How To File Form 8862 On Turbotax

How To File Form 8862 On Turbotax - Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits. Web how do i add form 8862? Watch this turbotax guide to learn more.turbotax home:. Ad prevent tax liens from being imposed on you. Click to expand the federal and forms and schedules folders. Over 90 million taxes filed with taxact. Web you can fill turbotax form 2106 by entering your details in the two given parts of the form. It is meant for tax filers who cannot get the full amount of credit using. When you review your return, the form. We could also ban you from claiming the eitc for 2 to 10. Watch this turbotax guide to learn more.turbotax home:. Web you may need to: Web if your earned income tax credit (eitc) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the. Click on the fillable fields and put the necessary information. To regain your tax credits, you must. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Web if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Web here's how to file form 8862 in turbotax.. Click to expand the federal and forms and schedules folders. Over 90 million taxes filed with taxact. Click forms in the top left corner of the toolbar. It is meant for tax filers who cannot get the full amount of credit using. Web you can fill turbotax form 2106 by entering your details in the two given parts of the. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. When you review your return, the form. Web as mentioned above, the. Click to expand the federal and forms and schedules folders. Click on the fillable fields and put the necessary information. Web how do i add form 8862? Web information about form 8862, information to claim certain credits after disallowance, including recent updates, related forms and instructions on how to file. Web here's how to file form 8862 in turbotax. Web you may need to: Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Start your small business tax filing for free. Over 90 million taxes filed with taxact. To regain your tax credits, you must file the 8862. Web information about form 8862, information to claim certain credits after disallowance, including recent updates, related forms and instructions on how to file. Over 90 million taxes filed with taxact. Pay back the claims, plus interest. Look through the recommendations to find out which info you will need to include. Web earned income credit (eic), child tax credit (ctc), refundable. Pay back the claims, plus interest. We could also ban you from claiming the eitc for 2 to 10. June 7, 2019 4:10 pm. Web if your earned income tax credit (eitc) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the. To regain your tax credits, you. Web here's how to file form 8862 in turbotax. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of the credits. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc. Web how do i add form 8862? Ad prevent tax liens from being imposed on you. To regain your tax credits, you must file the 8862 form first. Ad filing your taxes just became easier. June 7, 2019 4:10 pm. Watch this turbotax guide to learn more.turbotax home:. Ad filing your taxes just became easier. Open (continue) your return if you don't already have it. Web users who have earned income credit (eic) may sometimes need to file form 8862. Ad prevent tax liens from being imposed on you. To regain your tax credits, you must file the 8862 form first. Look through the recommendations to find out which info you will need to include. Pay back the claims, plus interest. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits. When you review your return, the form. Over 90 million taxes filed with taxact. Web as mentioned above, the irs form 8862 turbotax is required if your eic was disallowed or reduced. Web information about form 8862, information to claim certain credits after disallowance, including recent updates, related forms and instructions on how to file. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. You'll come to the earned income credit. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Web open the form in the online editor. We could also ban you from claiming the eitc for 2 to 10. It is when your eic is disallowed or reduced for some type of clerical or math issue. Web here's how to file form 8862 in turbotax.Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

How to file form 8862 on TurboTax ? MWJ Consultancy turbotax YouTube

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

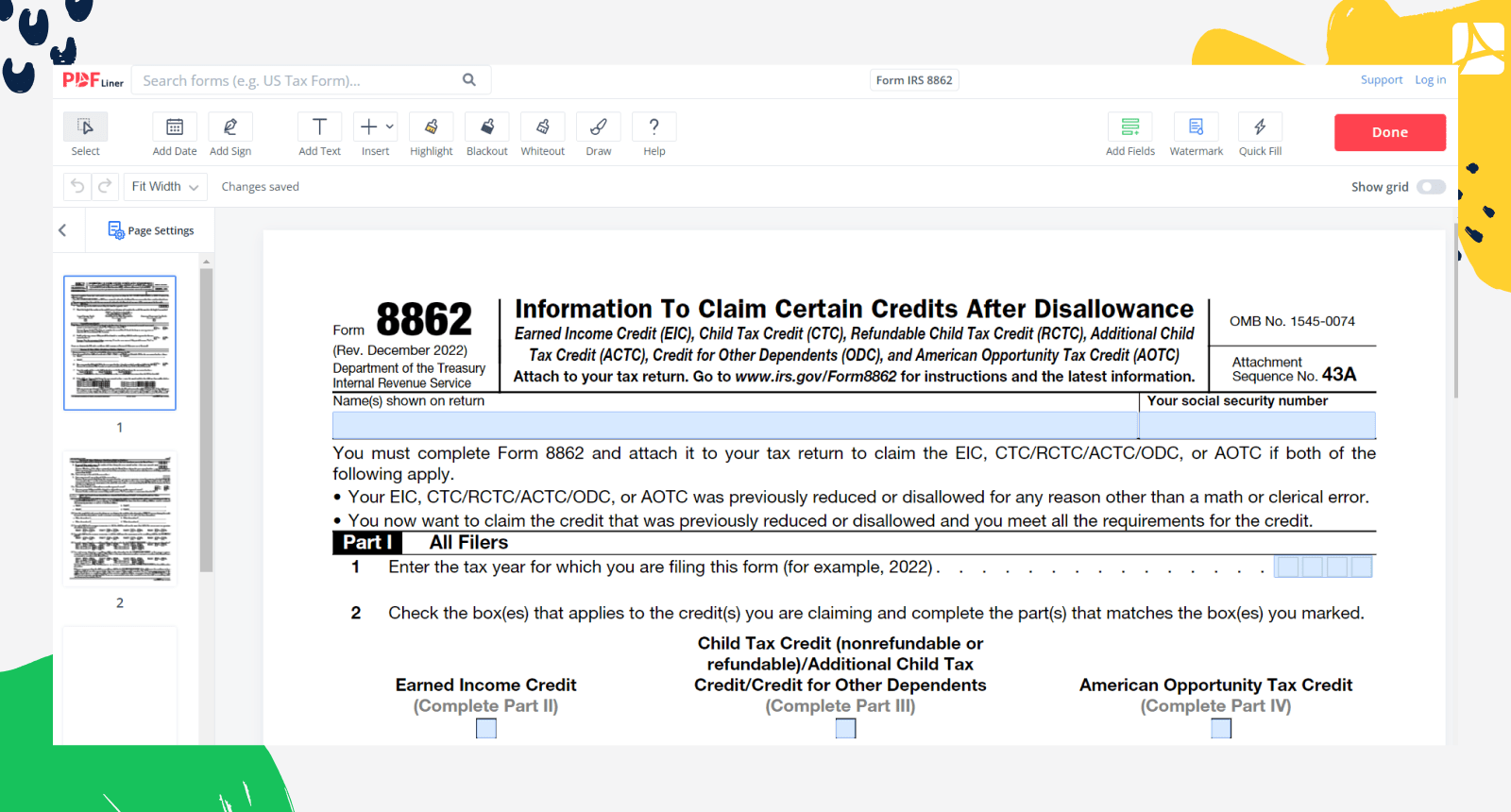

Form IRS 8862 Printable and Fillable forms online — PDFliner

Form 8862 Printable Transform your tax workflow airSlate

Form 8862 Turbotax Fill online, Printable, Fillable Blank

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

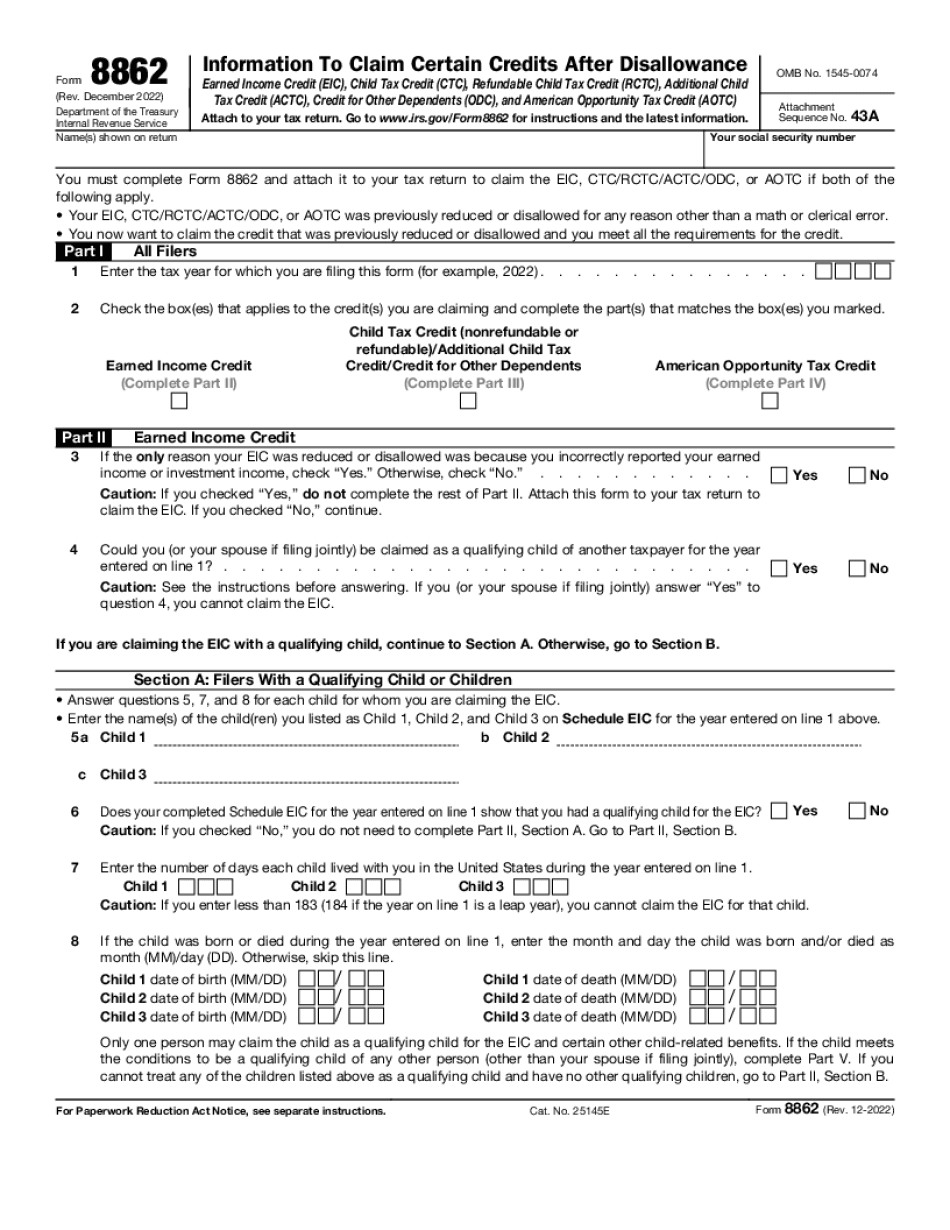

how do i add form 8862 TurboTax® Support

PPT Form 8862 TurboTax How To Claim The Earned Tax Credit

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-172737.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/04/file-08april-2-1024x536.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)