Irs Form 5564

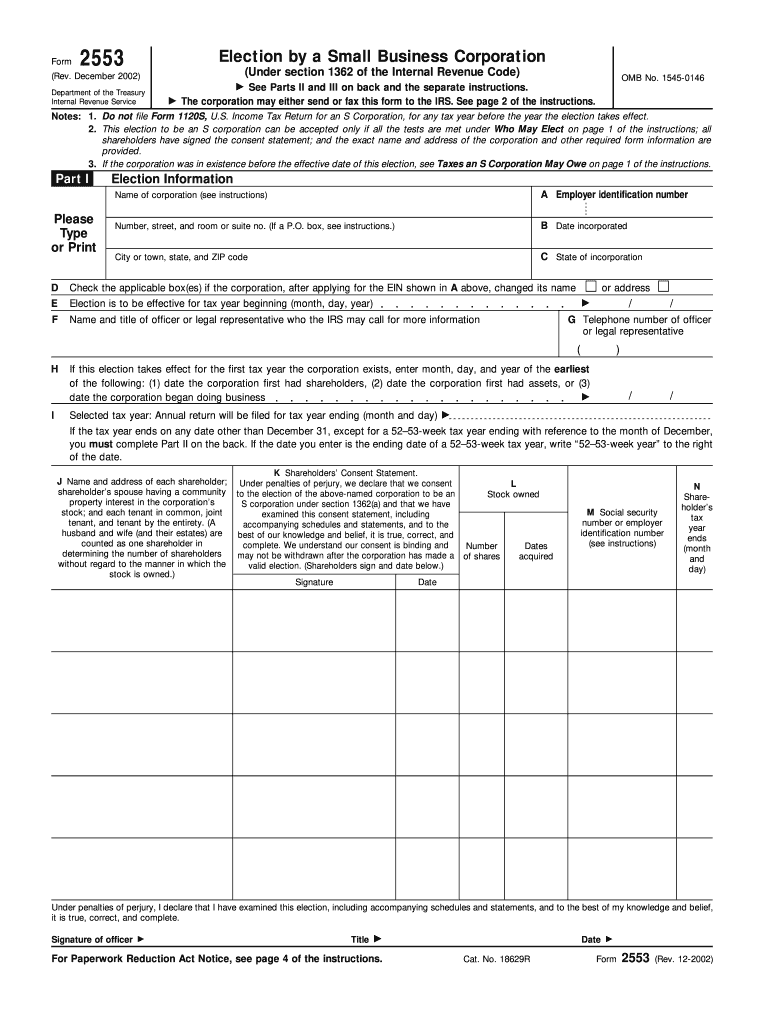

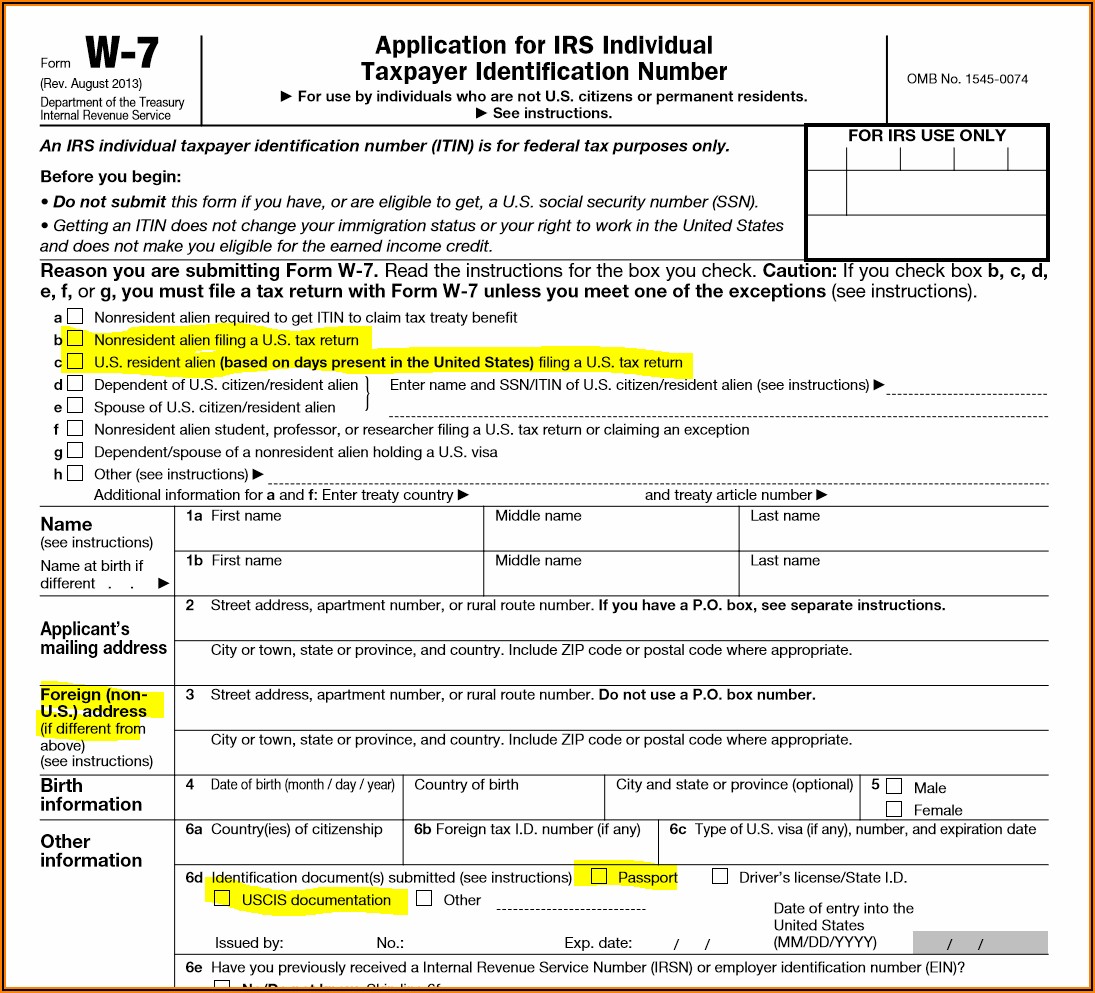

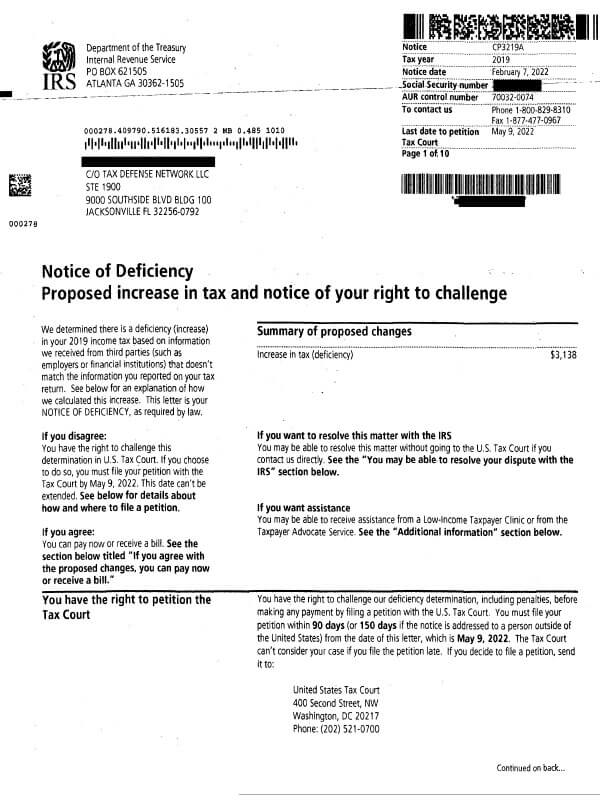

Irs Form 5564 - Web you should determine if you agree with the proposed changes or wish to file a petition with the tax court to dispute the adjustments made by the irs. Web what is irs form 5564? You do not enter form 5564 in the program. Sign and return form 5564, certified with a return receipt requested, as soon as. Review the changes and compare them to your tax return. Web you should review the complete audit report enclosed with your letter. The notice explains how the amount was calculated, what to do if you agree or disagree,. Web what is irs form 5564? Web it indicates your consent with the proposed decrease or increase in tax payments. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency. Estimate how much you could potentially save in just a matter of minutes. This may result in an increase or decrease in your tax. Find irs forms and answers to tax questions. Web this form notifies the irs that you agree with the proposed additional tax due. If you agree with the changes, sign the enclosed form 5564, notice of. Web this form notifies the irs that you agree with the proposed additional tax due. If you agree with the changes, sign the enclosed form 5564, notice of. This may result in an increase or decrease in your tax. Web get your refund status. Review the changes and compare them to your tax return. If you are making a. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. How to fill out form 5564. Review the changes and compare them to your tax return. Web what is irs form 5564? Free, fast, full version (2023) available! Web use a form 5564 template to make your document workflow more streamlined. The notice explains how the amount was calculated, what to do if you agree or disagree,. We received information that is different from what you reported on your tax return. Web if you agree with the notice of deficiency and don’t. Web you should review the complete audit report enclosed with your letter. The notice explains how the amount was calculated, what to do if you agree or disagree,. If you have no objections to the information on the. If you agree with the changes, sign the enclosed form 5564, notice of. This may result in an increase or decrease in. Web what is irs form 5564? We received information that is different from what you reported on your tax return. The notice explains how the amount was calculated, what to do if you agree or disagree,. Web use a form 5564 template to make your document workflow more streamlined. Web this form notifies the irs that you agree with the. Web up to $40 cash back get the free irs form 5564 pdf. Web forms, instructions and publications search. 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web what is irs form 5564? The notice explains how the amount was calculated, what to do if you agree or disagree,. We received information that is different from what you reported on your tax return. Estimate how much you could potentially save in just a matter of minutes. Web get your refund status. Web form 5564 notice of deficiency waiver if the irs believes that. Complete, edit or print tax forms instantly. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web form 5564 get form 5564 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save notice of deficiency waiver. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. This may result in an increase or decrease in your tax. Web this letter explains the changes and your right to challenge the increase in tax court. How to fill out form 5564. Web 400 second street, nw washington,. Web what is irs form 5564? Show details how it works upload the form 5564 pdf edit & sign form 5564 download from anywhere. Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency waiver, and send it back to the agency. We help you understand and meet your federal tax responsibilities. If you agree with the changes, sign the enclosed form 5564, notice of. Web 400 second street, nw washington, dc 20217 you may be able to resolve your dispute with the irs you can download a petition form and rules from the u.s. Sign and return form 5564, certified with a return receipt requested, as soon as. If you agree with the information. This may result in an increase or decrease in your tax. Get ready for tax season deadlines by completing any required tax forms today. Web get your refund status. Ad we help get taxpayers relief from owed irs back taxes. Web what is irs form 5564? Web what is irs form 5564? Web up to $40 cash back get the free irs form 5564 pdf. We received information that is different from what you reported on your tax return. Free, fast, full version (2023) available! Web you should review the complete audit report enclosed with your letter. If you have no objections to the information on the. Web you should determine if you agree with the proposed changes or wish to file a petition with the tax court to dispute the adjustments made by the irs.Ir's Form 2553 Fill in Fill Out and Sign Printable PDF Template signNow

IRS Form 1040 Download Fillable PDF or Fill Online U.S. Individual

Irs.gov Forms 941 Instructions Form Resume Examples Bw9jr5n97X

20142019 Form IRS 1310 Fill Online, Printable, Fillable, Blank PDFfiller

Delinquency Notice Template Master Template

Irs Form 5564 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Aviso del IRS CP3219A Tax Defense Network

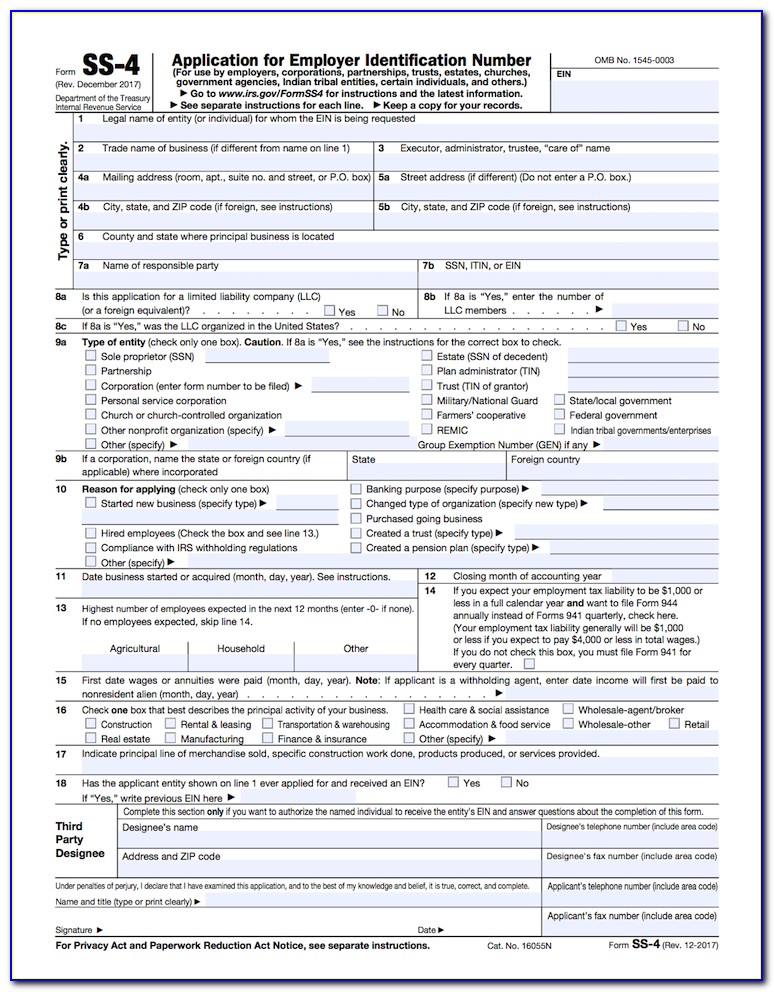

Irs Form Ss 4 Copy Form Resume Examples e4k4rLy5qN

Irs.gov Form 1040a 2016 Form Resume Examples dO3wPXGE8E

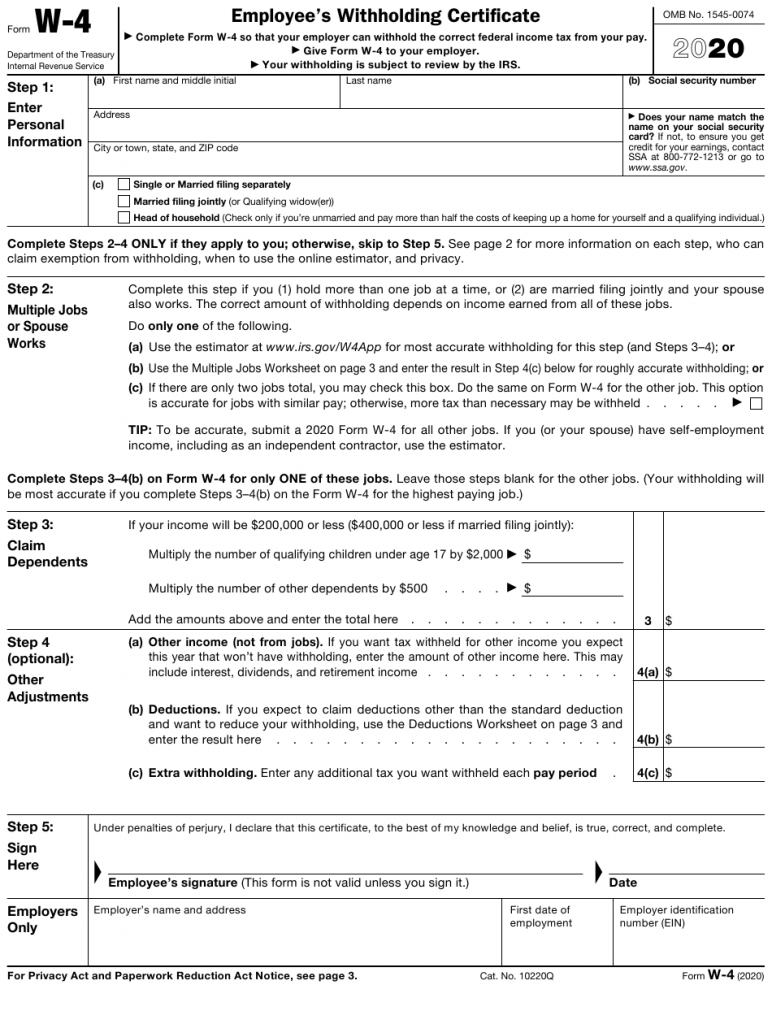

Irs W 4 Form Printable Printable Form 2021

Related Post: