Instructions For Form 4136

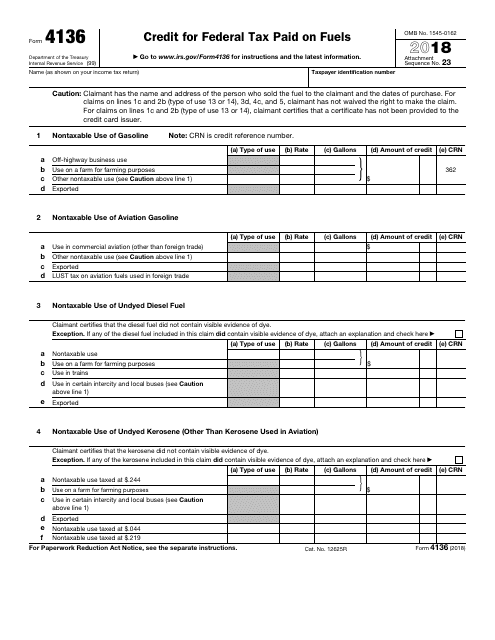

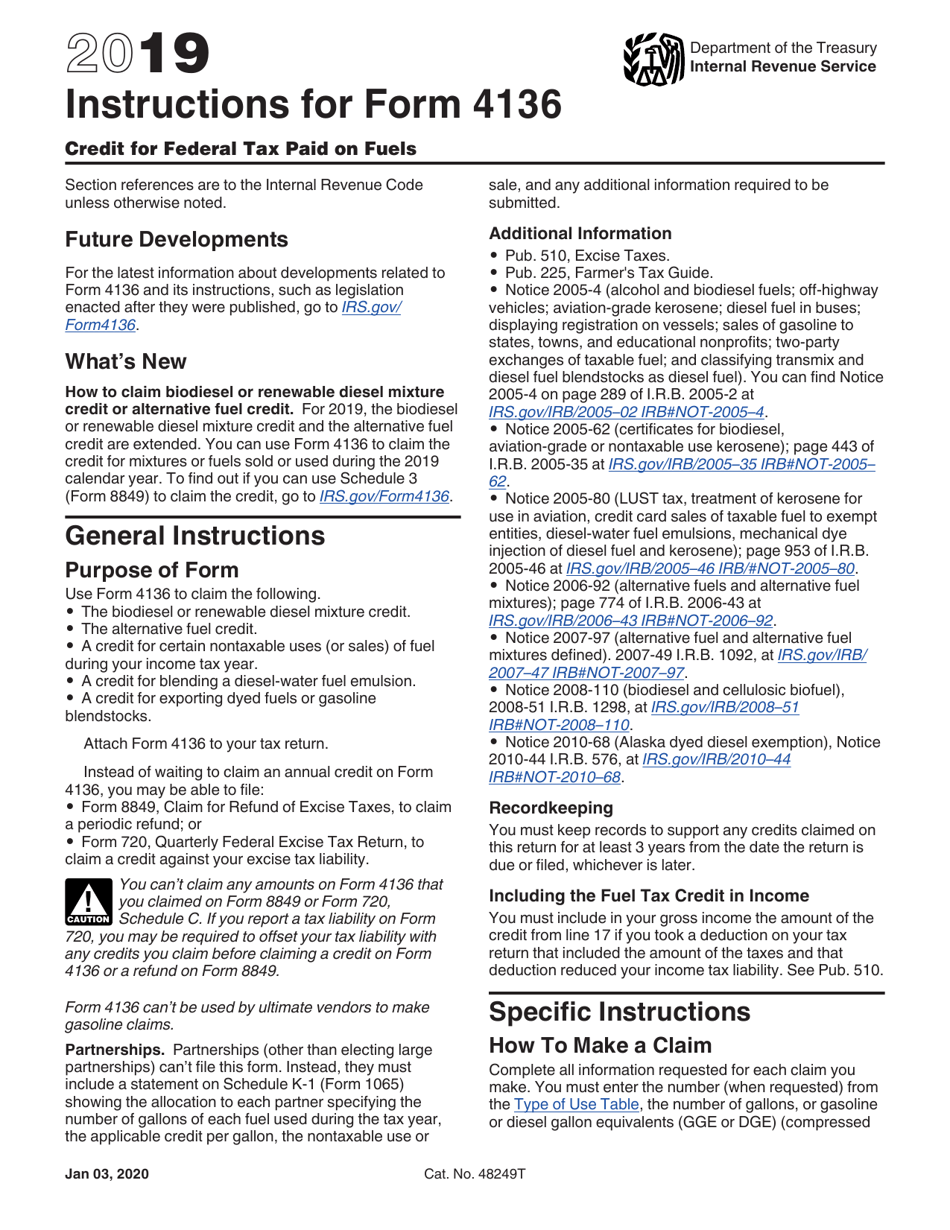

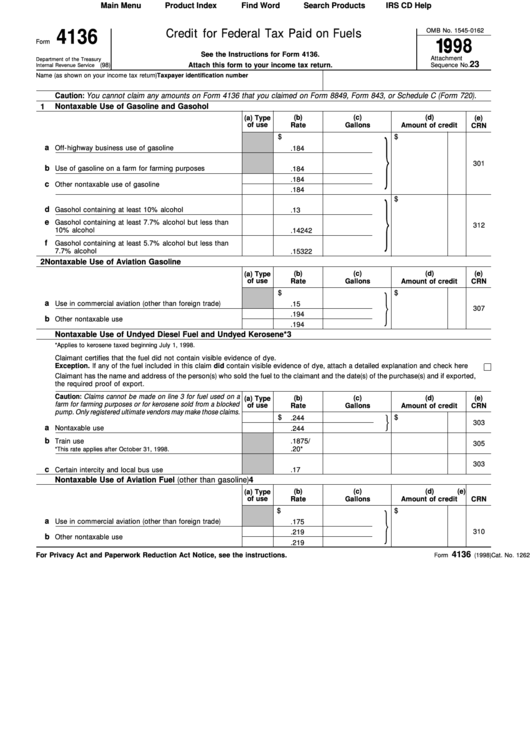

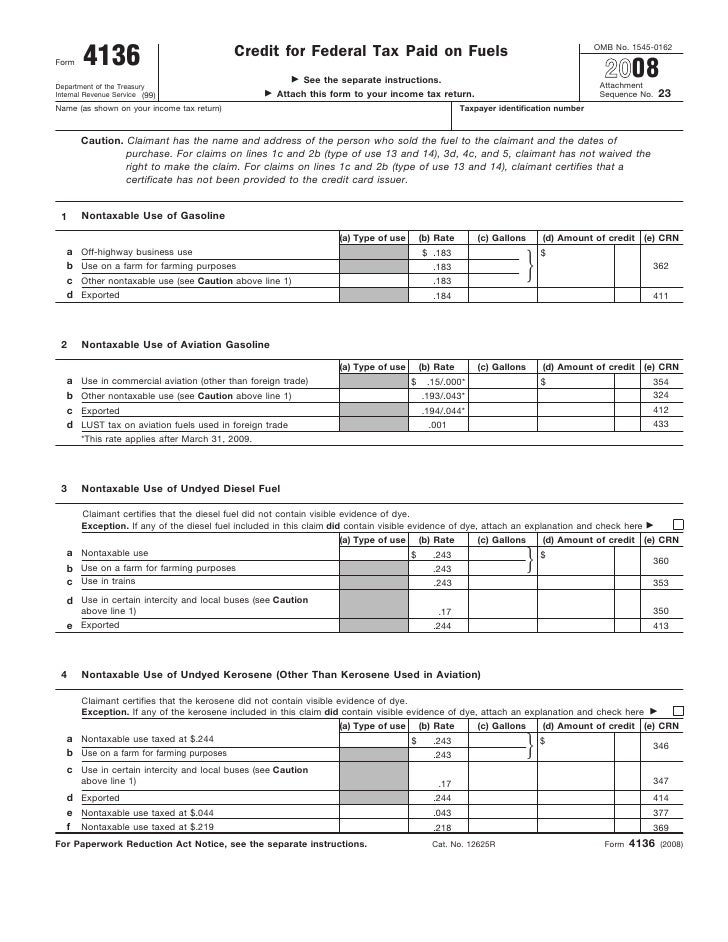

Instructions For Form 4136 - Say yes on credit for nontaxable fuel usage; Any alternative fuel credit must first be claimed on form 720, schedule. The alternative fuel a credit for. Instructions for form 4136, credit for federal tax paid on fuels 2016 inst. Instead of waiting to claim an annual credit. Instead of waiting to claim an annual credit on form 4136, you may be able to file: You can download or print. Use form 4136 to claim a credit. Web for instructions and the latest information. Web reporting tax and fuel credits on form 4136 in lacerte to generate form 4136 on an individual return:go to screen 36, fuel tax credit (4136).enter any. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest. Web we last updated the credit for federal tax paid on fuels in january 2023, so this is the latest version of form 4136, fully updated for tax year 2022. Web form 4136. Get ready for tax season deadlines by completing any required tax forms today. 23 name (as shown on your income tax return). Ad register and subscribe now to work on your irs form 4136 & more fillable forms. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Web we last updated the credit for federal tax paid on fuels in january 2023, so this is the latest version of form 4136, fully updated for tax year 2022. Instead of waiting to claim an annual. If you report a tax liability on form 720, you may be required to offset your tax liability with any credits you claim before claiming a credit on form 4136 or a refund on. Instructions for form 4136, credit for federal tax paid on fuels 2015 inst 4136: Instead of waiting to claim an annual credit on form 4136, you. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until. Web a credit for exporting dyed fuels or gasoline blendstocks. Web general instructions purpose of form use form 4136 to claim the following. Say yes on credit for nontaxable fuel usage; Web go to www.irs.gov/form4136 for instructions and the. Web general instructions purpose of form use form 4136 to claim the following. Substainable aviation fuel (saf) credit. Instructions for form 4136, credit for federal tax paid on fuels 2015 inst 4136: The biodiesel or renewable diesel mixture credit. Complete, edit or print tax forms instantly. Attach form 4136 to your tax return. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Web a credit for exporting dyed fuels or gasoline blendstocks. Web general instructions purpose of form use form 4136 to claim the following. Web form and the final revision of the form. The biodiesel or renewable diesel mixture credit the alternative fuel. Substainable aviation fuel (saf) credit. Web go to www.irs.gov/form4136 for instructions and the latest information. 23 name (as shown on your income tax return) taxpayer identification. The credits available on form 4136 are: The biodiesel or renewable diesel mixture credit. Instead of waiting to claim an annual credit. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest. Web to get form 4136 to populate correctly: If you report a tax liability on form 720, you. Web to get form 4136 to populate correctly: Web form and the final revision of the form. Credit for certain nontaxable uses (or sales) of fuel during your income tax year. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest. Say yes. Ad register and subscribe now to work on your irs form 4136 & more fillable forms. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. •form 8849, claim for refund of excise taxes, to claim a. The biodiesel or renewable diesel mixture credit. The biodiesel or renewable diesel mixture credit. Ad access irs tax forms. Web reporting tax and fuel credits on form 4136 in lacerte to generate form 4136 on an individual return:go to screen 36, fuel tax credit (4136).enter any. Web general instructions purpose of form use form 4136 to claim the following. The credits available on form 4136 are: Web general instructions purpose of form use form 4136 to claim the following. Use form 4136 to claim a credit. Get ready for tax season deadlines by completing any required tax forms today. Web to get form 4136 to populate correctly: 23 name (as shown on your income tax return). 23 name (as shown on your income tax return) taxpayer identification. Web go to www.irs.gov/form4136 for instructions and the latest information. Web general instructions purpose of form use form 4136 to claim the following. Credit for certain nontaxable uses (or sales) of fuel during your income tax year. Type form 4136 in search in the upper right; Complete, edit or print tax forms instantly.ads/responsive.txt

Instructions For Form 4136 Credit For Federal Tax Paid On Fuels

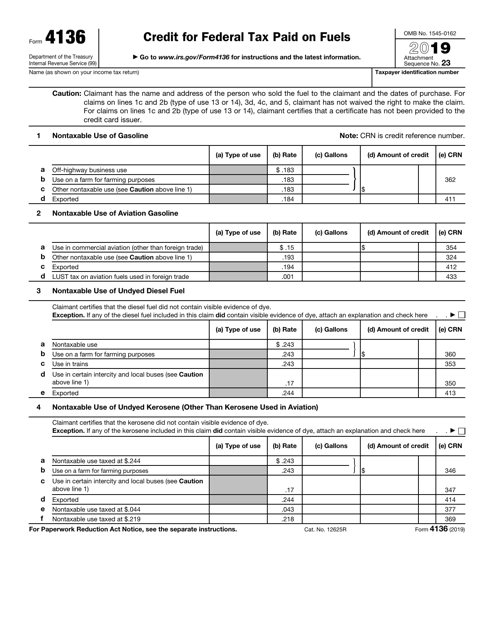

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Instructions For Form 4136 Credit For Federal Tax Paid On Fuels

Instructions For Form 4136 2005 printable pdf download

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

Fillable Credit For Federal Tax Paid On Fuels Irs 4136 printable pdf

Form 4136 Fill out & sign online DocHub

Form 4136Credit for Federal Tax Paid on Fuel

Related Post: