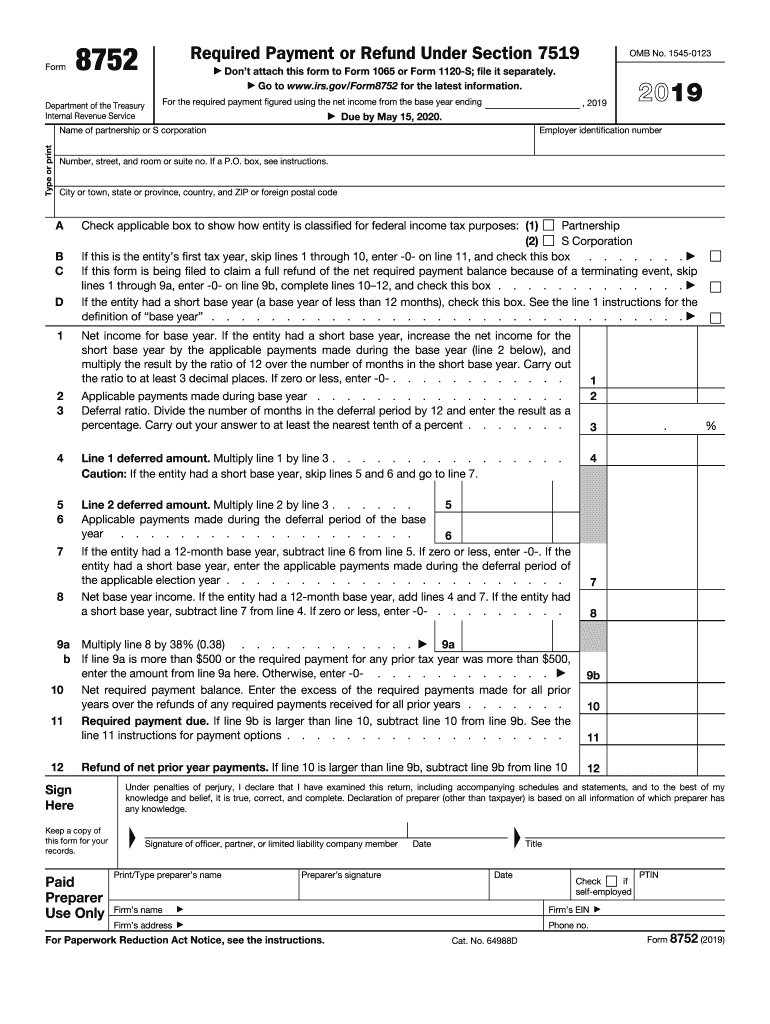

Instructions For Form 8752

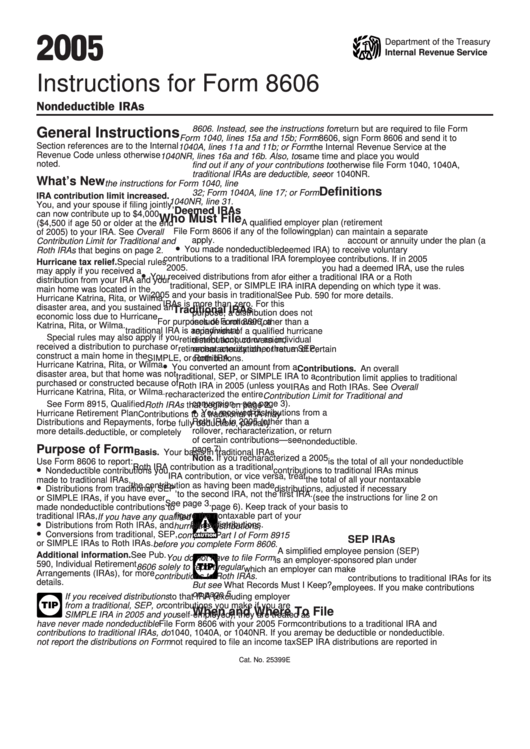

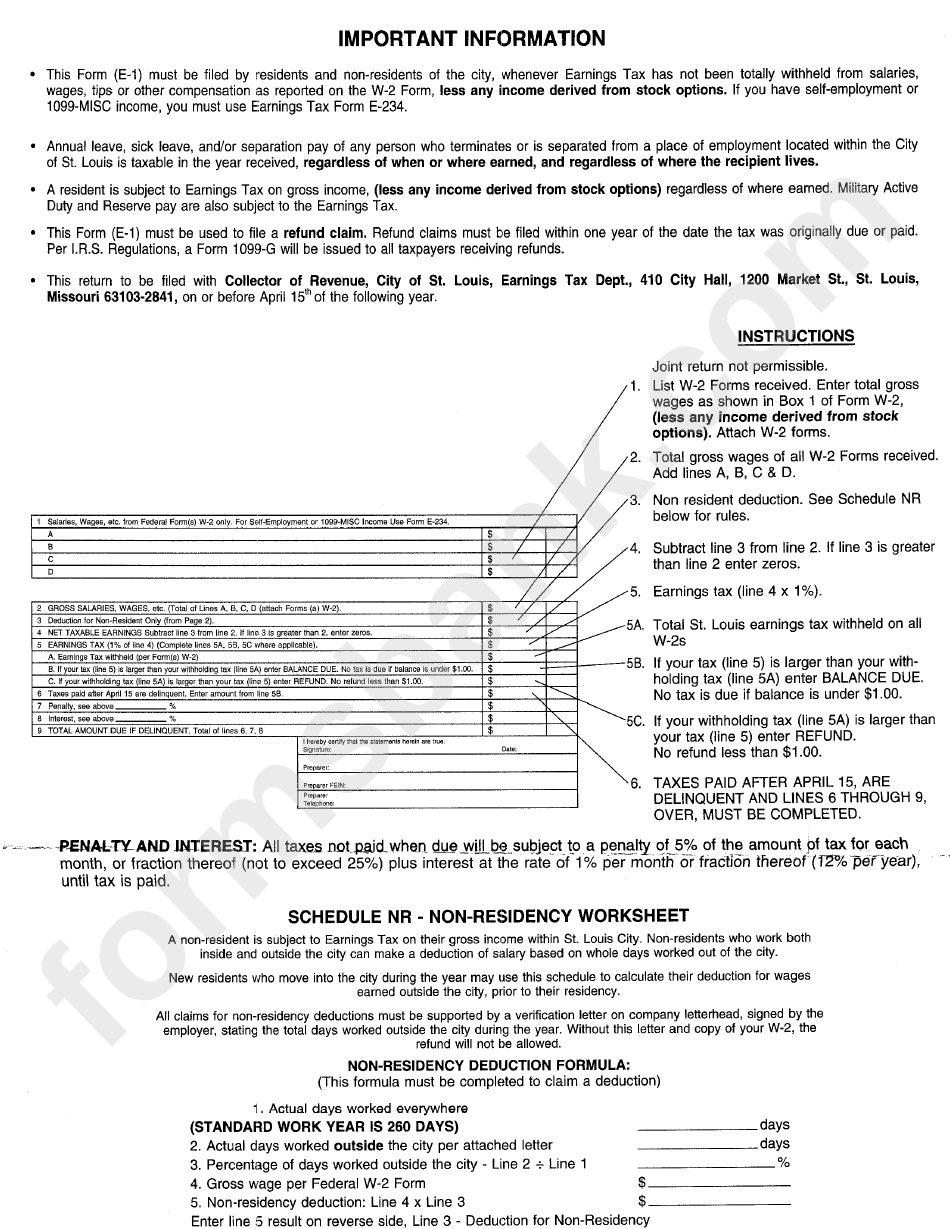

Instructions For Form 8752 - Go to www.irs.gov/form8752 for the latest. Form 8752 must be filed for each year the section 444 election is in effect, even if the required payment for the. See section 7519(c) for details. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. File form 8752 at the applicable irs address listed below. An entity without a principal office or agency or principal place of business in the united states must file. Web complete 2015 form 8752. Form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs). Web 8752 to claim a refund of its net required payment balance. Web the form 8752 and the payment are due not later than may 15th of the calendar year following the calendar year in which the entity’s applicable election year begins. Web instructions for form 8952 department of the treasury internal revenue service (rev. Web page last reviewed or updated: What is an 8752 form? Form 8752 must be filed for each year the section 444 election is in effect, even if the required payment for the. Go to www.irs.gov/form8752 for the latest. Web complete 2015 form 8752. Web the form 8752 and the payment are due not later than may 15th of the calendar year following the calendar year in which the entity’s applicable election year begins. Web information about form 8752 and its instructions is at www.irs.gov/form8752. Form 8752 (required payment or refund under section 7519) is a federal tax form. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Go to www.irs.gov/form8752 for the latest. For the required payment computed using the net income from the base year ending, 2013 due. File form 8752 at the applicable irs address listed below. What is an 8752 form? Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Web according to the form 8752 instructions, partnerships and s corporations use form 8752 to figure and report the payment required under section 7519 or to obtain a refund of net. Web complete. Web complete 2015 form 8752. November 2021) for use with form 8952 (rev. Web 4 rows for privacy act and paperwork reduction act notice, see back of form. Number of months in short base year. Web the form 8752 and the payment are due not later than may 15th of the calendar year following the calendar year in which the. November 2021) for use with form 8952 (rev. Web form 8752 must be filed for each year the section 444 election is in effect, even if the required payment for the applicable election year is zero. See section 7519(c) for details. Form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the. Form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs). Required payment for any prior tax year was more than $500. Partnerships and s corporations use form 8752. Go to www.irs.gov/form8752 for the latest. Web 8752 to claim a refund of its net required payment balance. Ad download or email irs 8752 & more fillable forms, register and subscribe now! Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web form 8752 must be filed for each year the section 444 election is in effect, even if the required payment for the applicable election year is. Web 4 rows for privacy act and paperwork reduction act notice, see back of form. See section 7519(c) for details. Get everything done in minutes. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Web complete 2015 form 8752. If the entity had a short base year, skip lines 5 and 6 and enter the applicable payments made during the deferral period on line 7 by. Ad download or email irs 8752 & more fillable forms, register and subscribe now! Web the form 8752 and the payment are due not later than may 15th of the calendar year following. Web show sources > form 8752 is a federal other form. Web an entity without a principal office or agency or principal place of business in the united states must file form 8752 with. Get everything done in minutes. Web fill online, printable, fillable, blank required payment or refund under section 7519 form 8752 form. Number of months in short base year. November 2021) for use with form 8952 (rev. Partnerships and s corporations use form 8752. Web information about form 8752 and its instructions is at www.irs.gov/form8752. For the required payment computed using the net income from the base year ending, 2013 due. Web 4 rows for privacy act and paperwork reduction act notice, see back of form. Web complete 2015 form 8752. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Easily fill out pdf blank, edit, and sign them. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs). Web the form 8752 and the payment are due not later than may 15th of the calendar year following the calendar year in which the entity’s applicable election year begins. Web form 8752 must be filed for each year the section 444 election is in effect, even if the required payment for the applicable election year is zero. Ad download or email irs 8752 & more fillable forms, register and subscribe now! If the entity had a short base year, skip lines 5 and 6 and enter the applicable payments made during the deferral period on line 7 by.Instructions For Form 8606 Nondeductible Iras 2005 printable pdf

Fill Free fillable Form 8752 Required Payment or Refund PDF form

2020 2021 Irs Instructions Form Printable Fill Out Digital PDF Sample

algunproblemita W2 Worksheet

IRS 8752 2019 Fill and Sign Printable Template Online US Legal Forms

Fill Free fillable Form 8752 Required Payment or Refund PDF form

Instructions For Form W2 printable pdf download

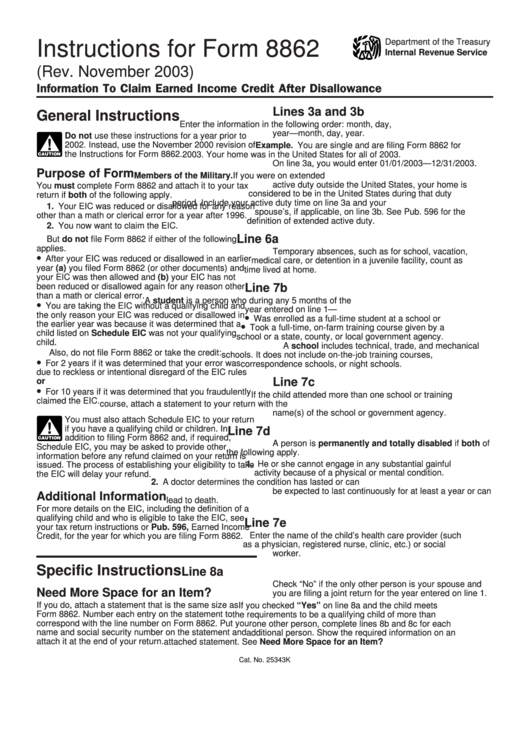

Instructions For Form 8862 Information To Claim Earned Credit

3.11.249 Processing Form 8752 Internal Revenue Service

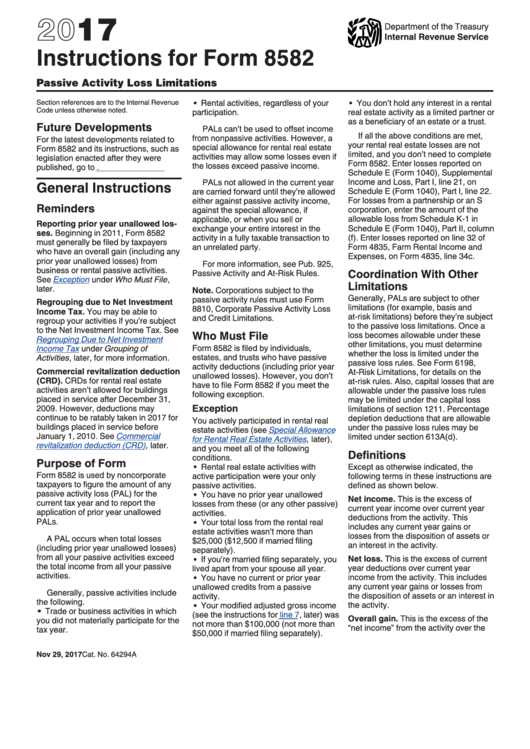

Instructions For Form 8582 Passive Activity Loss Limitations 2017

Related Post: