Instructions For Form 4562

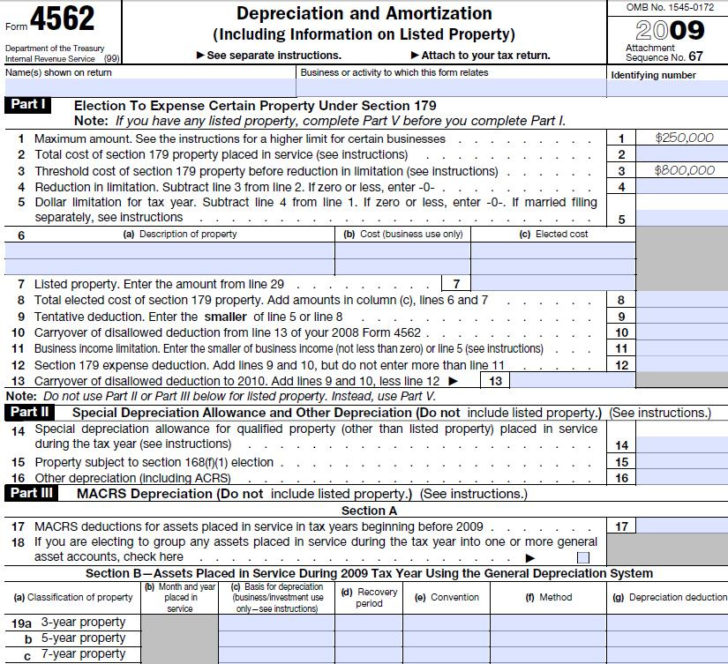

Instructions For Form 4562 - Web according to form 4562 instructions, the form is required if the taxpayer claims any of the following: General instructions purpose of form use form 4562 to: Form 4562 typically applies to your business when you have bought a piece. Ad access irs tax forms. Web irs form 4562 is due alongside your business tax return. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Updated for tax year 2022 • june 2, 2023 8:54 am. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web 4 rows form 4562 department of the treasury internal revenue service depreciation and amortization. Form 4562 typically applies to your business when you have bought a piece. Depreciation and amortization is. Generally, the maximum section 179 expense deduction is $1,050,000 for. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. If you've purchased. Web how to prepare irs form 4562? Form 4562 is used to. Updated for tax year 2022 • june 2, 2023 8:54 am. Web irs form 4562 is due alongside your business tax return. Web 4 rows form 4562 department of the treasury internal revenue service depreciation and amortization. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Form 4562 is used to. Ad access irs tax forms. To complete form 4562, you'll need to know the. General instructions purpose of form use form 4562 to: General instructions purpose of form use form 4562 to: Hence, the number of forms you must. Learn how to fill out form 4562 step by step and depreciate/amortize. Complete, edit or print tax forms instantly. Form 4562 typically applies to your business when you have bought a piece. Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Web irs form 4562 is due alongside your business tax return. Depreciation for property placed in service. • claim your deduction for depreciation and. Hence, the number of forms you must. Web written by a turbotax expert • reviewed by a turbotax cpa. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Ad access irs tax forms. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. General instructions purpose of form use form 4562 to: Generally, the maximum section 179 expense deduction is $1,050,000 for. Web form 4562 comprises six parts. Complete, edit or print tax forms instantly. Web use worksheet 1 provided in the form 4562 instructions to determine the amount entered on line 1. Hence, the number of forms you must. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web what is form 4562? Web according to form 4562 instructions, the form is required if the taxpayer claims any of the following: Learn how to fill out form 4562 step by step and depreciate/amortize. Web how to prepare irs form 4562? Form 4562 typically applies to your business when you have bought a piece. Web according to form 4562 instructions, the form is required if the taxpayer claims any of the following: Web irs form 4562 is due alongside your business tax return. Web what is form 4562? You’ll need more than one irs form 4562 if you’re amortizing or depreciating multiple assets. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web written by a turbotax expert • reviewed by a turbotax cpa. Ad access irs tax forms. Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. General instructions purpose of form use form 4562 to: Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. • claim your deduction for depreciation and. Get ready for tax season deadlines by completing any required tax forms today. Generally, the maximum section 179 expense deduction is $1,050,000 for. Hence, the number of forms you must. Complete, edit or print tax forms instantly. For sole proprietors and c corporations, this date usually falls on april 15 if you use a calendar tax year. Web 4 rows form 4562 department of the treasury internal revenue service depreciation and amortization. Complete, edit or print tax forms instantly.4562 Form 2022 2023

2002 Instructions for Form 4562

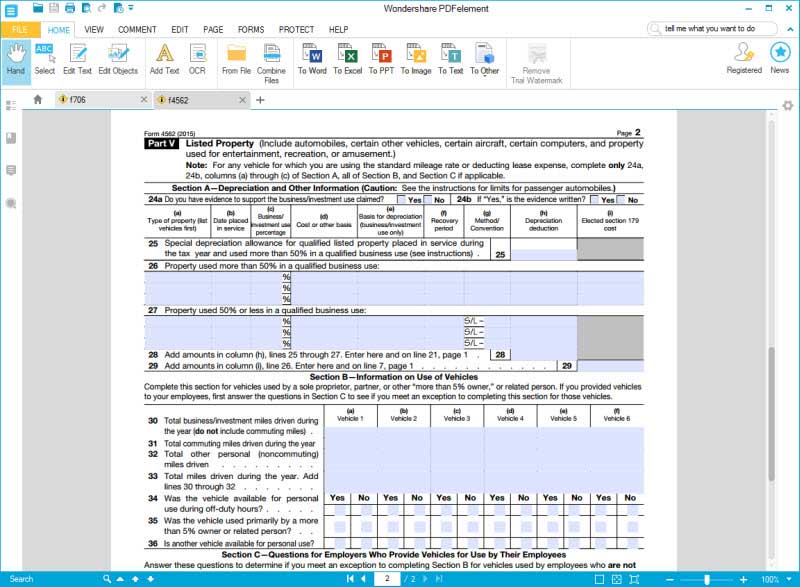

Irs Form 4562 Create A Digital Sample in PDF

2010 Instruction 4562 Albion Power Company

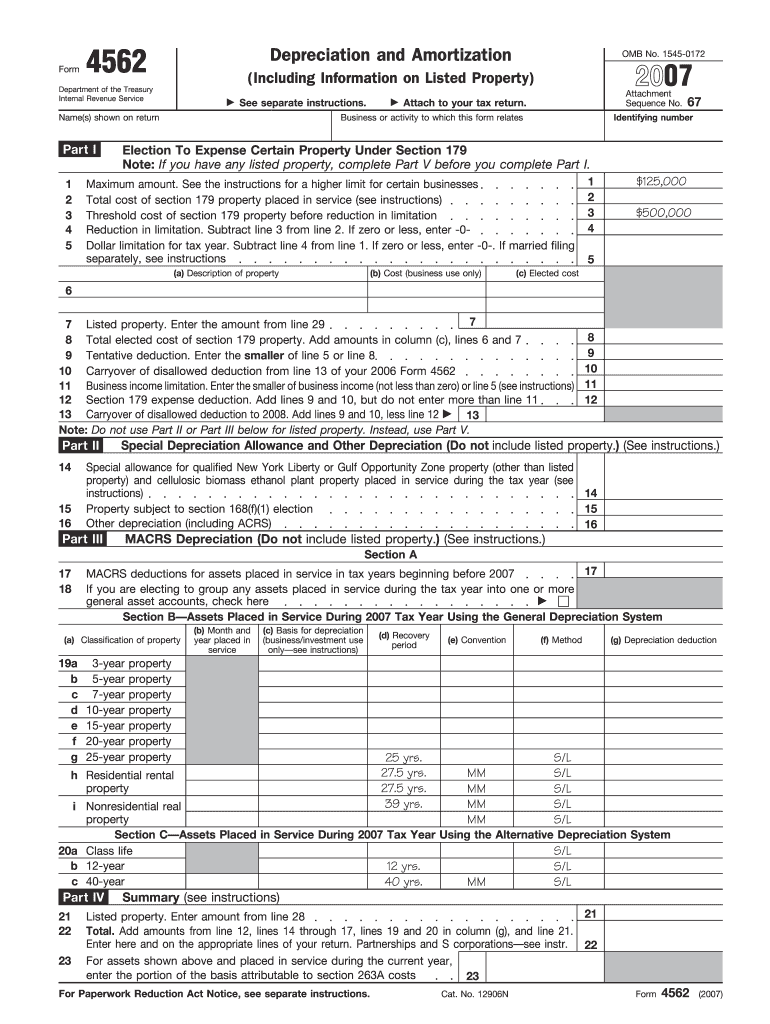

Form 4562, Depreciation and Amortization IRS.gov Fill out & sign

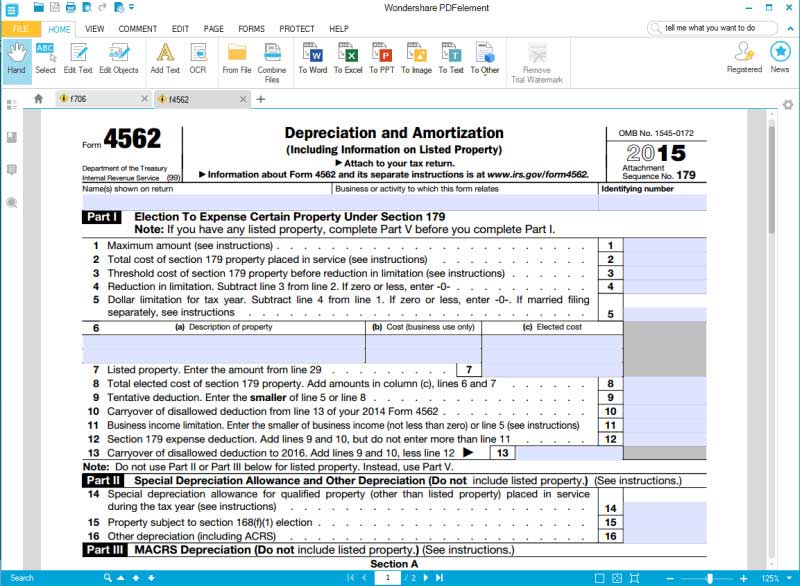

Instructions for How to Fill in IRS Form 4562

IRS Form 4562 Information And Instructions 2021 Tax Forms 1040 Printable

Irs Form 4562 Instructions 2014 Universal Network

Form 4562 A Simple Guide to the IRS Depreciation Form Bench Accounting

Irs Form 4562 Instructions Pdf sandsoftware

Related Post: