How To Fill Out A 8863 Form

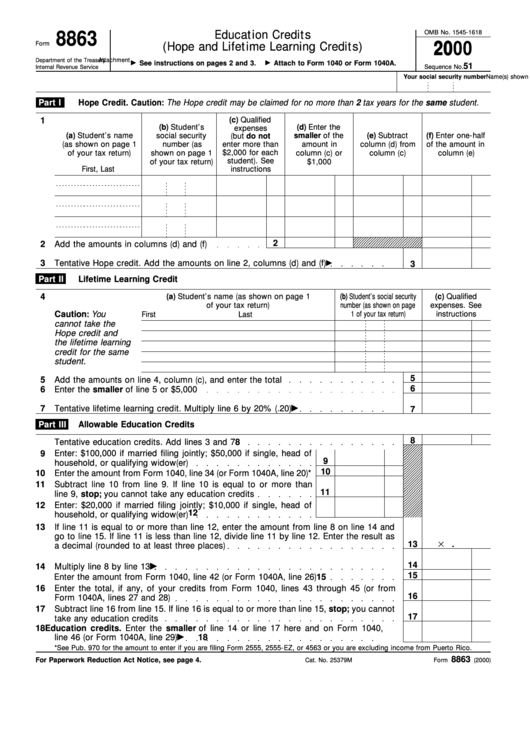

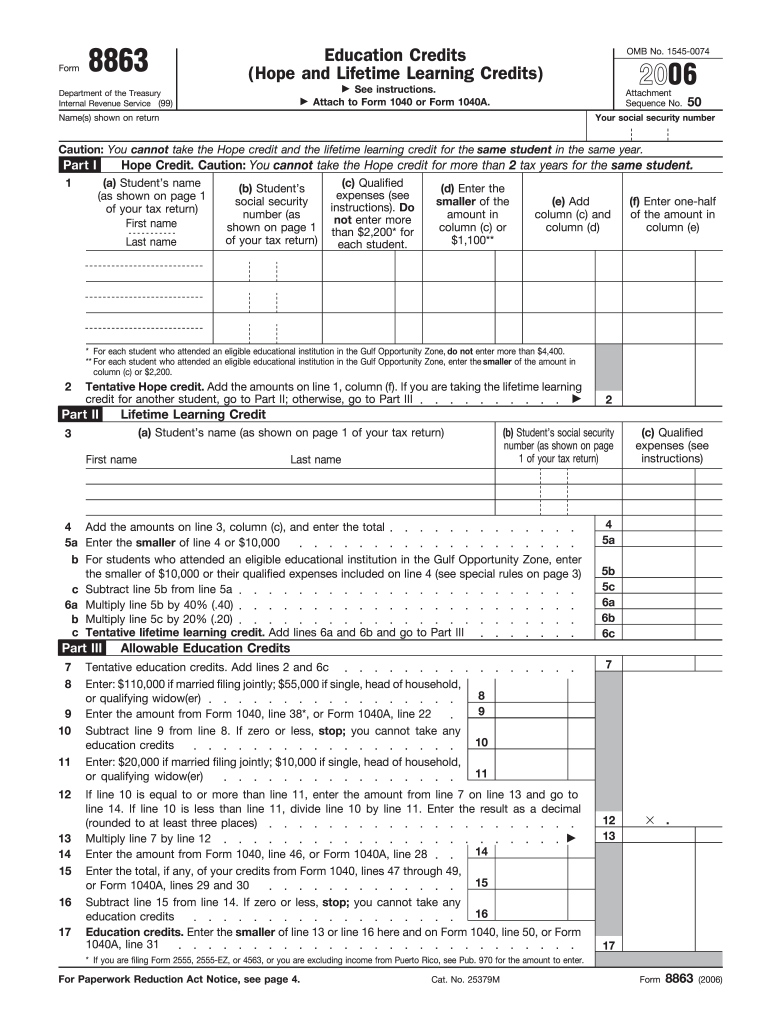

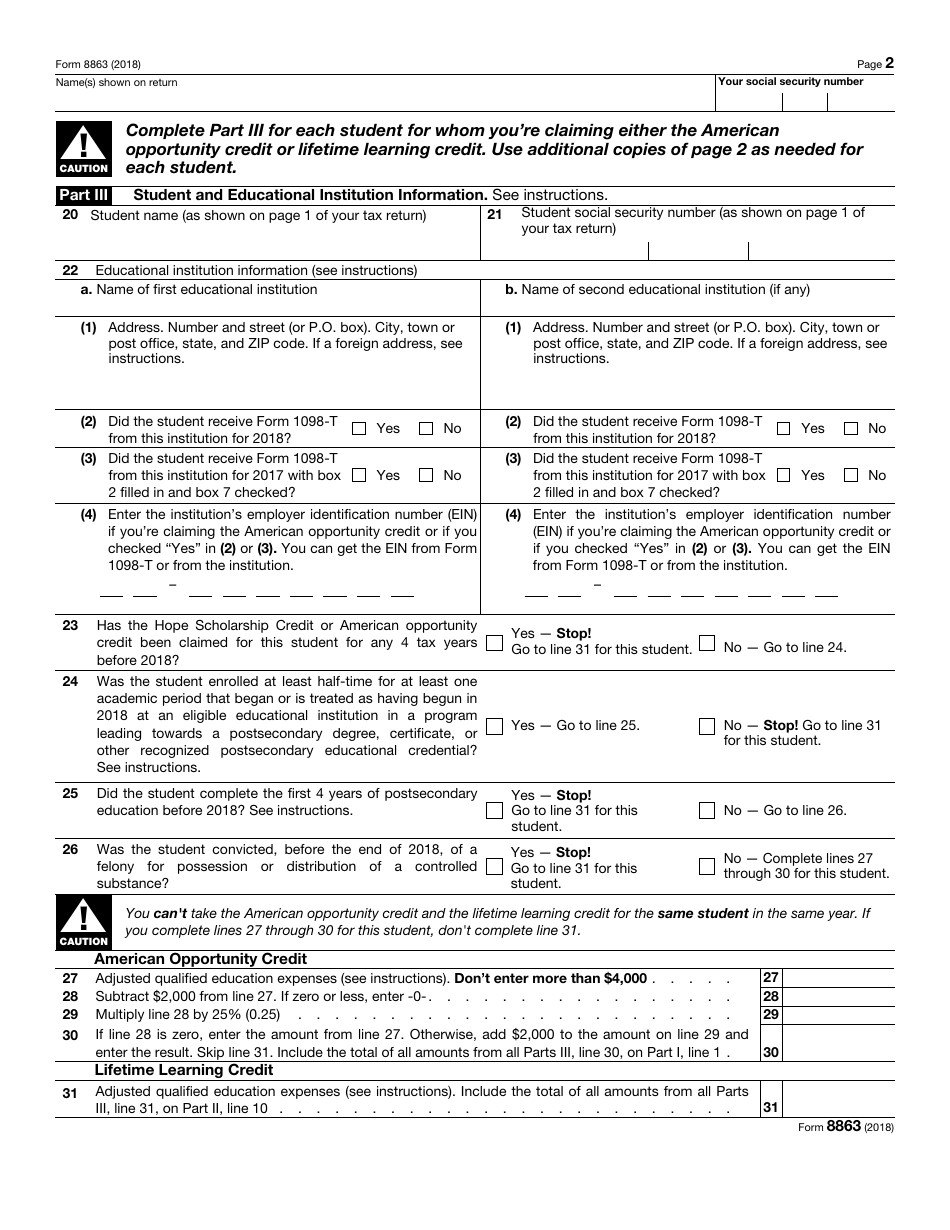

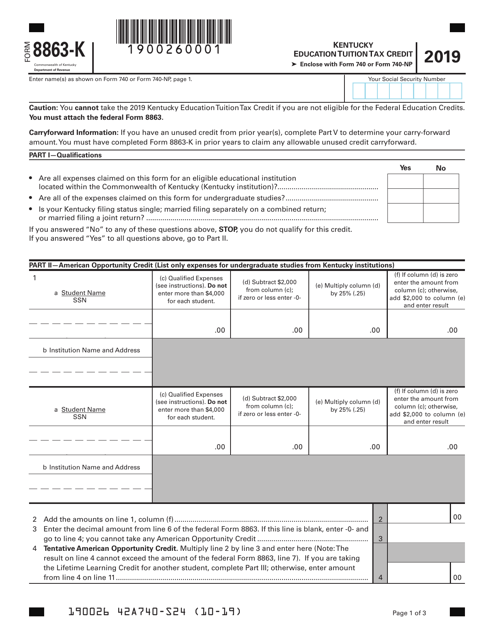

How To Fill Out A 8863 Form - Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web you can either fill out the 8863 template or use a sample pdf provided by the irs. Web instructions for form 8863 education credits (american opportunity and lifetime learning credits) general instructions section references are to the internal revenue code. Web how to file irs form 8863 for lifetime learning credits for 2022 what is the earned income credit (and do i qualify?) tax deductions for college. They’re available online or in a printable. Download blank or fill out online in pdf format. The irs form 8863 determines the amount of this tax. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Use form 8863 to figure and claim your. Printable or online, and include it with your federal return. To download the form 8863 in printable format and to know about.more.more visit: • click the blue common forms box towards the top of the screen. Launch the program, drag and drop the irs form 8863 into pdfelement. The irs form 8863 determines the amount of this tax. Web how to get to this form: Printable or online, and include it with your federal return. They’re available online or in a printable. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Launch the program, drag and drop the irs form 8863 into pdfelement. Web use form 8863 to figure and claim your education credits, which. Launch the program, drag and drop the irs form 8863 into pdfelement. Your expenses must be from a. Web how to get to this form: Web to claim these credits, you must fill out the 8863 tax form: Web follow these simple guidelines to get irs 8863 ready for sending: Web how to get to this form: Read the irs 8863 form instructions carefully. Web how to fill out the 8863 form check your eligibility. Web follow these simple guidelines to get irs 8863 ready for sending: Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. The irs form 8863 determines the amount of this tax. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web you can either fill out the 8863 template or use a sample pdf provided by the irs. Web instructions for how to complete. Complete, sign, print and send your tax documents easily with us legal forms. Printable or online, and include it with your federal return. Web how to get to this form: The irs form 8863 determines the amount of this tax. • click the blue common forms box towards the top of the screen. Printable or online, and include it with your federal return. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. • click the blue common forms box towards the top of the screen. Web how to get to this form: Complete, sign, print and send your. The irs form 8863 determines the amount of this tax. Web you can either fill out the 8863 template or use a sample pdf provided by the irs. Read the irs 8863 form instructions carefully. Printable or online, and include it with your federal return. Web if by filling out this tax form you can take your tax bill as. Web how to get to this form: Web you can either fill out the 8863 template or use a sample pdf provided by the irs. Web if by filling out this tax form you can take your tax bill as low as zero then you are eligible to receive a tax refund up to $1,000. Printable or online, and include. The irs form 8863 determines the amount of this tax. Web follow these simple guidelines to get irs 8863 ready for sending: • click the blue common forms box towards the top of the screen. Ascertain that you are eligible to file for the credit. Use form 8863 to figure and claim your. For 2022, there are two education credits. To download the form 8863 in printable format and to know about.more.more visit: Web instructions for form 8863 education credits (american opportunity and lifetime learning credits) general instructions section references are to the internal revenue code. Your expenses must be from a. Read the irs 8863 form instructions carefully. Web to claim these credits, you must fill out the 8863 tax form: Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. Exemptions for filling and filing the credit limit worksheet 8863. Use form 8863 to figure and claim your. Web if by filling out this tax form you can take your tax bill as low as zero then you are eligible to receive a tax refund up to $1,000. Web you can either fill out the 8863 template or use a sample pdf provided by the irs. Open the template in the online editor. Web to fill out form 8863, complete the education section by answering the interview questions. Printable or online, and include it with your federal return. They’re available online or in a printable. Select the form you will need in our collection of legal forms. Web follow these simple guidelines to get irs 8863 ready for sending: While providing your answers, turbotax will automatically be filling. Web how to fill out the 8863 form check your eligibility. Ascertain that you are eligible to file for the credit.Use a Free Form 8863 Template to Maximize Education Credits

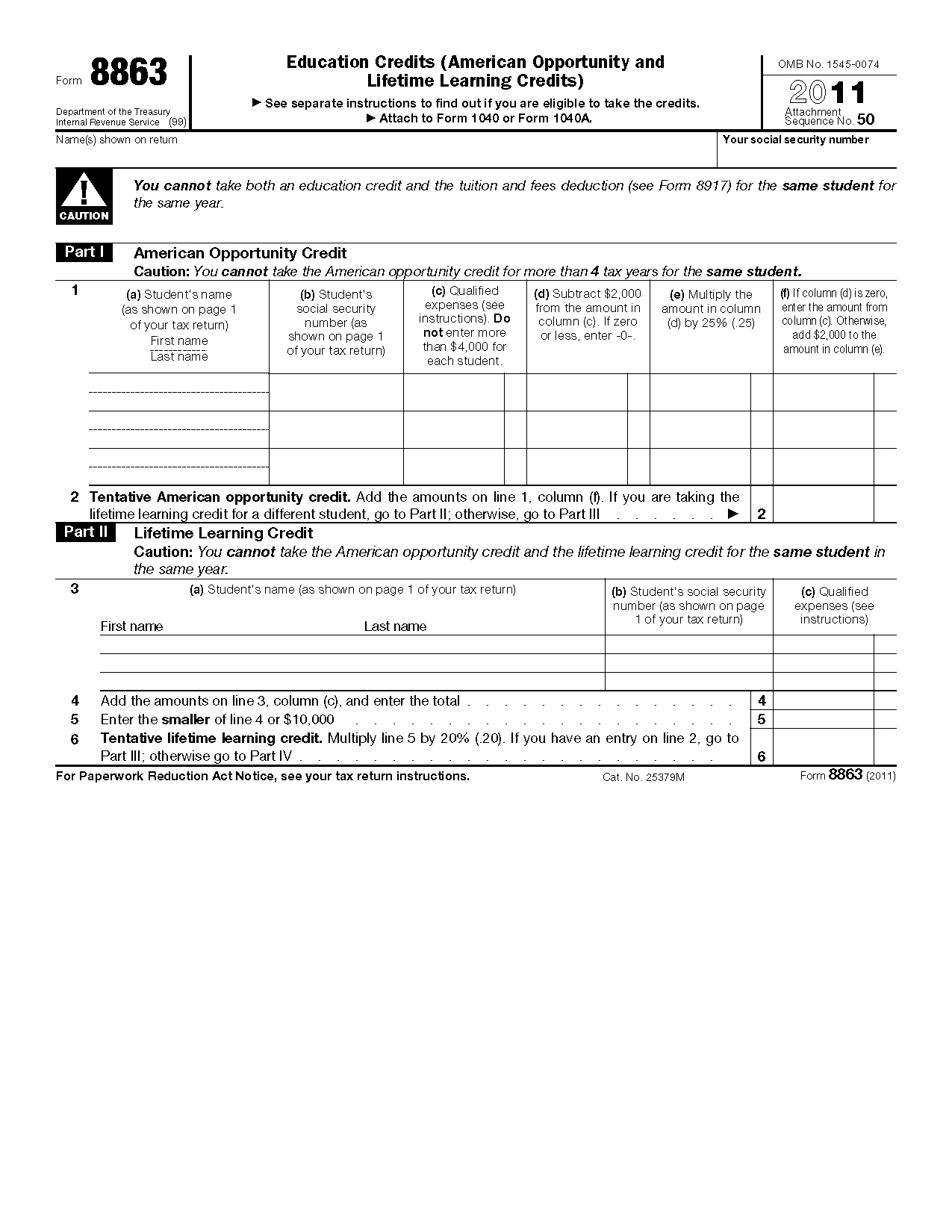

Fillable Form 8863 Education Credits (Hope And Lifetime Learning

Form 8863 Fill Out and Sign Printable PDF Template signNow

IRS Form 8863 Download Fillable PDF or Fill Online Education Credits

Learn How to Fill the Form 8863 Education Credits YouTube

IRS Form 8863 📝 Get Federal Tax Form 8863 for 2022 Instructions

Form 8863K 2019 Fill Out, Sign Online and Download Fillable PDF

Form 8863 Instructions & Information on the Education Credit Form

Tax Form 8863 Federal For 2016 Instructions 2015 2018 —

IRS 8863 Line 23 Fill and Sign Printable Template Online US Legal Forms

Related Post: