Instructions Schedule D Form 1041

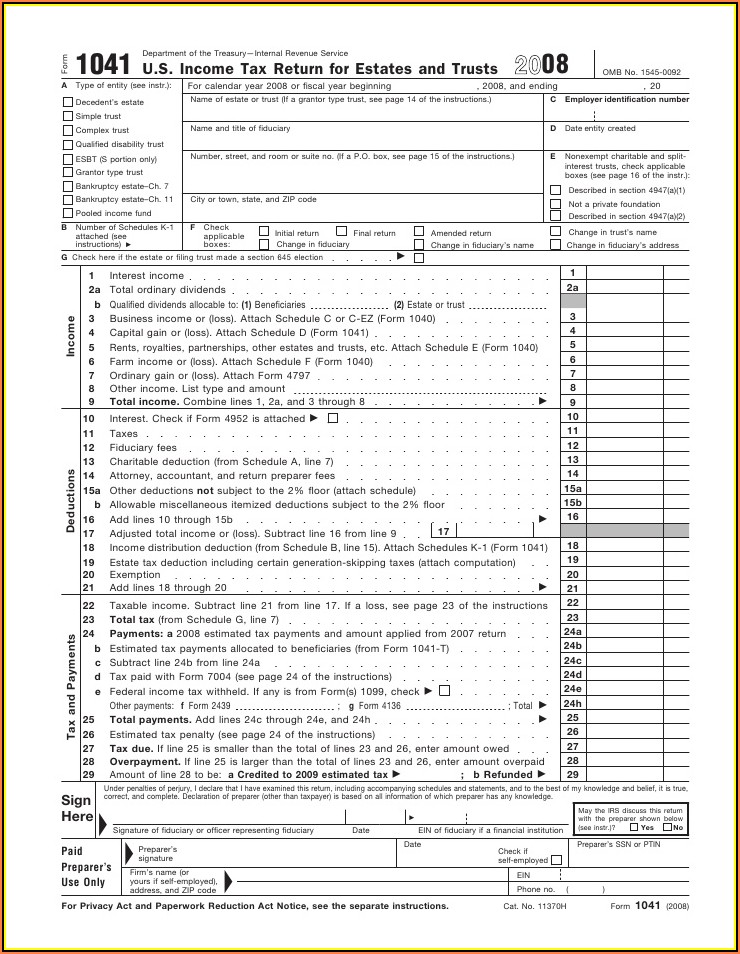

Instructions Schedule D Form 1041 - Instructions for schedule d \(form 1041\), capital gains and losses created date:. Please use the link below to. Web federal capital gains and losses 1041 (schedule d) pdf form content report error it appears you don't have a pdf plugin for this browser. Web use this worksheet to figure the estate’s or trust’s tax if line 14a, column (2), or line 15, column (2), of schedule d or form 1041, line 22 is zero or less; Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2021 to 2022 if schedule d, line 20 is a loss and (a) the loss on schedule d, line 19, col. Web 2021 instructions for schedule d (form 1041) author: Must be removed before printing. Updated for tax year 2022 • june 2, 2023 8:43 am. Ad access irs tax forms. Schedule d (form 1041) and schedule d tax worksheet. Instructions for schedule d \(form 1041\), capital gains and losses created date:. Web use schedule d (form 1041) to report gains and losses from the sale or exchange of capital assets by an estate or trust. Web these instructions explain how to complete schedule d (form 1041). Web use form 1041 schedule d to report gains or losses from capital. Ad access irs tax forms. Web schedule d (form 1041) department of the treasury internal revenue service capital gains and losses. Complete, edit or print tax forms instantly. Web use schedule d (form 1041) to report gains and losses from the sale or exchange of capital assets by an estate or trust. Schedule d (from 1041) pdf instructions for. Web use this worksheet to figure the estate’s or trust’s tax if line 14a, column (2), or line 15, column (2), of schedule d or form 1041, line 22 is zero or less; Must be removed before printing. Web these instructions explain how to complete schedule d (form 1041). The schedule d form is what. Complete form 8949 before you. Schedule d (form 1041) and schedule d tax worksheet. Ad access irs tax forms. Web once completed you can sign your fillable form or send for signing. On average this form takes 21. Please use the link below to. Must be removed before printing. Web instructions to complete form 1041 the executor, trustee, or personal representative of the estate or trust is responsible for filing form 1041 if the assets they. The schedule d form is what. Web written by a turbotax expert • reviewed by a turbotax cpa. Tip general instructions file schedule d (form 941) for: Web these instructions explain how to complete schedule d (form 1041). Web written by a turbotax expert • reviewed by a turbotax cpa. Web 6 rows if you used schedule d (form 1041), the schedule d tax worksheet in the instructions. Web use form 1041 schedule d to report gains or losses from capital assets associated with an estate or. Web once completed you can sign your fillable form or send for signing. Web federal capital gains and losses 1041 (schedule d) pdf form content report error it appears you don't have a pdf plugin for this browser. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. And trusts (see the schedule. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2021 to 2022 if schedule d, line 20 is a loss and (a) the loss on schedule d, line 19, col. Web 4 rows schedule d (form 1041) department of the treasury internal revenue service. Web form 1041 (schedule d) capital gains and losses 2022 12/08/2022. Web 6 rows if you used schedule d (form 1041), the schedule d tax worksheet in the instructions. Below) files its own schedule d (form 941). Instructions for schedule d \(form 1041\), capital gains and losses created date:. Web 2021 instructions for schedule d (form 1041) author: Web use schedule d (form 1041) to report gains and losses from the. Web use schedule d (form 1041) to report gains and losses from the sale or exchange of capital assets by an estate or trust. Web schedule d (form 1041) department of the treasury internal revenue service capital gains and losses. Schedule d (from 1041) pdf instructions for. Updated for tax year 2022 • june 2, 2023 8:43 am. All forms. Income tax return for estates and trusts. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2021 to 2022 if schedule d, line 20 is a loss and (a) the loss on schedule d, line 19, col. Schedule d (form 1041) and schedule d tax worksheet. Web schedule d (form 1041) department of the treasury internal revenue service capital gains and losses. Web these instructions explain how to complete schedule d (form 1041). All forms are printable and downloadable. Below) files its own schedule d (form 941). And trusts (see the schedule g instructions in the instructions. Web 2022 tax rate schedule. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Schedule d (from 1041) pdf instructions for. Web use form 1041 schedule d to report gains or losses from capital assets associated with an estate or trust. Web 4 rows schedule d (form 1041) department of the treasury internal revenue service. Web form 1041 (schedule d) capital gains and losses 2022 12/08/2022 inst 1041 (schedule d) instructions for schedule d (form 1041), capital gains and losses 2022. Web 6 rows if you used schedule d (form 1041), the schedule d tax worksheet in the instructions. On average this form takes 21. Web 2019 äéêèë¹ê¿åäé ¼åè ¹¾»ºëâ» º åèã ¸ · » ¸ » capital gains and losses »æ·èêã»äê å¼ ê¾» è»·éëèï Updated for tax year 2022 • june 2, 2023 8:43 am. Web these instructions explain how to complete schedule d (form 1041). Tip general instructions file schedule d (form 941) for:2022 Instructions for Schedule D (Form 1041) Internal Fill Online

Form 1041 schedule d instructions Fill online, Printable, Fillable Blank

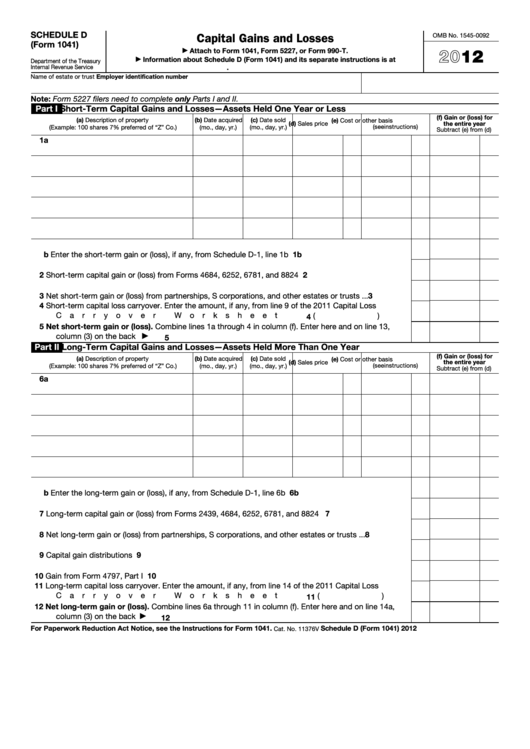

Fillable Schedule D (Form 1041) Capital Gains And Losses 2012

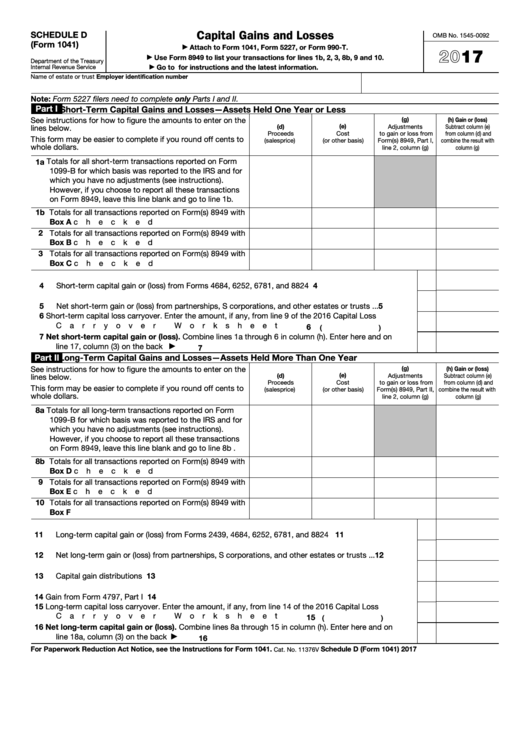

Fillable Schedule D (Form 1041) Capital Gains And Losses 2016

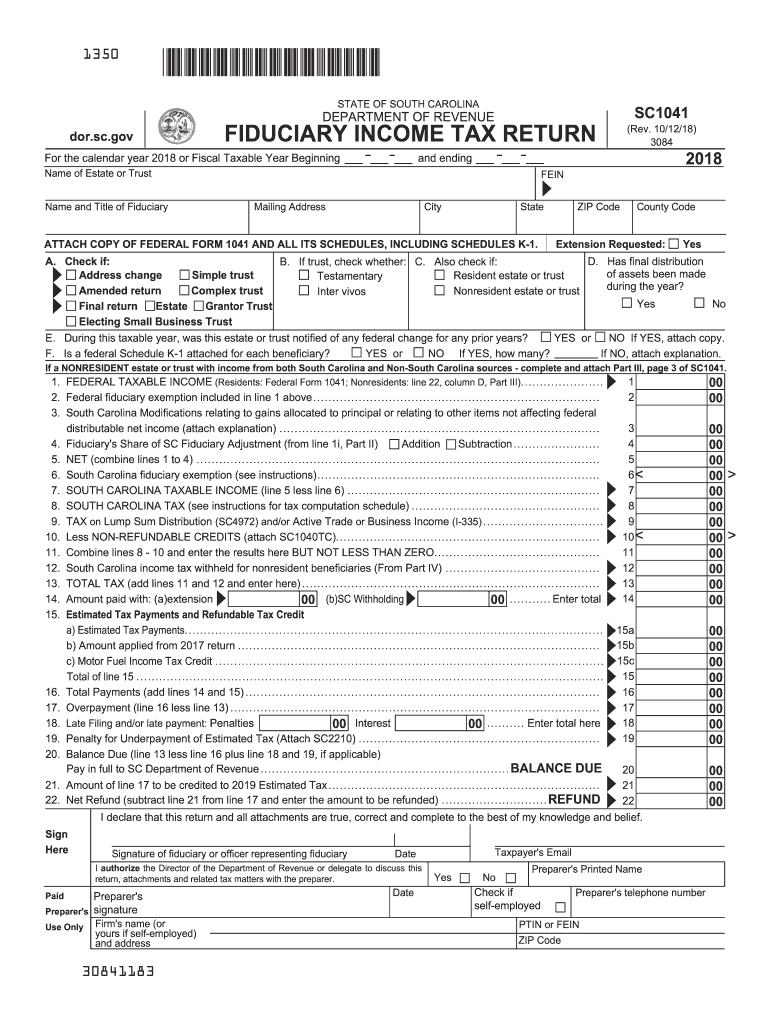

Sc1041 Fill out & sign online DocHub

Schedule D 1 Printable & Fillable Blank PDF Online IRS Tax Forms

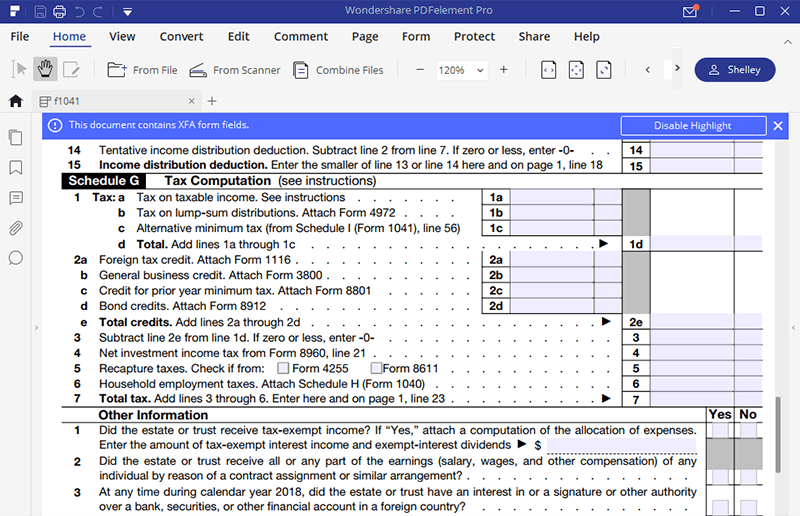

Guide for How to Fill in IRS Form 1041

1041 Schedule D Tax Worksheet

1041 Schedule D Tax Worksheet

Irs Forms 1041 Form Resume Examples 4x2v8xlY5l

Related Post: