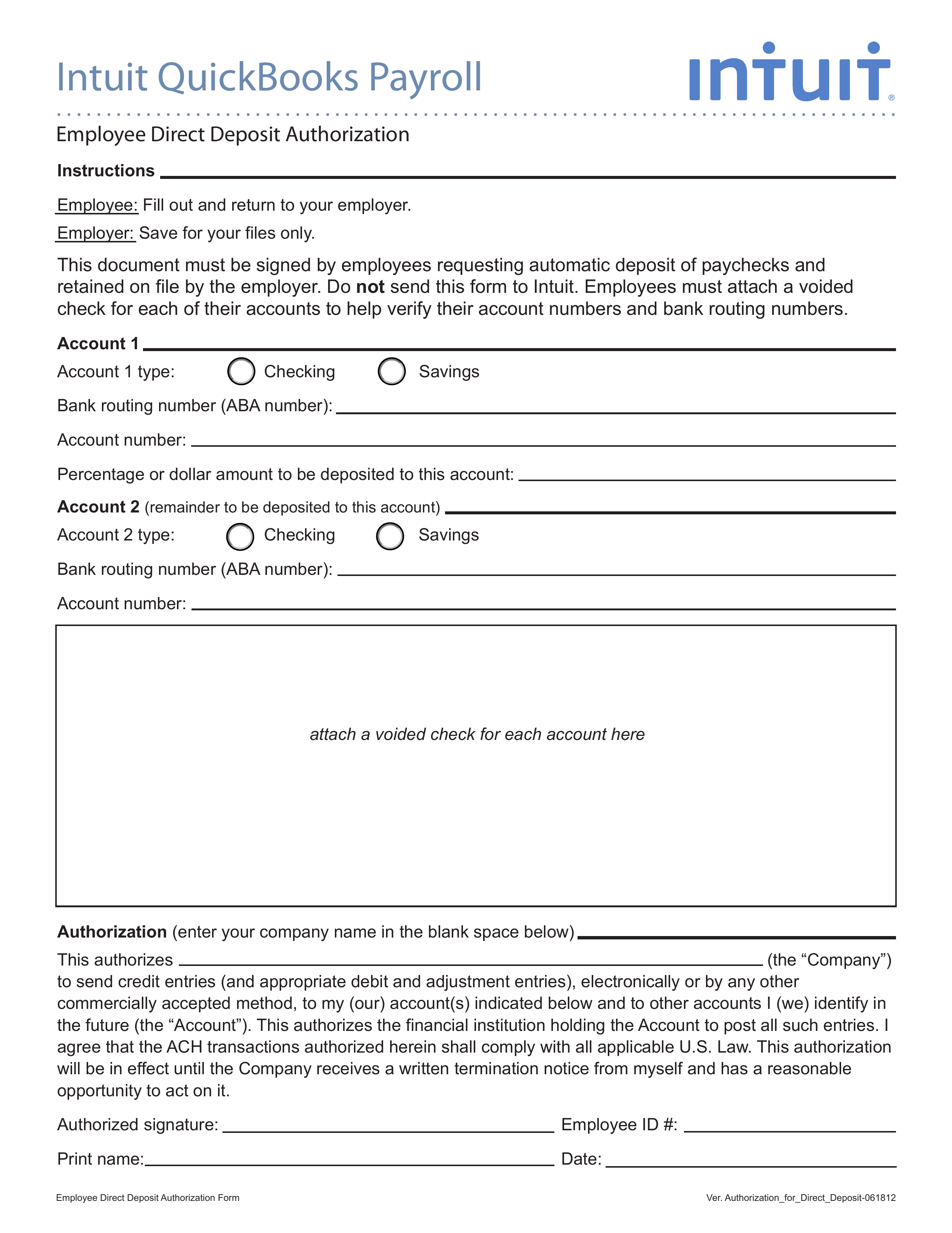

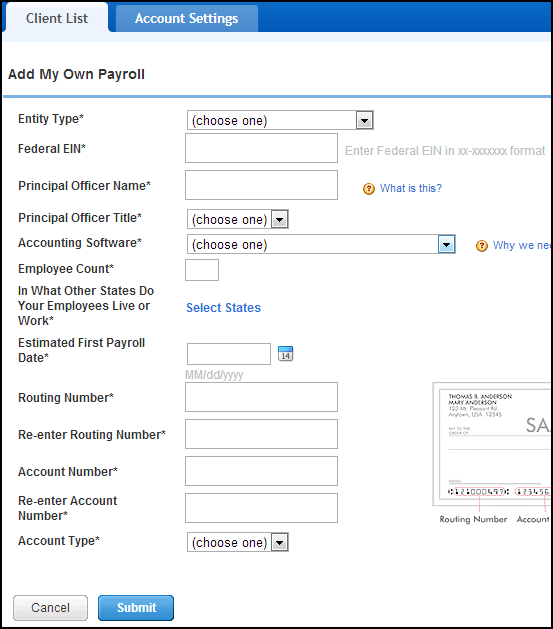

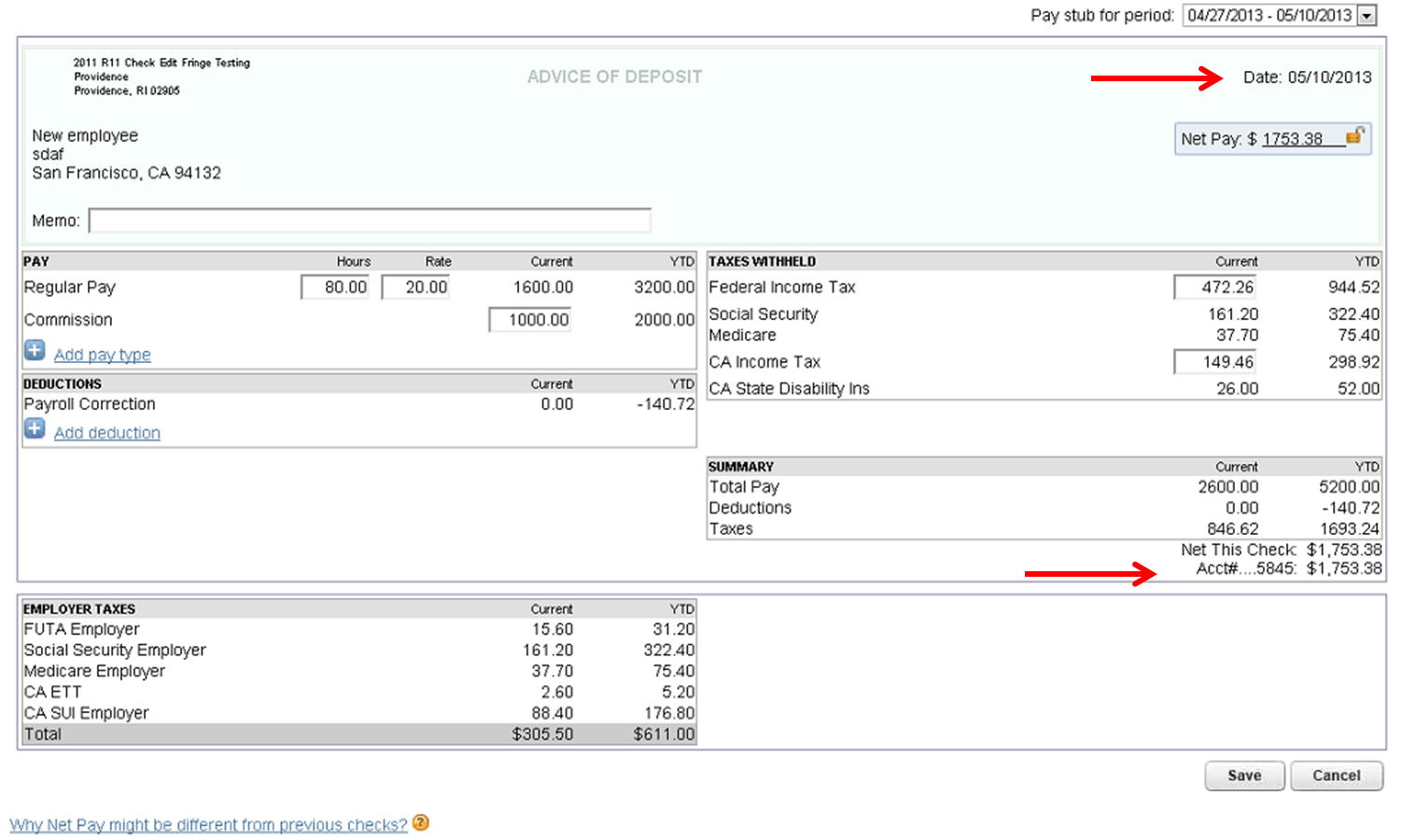

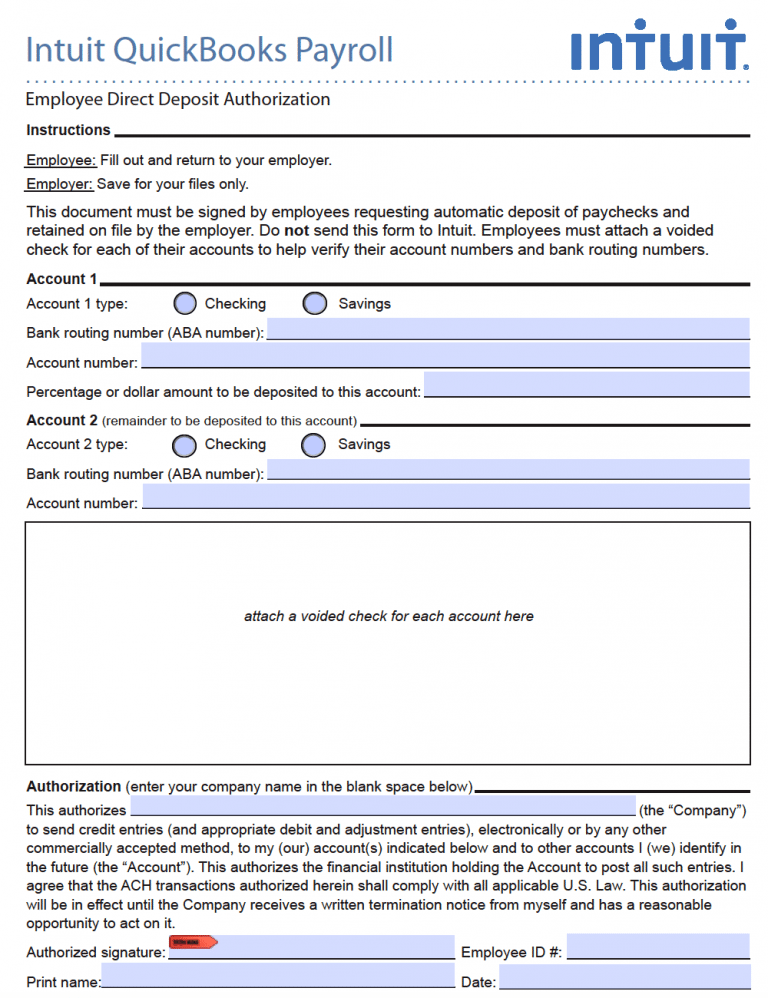

Intuit Payroll Form

Intuit Payroll Form - Try it free learn more. Not sure which payroll service you have? Set up local taxes in quickbooks online payroll. Intuit has, with the cooperation of computing resources, inc., arranged for you to make. If you were paid dividends or earned interest over $10. Web corporation is not a lender and furnishes no financial accommodations to intuit, company and company’s. Quickbooks printable business forms project a professional look and print directly from your quickbooks software. Apparently when we log on to the site we will be prompted to register and or authenticate with either login.gov or id.me. Quickbooks assisted payroll payroll services agreement. Payroll reports cover the following: We help you set up payroll. Checking savings bank routing number (aba number): Not sure which payroll service you have? Intuit will contact your bank to confirm your authority to initiate debits against the account indicated on this form. Web with quickbooks payroll, you’re free to access your filed tax forms and paid tax payments. If you received unemployment benefits. Web corporation is not a lender and furnishes no financial accommodations to intuit, company and company’s. Web within payroll forms, employers can document the taxes they have withheld from employee wages, for both federal and state taxes. Web if you’re trying to access the direct deposit authorization form for your employees, just visit the payroll. Set up local taxes in quickbooks online payroll. If you received unemployment benefits. Web within payroll forms, employers can document the taxes they have withheld from employee wages, for both federal and state taxes. Web here are some forms commonly printed for new employees (pdf): We help you set up payroll. (22201) form 944 for reporting agents (available for enhanced payroll for accountants payroll subscribers only), employer’s annual federal tax return, has been updated. Select bank verification, then view and print. If you received unemployment benefits. Reflect your business image by customizing colors, fonts and company logo. Intu), the global financial technology platform that makes intuit turbotax , credit karma ,. Employees must attach a voided check for each of their accounts to help verify their account numbers and bank routing numbers. Set up local taxes in quickbooks online payroll. Payroll reports cover the following: Includes a copy for your employee. Multiple worksites, payroll deductions and contributions, payroll tax liability, payroll tax and wage summary, time activities, vacation and sick leave,. Health benefits for your team. We file most federal and state payroll forms for you. Web you can customize, run, print, or export a payroll report and share valuable insights with your accountant. I want intuit to do my payroll for me. Web employee direct deposit authorization form for ifsp ver. Health benefits for your team. Do not send this form to intuit. Go to taxes and select payroll tax. Employees must attach a voided check for each of their accounts to help verify their account numbers and bank routing numbers. Account 1 account 1 type: Web form 945a, annual record of federal tax liability, has been updated. Pay and file payroll taxes and forms in quickbooks online payroll. Intuit will contact your bank to confirm your authority to initiate debits against the account indicated on this form. Try it free learn more. Here's how to find your payroll service. (22201) form 944 for reporting agents (available for enhanced payroll for accountants payroll subscribers only), employer’s annual federal tax return, has been updated. All money to be transferred as payroll or any other form must be collaterally funded and fully guaranteed by company. You further authorize intuit to reinitiate. Select bank verification, then view and print. Direct deposit forms keep. Go to taxes and select payroll tax. Multiple worksites, payroll deductions and contributions, payroll tax liability, payroll tax and wage summary, time activities, vacation and sick leave, and workers’ comp. This way, your employees can start to fill out and sign. We help you set up payroll. Manage automatic tax payments and form filings. Web within payroll forms, employers can document the taxes they have withheld from employee wages, for both federal and state taxes. Web here are some forms commonly printed for new employees (pdf): If you received unemployment benefits. If the company’s debit for the direct deposit of payroll is returned for any reason and intercept has credited my. Take care of your team. Direct deposit forms keep records straight by providing two stubs, one for company records and one for employee or vendor records. If you were paid dividends or earned interest over $10. Intuit will use the information on this page for processing changes to your direct deposit service and for no. Web here are some common tax forms where your income will be reported and you can expect to receive if any of these scenarios apply to you: Web the intuit (quickbooks) payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit. Intuit will contact your bank to confirm your authority to initiate debits against the account indicated on this form. Your bank account to collect payroll funds and/or pay the intuit payroll fees. Web form 945a, annual record of federal tax liability, has been updated. (fax) 877.699.8996 or [email protected] intuit quickbooks payroll Checking savings bank routing number (aba number): Here's how to find your payroll service. Apparently when we log on to the site we will be prompted to register and or authenticate with either login.gov or id.me. Contact to order learn more. Quickbooks assisted payroll payroll services agreement. Payroll reports cover the following:Intuit QuickBooks Enhanced Payroll 2013 419312 B&H Photo Video

Intuit Quickbooks Online Payroll Services Best Payroll Service Review

Intuit Payroll Direct Deposit Forms prosecution2012

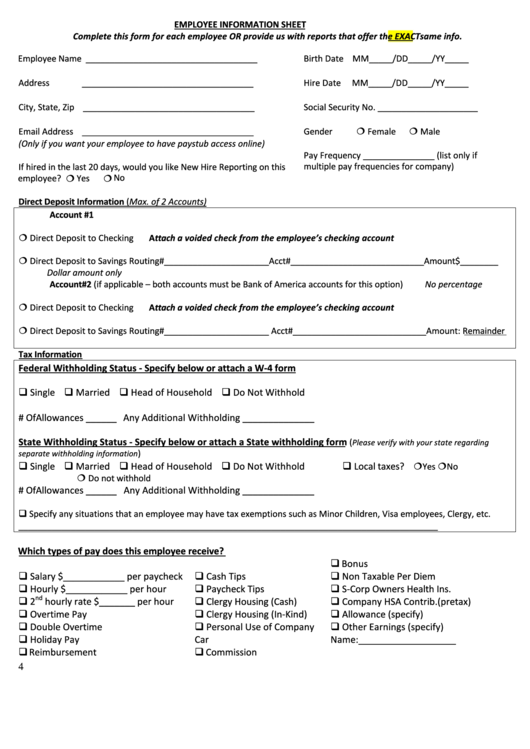

Fillable Employee Information Sheet For Intuit Full Service Payroll

7+ Quickbooks Direct Deposit Form Free Download [Word, PDF]

Free Intuit/Quickbooks Payroll Direct Deposit Form PDF eForms

Intuit Full Service Payroll for Accountants

Intuit QuickBooks Pro with QuickBooks Enhanced Payroll 2013 3 Employees

Payroll Check Intuit Payroll Check Stubs

Free Intuit / Quickbooks Direct Deposit Authorization Form PDF

Related Post:

![7+ Quickbooks Direct Deposit Form Free Download [Word, PDF]](https://www.opensourcetext.org/wp-content/uploads/2020/09/ddf-1-768x557.png)