Idaho Form 910

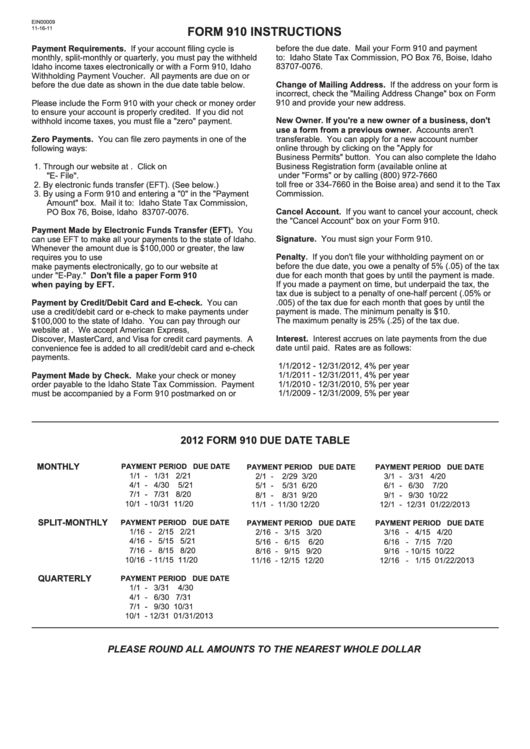

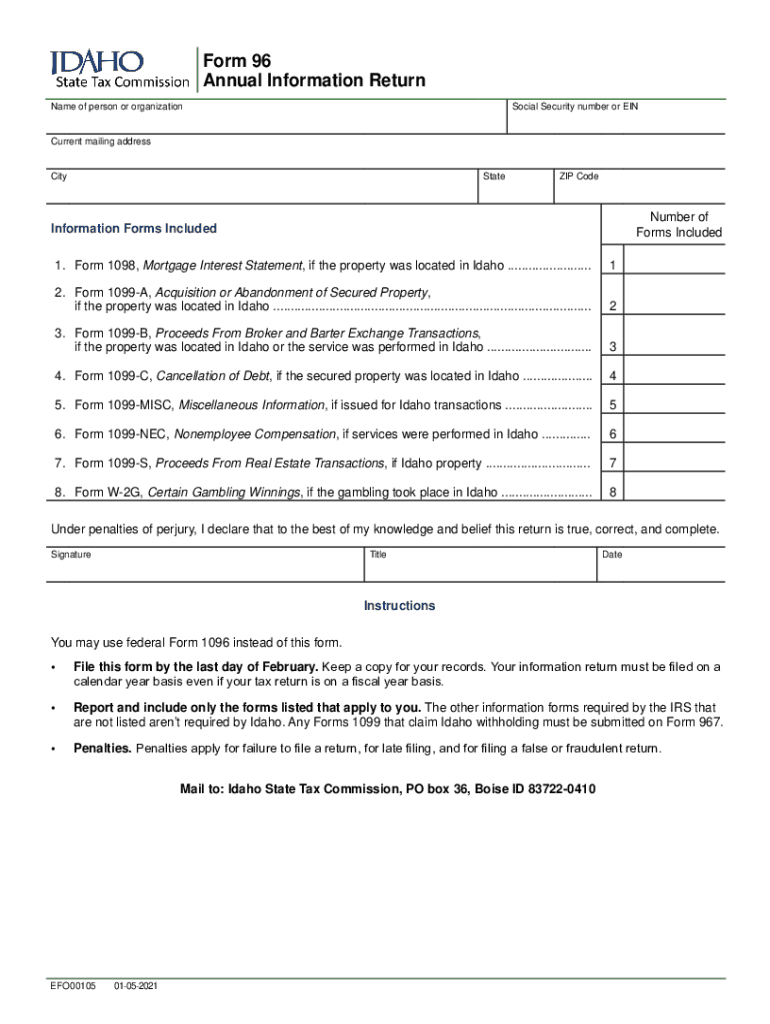

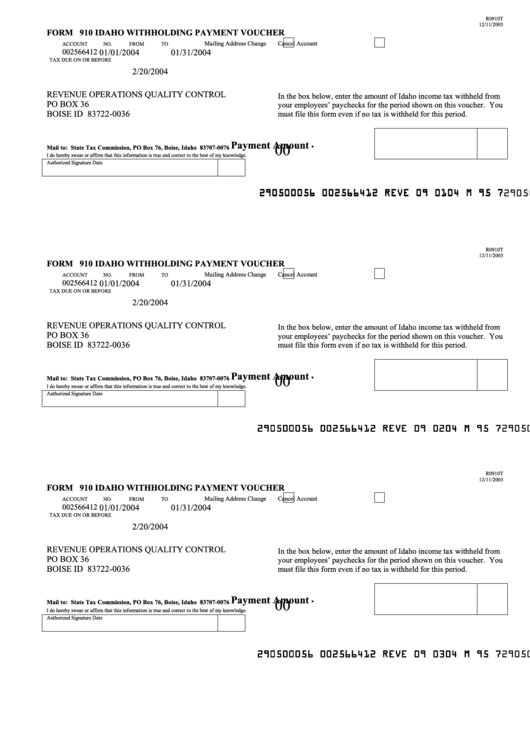

Idaho Form 910 - Fuels taxes and fees forms. They also have the option to pay the taxes withheld. Web you must file form 910 for every filing period (e.g., monthly, quarterly). If you have no withholding to report, you must file a “zero” form 910, either online or. It’s mostly for businesses, but. Form 910, withholding payment voucher state income withholdings and is filed with payment based on the filing. Get ready for tax season deadlines by completing any required tax forms today. Web idaho 926 is the other annual form. 14 released instructions for filing form 910, idaho withholding payment voucher, for corporate income and individual. Web the idaho state tax commission jan. Employers are required by idaho law to withhold income tax from their employees’ wages. Individual income tax forms (current) individual. Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. If you have no withholding to report, you must file a “zero” form 910, either online or. Web complete idaho form 910 online with us legal forms. Individual income tax forms (current) individual. Web for employers who pay employees in idaho, use this guide to learn what’s required to start running payroll while keeping compliant with state payroll tax. Web you must file form 910 for every filing period (e.g., monthly, quarterly). Complete, edit or print tax. They also have the option to pay the taxes withheld. Web complete idaho form 910 online with us legal forms. Web idaho form 910 instructions payment requirements. Web for employers who pay employees in idaho, use this guide to learn what’s required to start running payroll while keeping compliant with state payroll tax. Easily fill out pdf blank, edit, and. In the amount field on form 910*, enter the amount of idaho income tax you withheld for this period. Web complete idaho form 910 online with us legal forms. Web idaho form 910 instructions payment requirements. Web form 910 withholding annual reconciliation form 967 did you know in many cases, your penalty can be greatly reduced by filing your tax. Web for employers who pay employees in idaho, use this guide to learn what’s required to start running payroll while keeping compliant with state payroll tax. It’s mostly for businesses, but. Find the idaho form 910 you want. Get ready for tax season deadlines by completing any required tax forms today. Save or instantly send your ready documents. Web idaho income tax withholding for information call: Fuels taxes and fees forms. Web for employers who pay employees in idaho, use this guide to learn what’s required to start running payroll while keeping compliant with state payroll tax. In the amount field on form 910*, enter the amount of idaho income tax you withheld for this period. Withholdi ng. Web farmers not required to file with the idaho department of labor can pay the taxes withheld on a yearly basis using form 910. 14 released instructions for filing form 910, idaho withholding payment voucher, for corporate income and individual. Use get form or simply click on the template preview to open it in the editor. Enter “0” in the. Web the taxpayer access point (tap) is an online system for people who regularly file idaho returns and pay on certain tax types. Get ready for tax season deadlines by completing any required tax forms today. Web for employers who pay employees in idaho, use this guide to learn what’s required to start running payroll while keeping compliant with state. Get ready for tax season deadlines by completing any required tax forms today. Web business income tax forms (archive) cigarette taxes forms. If you have no withholding to report, you must file a “zero” form 910, either online or. Web forms required to be filed idaho payroll taxes are: The idaho 926 is an annual report that reconciles all the. Web forms required to be filed idaho payroll taxes are: Web you must file form 910 for every filing period (e.g., monthly, quarterly). The idaho 926 is an annual report that reconciles all the quarterly 910s. Web farmers not required to file with the idaho department of labor can pay the taxes withheld on a yearly basis using form 910.. Individual income tax forms (current) individual. Start completing the fillable fields and carefully. Web complete idaho form 910 online with us legal forms. Web business income tax forms (archive) cigarette taxes forms. Web idaho form 910 instructions payment requirements. Web idaho income tax withholding for information call: Get ready for tax season deadlines by completing any required tax forms today. Use get form or simply click on the template preview to open it in the editor. If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld idaho income. Web form 910 withholding annual reconciliation form 967 did you know in many cases, your penalty can be greatly reduced by filing your tax return on time, even if you can't pay. The idaho 926 is an annual report that reconciles all the quarterly 910s. Employers are required by idaho law to withhold income tax from their employees’ wages. They also have the option to pay the taxes withheld. Get ready for tax season deadlines by completing any required tax forms today. In the amount field on form 910*, enter the amount of idaho income tax you withheld for this period. Web forms required to be filed idaho payroll taxes are: Complete, edit or print tax forms instantly. Web the taxpayer access point (tap) is an online system for people who regularly file idaho returns and pay on certain tax types. Form 910, withholding payment voucher state income withholdings and is filed with payment based on the filing. If you have no withholding to report, you must file a “zero” form 910, either online or.Instructions For Form 910 Idaho Withholding Payment Voucher 2012

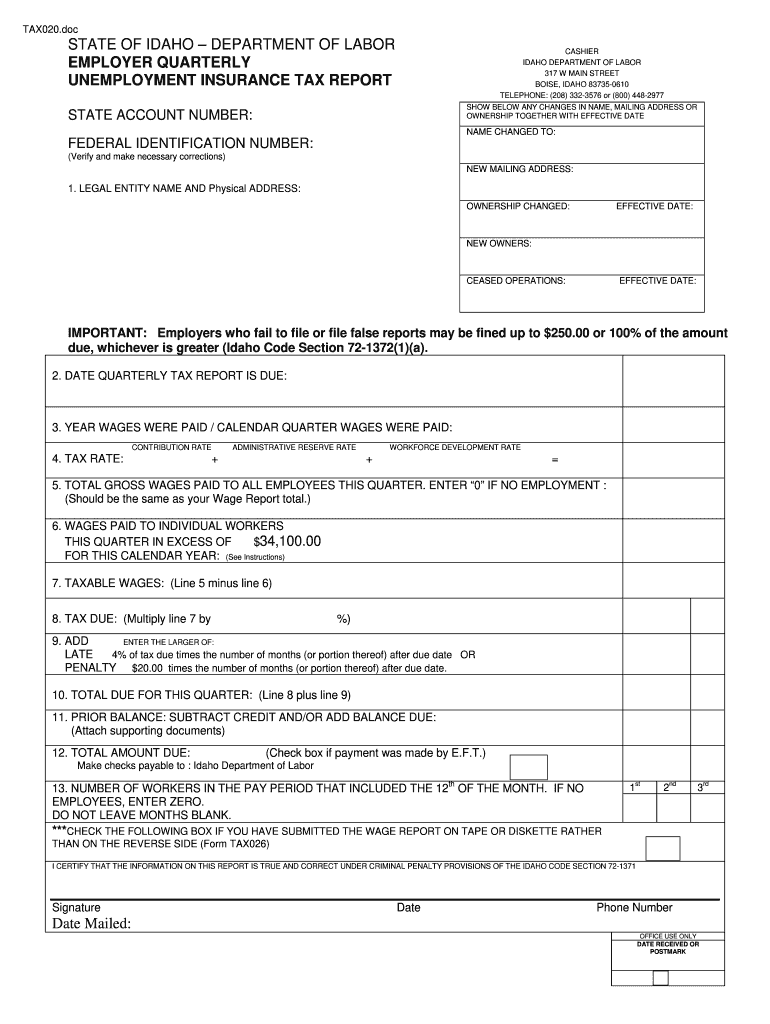

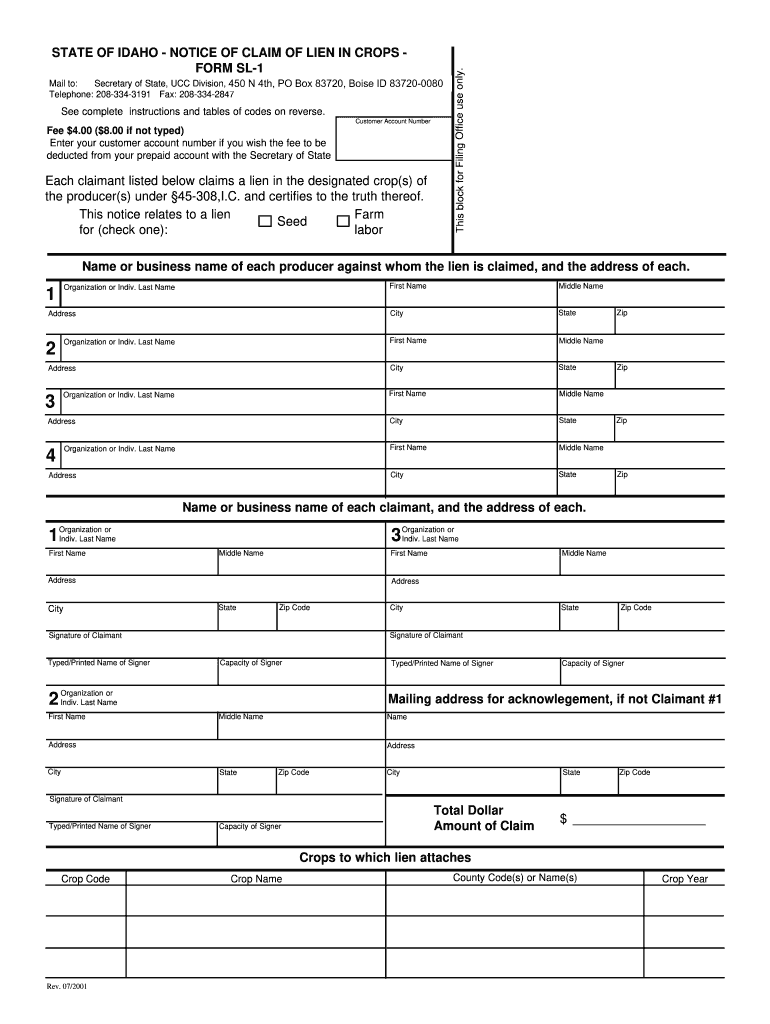

Idaho Effective Labor Form Fill Out and Sign Printable PDF Template

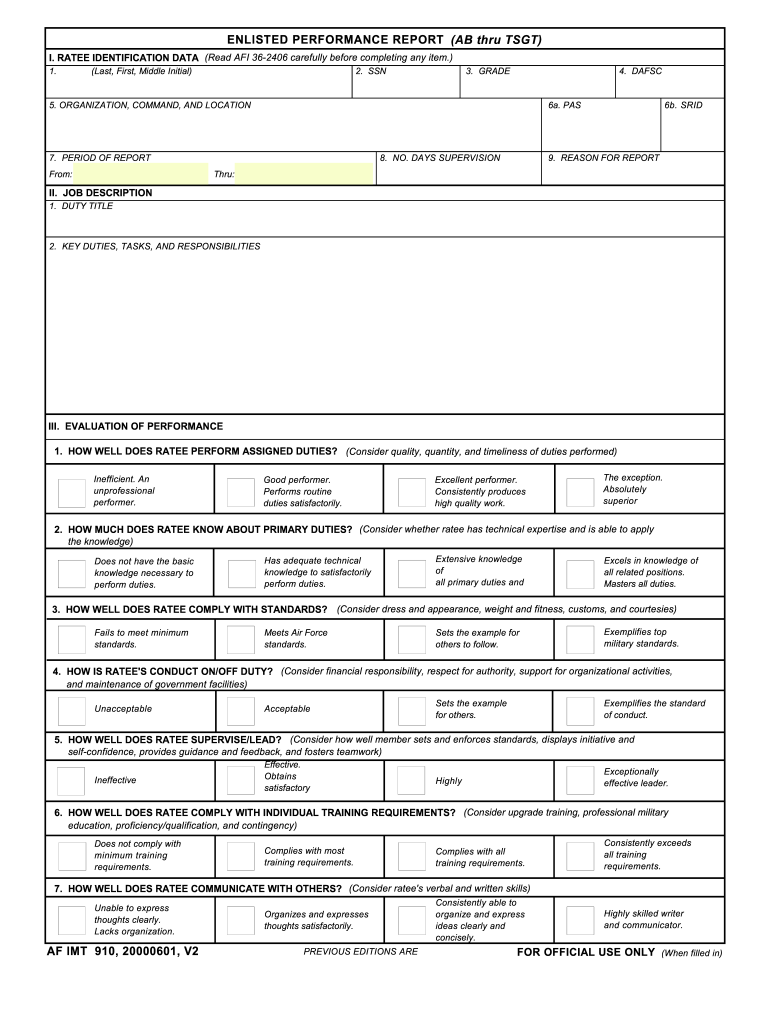

Af Form 910 Fill Online, Printable, Fillable, Blank pdfFiller

Idaho form 910 Fill out & sign online DocHub

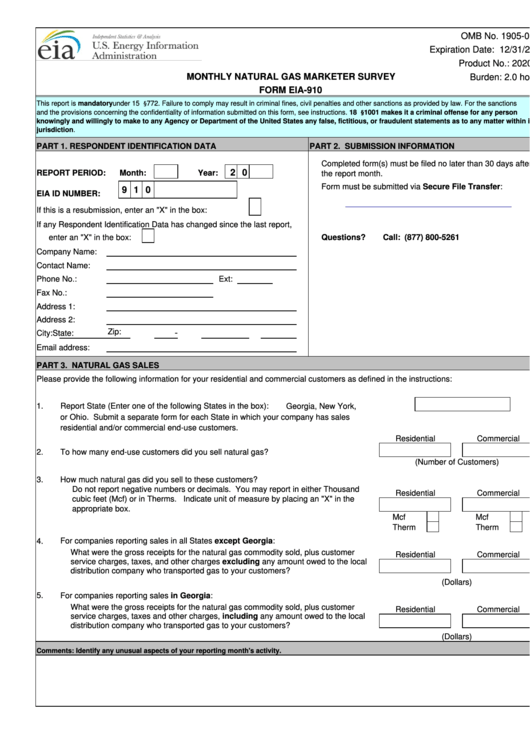

Form Eia910 Monthly Natural Gas Marketer Survey printable pdf download

Free Idaho Medicaid Prior (Rx) Authorization Form PDF eForms

Idaho Mechanics Lien Form Pdf Fill Out and Sign Printable PDF

W 9 Idaho Fill Online, Printable, Fillable, Blank pdfFiller

Form 910 Idaho Withholding Payment Voucher 2004 printable pdf download

1+ Idaho Do Not Resuscitate Form Free Download

Related Post: