How To Fill Out Form 7203

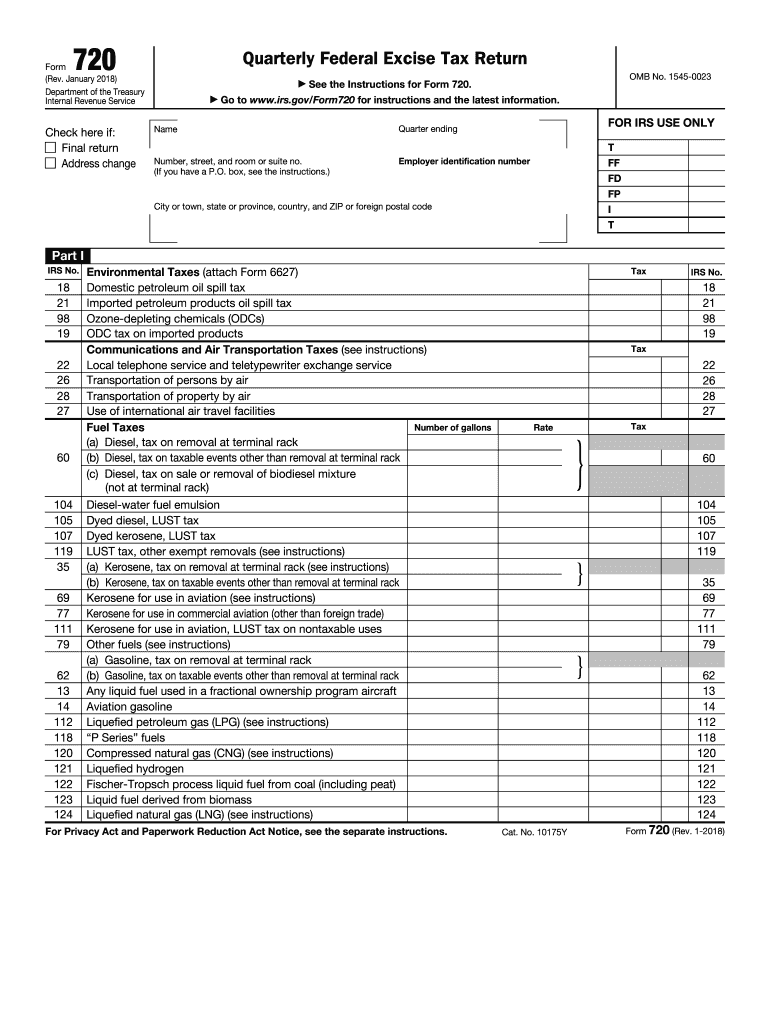

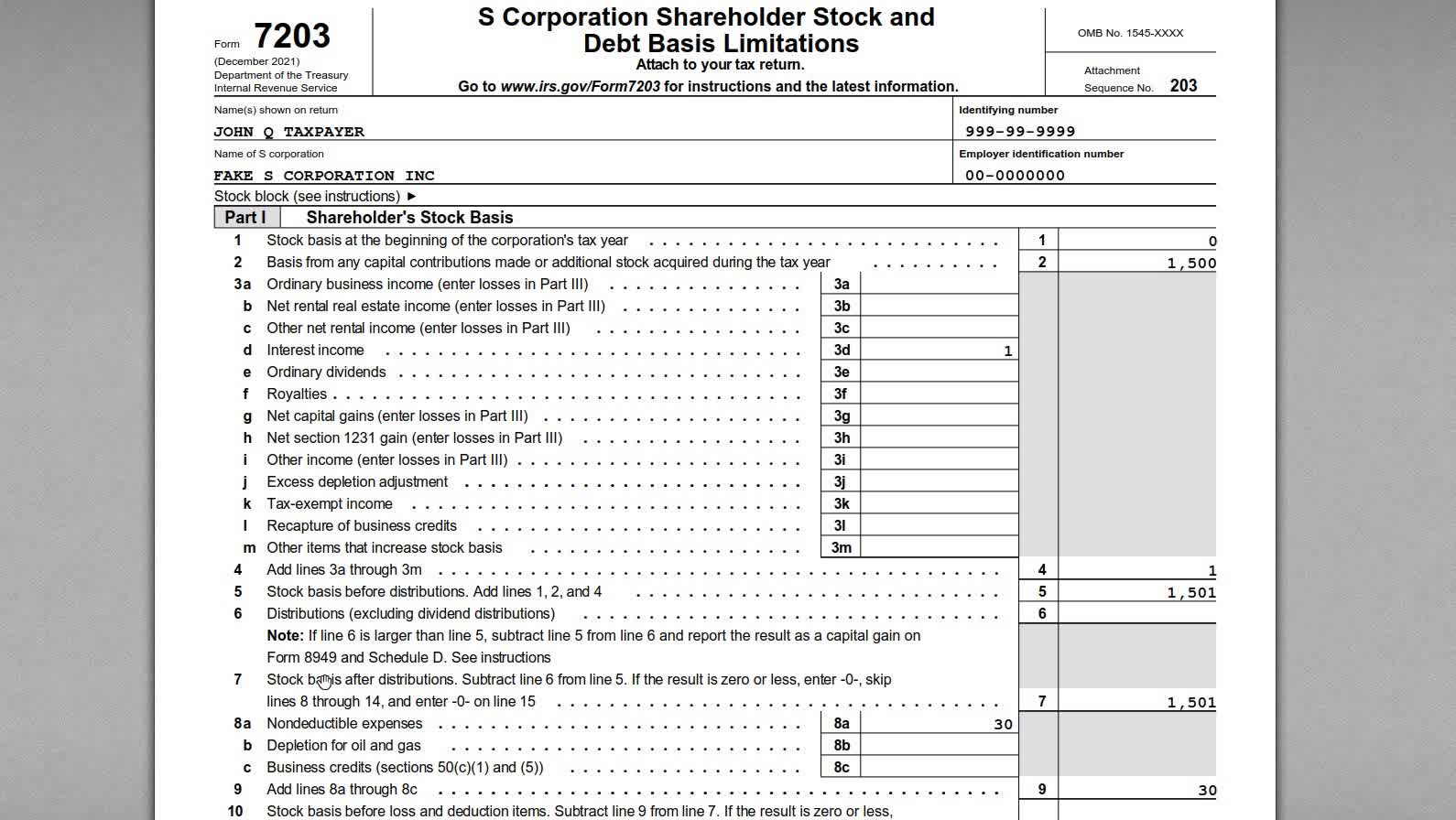

How To Fill Out Form 7203 - Claiming a deduction for their share. If you're wondering how to fill out this form, read on to learn what information it requires and so. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Go to www.irs.gov/form7203 for instructions and the latest information. Web s corporation shareholder stock and debt basis limitations. We last updated california form 3803 in february 2023 from the california franchise tax board. Information that must be filled in this form includes the child's interest and dividend income. Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. Learn more about what will be covered in this webinar. Basis is handled as follows: Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Learn more about what will be covered in this webinar. Go to www.irs.gov/form7203. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Go to www.irs.gov/form7203 for instructions and the latest information. Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. This form is for income earned in tax year. Basis is handled as follows: December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your. Web form 7203 is filed by s corporation shareholders who: Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on. Go to www.irs.gov/form7203 for instructions and the latest information. If you're wondering how to fill out this form, read on to learn what information it requires. Solved • by turbotax • 114 • updated january 13, 2023 form 7203 is used to calculate any limits on the deductions you can. Form 7203 is filed by s corporation shareholders who: Web form 7203 is filed by s corporation shareholders who: We last updated the parents' election. Web did you know that there is a new version of. Basis is handled as follows: We last updated california form 3803 in february 2023 from the california franchise tax board. Learn more about what will be covered in this webinar. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on. Information that must be filled in. Web when should i file form 7203? Web did you know that there is a new version of irs form 7203? Attach to your tax return. Information that must be filled in this form includes the child's interest and dividend income. Web since shareholder stock basis in an s corporation changes every year, it must be computed every year. Information that must be filled in this form includes the child's interest and dividend income. Go to www.irs.gov/form7203 for instructions and the latest information. Web more about the california form 3803. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. We last updated. Solved • by turbotax • 114 • updated january 13, 2023 form 7203 is used to calculate any limits on the deductions you can. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on. Use form 7203 to figure potential limitations of your share of the. Claiming a deduction for their share. Web if one of these requirements applies, then form 7203 is required. Web when should i file form 7203? Go to www.irs.gov/form7203 for instructions and the latest information. Attach to your tax return. Web if one of these requirements applies, then form 7203 is required. Web s corporation shareholder stock and debt basis limitations. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web since shareholder stock basis in an s corporation changes every year, it must be computed every year. We last updated the parents' election. Web attach this to the parents' form 540 or 540nr. Go to www.irs.gov/form7203 for instructions and the latest information. Are claiming a deduction for their share of an aggregate loss from an s corporation (including an aggregate loss not. Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. Claiming a deduction for their share. Information that must be filled in this form includes the child's interest and dividend income. Use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on. Web when should i file form 7203? Web form 7203 is filed by s corporation shareholders who: Learn more about what will be covered in this webinar. Web more about the california form 3803. Basis is handled as follows: Web did you know that there is a new version of irs form 7203? If you're wondering how to fill out this form, read on to learn what information it requires and so. Solved • by turbotax • 114 • updated january 13, 2023 form 7203 is used to calculate any limits on the deductions you can.Irs form 720 Fill out & sign online DocHub

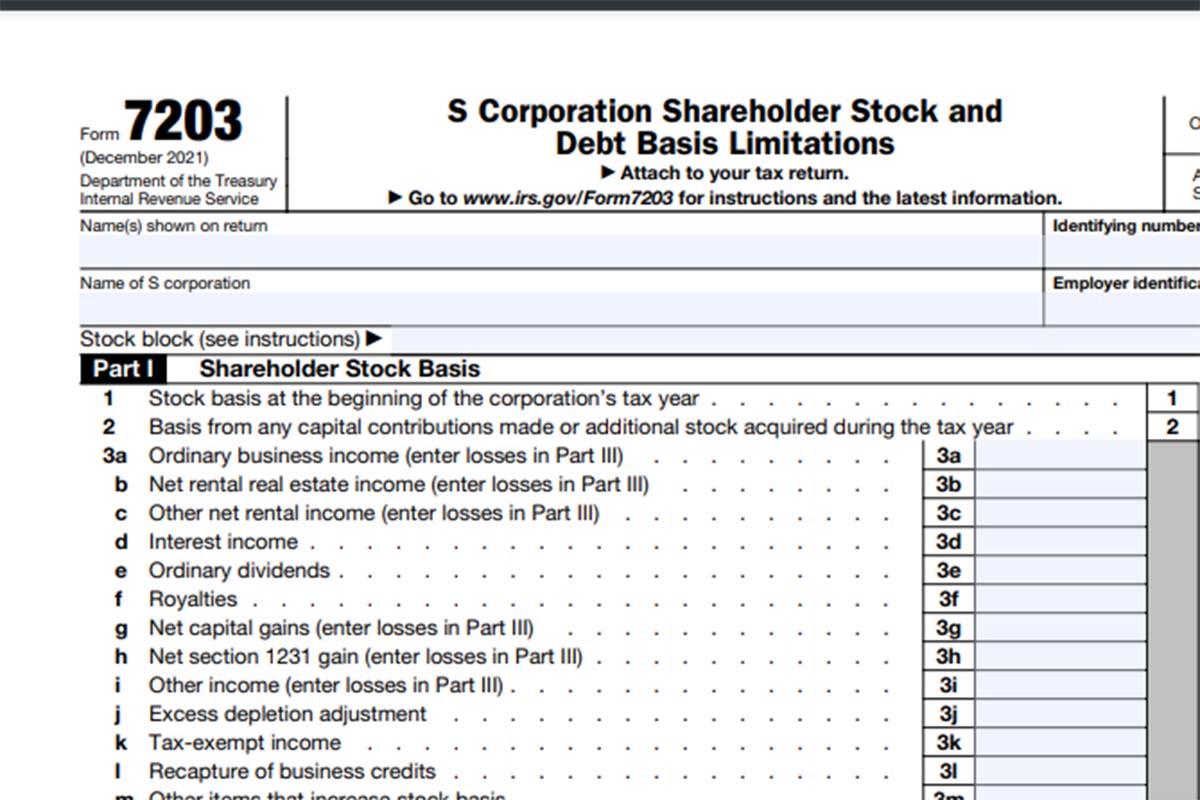

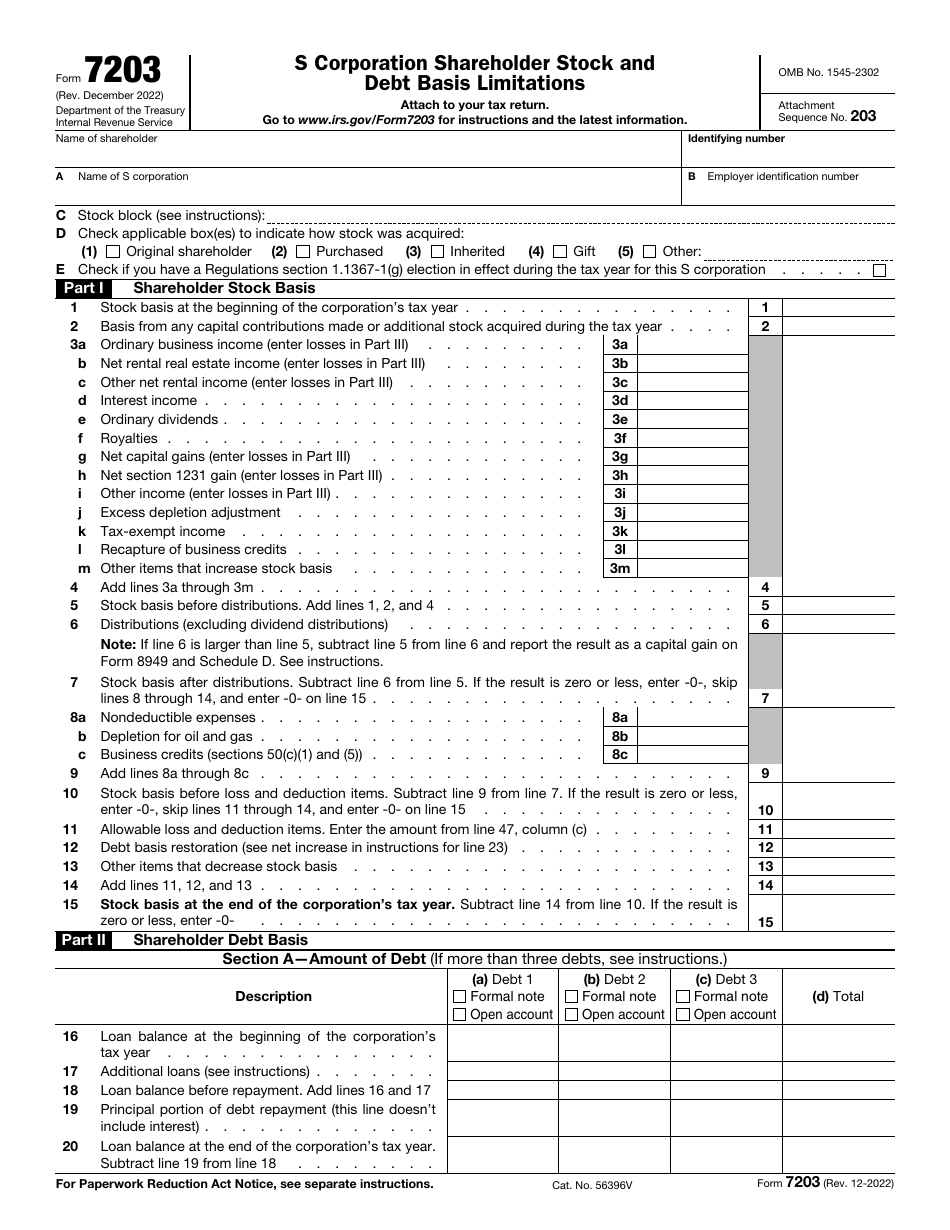

More Basis Disclosures This Year for S corporation Shareholders Need

IRS Form 7203 Fill Out, Sign Online and Download Fillable PDF

National Association of Tax Professionals Blog

IRS Form 720 Instructions for the PatientCentered Research

SCorporation Shareholders May Need to File Form 7203

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

IRS Issues New Form 7203 for Farmers and Fishermen

How to Complete IRS Form 7203 S Corporation Shareholder Basis

IRS Form 720 Instructions for the PatientCentered Research

Related Post: