How To File Form 8332 Electronically

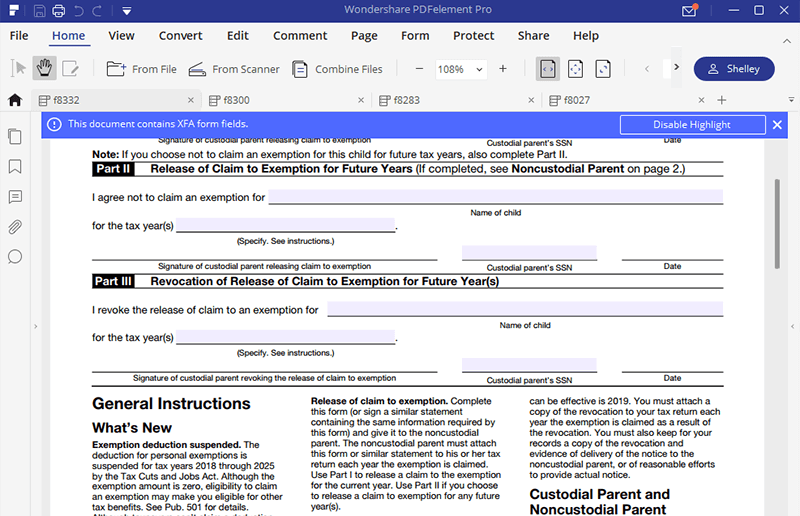

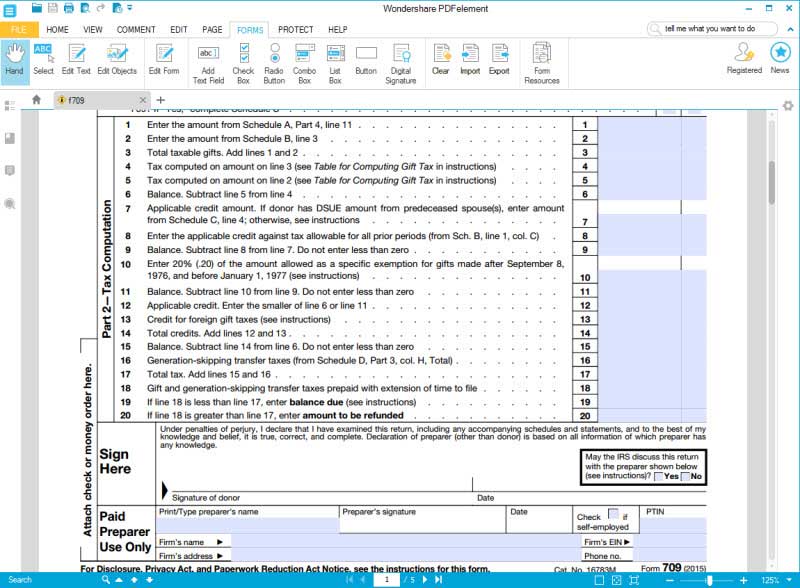

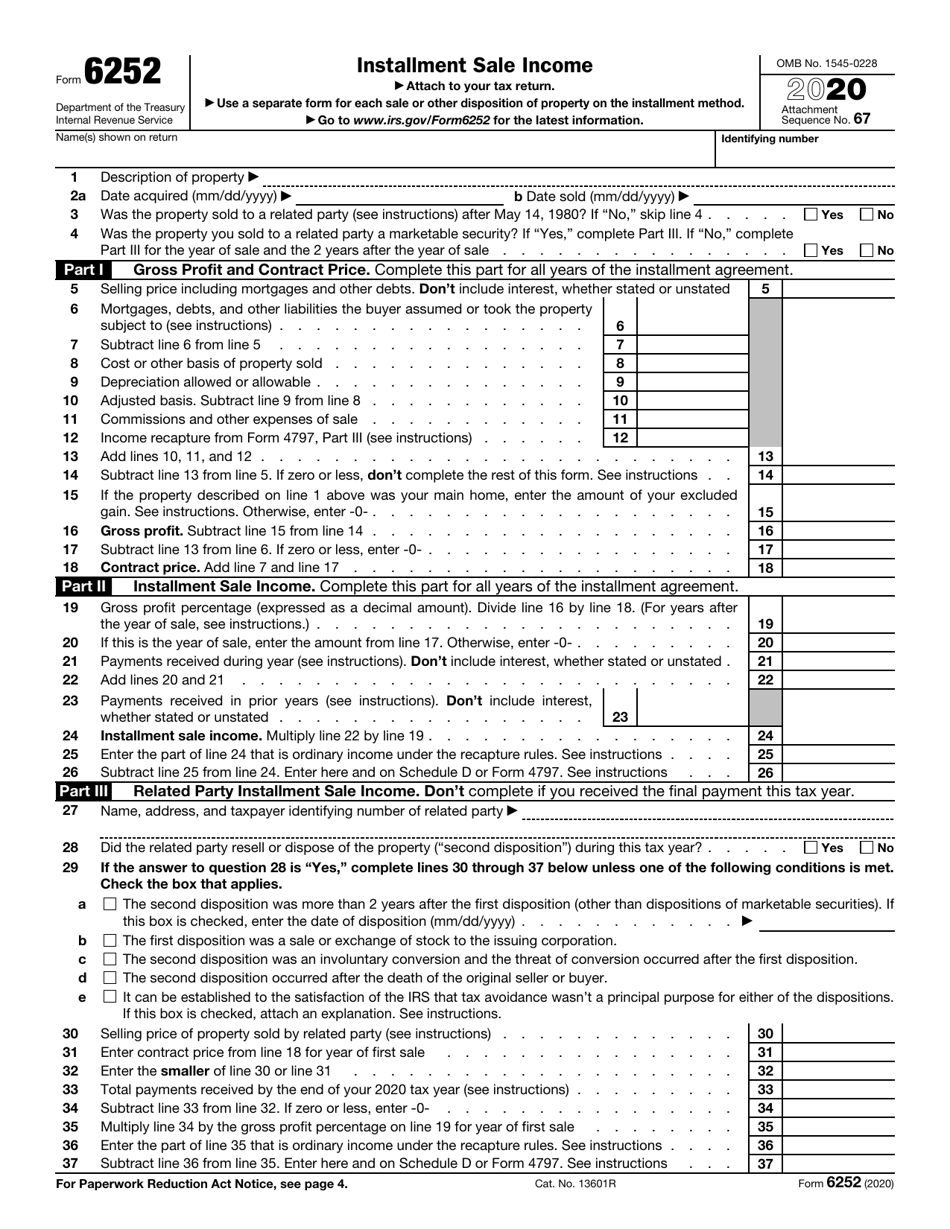

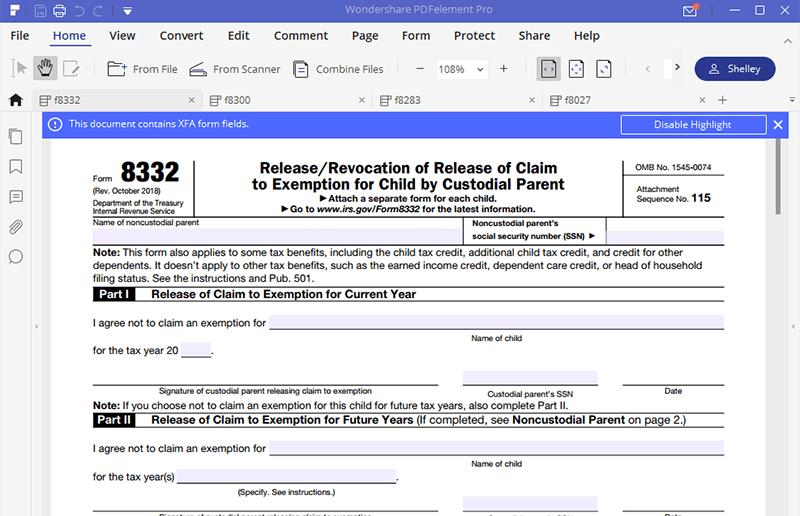

How To File Form 8332 Electronically - One recommended software is easeus pdf editor ,. Use get form or simply click on the template preview to open it in the editor. If an attempt is made to attach form 8332 (on screen 8453, located under the. Easily sign the form with your finger. What is tax form 8332? Web if you are filing your return electronically, you must file form 8332 with form 8453, u.s. Web per form 8332 instructions, form 8332 should be filed only with the noncustodial parent’s return. You also can obtain it from the irs website (see resources. Web when to use form 8332. Web 1 best answer. Web if you are filing your return electronically, you must file form 8332 with form 8453, u.s. Web per form 8332 instructions, form 8332 should be filed only with the noncustodial parent’s return. Ad pdffiller.com has been visited by 1m+ users in the past month Keep a copy for your records. If you have custody of your child, but want. Regardless of which part (or parts) are completed by the. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax. Web 1 best answer. Web if you are filing your return electronically, you must file form 8332 with form 8453, u.s. Web information. We offer a variety of software related to various fields at great prices. If you are filing your. Web after receiving form 8332 from the custodial parent, the noncustodial parent must file it electronically or send it to the irs via post. Web when to use form 8332. Regardless of which part (or parts) are completed by the. Form 8332 is used by custodial parents to release their claim. There are three parts to form 8832. Easily sign the form with your finger. Web information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. You also can obtain it from the. If you have custody of your child, but want to release the right to claim your child as a dependent to the noncustodial parent you’ll. Gather all of the necessary documents, including your tax return, form 8332, and any. Web after receiving form 8332 from the custodial parent, the noncustodial parent must file it electronically or send it to the. Use get form or simply click on the template preview to open it in the editor. Gather all of the necessary documents, including your tax return, form 8332, and any. If an attempt is made to attach form 8332 (on screen 8453, located under the. Easily sign the form with your finger. United states (english) united states (spanish) canada (english). Open form follow the instructions. Web information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how to file. No, the irs and turbotax do not support attachments. Ad pdffiller.com has been visited by 1m+ users in the past month Form 8332 is used by custodial. Open form follow the instructions. Gather all of the necessary documents, including your tax return, form 8332, and any. Web tax information center filing dependents. If you have custody of your child, but want to release the right to claim your child as a dependent to the noncustodial parent you’ll. United states (english) united states (spanish) canada (english) canada (french). If an attempt is made to attach form 8332 (on screen 8453, located under the. Regardless of which part (or parts) are completed by the. Web after receiving form 8332 from the custodial parent, the noncustodial parent must file it electronically or send it to the irs via post. United states (english) united states (spanish) canada (english) canada (french). Open. We offer a variety of software related to various fields at great prices. If you have custody of your child, but want to release the right to claim your child as a dependent to the noncustodial parent you’ll. Regardless of which part (or parts) are completed by the. Web per form 8332 instructions, form 8332 should be filed only with. Web after receiving form 8332 from the custodial parent, the noncustodial parent must file it electronically or send it to the irs via post. Form 8332 is used by custodial parents to release their claim. Regardless of which part (or parts) are completed by the. Get form 8332 file electronically. Web per form 8332 instructions, form 8332 should be filed only with the noncustodial parent’s return. If you are filing your. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax. Gather all of the necessary documents, including your tax return, form 8332, and any. Instead, if you are claiming a dependent using form 8332, turbotax will. What is tax form 8332? Web to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), in the taxact program:. Web if you are filing your return electronically, you must file form 8332 with form 8453, u.s. Open form follow the instructions. Form 8332 is the form custodial parents can use to release their right to claim a child as a. Web 1 best answer. No, the irs and turbotax do not support attachments. One recommended software is easeus pdf editor ,. If an attempt is made to attach form 8332 (on screen 8453, located under the. There are three parts to form 8832. Use get form or simply click on the template preview to open it in the editor.IRS Form 8332 Fill it with the Best PDF Form Filler

Printable Irs Forms 2021 8332 Calendar Printable Free

Tax Form 8332 Printable Master of Documents

Create Fillable IRS Form 8332 According To Your Needs

Tax Form 8332 Printable Printable World Holiday

Tax Form 8332 Printable Printable Templates

Irs Form 8332 Printable

IRS Form 8332 Fill it with the Best PDF Form Filler

How to Fill and File Form 8332 Pocket Sense

Irs Form 8332 Printable Printable World Holiday

Related Post: