Irs Form 843 Instructions

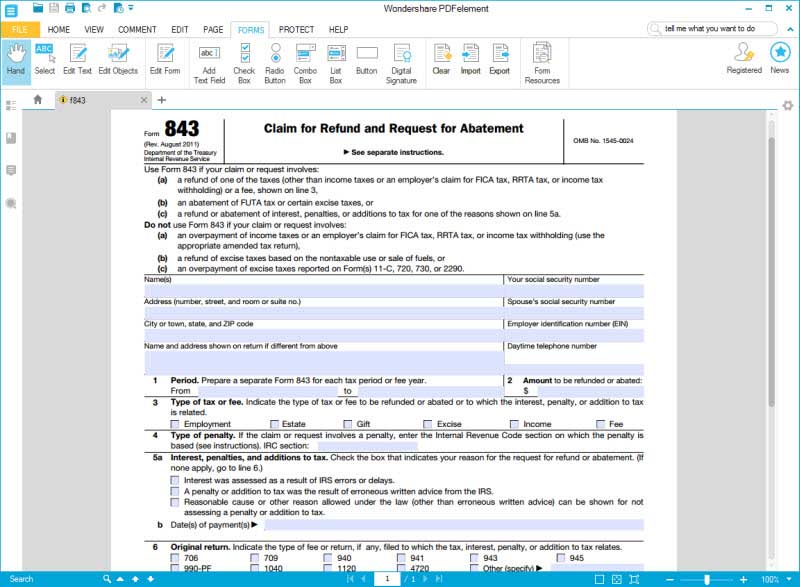

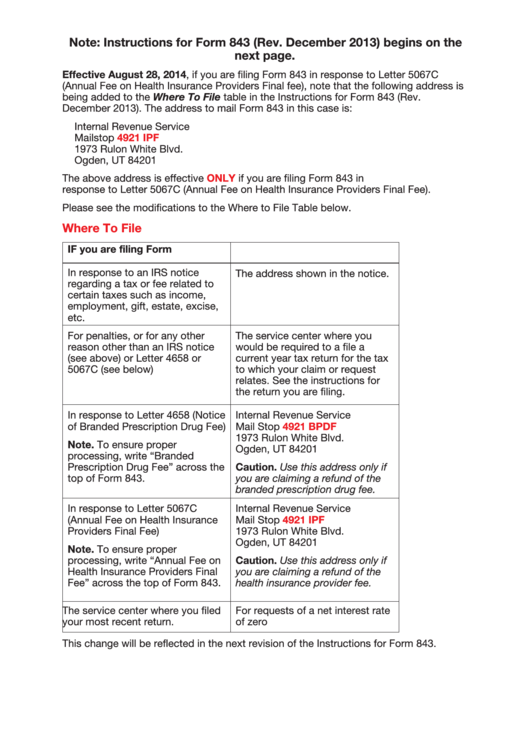

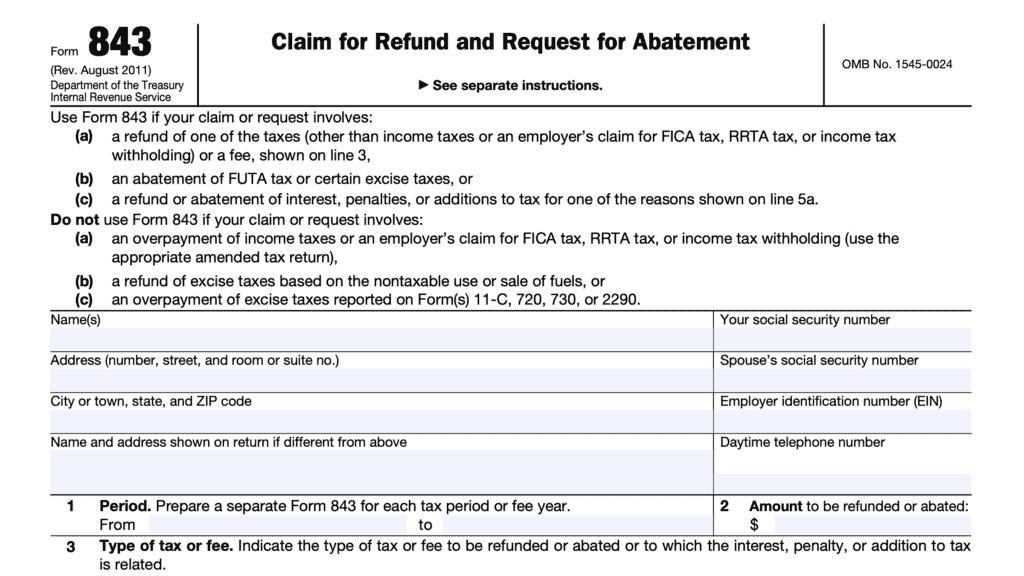

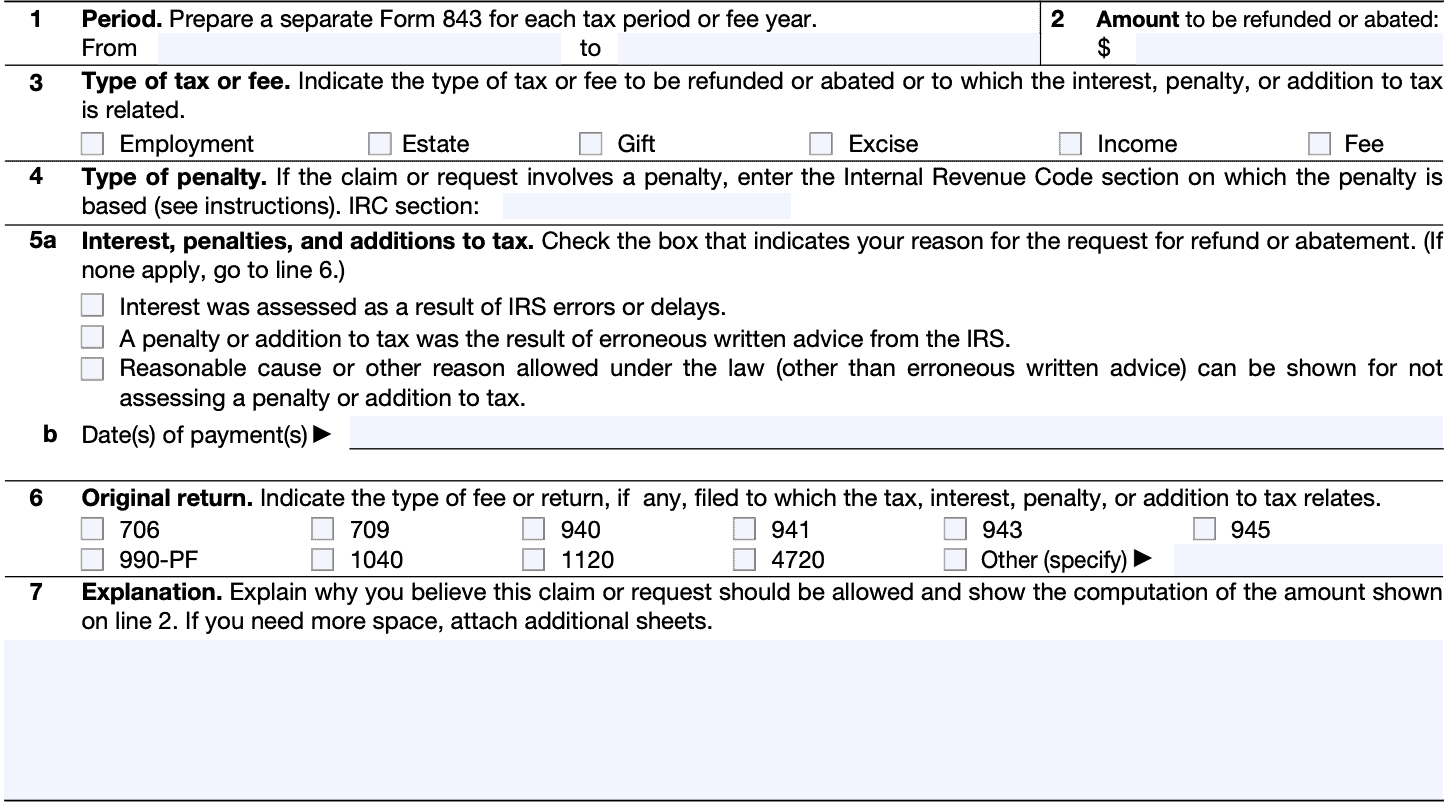

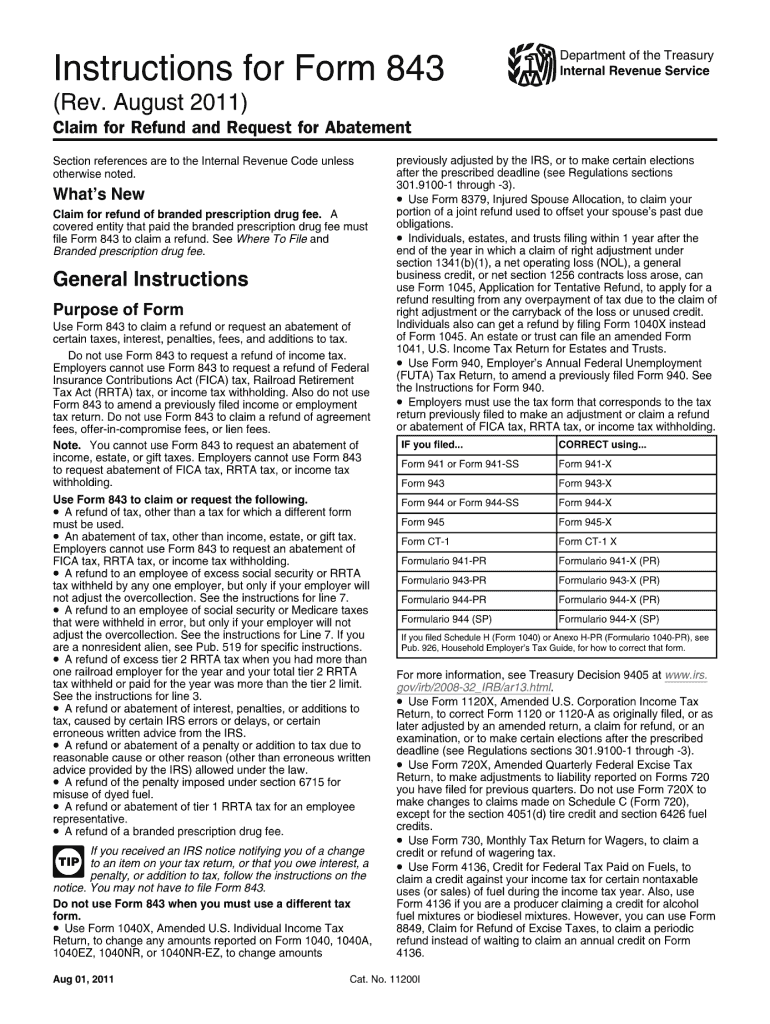

Irs Form 843 Instructions - Web how do i complete abatement form 843? Form 843 is available in the 1040, 1120, 1120s, 990, 706 and. However, you cannot use form 843 to request a refund or an abatement of income tax. When you should file form 843. You cannot request refunds for income, gift, or estate taxes with this form, but. If you are filing form 843. Use form 843 to file a claim for refund of certain overpaid taxes, interest, penalties, and additions to tax. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate to your income tax return. You may have to submit additional forms as well. Line 1 is the tax year the. The service center where you would be required to file a current year tax. Get ready for tax season deadlines by completing any required tax forms today. Use form 843 if your claim or request involves: Web form 843, claim for refund and request for abatement can be completed by making entries on the 843 screen. Web you can use. Web irs form 843 allows you to request a refund or abatement of certain taxes, interest, penalties. Web irs form 843 (request for abatement & refund): Web individuals should follow the instructions to file tax form 843 to correct a previously filed tax return if they meet one of the following guidelines: Upload, modify or create forms. Complete, edit or. Purposes of irs form 843. A refund of tax, other than a tax for. See the instructions for form 843 for details on. Web instead, you can use form 843 to request a refund or abatement. Ad download or email instr 843 & more fillable forms, register and subscribe now! Web irs form 843 (request for abatement & refund): See the instructions for form 843 for details on. When requesting a penalty abatement, it’s important to include the specific irs section number related to the penalty. Get ready for tax season deadlines by completing any required tax forms today. Web form 843, claim for refund and request for abatement can. When you should not file form 843. However, you cannot use form 843 to request a refund or an abatement of income tax. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate to your income tax return. Claim for refund and request for abatement, and attach their. Web individuals should follow the instructions to file tax form 843 to correct a previously filed tax return if they meet one of the following guidelines: Upload, modify or create forms. The service center where you would be required to file a current year tax. Web you can use form 843 to request a refund or an abatement of interest,. Access irs forms, instructions and publications in electronic and print media. Web instead, you can use form 843 to request a refund or abatement. Web taxpayers can complete form 843: Purposes of irs form 843. Complete, edit or print tax forms instantly. Web how do i complete abatement form 843? This number should be clearly stated. When you should file form 843. Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. When requesting a penalty abatement, it’s important to include the specific irs section number related to the penalty. This number should be clearly stated. When you should not file form 843. Access irs forms, instructions and publications in electronic and print media. Web forms, instructions and publications search. Web instead, you can use form 843 to request a refund or abatement. The service center where you would be required to file a current year tax. You cannot request refunds for income, gift, or estate taxes with this form, but. When you should not file form 843. Ad access irs tax forms. The instructions for form 843 state that for penalties, the form should be mailed to: Then mail the form to… in response to an irs notice regarding a tax or fee related to certain taxes. Purposes of irs form 843. Claim for refund and request for abatement, and attach their rationale and evidence to support their reasonable cause. Web irs form 843 (request for abatement & refund): You cannot request refunds for income, gift, or estate taxes with this form, but. Web this article will walk you through the basics of this tax form, including: Web individuals should follow the instructions to file tax form 843 to correct a previously filed tax return if they meet one of the following guidelines: See the instructions for form 843 for details on. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate to your income tax return. You may have to submit additional forms as well. Web forms, instructions and publications search. Web irs form 843 allows you to request a refund or abatement of certain taxes, interest, penalties. Ad access irs tax forms. Web form 843, claim for refund and request for abatement can be completed by making entries on the 843 screen. Web how do i complete abatement form 843? Ad download or email instr 843 & more fillable forms, register and subscribe now! When requesting a penalty abatement, it’s important to include the specific irs section number related to the penalty. Complete, edit or print tax forms instantly. When you should not file form 843. Web taxpayers can complete form 843:Download Instructions for IRS Form 843 Claim for Refund and Request for

20212023 Form IRS Instruction 843 Fill Online, Printable, Fillable

Online IRS Instructions 843 2013 2019 Fillable and Editable PDF

IRS Form 843 Fill it Right the First Time

Instructions For Form 843 (Rev. December 2013) (For Use With Form 843

IRS Form 3911 Instructions Replacing A Lost Tax Refund Check

IRS Form 843 Instructions

Irs form 843 2011 Fill out & sign online DocHub

Instructions for Form 843, Claim for Refund and Request for Abatement

Instructions for Form 843, Claim for Refund and Request for Abatement

Related Post: