How To Fill Out Form 3115 For Missed Depreciation

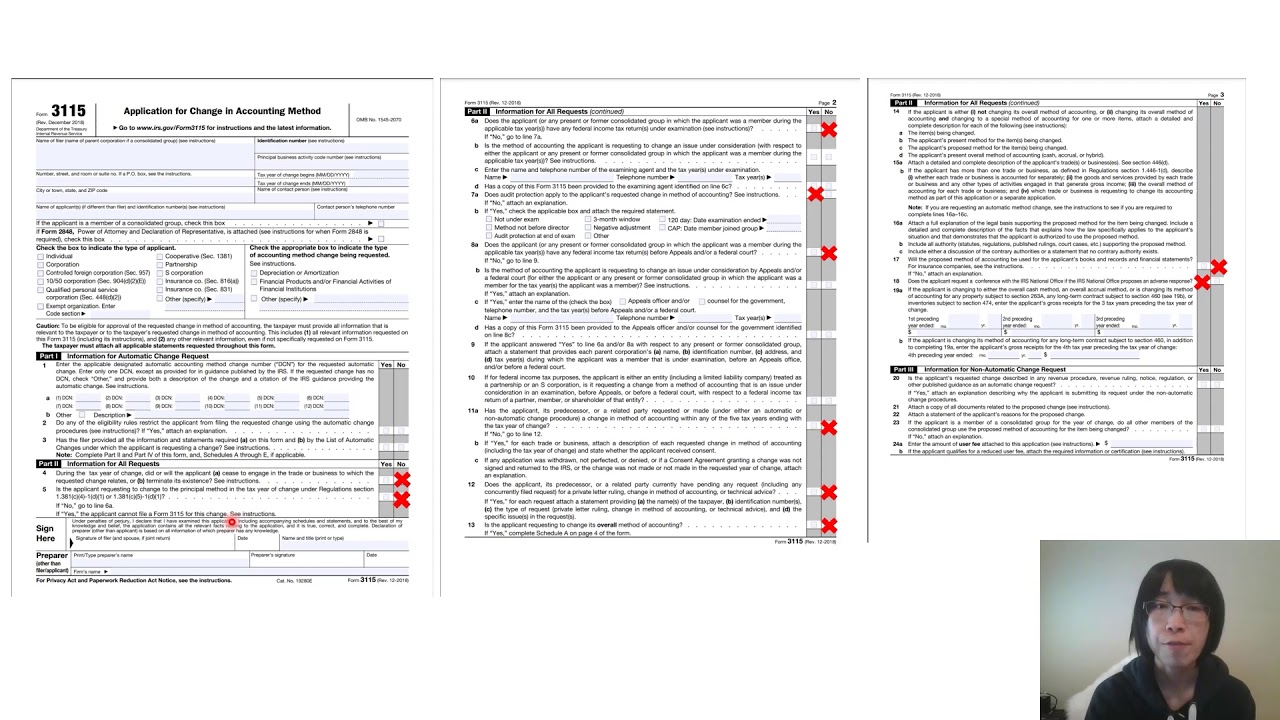

How To Fill Out Form 3115 For Missed Depreciation - Taxpayers can correct depreciation deductions by claiming the missed depreciation and correcting the depreciation methods. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. Web files a copy of form 3115 with the national office no later than when the original is filed with the amended return. Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with. 4.1k views 2 years ago. The irs allows a taxpayer to correct depreciation deductions by claiming the missed. Change in accounting method and select open form; Few tax professionals have seen a cost segregation study or only a few over their. Web follow these steps to generate form 3115 in the program: Depreciation and correcting the depreciation. Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with. Few tax professionals have seen a cost segregation study or only a few over their. Taxpayers can correct depreciation deductions by claiming the missed depreciation and correcting the depreciation methods.. Choose what type of entity you are; Form 3115 and depreciation adjustments. Web this form 3115 (including its instructions), and (2) any other relevant information, even if not specifically requested on form 3115. The irs allows a taxpayer to correct depreciation deductions by claiming the missed. Taxpayers can correct depreciation deductions by claiming the missed depreciation and correcting the depreciation. Few tax professionals have seen a cost segregation study or only a few over their. Web this form 3115 (including its instructions), and (2) any other relevant information, even if not specifically requested on form 3115. If you missed a few years depreciation on 1040 schedule e for your rental property, you may need to. Web code 107 on form. The biggest question i get from readers involves form 3115. Complete these lines and boxes: Web a good guide for using form 3115 to claim missed depreciation? I have read before that people who own rental property and who have not claimed depreciation. If you missed a few years depreciation on 1040 schedule e for your rental property, you may. Web this form 3115 (including its instructions), and (2) any other relevant information, even if not specifically requested on form 3115. Few tax professionals have seen a cost segregation study or only a few over their. Web code 107 on form 3115 is to be used to “catch up” omitted depreciation on an asset when it is sold. Complete these. I have read before that people who own rental property and who have not claimed depreciation. Few tax professionals have seen a cost segregation study or only a few over their. Web form 3115, change in accounting method, is used to correct most other depreciation errors, including the omission of depreciation. The biggest question i get from readers involves form. Taxpayers can correct depreciation deductions by claiming the missed depreciation and correcting the depreciation methods. Form 3115 will have to be filed, with the entire amount of incorrect or. Choose what type of entity you are; Web files a copy of form 3115 with the national office no later than when the original is filed with the amended return. Web. Depreciation and correcting the depreciation. Change in accounting method and select open form; The irs allows a taxpayer to correct depreciation deductions by claiming the missed. Page last reviewed or updated: 8.4k views 2 years ago. Choose what type of entity you are; Web follow these steps to generate form 3115 in the program: Web can you fill out form 3115 for missed depreciation? 2) yes, you put 7 on the dcn line. Check the box labeled print this form 3115. Change in accounting method and select open form; Web 231 rows general instructions. Web files a copy of form 3115 with the national office no later than when the original is filed with the amended return. Web this form 3115 (including its instructions), and (2) any other relevant information, even if not specifically requested on form 3115. Complete these lines. I have read before that people who own rental property and who have not claimed depreciation. Web code 107 on form 3115 is to be used to “catch up” omitted depreciation on an asset when it is sold. Web follow these steps to generate form 3115 in the program: Taxpayers can correct depreciation deductions by claiming the missed depreciation and correcting the depreciation methods. Web files a copy of form 3115 with the national office no later than when the original is filed with the amended return. Change in accounting method and select open form; Under the tax year of change subsection, enter the beginning date (code. Depreciation and correcting the depreciation. Attaches a statement to form 3115 that it is being filed. The biggest question i get from readers involves form 3115. There is no need for an x, except to mark the depreciation or. Choose what type of entity you are; Web to qualify for the blanket consent to changing methods of depreciation, a taxpayer must change to a permissible method and complete and file a form 3115 in accordance with. Change in accounting method and select open form; Web filing form 3115 to catch up on missed depreciation, is form 4562 also needed to be filed or that will go next year you only use form 3115 for the year you are. Web select open form and type 3115; Web a good guide for using form 3115 to claim missed depreciation? File form 3115 to request a change in. If you forget to take depreciation on an. 4.1k views 2 years ago.Form 3115 Edit, Fill, Sign Online Handypdf

Instructions For Form 3115 printable pdf download

Form 3115 App for change in acctg method Capstan Tax Strategies

Form 3115 Application for Change in Accounting Method(2015) Free Download

3115 Form now Required for ALL business owners with Depreciation

How to catch up missed depreciation on rental property (part I) filing

Form 3115 Applying a Cost Segregation Study on a Tax Return The

Form 3115 Depreciation Guru

Form 3115 Application for Change in Accounting Method(2015) Free Download

How to catch up missed depreciation on rental property (part I) filing

Related Post: