Instructions To Form 706

Instructions To Form 706 - 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. Tax cuts and jobs act; August 2019)) department of the treasury. What's new various dollar amounts and limitations in form 706 are. Web instructions for form 706; Web form 706 pdf. Simplified sample 706 for portability section a: Web form 706 and its instructions, such as legislation enacted after they were published, go to irs.gov/form706. If you find that you must change something on a return that has already been filed, you should: Web the specific instructions given are: If you find that you must change something on a return that has already been filed, click the detail tab. Simplified sample 706 for portability section a: Web irs form 706, the u.s. Get ready for tax season deadlines by completing any required tax forms today. All estates that exceed the exemption amount. If you find that you must change something on a return that has already been filed, you should: The catalog number for the instructions is 16779e. August 2019)) department of the treasury. Form to be filed on certain estates of a deceased resident or citizen. Get ready for tax season deadlines by completing any required tax forms today. Executors need to file it for large. Web per 706 instructions, amending form 706: Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Web instructions for form 706; Ad irs 706 inst & more fillable forms, register and subscribe now! In the wake of last winter’s. Web many estates are still required to file an irs form 706 (either because it is a taxable estate or it is a first death and you want to preserve portability for the surviving spouse), and. Web instructions for form 706; Simplified sample 706 for portability section a: Web form 706 pdf. Web you must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Simplified sample 706 for portability section a: Get ready for tax season deadlines by completing any required tax forms today. Web form 706 for an estate tax return is an often misunderstood form. That’s why we created a. If you find that you must change something on a return that has already been filed, click the detail tab. Web for decedents dying in 1999, form 706 must be filed by the executor for the estate of every u.s. Opting out of portability section b:. All estates that exceed the exemption amount. Web per 706 instructions, amending form 706: If you find that you must change something on a return that has already been filed, click the detail tab. 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. All estates that exceed the exemption amount. The catalog number for the instructions is 16779e. If you are unable to file form. Both of these situations can trigger a tax liability. Form to be filed on certain estates of a deceased resident or citizen. Complete, edit or print tax forms instantly. Web form 706 for an estate tax return is an often misunderstood form. Web per 706 instructions, amending form 706: In the wake of last winter’s. Executors need to file it for large. Web let’s get started. All estates that exceed the exemption amount. Form to be filed on certain estates of a deceased resident or citizen. Tax cuts and jobs act; Web click on any of the following forms or instructions to view as pdf files: The catalog number for the instructions is 16779e. Web for decedents dying in 1999, form 706 must be filed by the executor for the estate of every u.s. Both of these situations can trigger a tax liability. Both of these situations can trigger a tax liability. Web form 706 and its instructions, such as legislation enacted after they were published, go to irs.gov/form706. Complete, edit or print tax forms instantly. Simplified sample 706 for portability section a: Web form 706 pdf. Web per 706 instructions, amending form 706: Web form 706 for an estate tax return is an often misunderstood form. Opting out of portability section b:. August 2019)) department of the treasury. What's new various dollar amounts and limitations in form 706 are. In the wake of last winter’s. Web click on any of the following forms or instructions to view as pdf files: If you find that you must change something on a return that has already been filed, you should: Form to be filed on certain estates of a deceased resident or citizen. Tax cuts and jobs act; 16, 2023 — the internal revenue service today further postponed tax deadlines for most california taxpayers to nov. Web irs form 706, the u.s. Get ready for tax season deadlines by completing any required tax forms today. The catalog number for the instructions is 16779e. All estates that exceed the exemption amount.Download Instructions for IRS Form 706GS(T) GenerationSkipping

form 706 instructions 2019 Fill Online, Printable, Fillable Blank

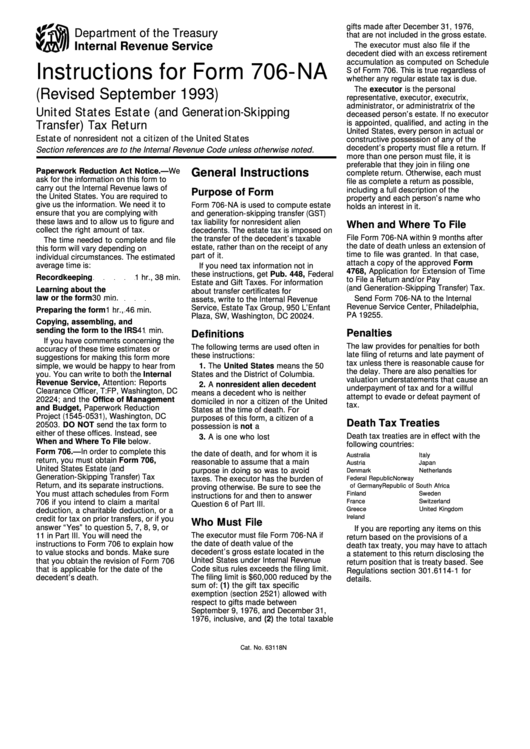

Instructions For Form 706Na United States Estate (And Generation

Instructions For Form 706Qdt Department Of The Treasury printable

Instructions For Form 706Gs(D) (Rev. February 2006) printable pdf download

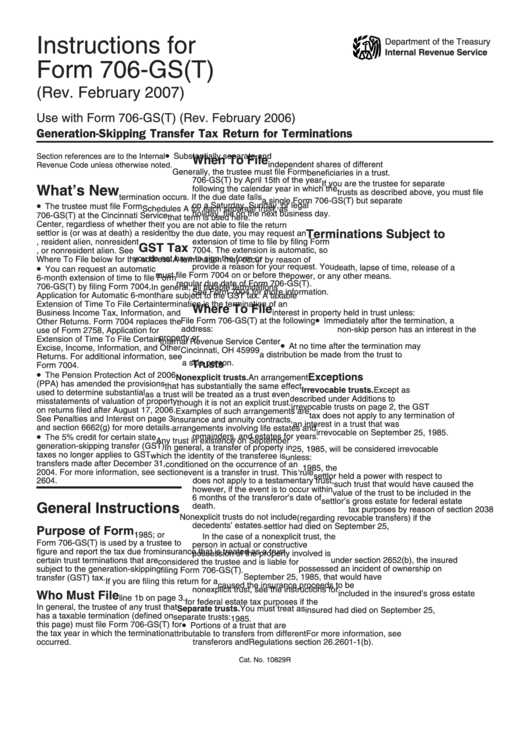

Instructions For Form 706Gs(T) Internal Revenur Service printable

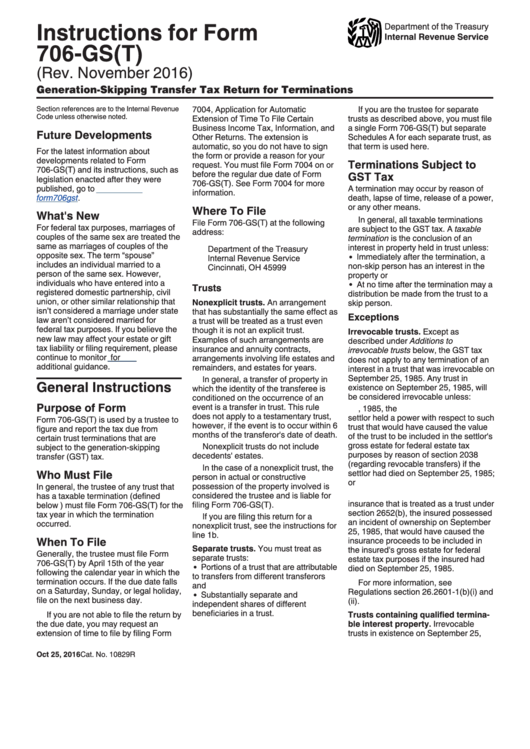

Instructions For Form 706Gs(T) 2016 printable pdf download

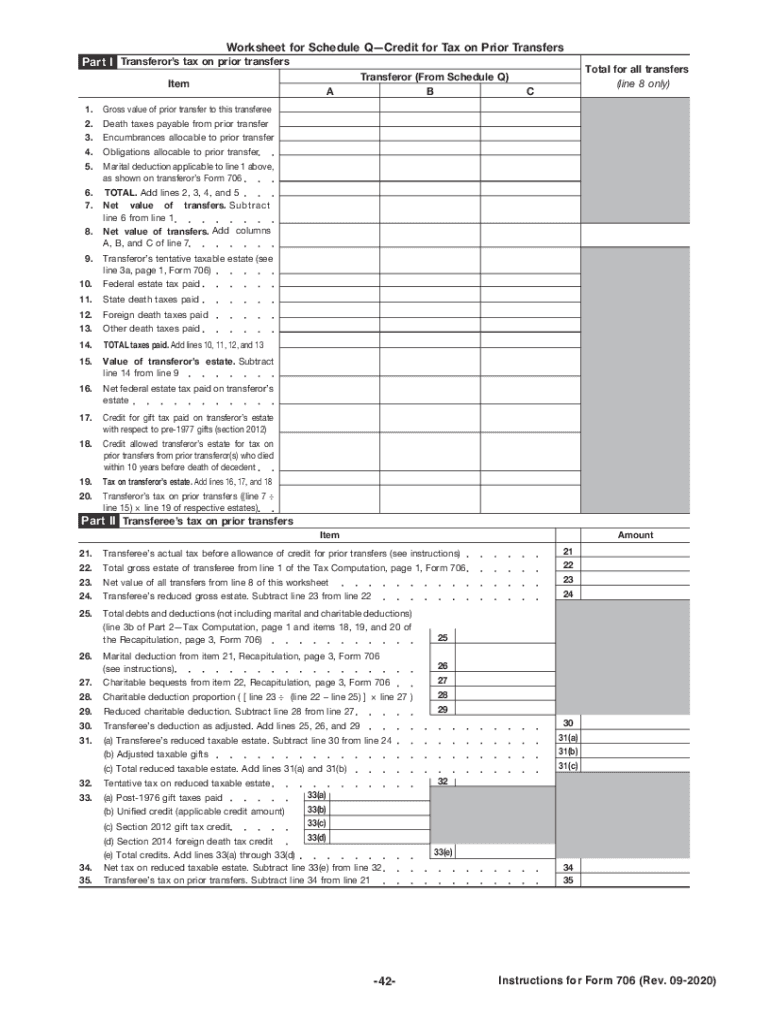

2020 Form IRS Instruction 706 Fill Online, Printable, Fillable, Blank

Instructions For Form 706Na United States Estate (And Generation

Instructions For Form 706Gs(D) 2013 printable pdf download

Related Post: