Instructions For Irs Form 4562

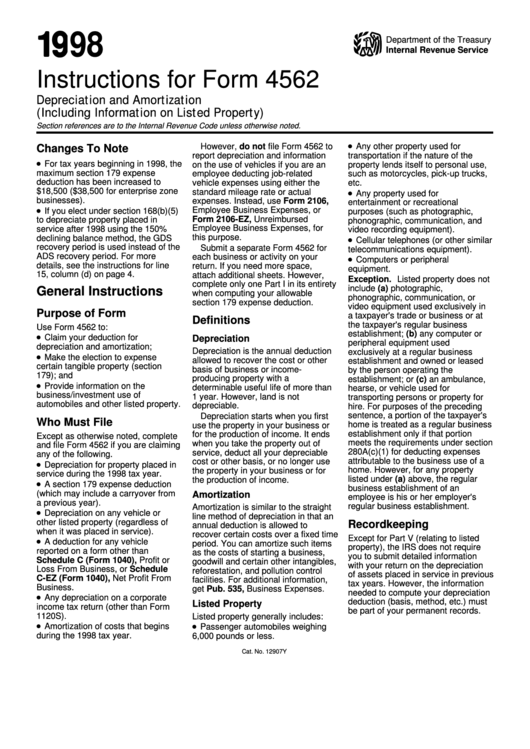

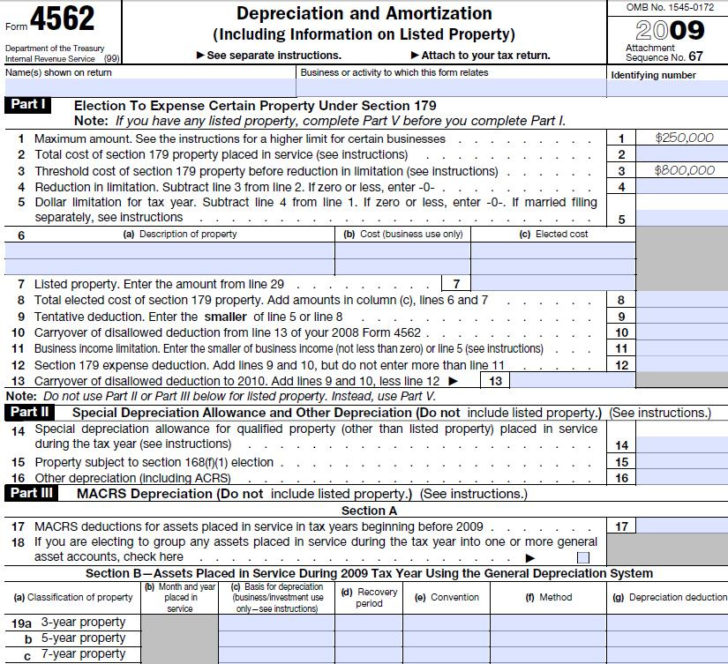

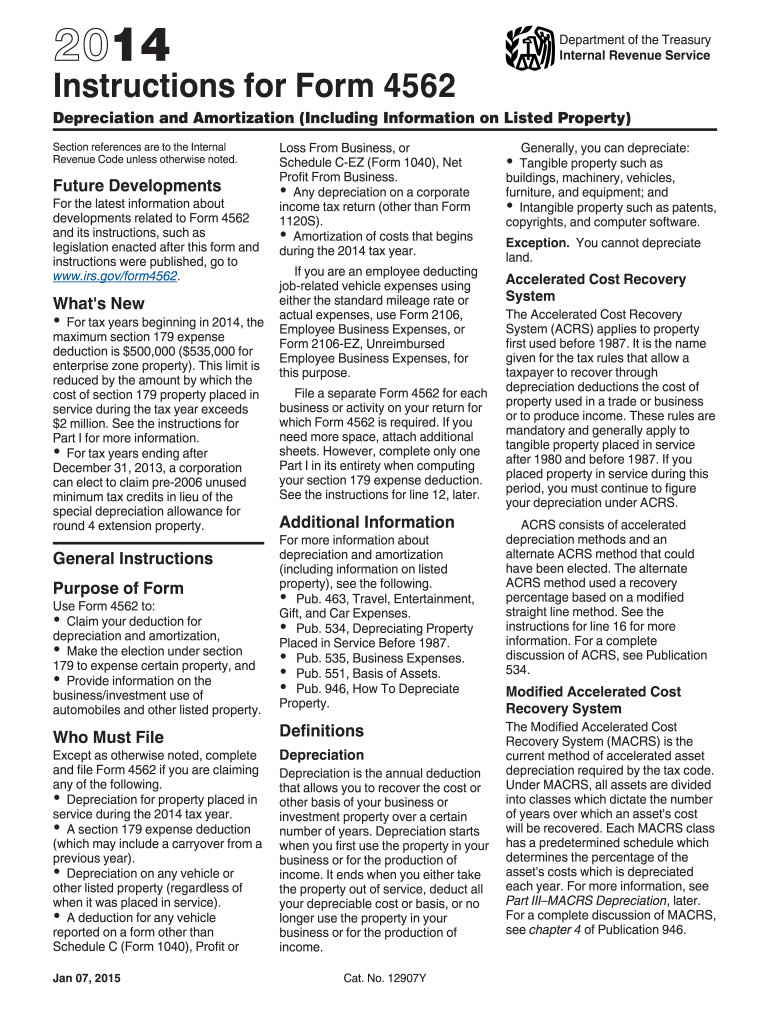

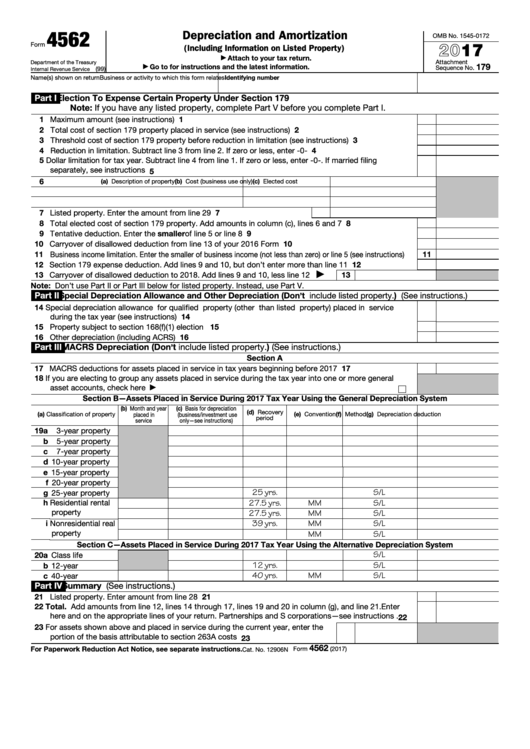

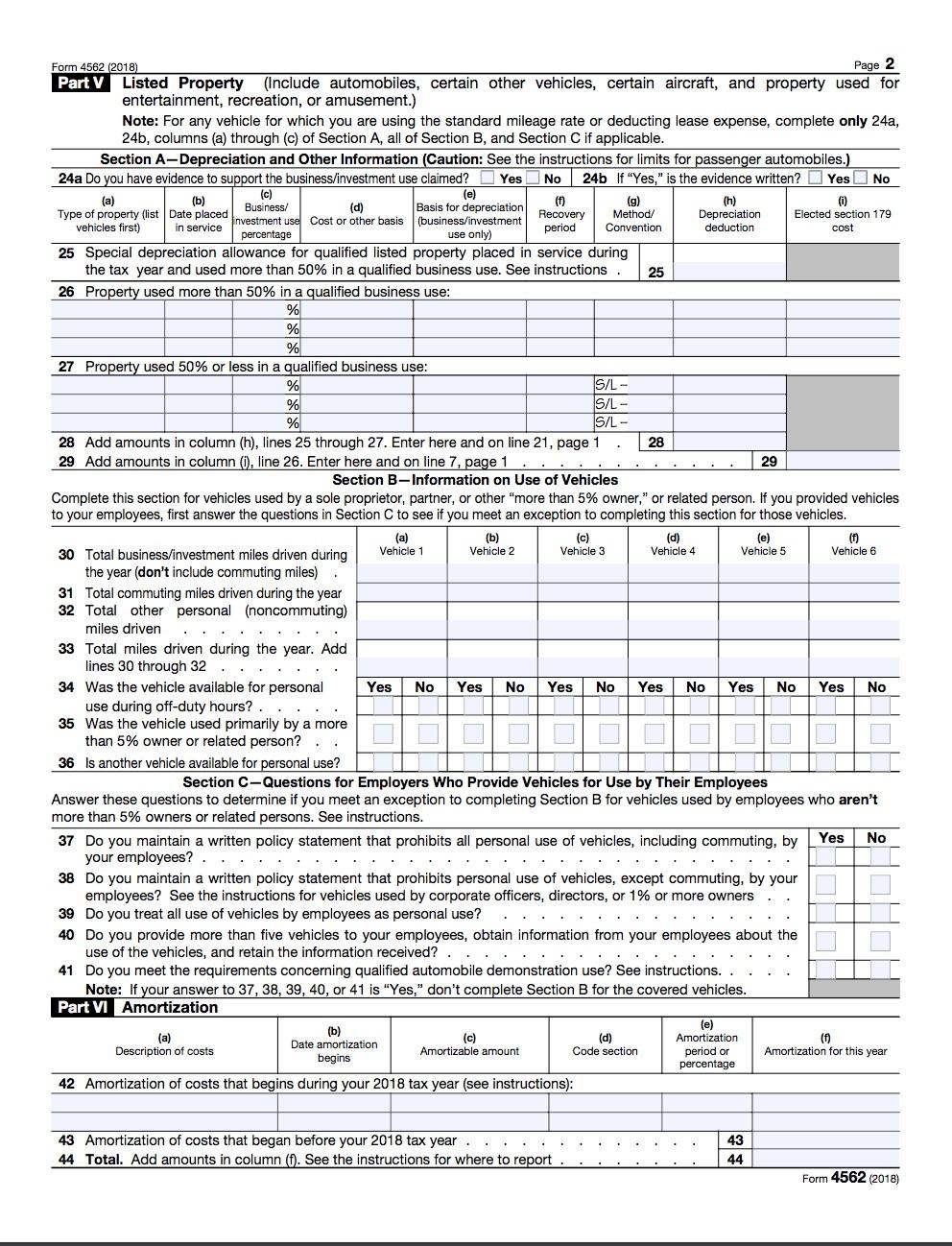

Instructions For Irs Form 4562 - This limit is reduced by. Election to expense certain property under section 179. Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Ad access irs tax forms. Web irs updates instructions for form 4562 (2022) depreciation and amortization including immediate expense limit — orbitax tax news & alerts. Web for tax years beginning in 2018, the maximum section 179 expense deduction is $1,000,000 ($1,035,000 for qualified enterprise zone property). Web open screen 22, depreciation (4562). Web the latest versions of irs forms, instructions, and publications. You must make section 179 election on irs form. Election to expense certain property under section 179. In the asset list, click add.; Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s depreciation or amortization. Web instructions for how to complete irs form 4562 step 1: You must make section 179 election on irs form. You can clarify any further doubts by checking out the irs. Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. Web how do i complete irs form 4562? This includes the section 179 expense deduction,. You must make section 179 election on irs form. Web for tax years beginning in 2018, the maximum section 179 expense deduction is $1,000,000 ($1,035,000 for qualified enterprise zone property). This form is also available at public. Download a copy of the irs form 4562 from the irs official website. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s. Web 4 rows form 4562 department of the treasury internal revenue service depreciation and amortization. Web depreciation and amortization (including information on listed property) 2022 form 4562 4562 (including information on listed property) department of the treasury internal. Web what is the irs form 4562? Web instructions for how to complete irs form 4562 step 1: Estimate how much you. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web open screen 22, depreciation (4562). Get ready for tax season deadlines by completing any required tax forms today. In part i, we’ll calculate the amount of section 179. Learn how to fill out form 4562 step by step and depreciate/amortize. Complete, edit or print tax forms instantly. Web open screen 22, depreciation (4562). Ad access irs tax forms. Remember, the irs instructions for form 4562 are also an excellent. Web 4 rows form 4562 department of the treasury internal revenue service depreciation and amortization. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s depreciation or amortization. Web for tax years beginning in 2018, the maximum section 179 expense deduction is $1,000,000 ($1,035,000 for qualified enterprise zone property). Web open screen 22, depreciation (4562). Web what is the irs form 4562? Ad we help get. In part i, we’ll calculate the amount of section 179. This limit is reduced by. This includes the section 179 expense deduction,. Ad we help get taxpayers relief from owed irs back taxes. You must make section 179 election on irs form. Web irs form 4562 instructions are available to download, along with form 4562 itself. Web instructions for how to complete irs form 4562 step 1: Election to expense certain property under section 179. Complete, edit or print tax forms instantly. You must make section 179 election on irs form. You can clarify any further doubts by checking out the irs. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • june 2, 2023 8:54 am overview if. Form 4562 is used by taxpayers to claim deductions for depreciable assets. Remember, the irs instructions for form 4562 are also an excellent. Get ready. Ad we help get taxpayers relief from owed irs back taxes. Learn how to fill out form 4562 step by step and depreciate/amortize asset. Complete, edit or print tax forms instantly. Web depreciation and amortization (including information on listed property) 2022 form 4562 4562 (including information on listed property) department of the treasury internal. Ad access irs tax forms. You can clarify any further doubts by checking out the irs. Web 4 rows form 4562 department of the treasury internal revenue service depreciation and amortization. In the show assets for list, click the form that relates to the amortization expense.; Web for tax years beginning in 2018, the maximum section 179 expense deduction is $1,000,000 ($1,035,000 for qualified enterprise zone property). In the asset list, click add.; Web irs updates instructions for form 4562 (2022) depreciation and amortization including immediate expense limit — orbitax tax news & alerts. Web what is the irs form 4562? Web irs form 4562 instructions are available to download, along with form 4562 itself. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • june 2, 2023 8:54 am overview if. This includes the section 179 expense deduction,. You must make section 179 election on irs form. Remember, the irs instructions for form 4562 are also an excellent. The instructions provide detailed information about what should and. Depreciation and amortization is a form that a business or individuals can use to claim deductions for an asset’s depreciation or amortization. Web open screen 22, depreciation (4562).Fillable IRS Form 4562 Depreciation and Amortization Printable

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

IRS Form 4562 Information And Instructions 2021 Tax Forms 1040 Printable

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

Ir's Instructions Form 4562 Fill Out and Sign Printable PDF Template

Fillable IRS Form 4562 Depreciation and Amortization Printable

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

IRS 4562 Instructions 2011 Fill out Tax Template Online US Legal Forms

2012 Form 4562 Instructions Universal Network

Tutorial pour remplir le formulaire 4562 de l'IRS

Related Post: