Irs Form 5564 Notice Of Deficiency Waiver

Irs Form 5564 Notice Of Deficiency Waiver - Checking the documents you receive from your employer,. This is the only document that should. You can avoid future problems by: Waiting until you get all your income statements before filing your tax return. If you agree with the changes, sign the enclosed form 5564, notice of. Keeping accurate and full records. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency waiver, and send it back to the. Web if you received a letter cp3219a, statutory notice of deficiency, and are wondering what to do, this may help. This form notifies the irs that you agree with the proposed additional tax due. Web up to $40 cash back 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10 off orator sites upcoming southwest airlines flight promo codes. For more information about tas and your rights. Waiting until you get all your income statements before filing your tax return. Web if you received a letter cp3219a, statutory notice of deficiency,. Along with notice cp3219a, you should receive form 5564. The letter explains why there is a proposed. Web 1 best answer tomk expert alumni you do not enter form 5564 in the program. Web the irs independent office of appeals is here to resolve disputes, without litigation, in a way that is fair and impartial to the government and to. Web your petition to the tax court: Web 1) a copy of any notice of deficiency, notice of determination, or final 2) your statement of taxpayer identification number (form 4). Estimate how much you could potentially save in just a matter of minutes. Web if you have no objections to the information on the tax deficiency notice from the internal. Keeping accurate and full records. Waiting until you get all your income statements before filing your tax return. Estimate how much you could potentially save in just a matter of minutes. This is the only document that should. If you are making a. If you are making a. Learn how to respond toward irs notices of deficiency or when to lodge this tax assessment letter This form notifies the irs that you agree with the proposed additional tax due. Web if the irs is proposing to adjust the amount of tax you owe, you will typically be sent a statutory notice of deficiency. The letter explains why there is a proposed. Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency waiver, and send it back to the. Web if the deficiency is because they made a mistake on their tax return, like marking an allowance they do not. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. You can avoid future problems by: Waiting until you get all your income statements before filing your tax return. Web if you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and. You can avoid future problems by: Web the irs independent office of appeals is here to resolve disputes, without litigation, in a way that is fair and impartial to the government and to you. Web if the irs is proposing to adjust the amount of tax you owe, you will typically be sent a statutory notice of deficiency informing you. Web if the irs is proposing to adjust the amount of tax you owe, you will typically be sent a statutory notice of deficiency informing you of the proposed change resulting. Estimate how much you could potentially save in just a matter of minutes. Web 1) a copy of any notice of deficiency, notice of determination, or final 2) your. For more information about tas and your rights. Web your petition to the tax court: Learn how to respond toward irs notices of deficiency or when to lodge this tax assessment letter Along with notice cp3219a, you should receive form 5564. Web up to $40 cash back 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10. Web don't fill out irs notice of deficiency waiver form 5564 yet! Web your petition to the tax court: Web 1) a copy of any notice of deficiency, notice of determination, or final 2) your statement of taxpayer identification number (form 4). Web if the deficiency is because they made a mistake on their tax return, like marking an allowance they do not qualify for or typing their income incorrectly, they will. This is the only document that should. For more information about tas and your rights. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web what is irs form 5564? Web your local advocate’s number is in your local directory and at taxpayeradvocate.irs.gov. Along with notice cp3219a, you should receive form 5564. If you are making a. Web if you have no objections to the information on the tax deficiency notice from the internal revenue service, sign the deficiency waiver form and send a certified. You can avoid future problems by: Web if you received a letter cp3219a, statutory notice of deficiency, and are wondering what to do, this may help. If you agree with the. Estimate how much you could potentially save in just a matter of minutes. Web up to $40 cash back 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10 off orator sites upcoming southwest airlines flight promo codes. This form notifies the irs that you agree with the proposed additional tax due. Web if the irs is proposing to adjust the amount of tax you owe, you will typically be sent a statutory notice of deficiency informing you of the proposed change resulting. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter.IRS Audit Letter CP3219A Sample 1

Irs Form 5564 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Notice of Deficiency. Wth?! r/IRS

IRS Audit Letter CP3219A Sample 1

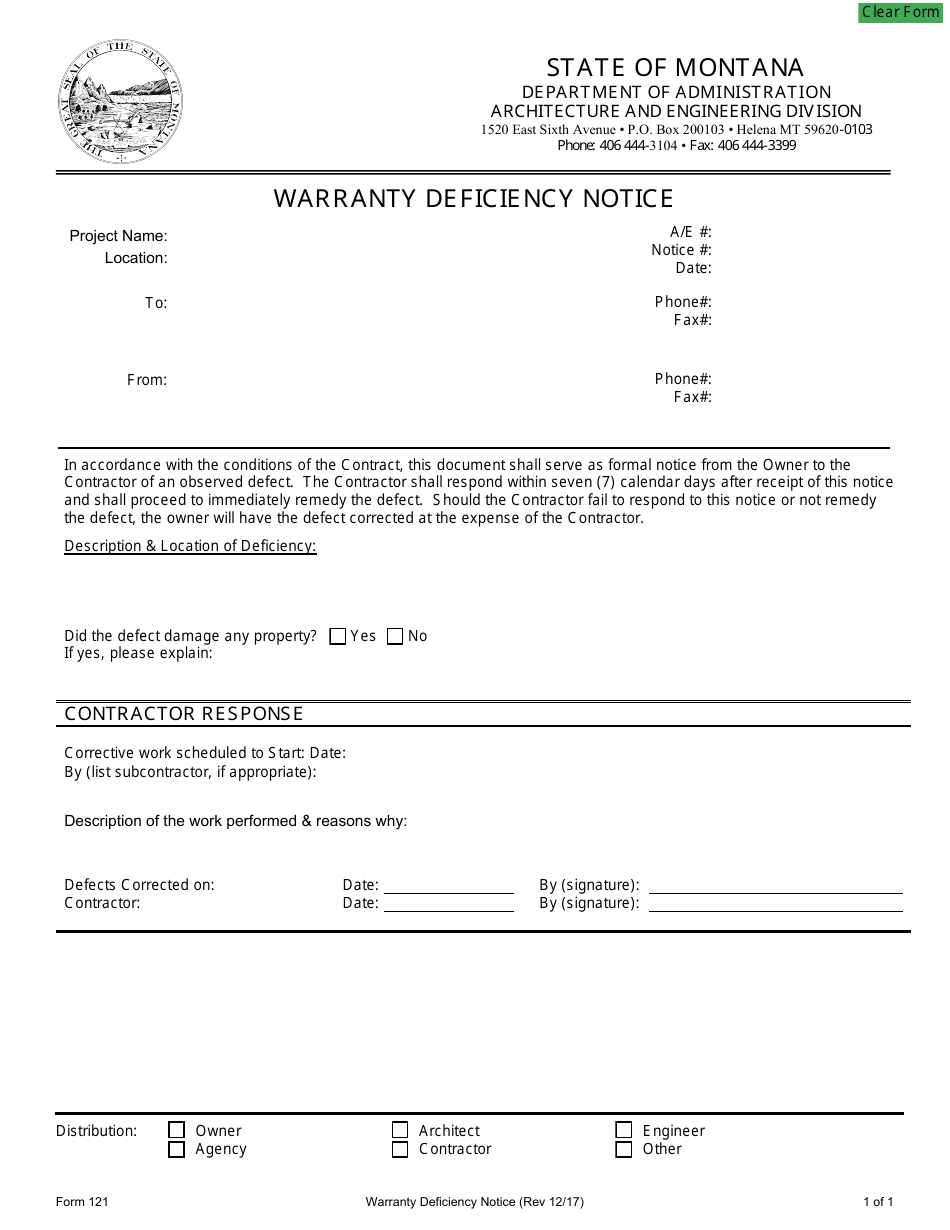

Form 121 Download Fillable PDF or Fill Online Warranty Deficiency

Delinquency Notice Template Master Template

Here's What to Do with an IRS Notice of Deficiency

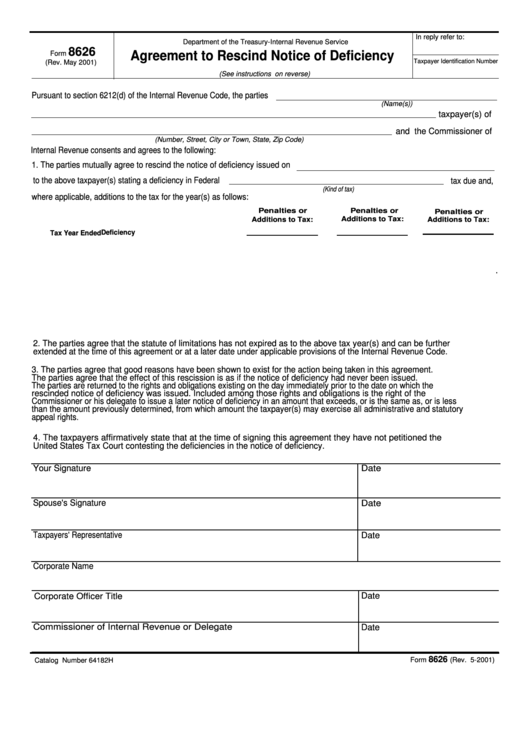

Fillable Form 8626 Agreement To Rescind Notice Of Deficiency

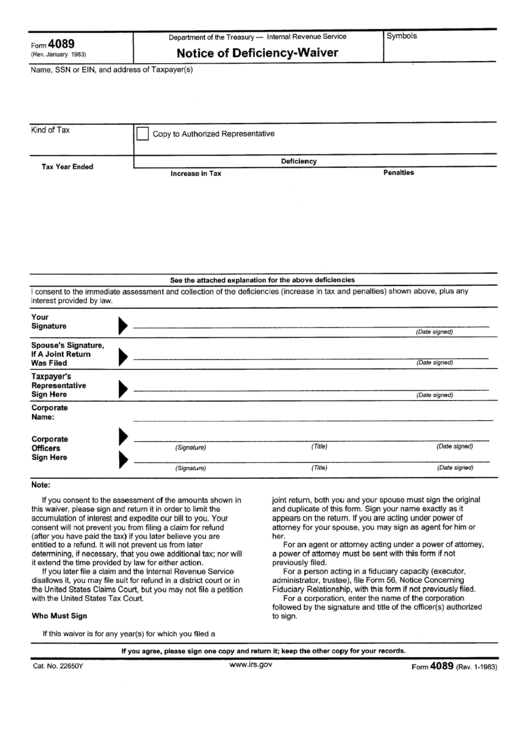

Form 4089 Notice Of DeficiencyWaiver printable pdf download

What To Do About IRS Notice of Deficiency

Related Post: