Irs Form 4952 Instructions

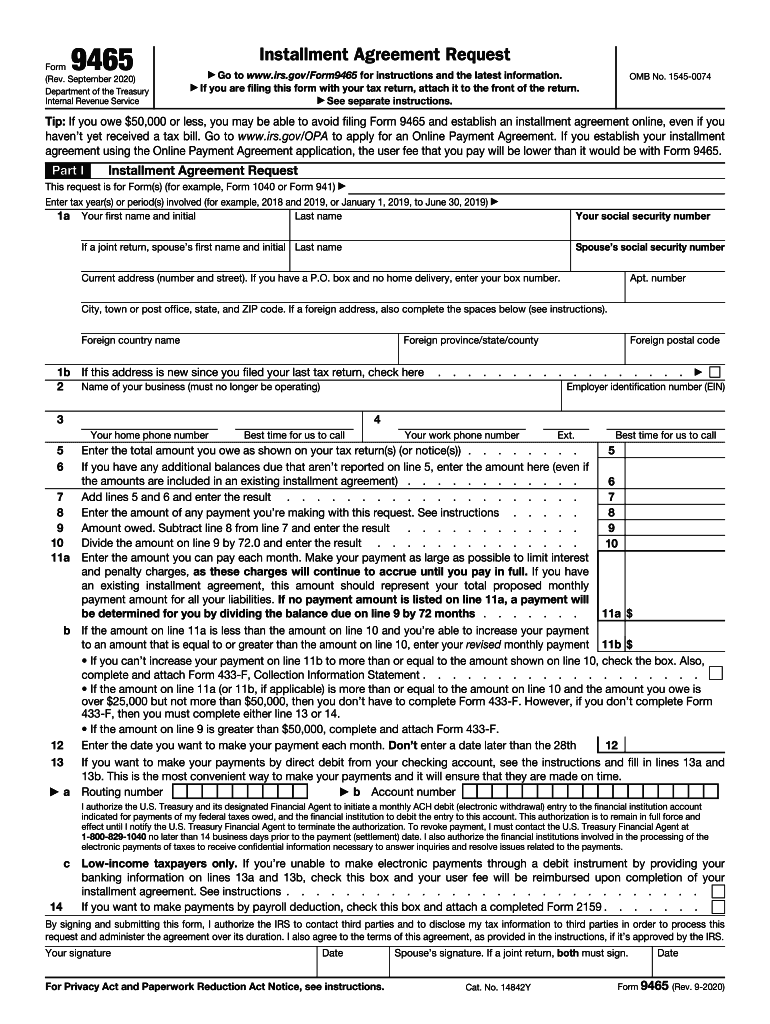

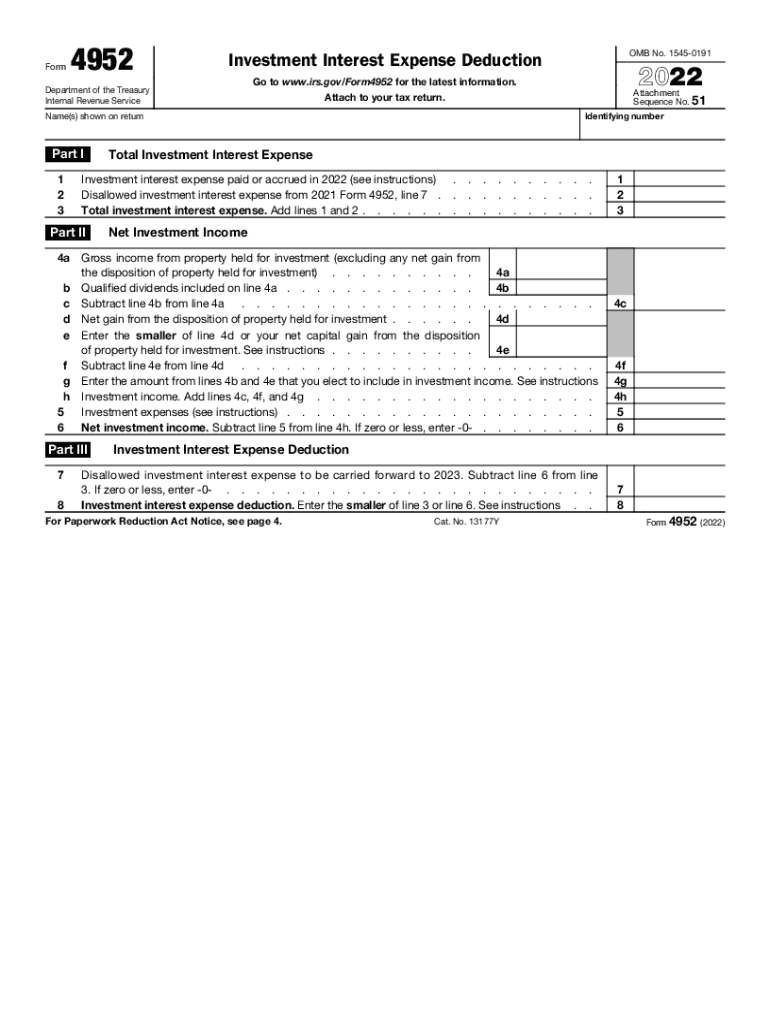

Irs Form 4952 Instructions - Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. However, you can treat less of the amount on line 4e as attributable to line 4g and more. Select the button get form to open it and start editing. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. Web access irs forms, instructions and publications in electronic and print media. Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due in april. Web form 4952 investment interest expense deduction department of the treasury internal revenue service (99) a go to www.irs.gov/form4952 for the latest information. Complete, edit or print tax forms instantly. Amount of investment interest you can deduct; Complete, edit or print tax forms instantly. Use this form to figure the amount of investment interest expense you can deduct for the current year and. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. Web per form 4952, line 4g, enter. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Web form 4952 is an irs tax form determining the investment interest expense that may be either deducted or carried forward to a future tax year. Web if you filled out form 4952, investment interest expense deduction, for your regular. Enter the ale member’s complete address (including. Web a taxpayer filing form 8952 in december of 2021 with one worker would look to compensation paid to the worker in 2020 because 2020 is the most recently completed. Select the button get form to open it and start editing. How you can identify investment interest expense as one of your tax.. Complete, edit or print tax forms instantly. Enter the ale member’s complete address (including. Amount of investment interest you can deduct; Web follow this guideline to properly and quickly fill in irs 4952. Web form 4952 investment interest expense deduction department of the treasury internal revenue service (99) a go to www.irs.gov/form4952 for the latest information. How you can identify investment interest expense as one of your tax. Enter the ale member’s complete address (including. However, you can treat less of the amount on line 4e as attributable to line 4g and more. Use this form to figure the amount of investment interest expense you can deduct for the current year and. Web to deduct investment. Web to deduct investment interest, you must file a form 4952 with your return. Web if you filled out form 4952, investment interest expense deduction, for your regular tax, you will need to fill out a second form 4952 for the amt as follows. Complete, edit or print tax forms instantly. On this form, figure these: How you can identify. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. Web this article will walk you through irs form 4952 so you can better understand: Web we last updated the investment interest expense deduction in december 2022, so this is the latest version. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment interest. Web we last updated federal form 4952 in december 2022 from the federal internal revenue service. Web form 4952 investment interest expense deduction department of the treasury internal revenue service. However,. Web form 4952 investment interest expense deduction department of the treasury internal revenue service (99) a go to www.irs.gov/form4952 for the latest information. However, you can treat less of the amount on line 4e as attributable to line 4g and more. Web to deduct investment interest, you must file a form 4952 with your return. Web access irs forms, instructions. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Web to deduct investment interest, you must file a form 4952 with your return. Web follow this guideline to properly and quickly fill in irs 4952. How you can identify investment interest expense as one of your tax. Web a. This form is for income earned in tax year 2022, with tax returns due in april. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. Web follow this guideline to properly and quickly fill in irs 4952. Web form 4952 investment interest expense deduction department of the treasury internal revenue service. How you can identify investment interest expense as one of your tax. However, you can treat less of the amount on line 4e as attributable to line 4g and more. Get ready for tax season deadlines by completing any required tax forms today. Ad outgrow.us has been visited by 10k+ users in the past month This form is used by. Web we last updated federal form 4952 in december 2022 from the federal internal revenue service. Web if you filled out form 4952, investment interest expense deduction, for your regular tax, you will need to fill out a second form 4952 for the amt as follows. Ago to www.irs.gov/form4952 for the latest information. Web information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on how to file. Web access irs forms, instructions and publications in electronic and print media. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2022 and the amount you can carry forward to future years. Enter the ale member’s complete address (including. Web to deduct investment interest, you must file a form 4952 with your return. Web a taxpayer filing form 8952 in december of 2021 with one worker would look to compensation paid to the worker in 2020 because 2020 is the most recently completed. On this form, figure these: Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. the taxpayer has $60,000 in investment interest.Form 4952Investment Interest Expense Deduction

Form 9465 Fill Out and Sign Printable PDF Template signNow

Fill Free fillable F4952 2019 Form 4952 PDF form

IRS Form 8990 Instructions Business Interest Expense Limitation

Form 4952 Fill Out and Sign Printable PDF Template signNow

Fill Free fillable IRS PDF forms

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Fill Free fillable Investment Interest Expense Deduction 4952 PDF form

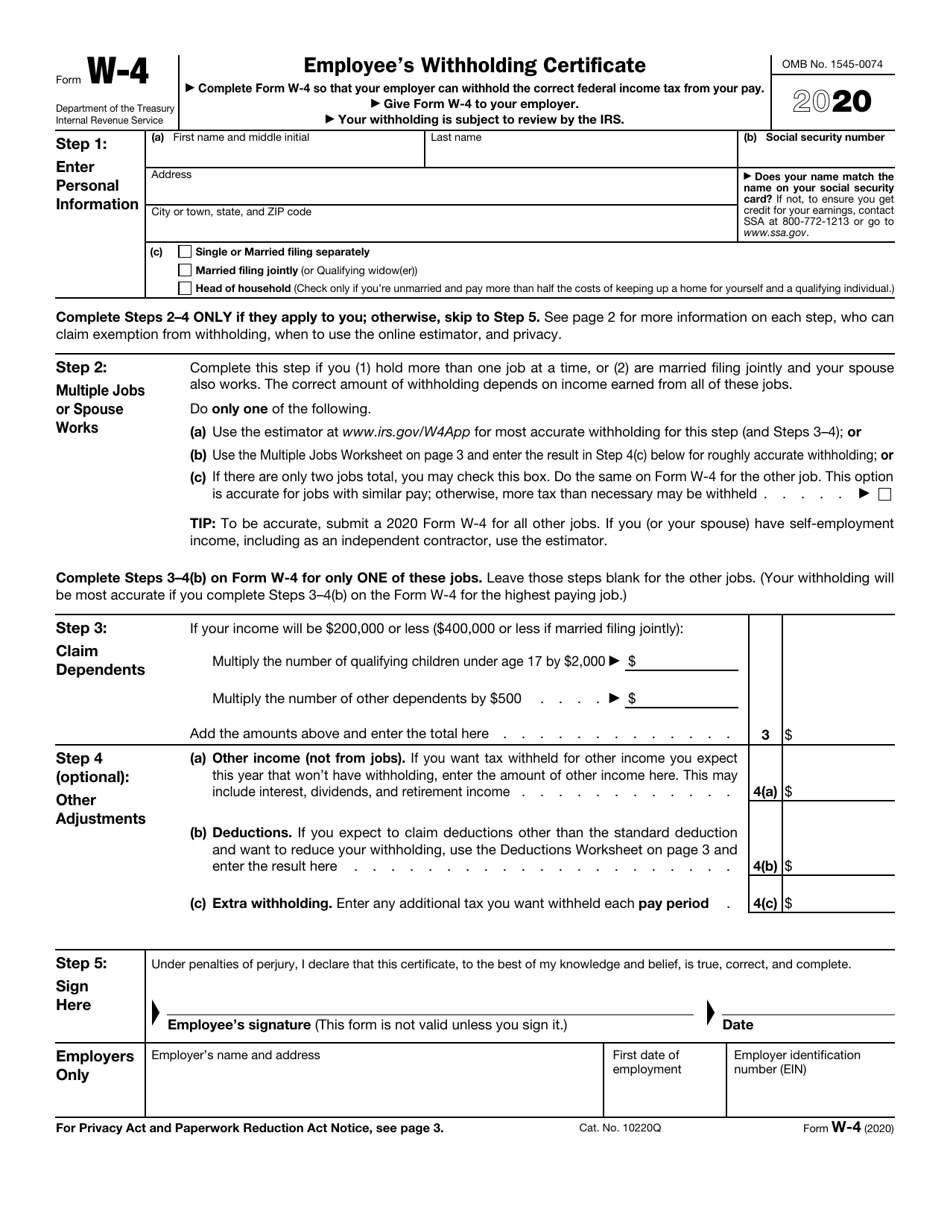

IRS Form W4 Download Fillable PDF or Fill Online Employee's

Related Post: