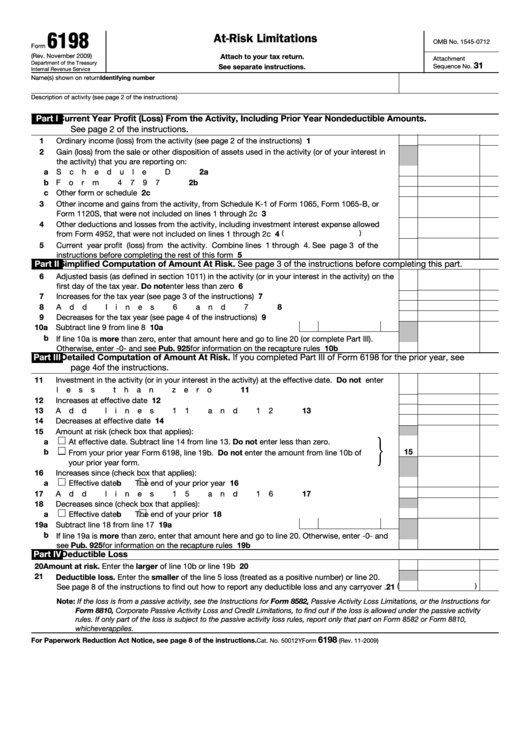

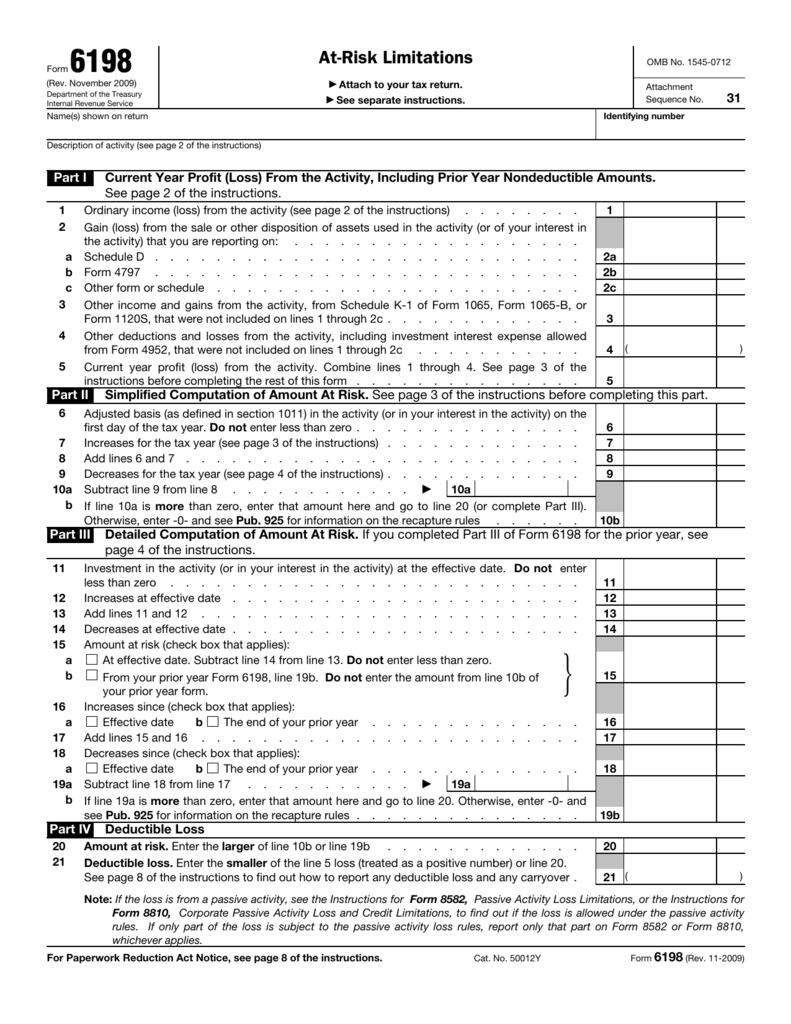

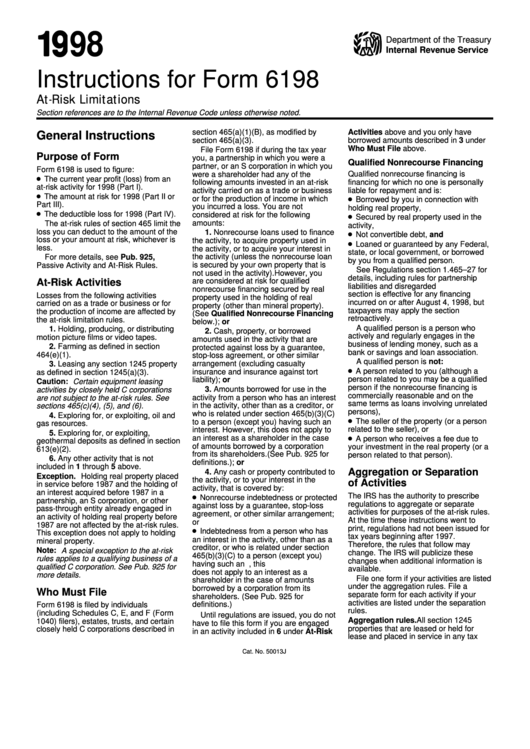

Irs Form 6198

Irs Form 6198 - Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). The internal revenue service, tax forms and publications, 1111 constitution ave. Any tax practitioner wishing to. Somewhere in the interview you have indicated that you have a business. Tax form 6198 helps you to figure out the amount you can. Form 6198 is used to determine the profit (or loss). Drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business. Web guide on how to write a form 6198. Department of the treasury—internal revenue service (99) u.s. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Web the internal revenue service (irs) usually allows taxpayers to deduct money spent on a business up to a certain limit. If line 21 is less than line 5 of form 6198, losses on line 5 (form. Web using form 6198, you can figure out the maximum amount you can deduct after you have suffered a loss in your business. Web the internal revenue service (irs) usually allows taxpayers to deduct money spent on a business up to a certain limit. December 2020) department of the treasury internal revenue service. Tax form 6198 helps you to figure out the amount you can. Somewhere in the interview you have indicated that you have a business. Complete, edit or print tax forms. Register and subscribe now to work on your irs instructions 6198 & more fillable forms. Any tax practitioner wishing to. Ad access irs tax forms. The internal revenue service, tax forms and publications, 1111 constitution ave. Complete, edit or print tax forms instantly. Attach to your tax return. The internal revenue service, tax forms and publications, 1111 constitution ave. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web the internal revenue service (irs) usually allows taxpayers to deduct money spent. Any tax practitioner wishing to. Ad access irs tax forms. You can download or print current or past. The internal revenue service, tax forms and publications, 1111 constitution ave. Drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business. If line 21 is less than line 5 of form 6198, losses on line 5 (form. Drafting irs form 6198 is a good skill to have so you can determine the maximum deductible amount after a loss in your invested business. Form 6198 should be filed when a taxpayer has a loss in a business. Web use this form to. You can download or print current or past. Ad access irs tax forms. The internal revenue service, tax forms and publications, 1111 constitution ave. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Get ready for tax season. Form 6198 should be filed when a taxpayer has a loss in a business. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). If line 21 is less than line 5 of form 6198, losses on line 5. Get ready for tax season deadlines by completing any required tax forms today. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Drafting irs form 6198 is a good skill to have so you can determine the maximum. Web the internal revenue service (irs) usually allows taxpayers to deduct money spent on a business up to a certain limit. Complete, edit or print tax forms instantly. Any tax practitioner wishing to. Form 6198 should be filed when a taxpayer has a loss in a business. Get ready for tax season deadlines by completing any required tax forms today. Somewhere in the interview you have indicated that you have a business. Any tax practitioner wishing to. Web use this form to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). You can download or print current or past. Department of the treasury—internal revenue service (99) u.s. Get ready for tax season deadlines by completing any required tax forms today. If line 21 is less than line 5 of form 6198, losses on line 5 (form. Ad access irs tax forms. Complete, edit or print tax forms instantly. Attach to your tax return. Tax form 6198 helps you to figure out the amount you can. Web guide on how to write a form 6198. Form 6198 is used to determine the profit (or loss). Complete, edit or print tax forms instantly. The internal revenue service, tax forms and publications, 1111 constitution ave. Web the internal revenue service (irs) lets taxpayers deduct cash spent on company expenses up to a specified amount. Web using form 6198, you can figure out the maximum amount you can deduct after you have suffered a loss in your business in the tax year. December 2020) department of the treasury internal revenue service. Form 6198 should be filed when a taxpayer has a loss in a business. Register and subscribe now to work on your irs instructions 6198 & more fillable forms.Fillable Form 6198 AtRisk Limitations printable pdf download

Form 6198

Instructions For Form 6198 AtRisk Limitations 1998 printable pdf

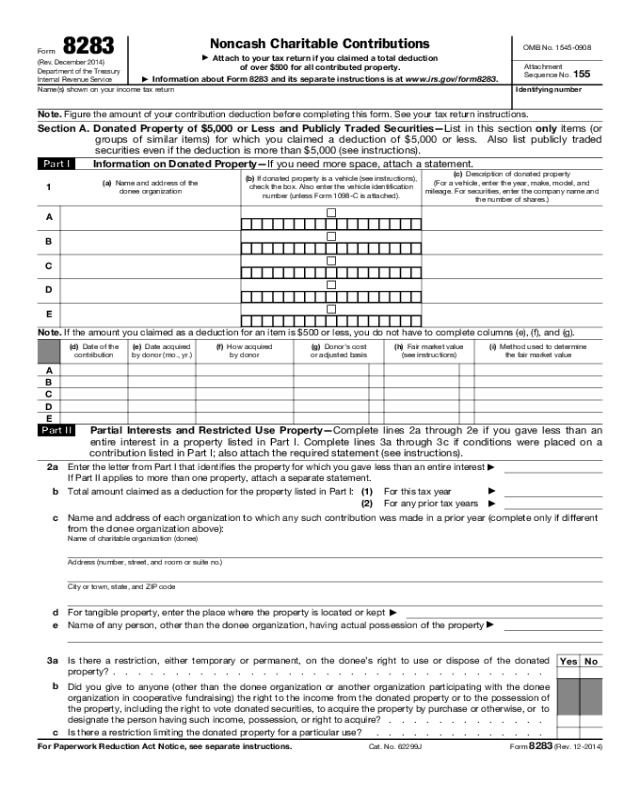

2019 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

IRS Form 6198 Instructions AtRisk Limitations

Form 6198 Instructions Fill Out and Sign Printable PDF Template signNow

IRS Tax Form 6198 Guide TFX.tax

Download Instructions for IRS Form 6198 AtRisk Limitations PDF

2007 Tax Form 6198 At

Instructions for Form 6198

Related Post: