Hsa Form 8889 Instructions

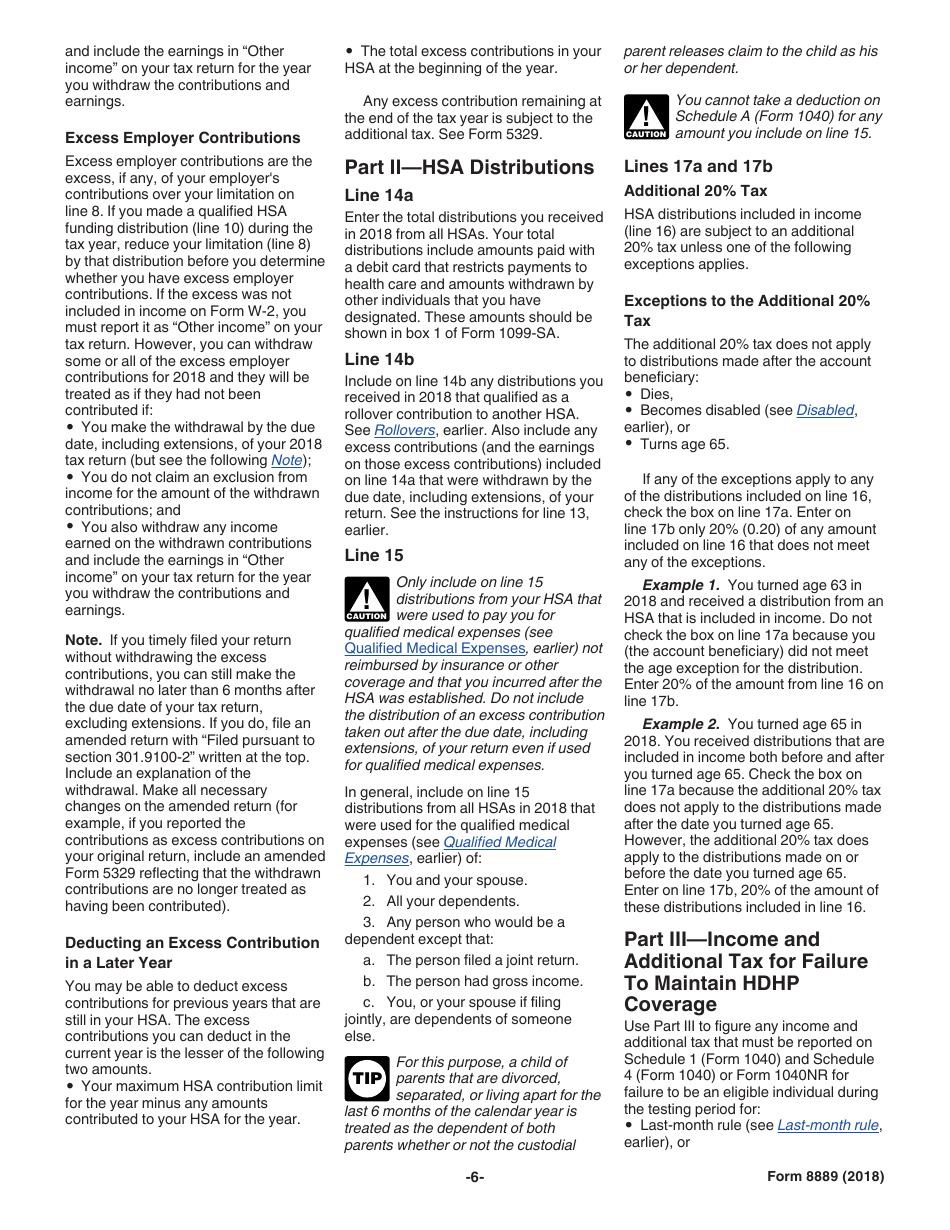

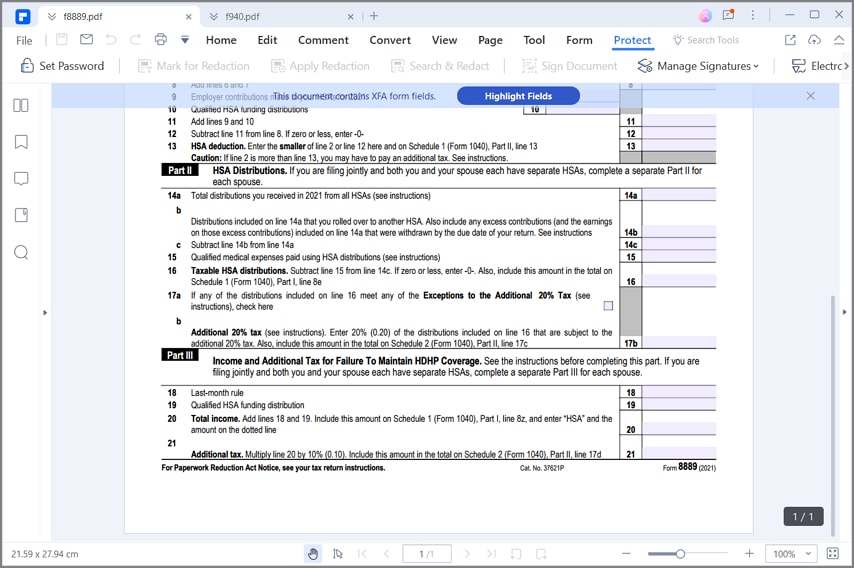

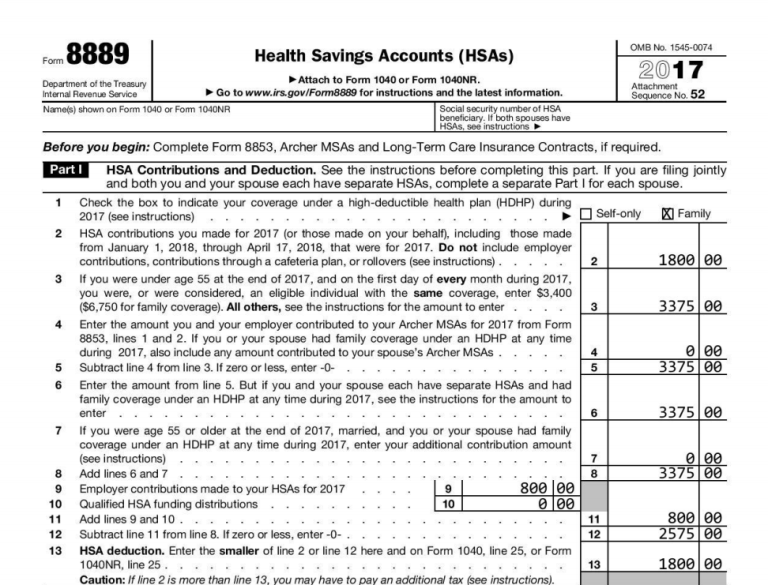

Hsa Form 8889 Instructions - Section references are to the internal revenue code unless. Web the purpose of the form is to report your deductible contributions, calculate the deduction, report the distributions you take to pay medical expenses and to calculate. Ad register and subscribe now to work on irs form 8889 instructions & more fillable forms. Web forms you will need to complete: Web general instructions purpose of form use form 8889 to: Simple instructions to complete form 8889, the irs tax form for hsa's, in 10 minutes. Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa deduction and if any distributions are taxable. Irs form 8853 is used to file medical savings account (msa) contributions and distributions if you currently have an msa or have transferred your. Web you may repay a mistaken distribution from an hsa no later than april 15 following the first year you knew or should have known the distribution was a mistake, providing the. Part 3 of form 8889 involves a calculation of various taxes and penalties you might owe. Web irs form 8889 instructions. Web health savings accounts (hsas) 8889. Web instructions for form 8889. Web instructions for form 8889. Web up to 10% cash back the irs released draft instructions for form 8889, health savings accounts (hsas), for the 2022 tax year to reflect several important legislative. Web use form 8889 to: Try it for free now! To report health savings account contributions, distributions, or to report any adjustments,. Irs form 8853 is used to file medical savings account (msa) contributions and distributions if you currently have an msa or have transferred your. Part 3 of form 8889 involves a calculation of various taxes and penalties you. Part 3 of form 8889 involves a calculation of various taxes and penalties you might owe. This includes your contributions, those made on your behalf, and employer contributions. Ad register and subscribe now to work on irs form 8889 instructions & more fillable forms. By forrest baumhover march 17, 2023 reading time: Simple instructions to complete form 8889, the irs. Web the 2021 versions of form 8889 and its instructions are substantially similar to their 2020 counterparts. Web when finished, pay $9.95 and download your completed form 8889 for your tax year. Section references are to the internal revenue code unless. By forrest baumhover march 17, 2023 reading time: • report health savings account (hsa) contributions (including those made on. To report health savings account contributions, distributions, or to report any adjustments,. Irs form 8853 is used to file medical savings account (msa) contributions and distributions if you currently have an msa or have transferred your. By forrest baumhover march 17, 2023 reading time: This includes your contributions, those made on your behalf, and employer contributions. Simple instructions to complete. Web up to 10% cash back the irs released draft instructions for form 8889, health savings accounts (hsas), for the 2022 tax year to reflect several important legislative. Web instructions for form 8889. Web general instructions purpose of form use form 8889 to: • report health savings account (hsa) contributions (including those made on your behalf and employer contributions), •.. Web health savings account form 8889. Simple instructions to complete form 8889, the irs tax form for hsa's, in 10 minutes. To report health savings account contributions, distributions, or to report any adjustments,. Section references are to the internal revenue code unless. Web the purpose of the form is to report your deductible contributions, calculate the deduction, report the distributions. Web up to 10% cash back the irs released draft instructions for form 8889, health savings accounts (hsas), for the 2022 tax year to reflect several important legislative. Web instructions for form 8889. Web forms you will need to complete: Web the 2021 versions of form 8889 and its instructions are substantially similar to their 2020 counterparts. Try it for. To report health savings account contributions, distributions, or to report any adjustments,. Web form 8889 is used to report the contributions to and distributions from the hsa for the purpose of determining the hsa deduction and if any distributions are taxable. Ad pdffiller.com has been visited by 1m+ users in the past month Try it for free now! Section references. For the latest information about developments related to form 8889 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8889. Section references are to the internal revenue code unless. Ad pdffiller.com has been visited by 1m+ users in the past month Web the purpose of the form is to report your deductible contributions, calculate the deduction,. Try it for free now! Instructions for form 8889 ( print version pdf) recent developments. By forrest baumhover march 17, 2023 reading time: Web forms you will need to complete: They have been updated to reflect the 2021 hsa and hdhp. Irs form 8853 is used to file medical savings account (msa) contributions and distributions if you currently have an msa or have transferred your. How do i report my health savings account (hsa) form 8889? These can arise from failure to comply with. • report health savings account (hsa) contributions (including those made on your behalf and employer contributions), •. To report health savings account contributions, distributions, or to report any adjustments,. Web up to 10% cash back the irs released draft instructions for form 8889, health savings accounts (hsas), for the 2022 tax year to reflect several important legislative. Simple instructions to complete form 8889, the irs tax form for hsa's, in 10 minutes. Upload, modify or create forms. Web health savings accounts (hsas) 8889. This includes your contributions, those made on your behalf, and employer contributions. Web use form 8889 to: Web irs form 8889 instructions. Web general instructions purpose of form use form 8889 to: Web health savings account form 8889. Web the purpose of the form is to report your deductible contributions, calculate the deduction, report the distributions you take to pay medical expenses and to calculate.Form 8889 Health Savings Accounts (HSAs) Contributions, Deductions

Download Instructions for IRS Form 8889 Health Savings Accounts (Hsas

Form 8889 Instructions & Information on the HSA Tax Form

Instructions For Form 8889 Health Savings Accounts 2010 printable

Form 8889 Example missmydesigns

2017 HSA Form 8889 Instructions and Example HSA Edge

Get a Copy of Form 8889 Health Savings Accounts (HSAs)

IRS Form 8889 Instructions A Guide to Health Savings Accounts

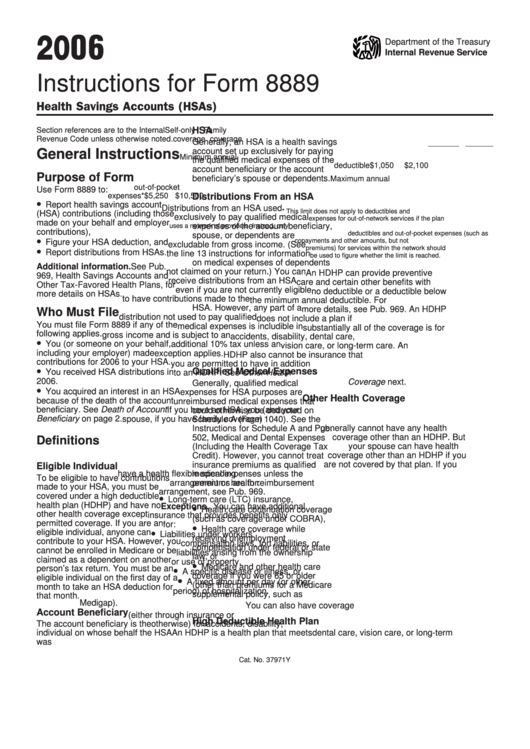

Instructions For Form 8889 Health Savings Accounts 2006 printable

59 [pdf] HSA BANK FORM 8889 PRINTABLE HD DOWNLOAD ZIP * BankForm

Related Post:

![59 [pdf] HSA BANK FORM 8889 PRINTABLE HD DOWNLOAD ZIP * BankForm](https://data.formsbank.com/pdf_docs_html/197/1976/197600/page_1_thumb_big.png)