How To Fill Out A W-4P Form If Single

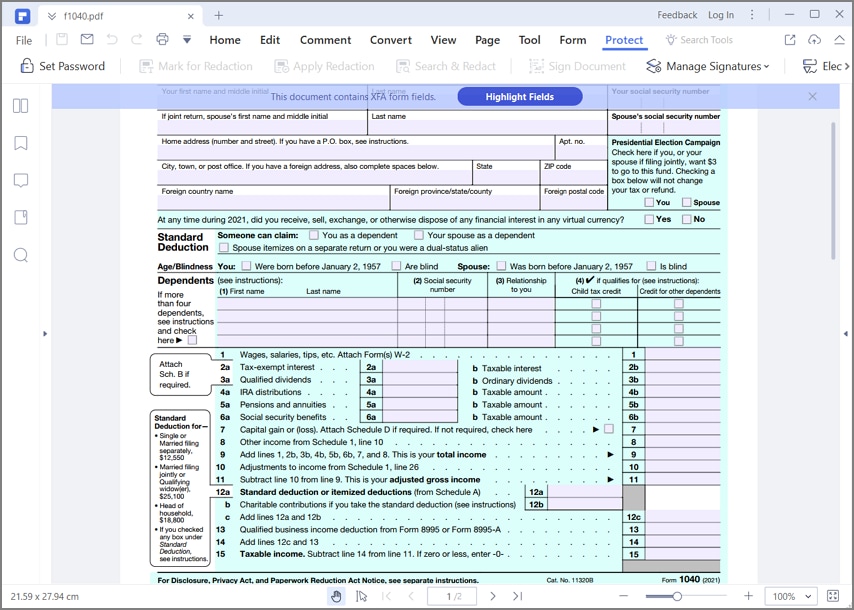

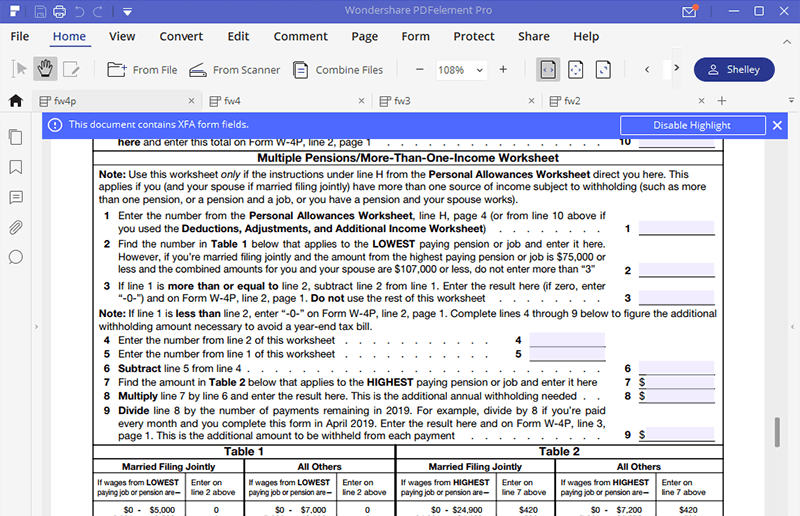

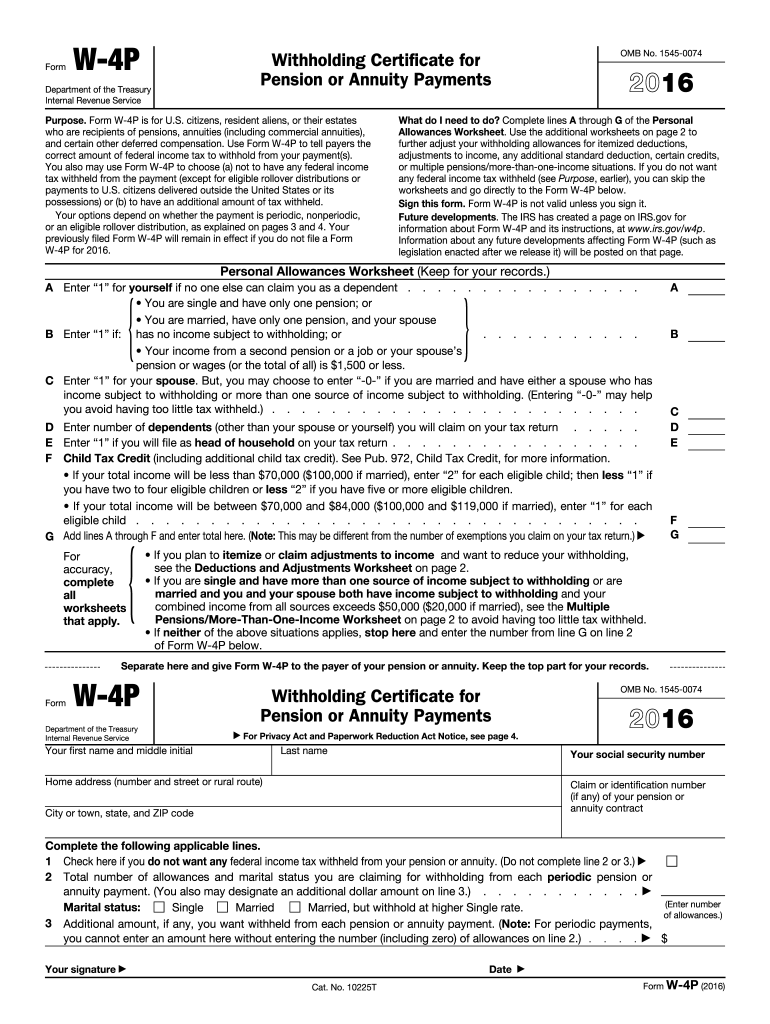

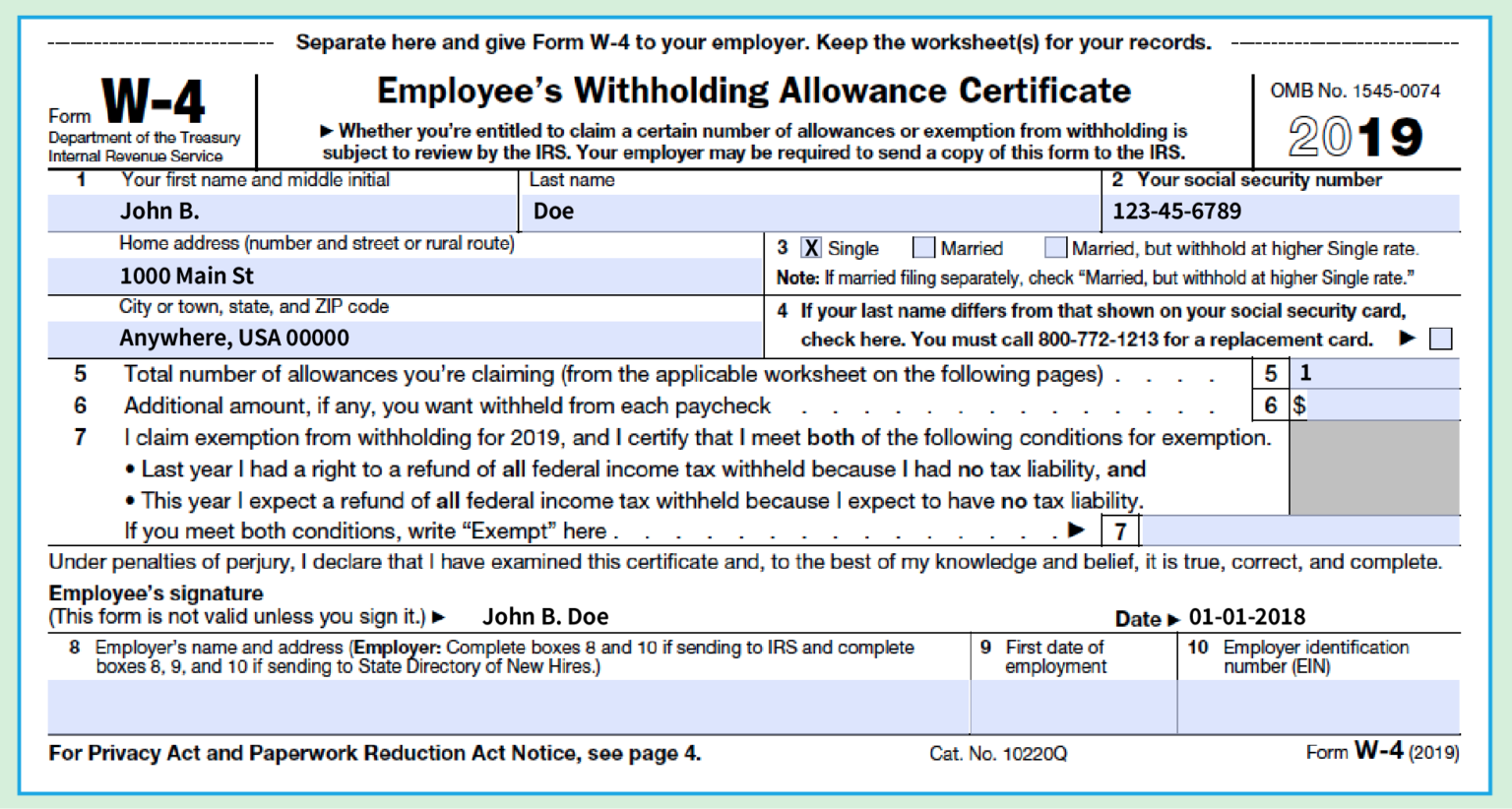

How To Fill Out A W-4P Form If Single - You have nonresident alien status. If you are single or are married to a spouse who doesn’t work, you don’t have dependents, you only have one job, and you aren’t claiming. If too little is withheld, you will generally owe tax when. This form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. John’s school vs osei tutu shs vs opoku ware school However, you can designate an. Personal information and filing status. What you probably aren’t familiar with is that system no longer exists. The rest of the form will depend on the number of jobs you work. Web form w‐4p is for u.s. What you probably aren’t familiar with is that system no longer exists. Web the form has steps 1 through 5 to guide employees through it. However, you can designate an. You must fill out essential information such as your name,. Personal information and filing status. This form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. If too little is withheld, you will generally owe tax when. You have nonresident alien status. However, you can designate an. One difference from prior forms is the expected filing. Web if you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out step. Income from other jobs and pensions/annuities the purpose of step 2 is to account for taxable income received. Complete, edit or print tax forms instantly. Enter your. This form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. However, you can designate an. One difference from prior forms is the expected filing. Web if you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill. If you are single or are married to a spouse who doesn’t work, you don’t have dependents, you only have one job, and you aren’t claiming. What you probably aren’t familiar with is that system no longer exists. John’s school vs osei tutu shs vs opoku ware school Web you picked married or single, and the number of exemptions you. If too little is withheld, you will generally owe tax when. Web you picked married or single, and the number of exemptions you were going to claim. You must fill out essential information such as your name,. Web the form has steps 1 through 5 to guide employees through it. The rest of the form will depend on the number. However, you can designate an. What you probably aren’t familiar with is that system no longer exists. Web while the calculation method is more complex, the irs maintains that, when completed correctly, the new form will more accurately approximate the amount of tax. This form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. If you. You must fill out essential information such as your name,. Web you picked married or single, and the number of exemptions you were going to claim. This form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred.. Web if you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out step. The rest of the form will depend on the number of jobs you work. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred. What you probably aren’t familiar with is that system no longer exists. This form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. John’s school vs osei tutu shs vs opoku ware school However, you can designate. If too little is withheld, you will generally owe tax when. The rest of the form will depend on the number of jobs you work. This form is used specifically for taxpayers that receive pensions, annuities, and other deferred compensation. However, you can designate an. You can’t designate a specific dollar amount to be withheld. John’s school vs osei tutu shs vs opoku ware school One difference from prior forms is the expected filing. What you probably aren’t familiar with is that system no longer exists. Web complete the items below. You must fill out essential information such as your name,. Enter your personal information first, you’ll fill out your personal information including your name, address, social security number, and tax filing status. Web the form has steps 1 through 5 to guide employees through it. Web form w‐4p is for u.s. You guys are probably familiar with this. Web while the calculation method is more complex, the irs maintains that, when completed correctly, the new form will more accurately approximate the amount of tax. If you are single or are married to a spouse who doesn’t work, you don’t have dependents, you only have one job, and you aren’t claiming. You have nonresident alien status. Income from other jobs and pensions/annuities the purpose of step 2 is to account for taxable income received. Personal information and filing status. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred.2021 W4 Guide How to Fill Out a W4 This Year Gusto

How To Fill Out A W 4 Form The Only Guide You Need W4 2020 Form Printable

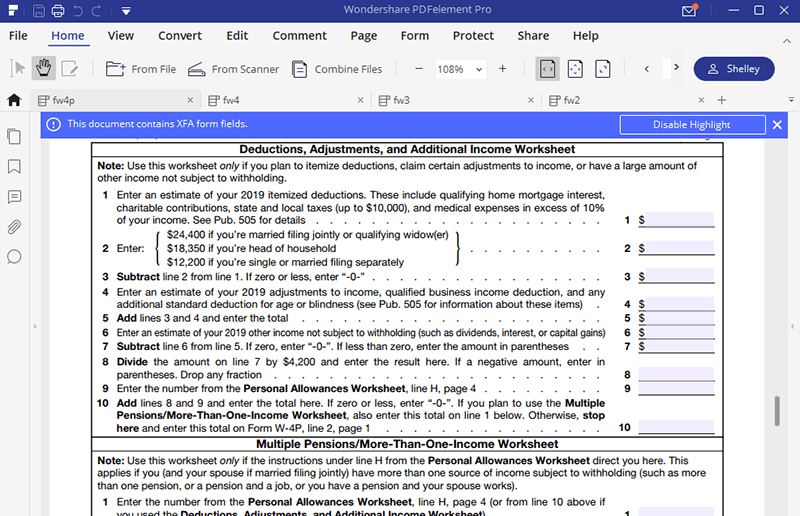

IRS Form W4P Fill it out in an Efficient Way

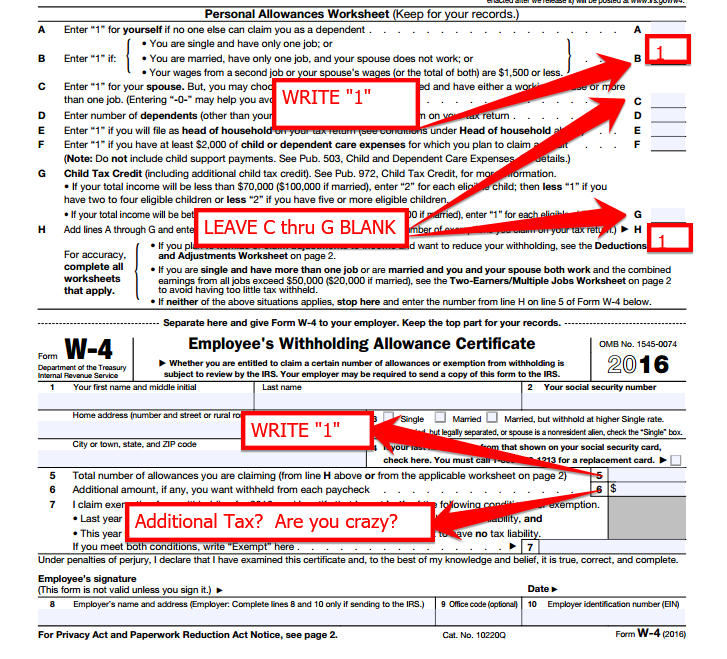

How to do Stuff Simple way to fill out a W4

W4 Form How to Fill It Out in 2022 (2022)

What Is a W4 Form? How to Fill Out an Employee’s Withholding

Hoe een IRS Formulier W4P invullen

How to fill out W4 for a single person MKRD.info

IRS Form W4P Fill it out in an Efficient Way

W 4p 2016 form Fill out & sign online DocHub

Related Post:

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)