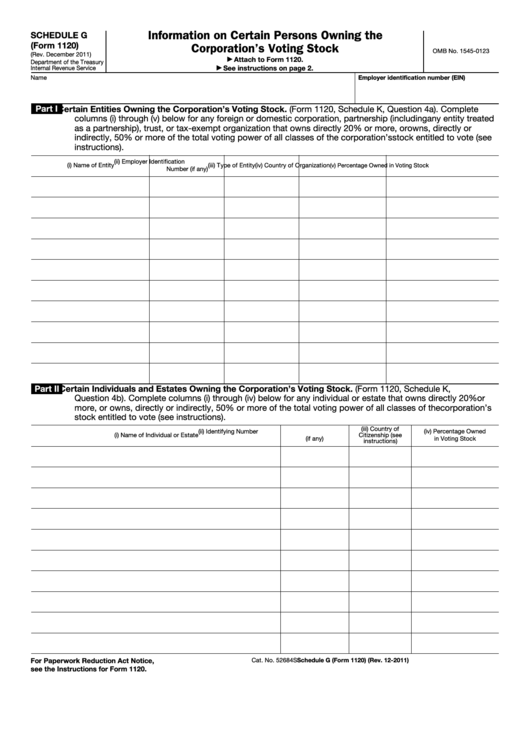

Irs Form 1120 Schedule G

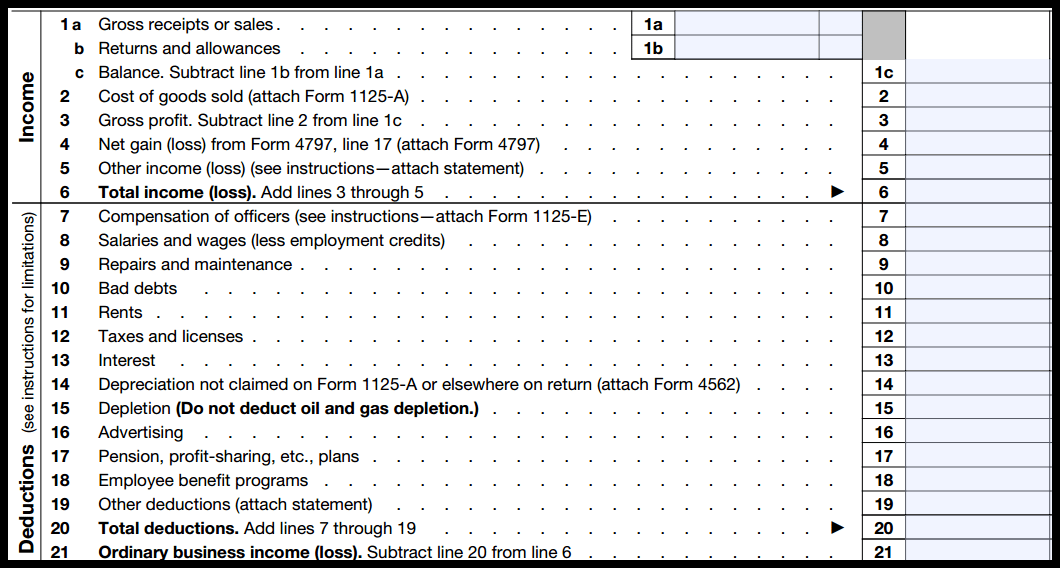

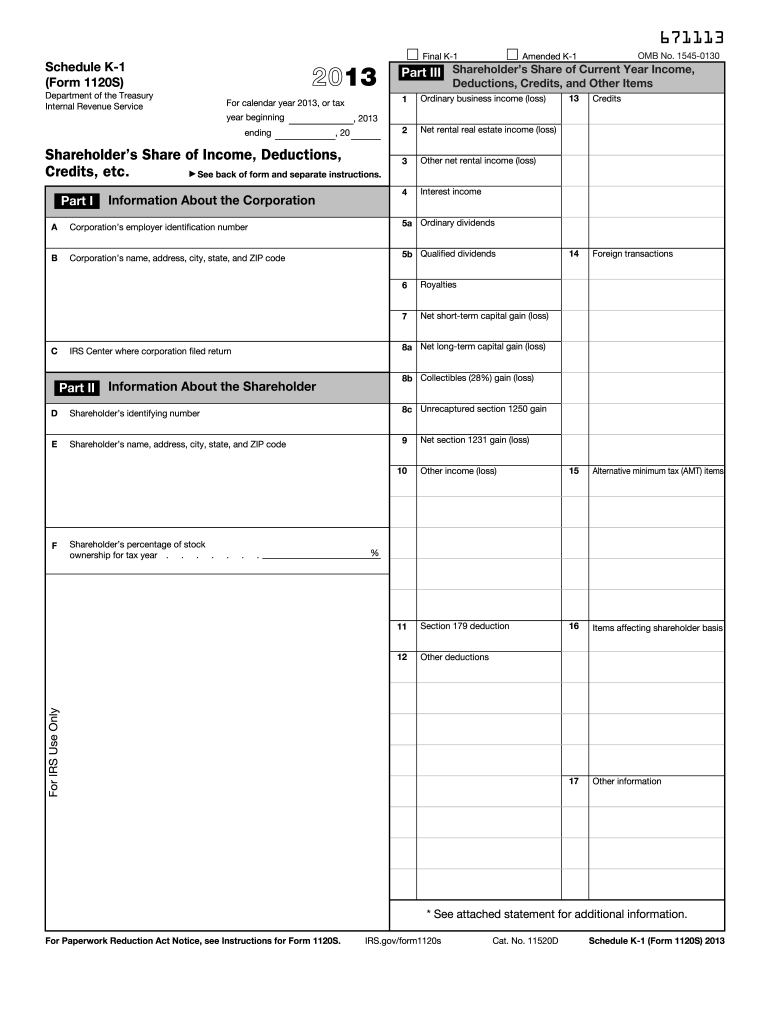

Irs Form 1120 Schedule G - Web schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Department of the treasury internal revenue service. This form is for income earned in tax year 2022, with tax returns due. December 2011) department of the treasury internal revenue service. Income tax return for regulated investment company form 1120s: Web schedule g (form 1120) and instructions. Schedule g (form 1120) (rev. Irs instructions for form 1120. Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. Income tax return for an s corporation. Select the button get form to open it. December 2011) department of the treasury internal revenue service information on certain persons owning the corporation’s voting stock. Web irs form 1120 schedule g is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Web 1120 mef ats scenario. Web understanding the constructive ownership percentage for form 1120. Web irs form 1120 schedule g is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Ad easy guidance & tools for c corporation tax returns. Web 1120 mef ats scenario 4: December 2011) department of the treasury. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Schedule g (form 1120) (rev. Information on certain persons ownin. Select the button get form to open it. Web schedule g (form 1120) and instructions. Solved•by intuit•1•updated 1 year ago. Do not file this form unless the corporation has filed or is attaching. December 2011) department of the treasury internal revenue service. Web understanding the constructive ownership percentage for form 1120. This form is for income earned in tax year 2022, with tax returns due. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. Income tax return for regulated investment company form 1120s: Web understanding the constructive ownership percentage for form 1120. Ad outgrow.us has been visited by 10k+ users in the past month For calendar year 2022 or tax year beginning, 2022,. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Proconnect tax will automatically carry your entry in. Web we last updated. For calendar year 2022 or tax year beginning, 2022, ending. This form is for income earned in tax year 2022, with tax returns due. Web irs form 1120 schedule g is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Income tax return for regulated investment company. December 2011) department of the treasury internal revenue service. Web irs form 1120 schedule g is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more,. Web schedule g (form 1120) and instructions. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web we last updated the information on certain persons owning the corporation's voting stock in february 2023, so this is the latest version of 1120 (schedule g), fully updated for. For calendar year 2022 or tax year beginning, 2022,. Web schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Select the button get form to open it. Web we last updated the information on certain persons owning the corporation's voting stock in february 2023, so this is the latest version of 1120 (schedule g),. December 2011) department of the treasury internal revenue service. Web schedule g (form 1120) (rev. December 2011) department of the treasury internal revenue service information on certain persons owning the corporation’s voting stock. Ad outgrow.us has been visited by 10k+ users in the past month Web understanding the constructive ownership percentage for form 1120. Web irs form 1120 schedule g is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. When you use a schedule c with form 1040, or file form 1120 for a corporation, you usually need to file your return by the april 15 deadline. Irs instructions for form 1120. Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. Web schedule g (form 1120) and instructions. Web irs form 1120 schedule g is used to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Web schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Information on certain persons ownin. Schedule g (form 1120) (rev. This form is for income earned in tax year 2022, with tax returns due. Income tax return for regulated investment company form 1120s: Web we last updated the information on certain persons owning the corporation's voting stock in february 2023, so this is the latest version of 1120 (schedule g), fully updated for. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a. Select the button get form to open it. Proconnect tax will automatically carry your entry in.IRS Form 1120S Definition, Download, & 1120S Instructions

IRS 1120W 2021 Fill out Tax Template Online US Legal Forms

Form 1120 schedule g 2017 Fill out & sign online DocHub

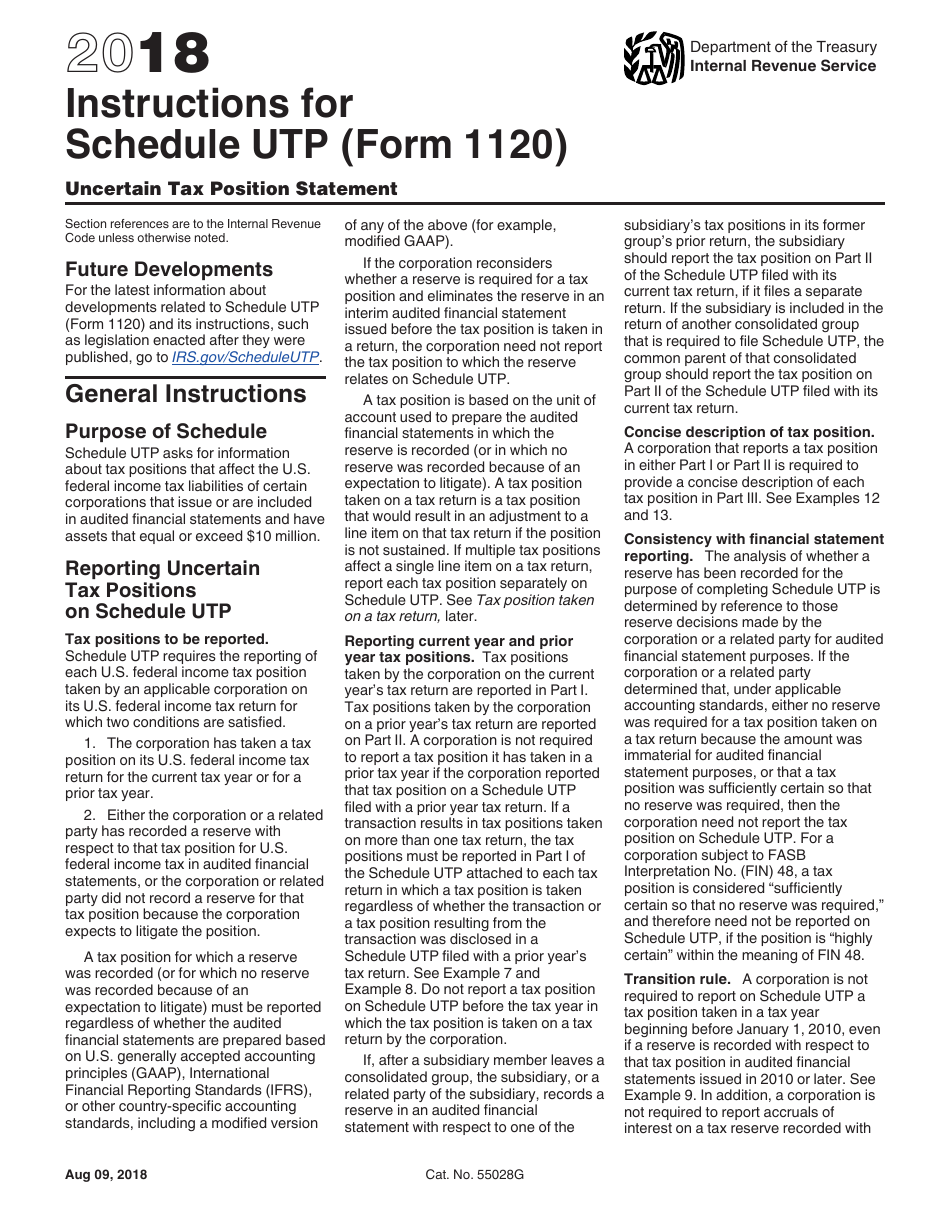

Download Instructions for IRS Form 1120 Schedule UTP Uncertain Tax

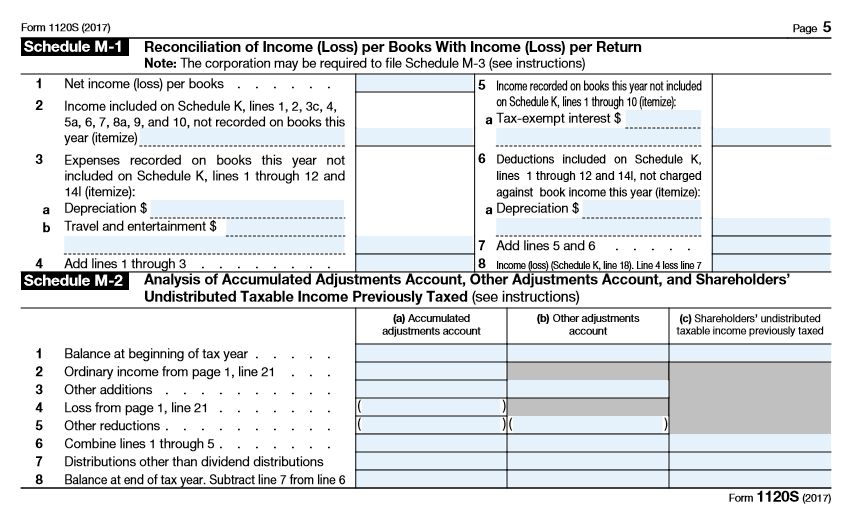

Fill out the 1120S Form including the M1 & M2 with

irs form 1120 schedule g

irs form 1120 schedule g

Fillable Schedule G (Form 1120) Information On Certain Persons Owning

IRS 1120 2008 Fill out Tax Template Online US Legal Forms

2013 form 1120 s Fill out & sign online DocHub

Related Post: