: As defined in publication 929, tax rules for. Purpose of form for children under age 18 and certain older children described below in who must file , unearned income over. Web children who have unearned income that’s subject to the kiddie tax must file a form 8615 with their 1040 tax return. Do not file draft forms. Web per irs instructions for form 8615 on page 1: 553 tax on child’s investment and other unearned income;. Web see the form 8615 instructions and irs publication 929, tax rules for children. Web solved•by intuit•12•updated april 26, 2023. The child has more than $2,500 in unearned income;. When using form 8615 in proseries, you should enter the child as the taxpayer on the federal. For children under age 18 and certain older children described below in who must file, unearned income over $2,000 is taxed at the parent's rate if the parent's.. Web children who have unearned income that’s subject to the kiddie tax must file a form 8615 with their 1040 tax return. Web solved•by intuit•2•updated february 08, 2023. If the child's unearned income is more than $2,300, use. Enter the tax on the amount on line 4. Web corrections to the 2020 instructions for form 8615, tax for certain children. Web solved•by intuit•12•updated april 26, 2023. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's rate is higher than the child's. If the qualified dividends and capital gain tax worksheet, schedule d. Ad register and subscribe now to work on. Use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain. Enter the tax on the amount on line 4. Web instructions for form 8615 tax for certain children who have unearned income department of the treasury internal revenue service section references are to the. Web form 8615 2021 tax. Complete, edit or print tax forms instantly. Purpose of form for children under age 18 and certain older children described below in who must file , unearned income over. Enter the tax on the amount on line 4. The child has more than $2,500 in unearned income;. Web solved•by intuit•2•updated february 08, 2023. Complete, edit or print tax forms instantly. The child has more than $2,500 in unearned income;. Use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain. Web who's required to file form 8615? Web instructions for form 8615 tax for certain children who have unearned income department of the treasury internal revenue service section references are to the. Below, you'll find answers to frequently asked questions about tax for certain children who have unearned income on. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's rate is higher than the child's. Web solved•by intuit•12•updated april 26, 2023. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web per irs instructions for form 8615 on page 1: Web per irs instructions for form 8615: While there have been other changes to the. Ad register and subscribe now to work on your irs form 8615 & more fillable forms. Purpose of form for children under age 18 and certain older children described below in who must file , unearned income over. Web if you file form 2555, see the instructions. Tax for certain children who have unearned. 553 tax on child’s investment and other unearned income;. Web solved•by intuit•2•updated february 08, 2023. Web for the latest information about developments related to form 8615 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8615. Complete, edit or print tax forms instantly.Download Instructions for IRS Form 8615 Tax for Certain Children Who

Instructions For Form 8615 Tax For Children Under Age 18 With

What Is IRS Form 8615 Tax For Certain Children Who Have TurboTax

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Form 8615 Instructions (2015) printable pdf download

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Download Instructions for IRS Form 8615 Tax for Certain Children Who

8615 Tax for Certain Children Who Have Unearned UltimateTax

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

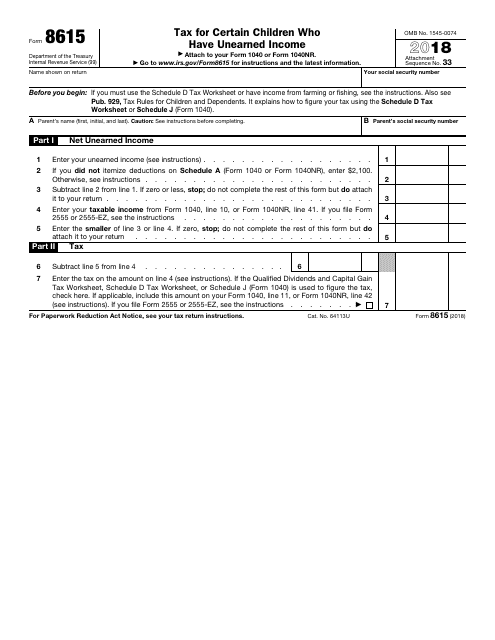

IRS Form 8615 2018 Fill Out, Sign Online and Download Fillable PDF

Related Post: