How To Fill Out Form 8824

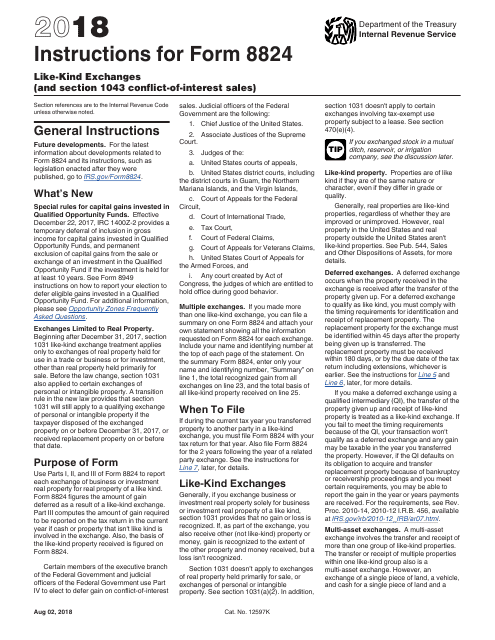

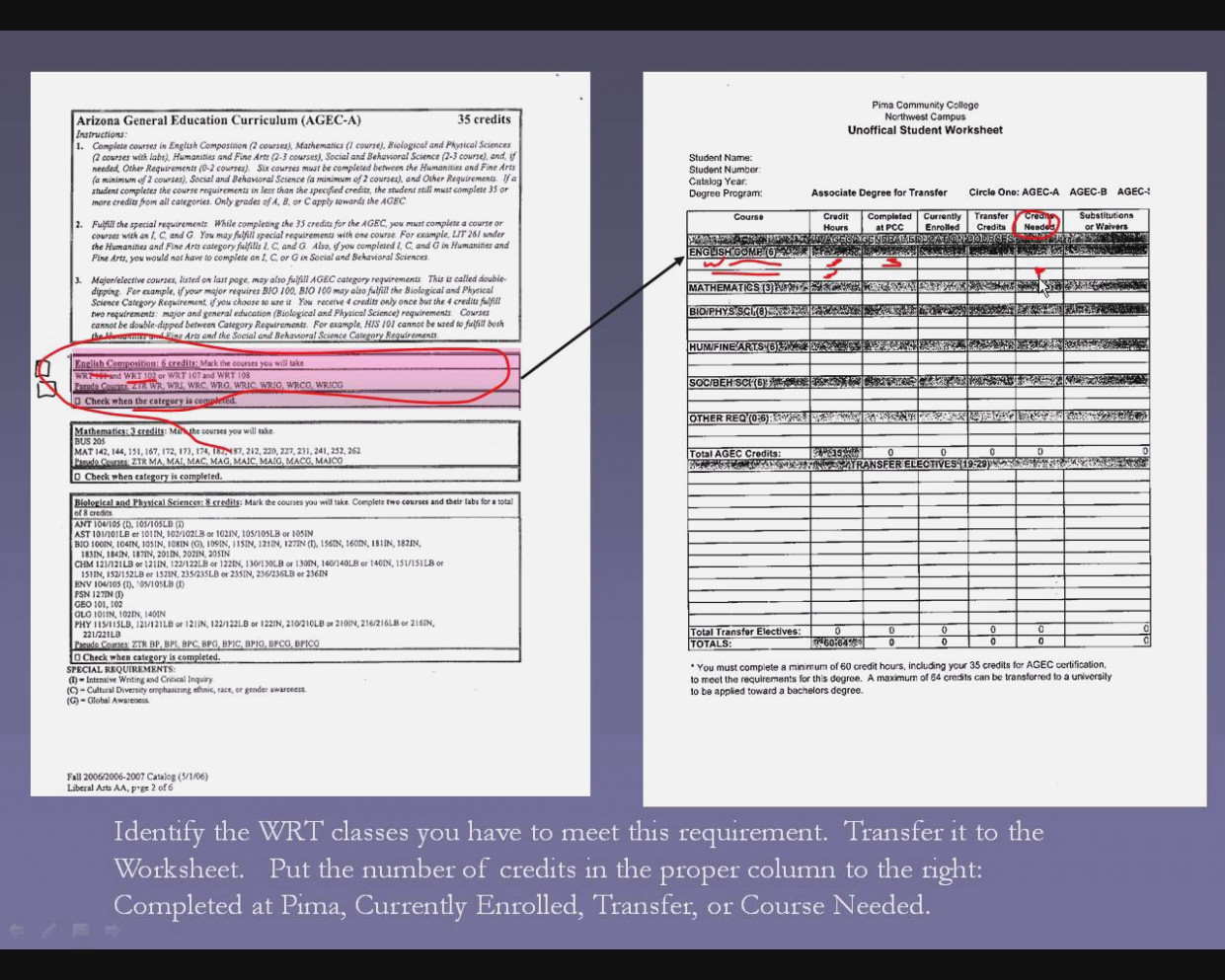

How To Fill Out Form 8824 - Make sure you use the current tax year's form. Also file form 8824 for the 2 years following the year of a related party exchange. Form 8824 figures the amount of. Web intuit help intuit common questions for form 8824 in proseries solved • by intuit • 3 • updated 1 year ago below are the most popular support articles associated. Web gain figured on form 8824. For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after they were. Steel mill) and indicate that the property is located in the. Web part i sale acquisition date of purchase date of sale line 1: Web filling out form 8824: See the form 8997 instructions. Explore the collection of software at amazon & take your skills to the next level. Web irs form 8824: Web part i sale acquisition date of purchase date of sale line 1: Ad we offer a variety of software related to various fields at great prices. Web general instructions future developments. Ad download or email irs 8824 & more fillable forms, register and subscribe now! Form 8824 is a very difficult form to complete. Web first, you must complete and file irs form 8824 along with your tax returns at the end of the year in which you sold the relinquished property and began the 1031. Ad we offer a variety. An overview of the delayed exchange. Web intuit help intuit common questions for form 8824 in proseries solved • by intuit • 3 • updated 1 year ago below are the most popular support articles associated. Web in this video we go over reporting a 1031 exchange on form 8824. Web you can enter form 8824 in either the schedule. Form 8824 is a very difficult form to complete. Ad we offer a variety of software related to various fields at great prices. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached. Web you can enter form 8824 in either the schedule d screen or depreciation screen in proconnect. For details on the. Web general instructions future developments. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Who should file form 8824? Web use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of a like kind. For the latest information about. Web part i sale acquisition date of purchase date of sale line 1: Form 8824 figures the amount of. An overview of the delayed exchange. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Ad we offer a variety of software related to various fields at great prices. Ad download or email irs 8824 & more fillable forms, register and subscribe now! These steps will walk you through the input in the schedule d, or. Web use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of a like kind. Ad we offer a variety of. For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after they were. Form 8824 figures the amount of. For details on the exclusion of gain (including how to figure the amount of the exclusion), see pub. An overview of the delayed exchange. Make sure you use the current tax year's form. Web gain figured on form 8824. These steps will walk you through the input in the schedule d, or. Web form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Ad download or email irs 8824 & more fillable forms, register and subscribe now! Section iii of the form determines the net results of. Web gain figured on form 8824. Web filling out form 8824: For details on the exclusion of gain (including how to figure the amount of the exclusion), see pub. Ad download or email irs 8824 & more fillable forms, register and subscribe now! Web first, you must complete and file irs form 8824 along with your tax returns at the. Web filling out form 8824 1. Web general instructions future developments. See the form 8997 instructions. Section iii of the form determines the net results of the transaction (gain or. For the latest information about developments related to form 8824 and its instructions, such as legislation enacted after they were. Ad download or email irs 8824 & more fillable forms, register and subscribe now! Web in this video we go over reporting a 1031 exchange on form 8824. These steps will walk you through the input in the schedule d, or. Web general instructions future developments. Who fills out form 1031? Explore the collection of software at amazon & take your skills to the next level. Form 8824 is a very difficult form to complete. An overview of the delayed exchange. Web you can enter form 8824 in either the schedule d screen or depreciation screen in proconnect. Steel mill) and indicate that the property is located in the. Who should file form 8824? List the address or legal description and type of property relinquished (sold). Form 8824 figures the amount of. Web part i sale acquisition date of purchase date of sale line 1: Web how do you fill out a 8824?Download Instructions for IRS Form 8824 LikeKind Exchanges PDF, 2018

How can/should I fill out Form 8824 with the following information

Irs Form 8824 Worksheet

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Form 8824 ≡ Fill Out Printable PDF Forms Online

Instructions For Form 8824 LikeKind Exchanges (And Section 1043

Irs Form 8824 Simple Worksheet lalarextra

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Fillable Form 8824 Printable Forms Free Online

Related Post: