Instructions For Maryland Form 502

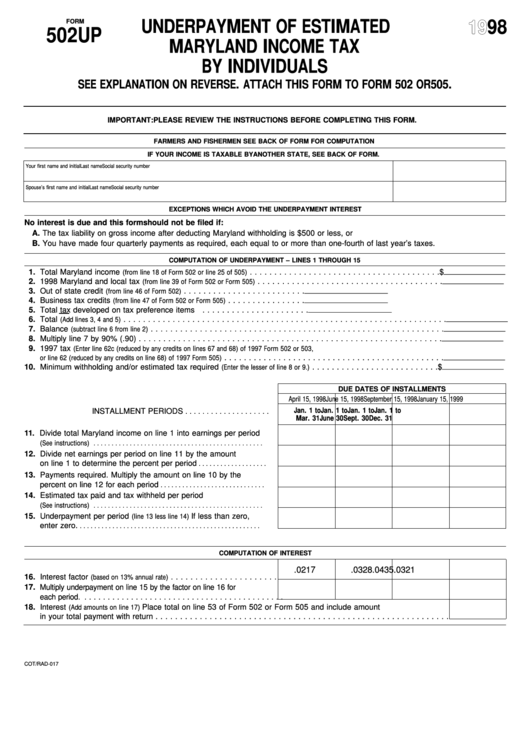

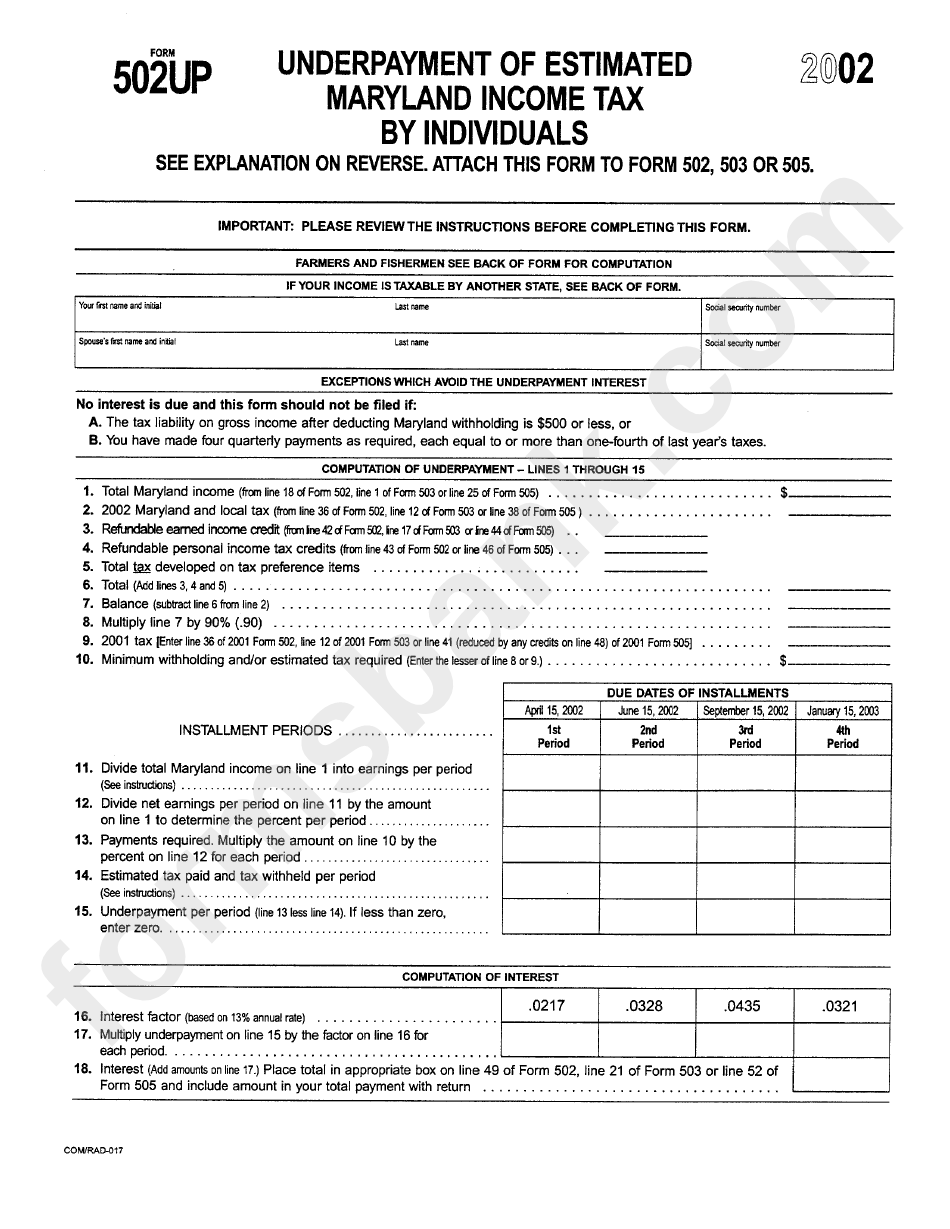

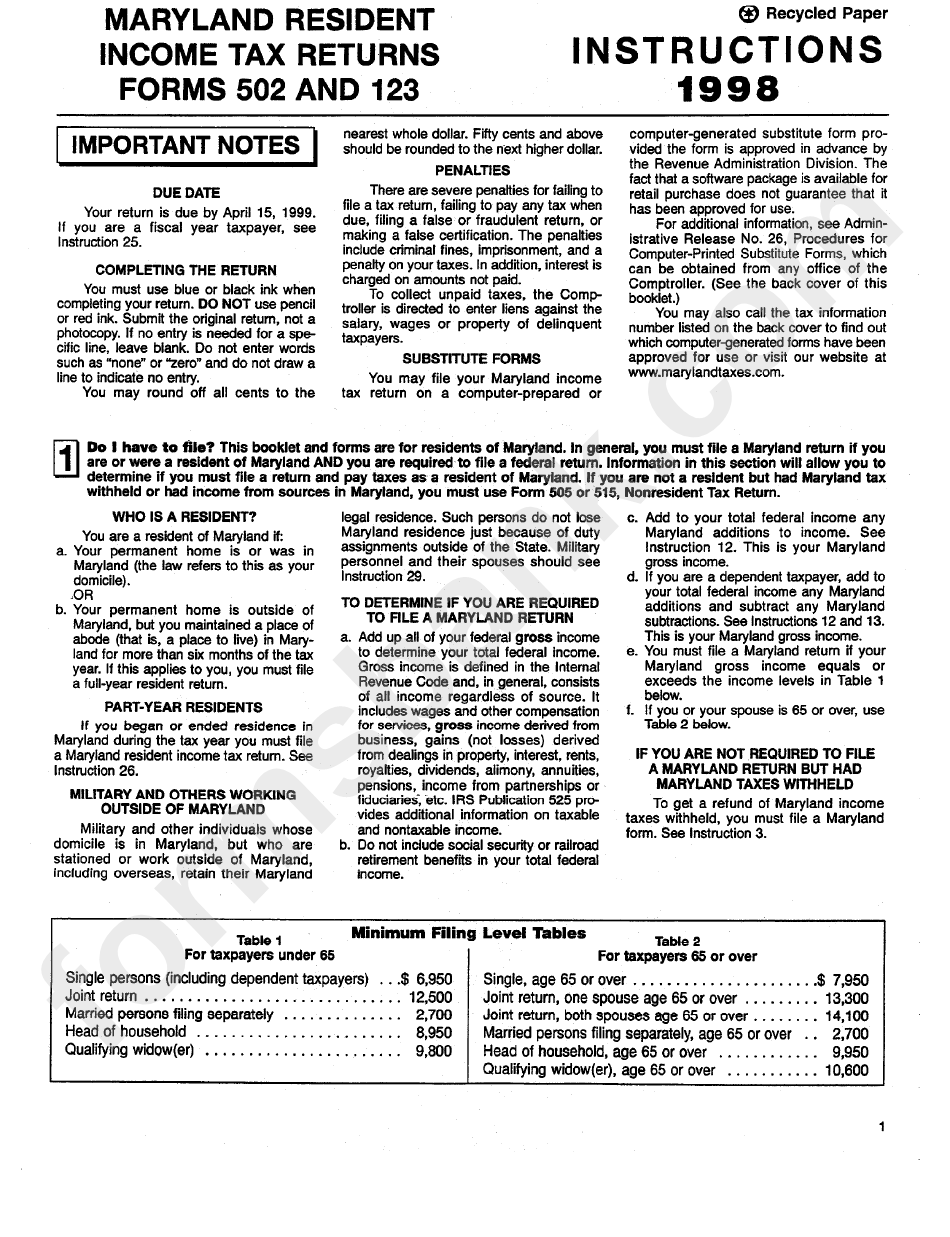

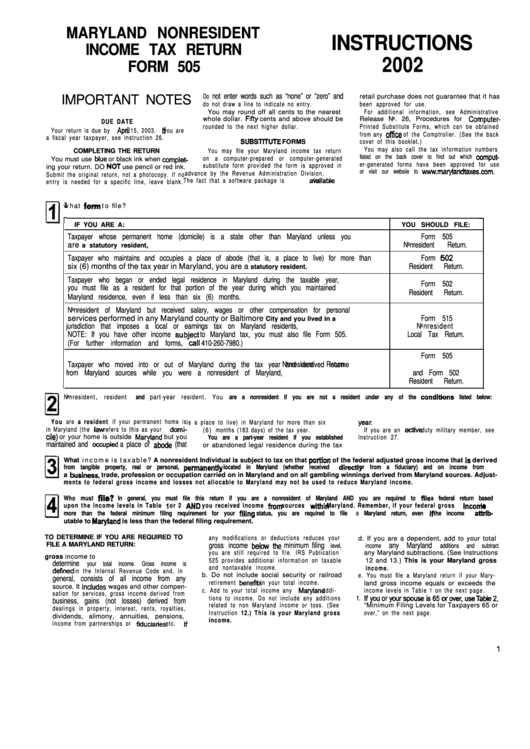

Instructions For Maryland Form 502 - Web read instructions for form 502cr. If you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Web taxpayers eligible to subtract unemployment benefits must use maryland form 502lu. Maryland form 502 resident income tax return print using blue or. Ad download or email form 502 & more fillable forms, register and subscribe now! The new federal limitation impacts your maryland return because you must addback the amount of state income taxes you claimed as federal itemized deductions. If you are a nonresident, you must file form 505 and form 505nr. Ad download or email form 502 & more fillable forms, register and subscribe now! Web 2020 individual income tax instruction booklets. Register and subscribe now to work on your md form 502 & more fillable forms. To claim a credit for taxes paid to the other state, and/or. Web determine the taxable amount of social security and/or railroad retirement benefits that were included in your federal adjusted gross income on line 1 of maryland form 502. If you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income. To claim a credit for taxes paid to the other state, and/or. If you underpaid or failed to pay your estimated income taxes for the previous tax year, you must file form 502up to calculate. Underpayment of estimated income tax by individuals. Web a maryland resident having income from one of these states must report the income on the maryland. Web if you meet certain requirements and are filing form 502, maryland's internet tax filing system (ifile) allows online electronic filing of resident personal income tax. Ad download or email form 502 & more fillable forms, register and subscribe now! You will need the following information and computer system setup to use ifile:. Web a maryland resident having income from. Ad download or email form 502 & more fillable forms, register and subscribe now! It appears you don't have a pdf plugin for this browser. If the power of attorney form does not include all the information as instructed it will not be accepted. Web the maryland general assembly enacted house bill 1148 in the 2016 session requiring the collection. You must use form 502 if your federal adjusted gross income is $100,000 or more. Web decide whether you will use form 502 (long form) or form 503 (short form). Web 2022 individual income tax instruction booklets. Web dates of maryland residence (mm dd yyyy) from to other state of residence: You must complete and submit pages 1 through 3. Ad download or email form 502 & more fillable forms, register and subscribe now! Attach this form to form 502, 505 or 515. Underpayment of estimated income tax by individuals. If you began or ended legal residence in maryland in 2022 place a p in the box. Ad download or email form 502 & more fillable forms, register and subscribe. Underpayment of estimated income tax by individuals. If the power of attorney form does not include all the information as instructed it will not be accepted. Maryland form 502 resident income tax return print using blue or. Ad download or email form 502 & more fillable forms, register and subscribe now! 22 29.special instructions for military taxpayers. You will need the following information and computer system setup to use ifile:. Web maryland tax form number (502, mw506) year(s) or period(s) covered; Web you can use our free ifile service if you are filing form 502 and most other maryland tax forms. Web taxpayers eligible to subtract unemployment benefits must use maryland form 502lu. Register and subscribe now. Maryland state and local tax forms and instructions. 22 29.special instructions for military taxpayers. Web payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or. Web if you meet certain requirements and are filing form 502, maryland's internet tax filing system (ifile). Underpayment of estimated income tax by individuals. You must complete and submit pages 1 through 3 of this form to receive credit for the items listed. If you are a nonresident, you must file form 505 and form 505nr. The new federal limitation impacts your maryland return because you must addback the amount of state income taxes you claimed as. Complete, edit or print tax forms instantly. To claim a credit for taxes paid to the other state, and/or. Web read instructions for form 502cr. Complete, edit or print tax forms instantly. If you lived in maryland only part of the year, you must file form 502. Web maryland tax form number (502, mw506) year(s) or period(s) covered; 22 29.special instructions for military taxpayers. Web if you meet certain requirements and are filing form 502, maryland's internet tax filing system (ifile) allows online electronic filing of resident personal income tax. You will need the following information and computer system setup to use ifile:. If the power of attorney form does not include all the information as instructed it will not be accepted. Get ready for tax season deadlines by completing any required tax forms today. You must complete and submit pages 1 through 3 of this form to receive credit for the items listed. Maryland state and local tax forms and instructions. Maryland form 502 resident income tax return print using blue or. Register and subscribe now to work on your md form 502 & more fillable forms. Maryland state and local tax forms and instructions. The new federal limitation impacts your maryland return because you must addback the amount of state income taxes you claimed as federal itemized deductions. Web decide whether you will use form 502 (long form) or form 503 (short form). Web 2022 individual income tax instruction booklets. Web determine the taxable amount of social security and/or railroad retirement benefits that were included in your federal adjusted gross income on line 1 of maryland form 502.Form 502 Up Underpayment Of Estimated Maryland Tax By

MD 502UP 20202021 Fill out Tax Template Online US Legal Forms

Form 502up Underpayment Of Estimated Maryland Tax By

Instructions For Maryland Resident Tax Returns Forms 502 And 123

Maryland Form 502 Instructions 2019

Maryland Form 502 Instructions 2019

2019 Maryland Form 502 Instructions designshavelife

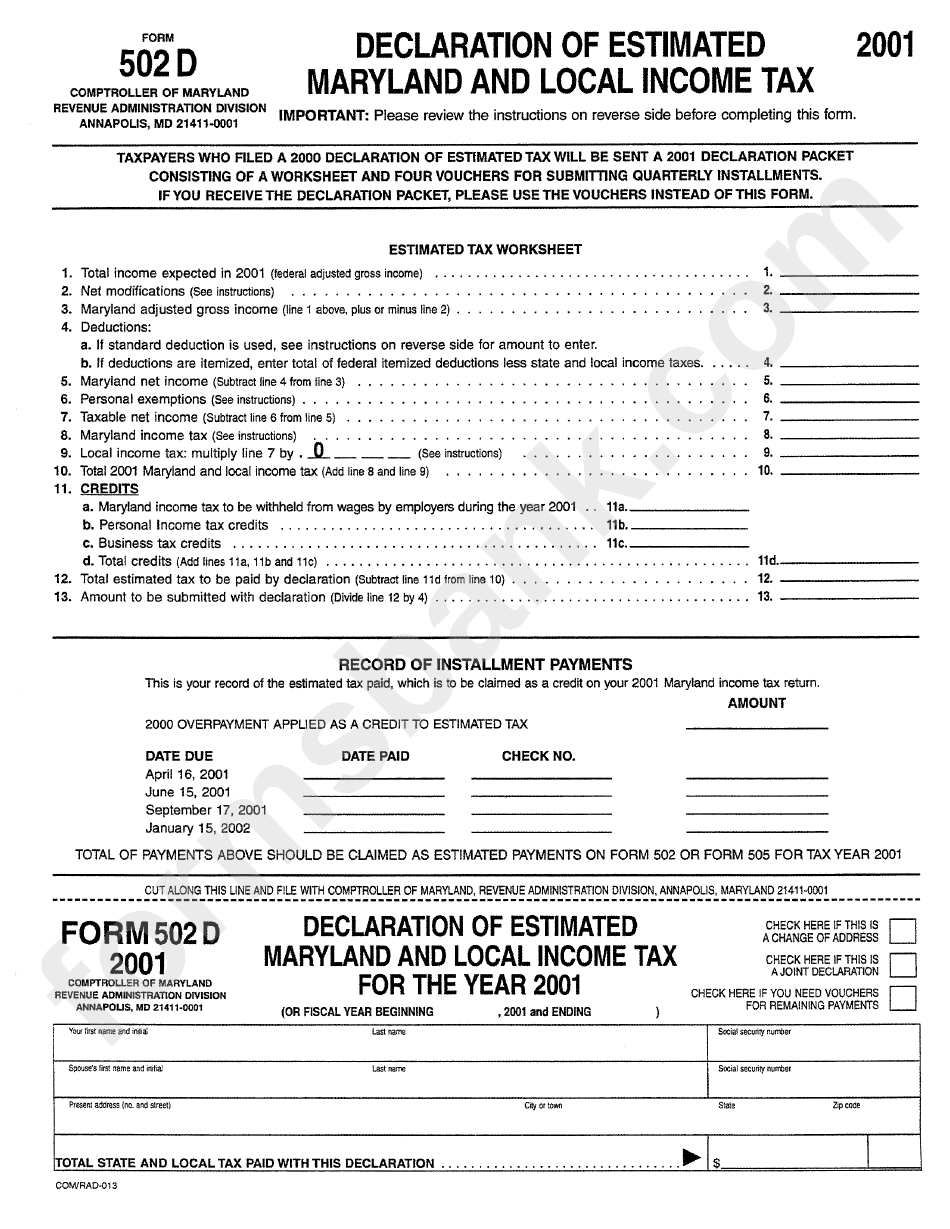

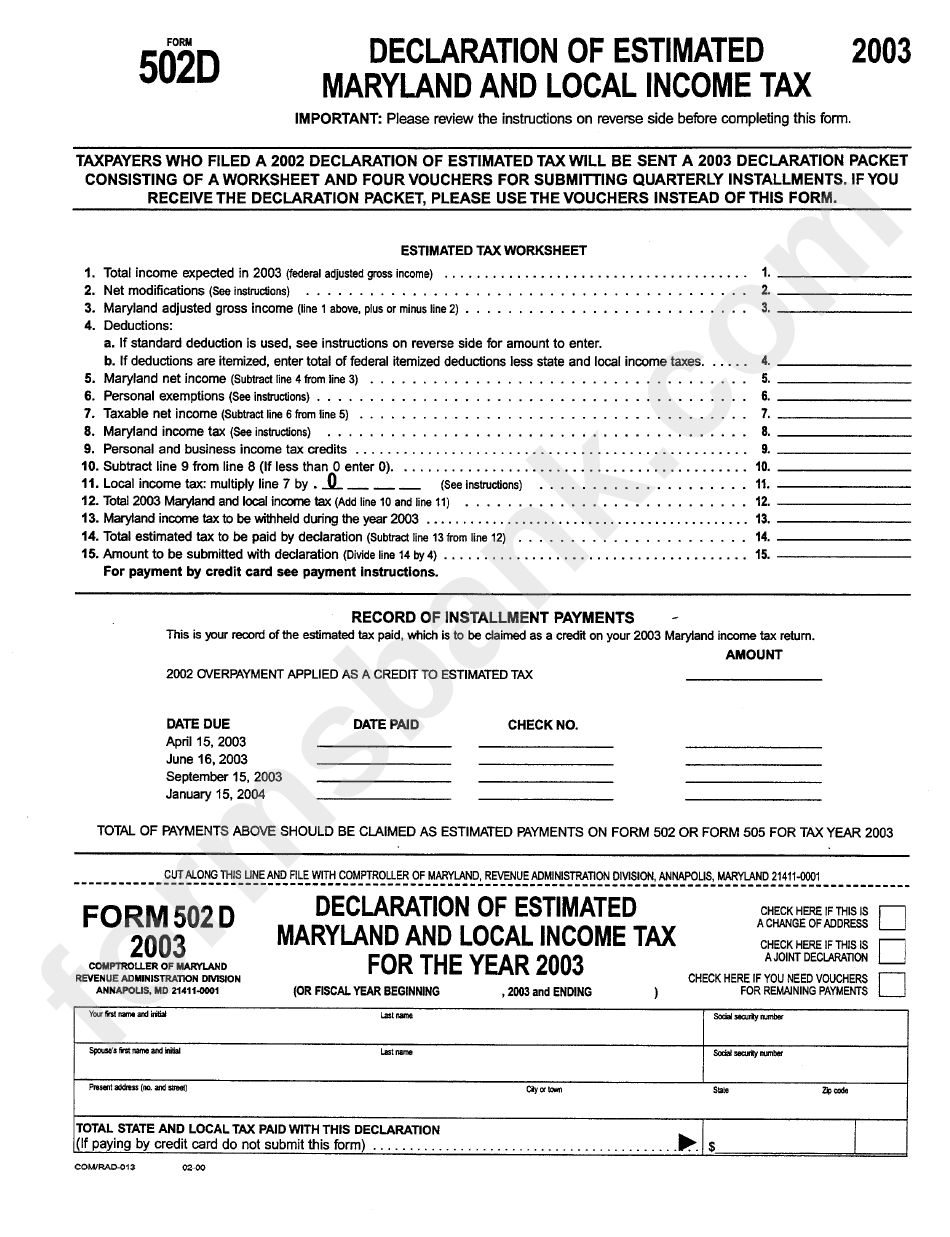

Form 502d Declaration Of Estimated Maryland And Local Tax

Maryland Form 502 Instructions ESmart Tax Fill Out and Sign Printable

Form 502d Declaration Of Estimated Maryland And Lockal Tax

Related Post: