Inheritance Tax Waiver Form Pa

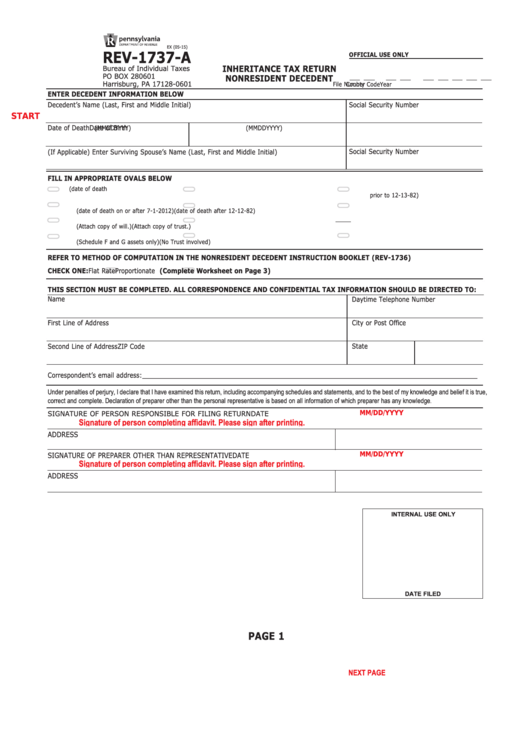

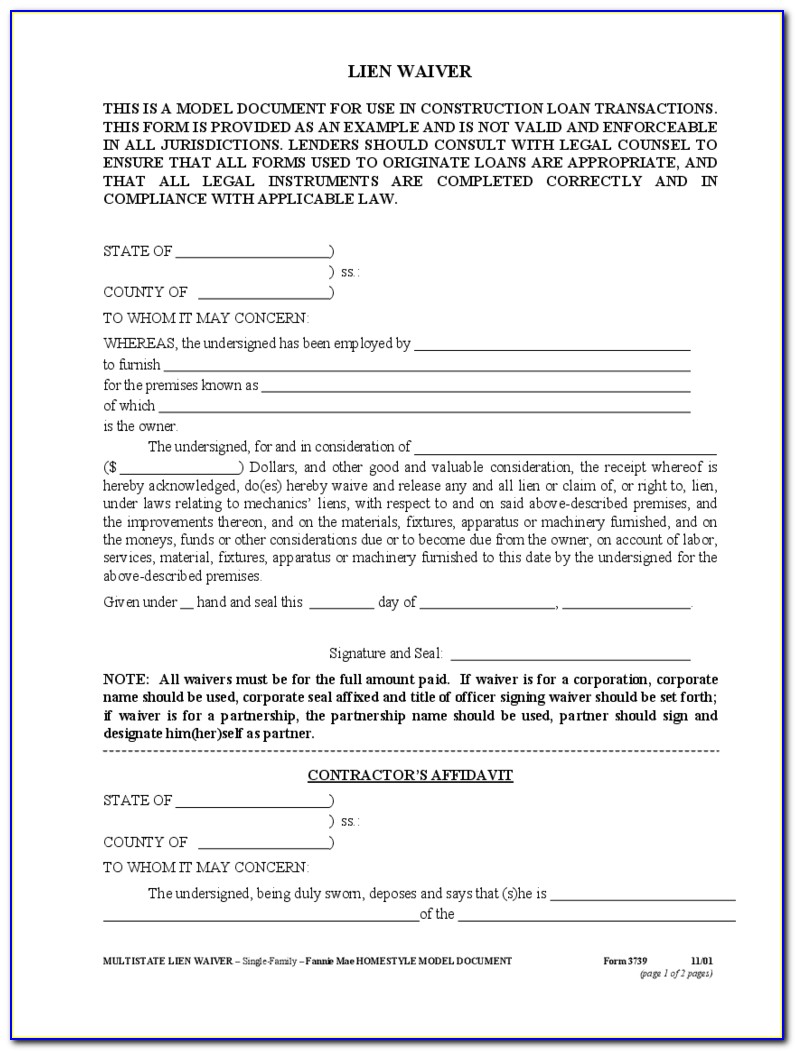

Inheritance Tax Waiver Form Pa - Web the pennsylvania inheritance tax is a transfer tax. Web what property is subject to inheritance tax? Inheritance tax forms, schedules and instructions are. It is different from the other taxes which you might pay regularly. The request may be mailed or faxed to: What assets are subject to inheritance tax?. Answer id 3902 | published 11/03/2020 11:30 am | updated 06/29/2023 06:30 pm. Explore books that can be an ultimate guide for you to understand the law. Web answer id 988 | published 04/07/2003 09:09 am | updated 11/22/2022 11:42 am. Online / digital waiver forms for parties, sporting events & more. Web the waiver can be requested before the return is filed. Web what inheritance tax forms are available in mypath? You do not need to draft another document. What assets are subject to pa inheritance tax? Answer id 3902 | published 11/03/2020 11:30 am | updated 06/29/2023 06:30 pm. Web an inheritance tax return must be filed for every decedent (or person who died) with property that may be subject to pa inheritance tax. Am i required to pay inheritance tax on an ira i inherited? Get your free trial today. Web the pennsylvania inheritance tax is a transfer tax. (for stocks, bonds, securities or security accounts held in. Web applicability of inheritance tax to estates of decedents who died before jan. Web what are the filing requirements for inheritance tax? Web the actual amount of the discount will not be determined until the final amount of tax is determined. Am i required to pay inheritance tax on an ira i inherited? Web to effectuate the waiver you must. Web applicability of inheritance tax to estates of decedents who died before jan. Web all inheritance tax forms and publications are available on the department of revenue website at: Answer id 3902 | published 11/03/2020 11:30 am | updated 06/29/2023 06:30 pm. Instructions for filing the request for waiver. Web to effectuate the waiver you must complete the pa form. Instructions for filing the request for waiver. However, if you are the surviving spouse you or you. Ad quick & easy waiver forms for parties, sporting events & more. Web the pennsylvania inheritance tax is a transfer tax. If there is no spouse, or if the spouse has forfeited his/her. Web the pennsylvania inheritance tax is a transfer tax. See instructions for more information. Web the tax rate for pennsylvania inheritance tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other. If there is no spouse, or if the spouse has forfeited his/her. Web to effectuate the waiver you. Web all inheritance tax forms and publications are available on the department of revenue website at: It is different from the other taxes which you might pay regularly. However, if you are the surviving spouse you or you. Ad quick & easy waiver forms for parties, sporting events & more. You do not need to draft another document. Answer id 3902 | published 11/03/2020 11:30 am | updated 06/29/2023 06:30 pm. Ad pdffiller.com has been visited by 1m+ users in the past month Inheritance tax forms, schedules and instructions are. Web the preparer must sign and date the form and provide. Web the actual amount of the discount will not be determined until the final amount of tax. Ad pdffiller.com has been visited by 1m+ users in the past month Web the tax rate for pennsylvania inheritance tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other. Web an online interest and penalty calculator is also available on the department’s online portal, mypath.pa.gov. Web an inheritance tax. Web answer id 988 | published 04/07/2003 09:09 am | updated 11/22/2022 11:42 am. See instructions for more information. Ad pdffiller.com has been visited by 1m+ users in the past month Inheritance tax forms, schedules and instructions are. Get your free trial today. Web what is an inheritance tax waiver in pa? Ad pdffiller.com has been visited by 1m+ users in the past month Am i required to pay inheritance tax on an ira i inherited? If there is no spouse, or if the spouse has forfeited his/her. (for stocks, bonds, securities or security accounts held in beneficiary form) bureau. Ad quick & easy waiver forms for parties, sporting events & more. An extension of time to file does not. Get your free trial today. Web the family exemption may be claimed by a spouse of a decedent who died as a resident of pennsylvania. Web the actual amount of the discount will not be determined until the final amount of tax is determined. It is different from the other taxes which you might pay regularly. The ira will be subject. Web what are the filing requirements for inheritance tax? What is exempt from pa inheritance tax? Enter the information for each beneficiary of the account. Web the pennsylvania inheritance tax is a transfer tax. What assets are subject to inheritance tax?. Web answer id 988 | published 04/07/2003 09:09 am | updated 11/22/2022 11:42 am. Web the waiver can be requested before the return is filed. Web what inheritance tax forms are available in mypath?Fillable Form Rev1737A Pa Inheritance Tax Return Nonresident

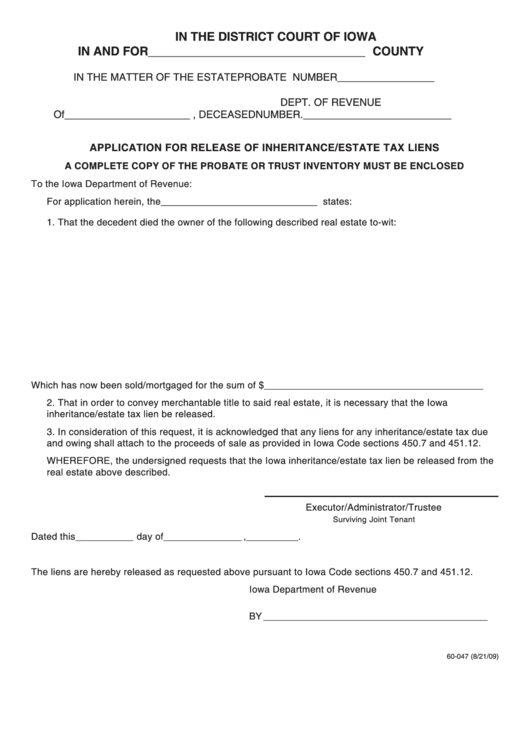

Form 60047 Application For Release Of Inheritance/estate Tax Liens

Pennsylvania Inheritance Tax 39 Free Templates in PDF, Word, Excel

Inheritance Tax Waiver Form Illinois Form Resume Examples aEDvBW8D1Y

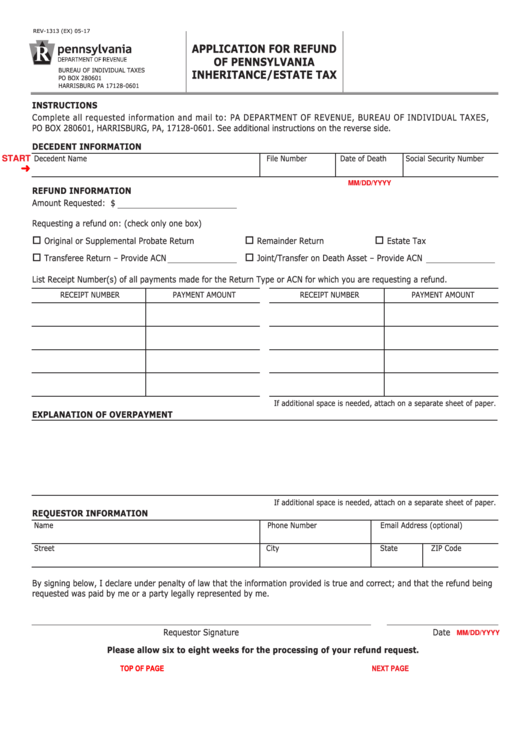

Fillable Form Rev1313 Application For Refund Of Pennsylvania

2022 Tax Calculator

Pa Inheritance Tax Waiver Form Rev 516 Tax Preparation Classes

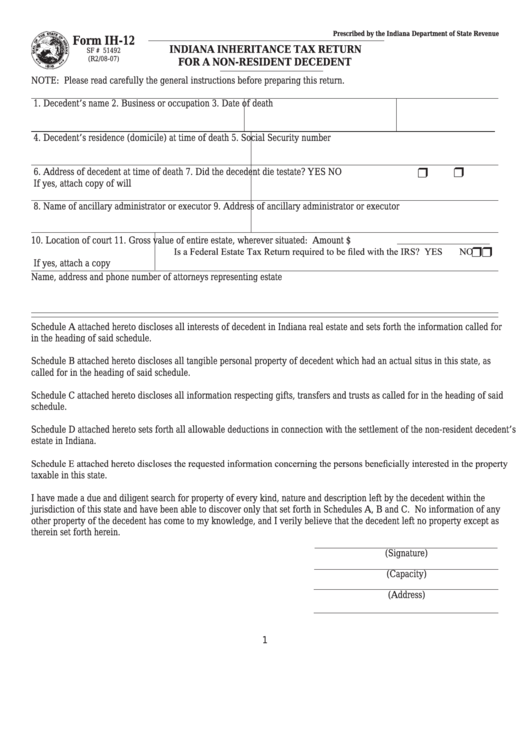

Fillable Form Ih12 Indiana Inheritance Tax Return For A NonResident

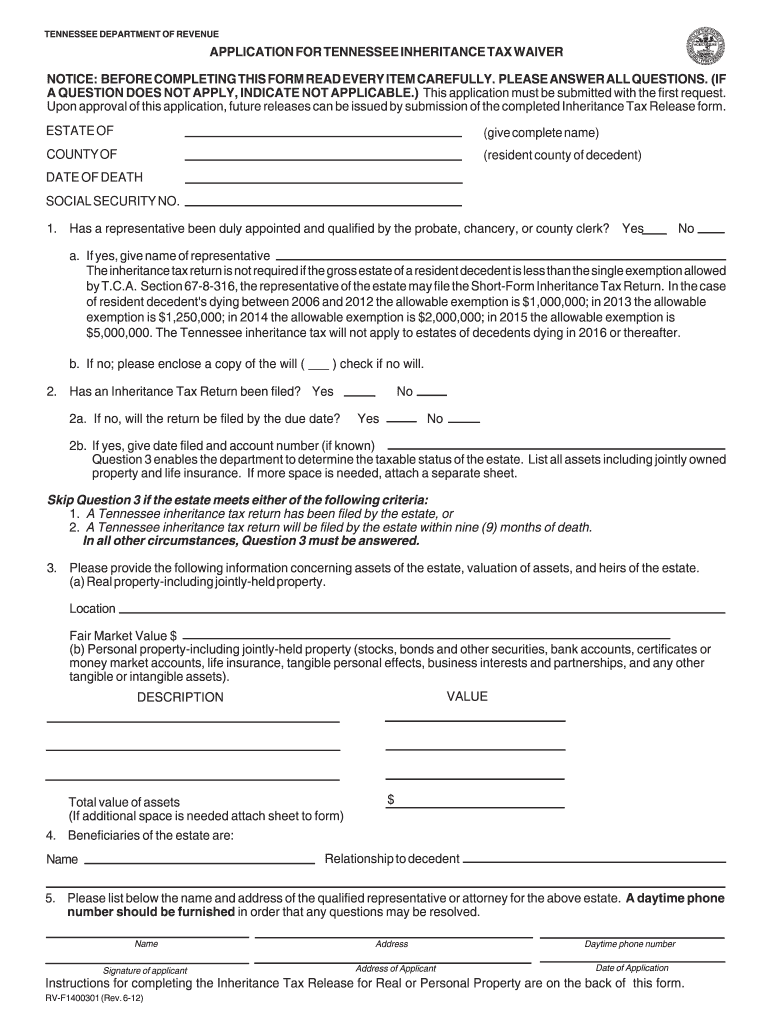

Tennessee Inheritance Tax Waiver Form Fill Out and Sign Printable PDF

Pa Inheritance Tax Waiver Form Rev 516 Tax Preparation Classes

Related Post: