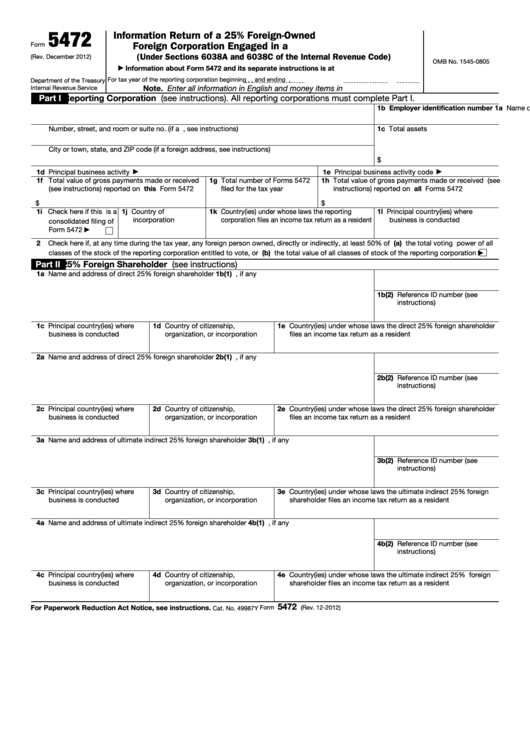

Instructions Form 5472

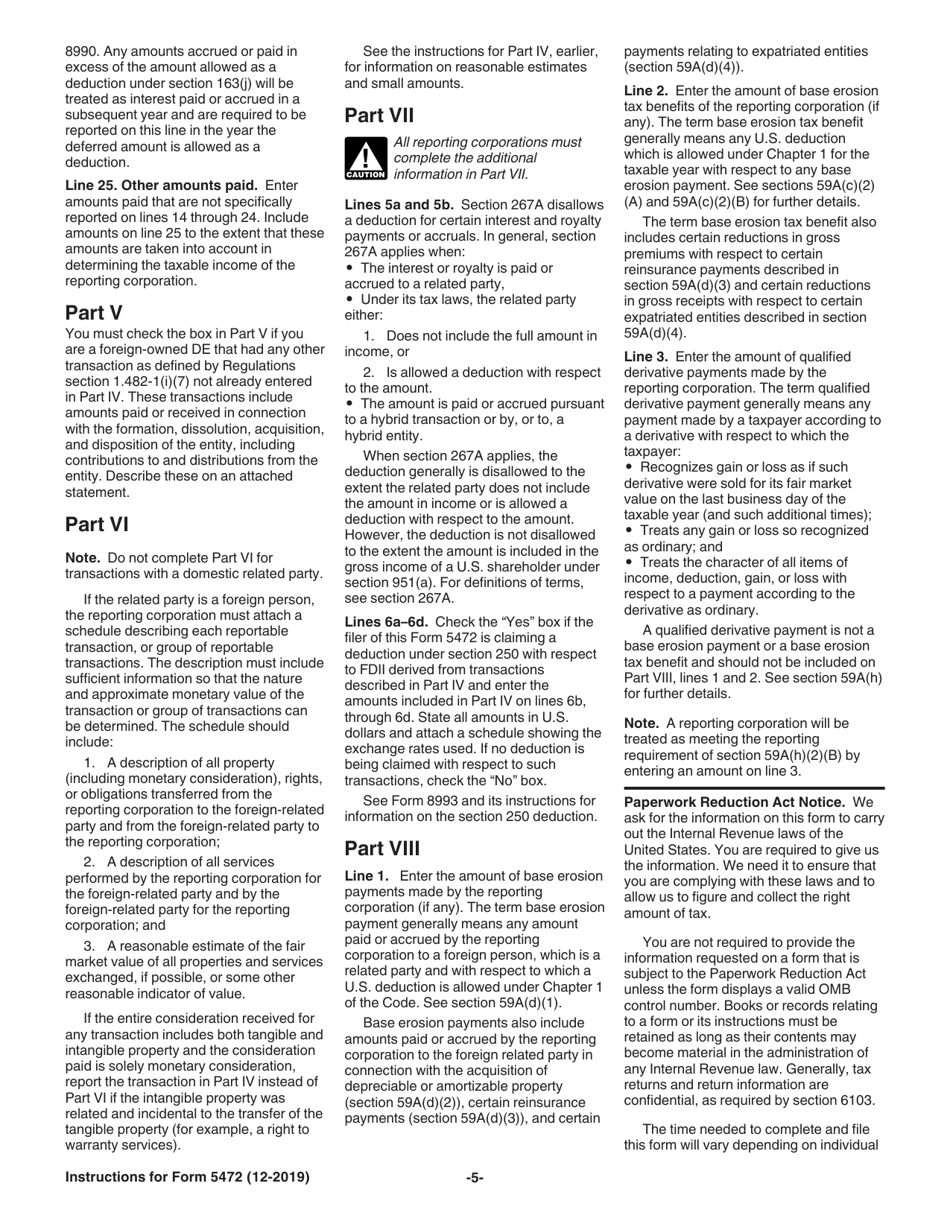

Instructions Form 5472 - Corporations file form 5472 to provide information required. Corporation or a foreign corporation engaged in a u.s. Web instructions for form 5472(rev. Web learn about form 5472 with these 10 instructions, including who needs to file, how to complete it, and the penalties for noncompliance. Form 5472 instructions are quite complex and difficult to understand. Web instructions for form 5472(rev. Web information about form 5472, including recent updates, related forms, and instructions on how to file. But, the information provided can still be rather confusing. Web instructions for form 5472(rev. Web how to file form 5472? Part vii, lines 41a through 41d. Pdffiller allows users to edit, sign, fill & share all type of documents online. Corporation or a foreign corporation engaged in a u.s. If you own a us llc, you may need to file this form under new irs regulations. Web anyone completing a form 5472 must understand the importance of this form and. Get instructions on how to file form 5472. Corporation or a foreign corporation engaged in a u.s. Web instructions for form 5472(rev. Web learn about form 5472 with these 10 instructions, including who needs to file, how to complete it, and the penalties for noncompliance. Web what is irs form 5472? Part octonary, lines 48b and 48c. Web up to $3 cash back instructions for form 5472. Corporation or a foreign corporation engaged in a u.s. Web instructions for form 5472(rev. Web anyone completing a form 5472 must understand the importance of this form and the fact that the irs often uses the form 5472 as a starting point for conducting. Form 5472 instructions are available from the irs. Irs form 5472 is known as information return of a 25% foreign owned us corporation or a foreign corporation engaged in a us trade or business. If you own a us llc, you may need to file this form under new irs regulations. Part octonary, lines 48b and 48c. Web information about. Web form 5472 must be filed by either 1) a us corporation that is 25% (or more) owned by a foreign shareholder or 2) a foreign corporation that is engaged in a us trade. If you own a us llc, you may need to file this form under new irs regulations. Corporation or a foreign corporation engaged in a u.s.. (under sections 6038a and 6038c of the internal. Web form 5472 must be filed by either 1) a us corporation that is 25% (or more) owned by a foreign shareholder or 2) a foreign corporation that is engaged in a us trade. Form 5472 instructions (search for the section titled. Corporation or a foreign corporation engaged in a u.s. Get. Web instructions for form 5472(rev. Please confirm the above mailing address (or fax number) with the information listed on irs: This is especially true for a foreign shareholder of a us. Form 5472 instructions are quite complex and difficult to understand. Web form 5472 must be filed by either 1) a us corporation that is 25% (or more) owned by. Web instructions for form 5472(rev. Corporation or a foreign corporation engaged in a u.s. Form 5472 instructions are available from the irs. Web what is irs form 5472? Part octonary, lines 48b and 48c. Web how to file form 5472? Part vii, lines 41a through 41d. Irs form 5472 is known as information return of a 25% foreign owned us corporation or a foreign corporation engaged in a us trade or business. Web instructions for form 5472(rev. Get instructions on how to file form 5472. Get ready for tax season deadlines by completing any required tax forms today. Web up to $3 cash back instructions for form 5472. Corporations file form 5472 to provide information required. Form 5472 instructions are available from the irs. Department of the treasury internal revenue service (rev. Web form 5472 must be filed by either 1) a us corporation that is 25% (or more) owned by a foreign shareholder or 2) a foreign corporation that is engaged in a us trade. Corporations file form 5472 to provide information required. But, the information provided can still be rather confusing. Corporation or a foreign corporation engaged in a u.s. Pdffiller allows users to edit, sign, fill & share all type of documents online. Corporation or a foreign corporation engaged in a u.s. Please confirm the above mailing address (or fax number) with the information listed on irs: Part octonary, lines 48b and 48c. Irs form 5472 is known as information return of a 25% foreign owned us corporation or a foreign corporation engaged in a us trade or business. Department of the treasury internal revenue service (rev. Complete, edit or print tax forms instantly. Web instructions for form 5472(rev. Get ready for tax season deadlines by completing any required tax forms today. Web learn about form 5472 with these 10 instructions, including who needs to file, how to complete it, and the penalties for noncompliance. (under sections 6038a and 6038c of the internal. Part vii, lines 41a through 41d. Form 5472 instructions (search for the section titled. Form 5472 instructions are quite complex and difficult to understand. Form 5472 instructions are available from the irs. Corporation or a foreign corporation engaged in a u.s.Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

Download Instructions for IRS Form 5472 Information Return of a 25

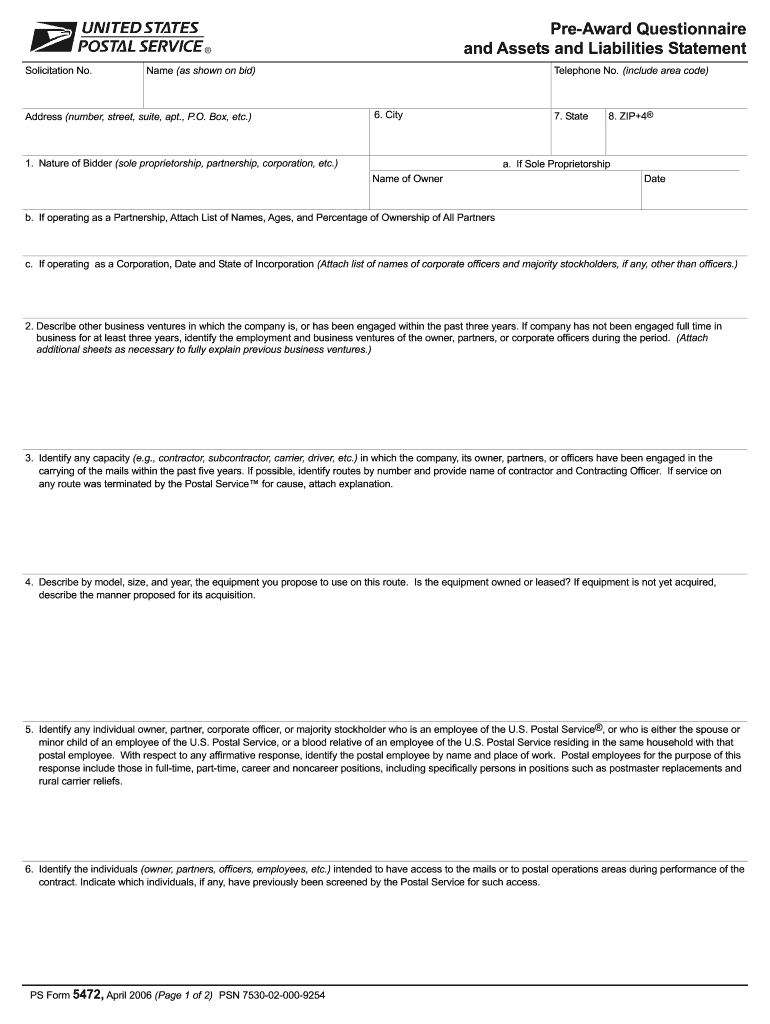

Usps Form 5472 Fill Online, Printable, Fillable, Blank pdfFiller

Form 5472, Info. Return of a 25 ForeignOwned U.S. or Foreign Corp

Instructions & Quick Guides on Form 5472 Asena Advisors

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

form 5472 instructions 2018 Fill Online, Printable, Fillable Blank

Form 5472 Information Return of Corporation Engaged in U.S. Trade

What’s New Foreignowned singlemember LLCs now must file Form 5472

Instructions for IRS Form 5472 Information Return Of A 25 Foreign

Related Post:

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity-1024x1024.jpg)