How Long Does It Take To Process Form 4549

How Long Does It Take To Process Form 4549 - Web follow this guideline to quickly and accurately fill in irs 4549. How you can submit the irs 4549 on the internet: Refer to your receipt notice to find your form, category, and office. The form also shows any adjustments to the income on your return and the changes to your taxable income, credits and your total taxes due. If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. Web catalog number 23105a www.irs.gov form 4549 (rev. Web how long does it take to process form 4549. Web how long will it take before i receive an answer to my request? Ad fill, sign, email form 4549 & more fillable forms, register and subscribe now! Before proceeding with any actions, carefully review the completed form 4549 to ensure accuracy. John’s school vs osei tutu shs vs opoku ware school Form 4549 adjusted gross income. The form also shows any adjustments to the income on your return and the changes to your taxable income, credits and your total taxes due. Complete, edit or print tax forms instantly. Generally, letter 525 is issued if your audit was conducted by mail and. Web depending on how many years were audited, the form can show the results of up to three years of audits. Web we display case processing times for select forms and locations to let you know how long it generally takes to process benefit requests and when you can contact us with questions about your case. The notice of deficiency. Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate. Web catalog number 23105a www.irs.gov form 4549 (rev. Web this does not include the taxpayer signing a waiver of restriction on assessment (e.g., form 4549, income tax examination changes, or form 870, waiver of restrictions on assessment &. Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate. Web we display case processing times for select forms and locations to let you know how long it generally takes to process benefit requests and when you can contact us with questions about your case. In this case,. Ad fill, sign, email form 4549 & more fillable forms, register and subscribe now! Web catalog number 23105a www.irs.gov form 4549 (rev. Complete, edit or print tax forms instantly. If the irs is proposing income tax changes and expects the taxpayer to agree to them, they’re likely to use this form. In chief counsel advice (cca), irs has held that. The notice of deficiency will provide you 90 days (150 days if you are outside the u.s.) to respond by petitioning the tax court. Web chief counsel advice 201921013. Web the irs uses form 4549 when the audit is complete. Web we send you a letter saying the audit is closed and then refund the amount due to you within. Irs also ruled on other issues, including whether a refund claim made after the taxpayer signed the form 4549 was a separate. Before proceeding with any actions, carefully review the completed form 4549 to ensure accuracy. If the documents don’t support all the audit items, we send a form 4549, income tax examination changes, or an audit letter. The form. A copy of your audit report (irs form 4549, income tax examination changes), if available. The irs estimates that taxpayers who file for audit reconsideration will receive a response within 30 days after submitting their request. Web we display case processing times for select forms and locations to let you know how long it generally takes to process benefit requests. The notice of deficiency will provide you 90 days (150 days if you are outside the u.s.) to respond by petitioning the tax court. If available, attach a copy of your examination report, form 4549, along with the new documentation that supports your position. How you can submit the irs 4549 on the internet: John’s school vs osei tutu shs. Web this does not include the taxpayer signing a waiver of restriction on assessment (e.g., form 4549, income tax examination changes, or form 870, waiver of restrictions on assessment & collection of deficiency in tax & acceptance of overassessment,) which does not constitute a return under irc 6020(a). The notice of deficiency will provide you 90 days (150 days if. Web how long will it take before i receive an answer to my request? Generally, letter 525 is issued if your audit was conducted by mail and letter 915 is issued if your audit was conducted in person. Ad fill, sign, email form 4549 & more fillable forms, register and subscribe now! Get access to thousands of forms. Web depending on how many years were audited, the form can show the results of up to three years of audits. Web you will have 90 days to petition the tax court. The irs estimates that taxpayers who file for audit reconsideration will receive a response within 30 days after submitting their request. Fill in all required fields in the file utilizing our powerful pdf editor. If the time to petition tax court expires, the irs will begin collection and enforcement. Create this form in 5 minutes! In chief counsel advice (cca), irs has held that form 4549, income tax examination changes, i.e., the form irs issued at the end of its audit, was an informal refund claim. Web here are some recommendations on what to do with form 4549: Web we display case processing times for select forms and locations to let you know how long it generally takes to process benefit requests and when you can contact us with questions about your case. Web if you do not sign the form 4549, the irs will send you a notice of deficiency. How to create an esignature for the irs audit form 4549. Web follow this guideline to quickly and accurately fill in irs 4549. Download or email form 4549 & more fillable forms, register and subscribe now! In this case, you have the choice of preparing the returns or filing a petition in tax court within 90 days. Web this does not include the taxpayer signing a waiver of restriction on assessment (e.g., form 4549, income tax examination changes, or form 870, waiver of restrictions on assessment & collection of deficiency in tax & acceptance of overassessment,) which does not constitute a return under irc 6020(a). Web we send you a letter saying the audit is closed and then refund the amount due to you within eight weeks.Irs form 4549 Sample Glendale Community

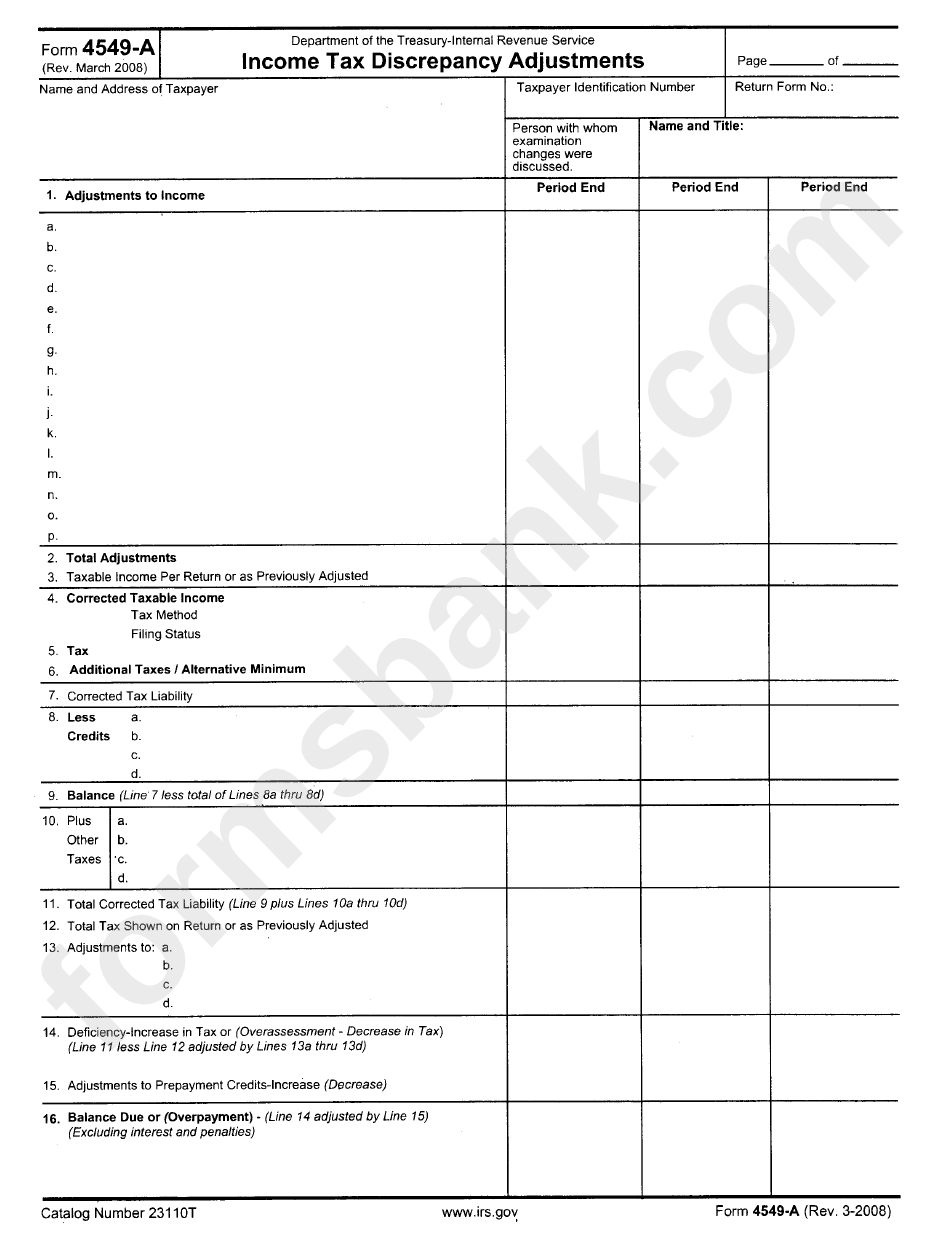

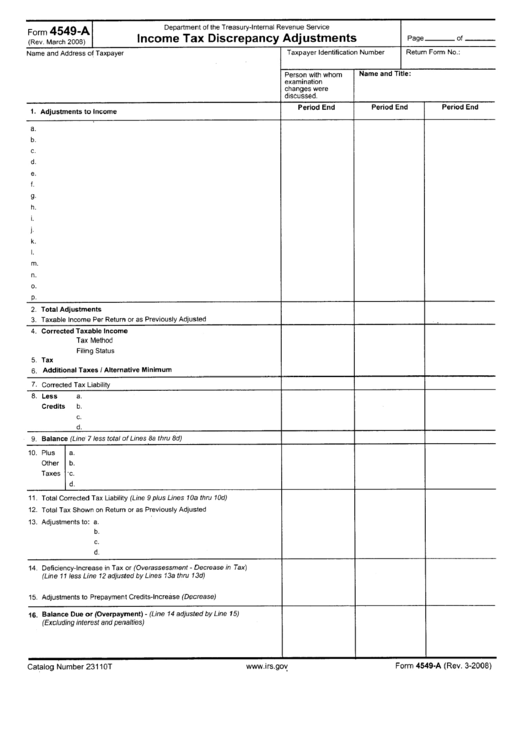

Form 4549A Tax Discrepancy Adjustments printable pdf download

IRS Audit Letter 692 Sample 1

Tax Letters Explained Washington Tax Services

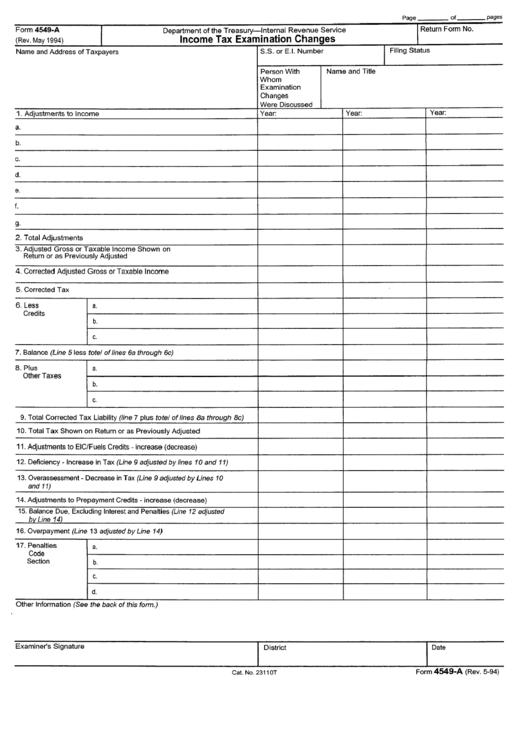

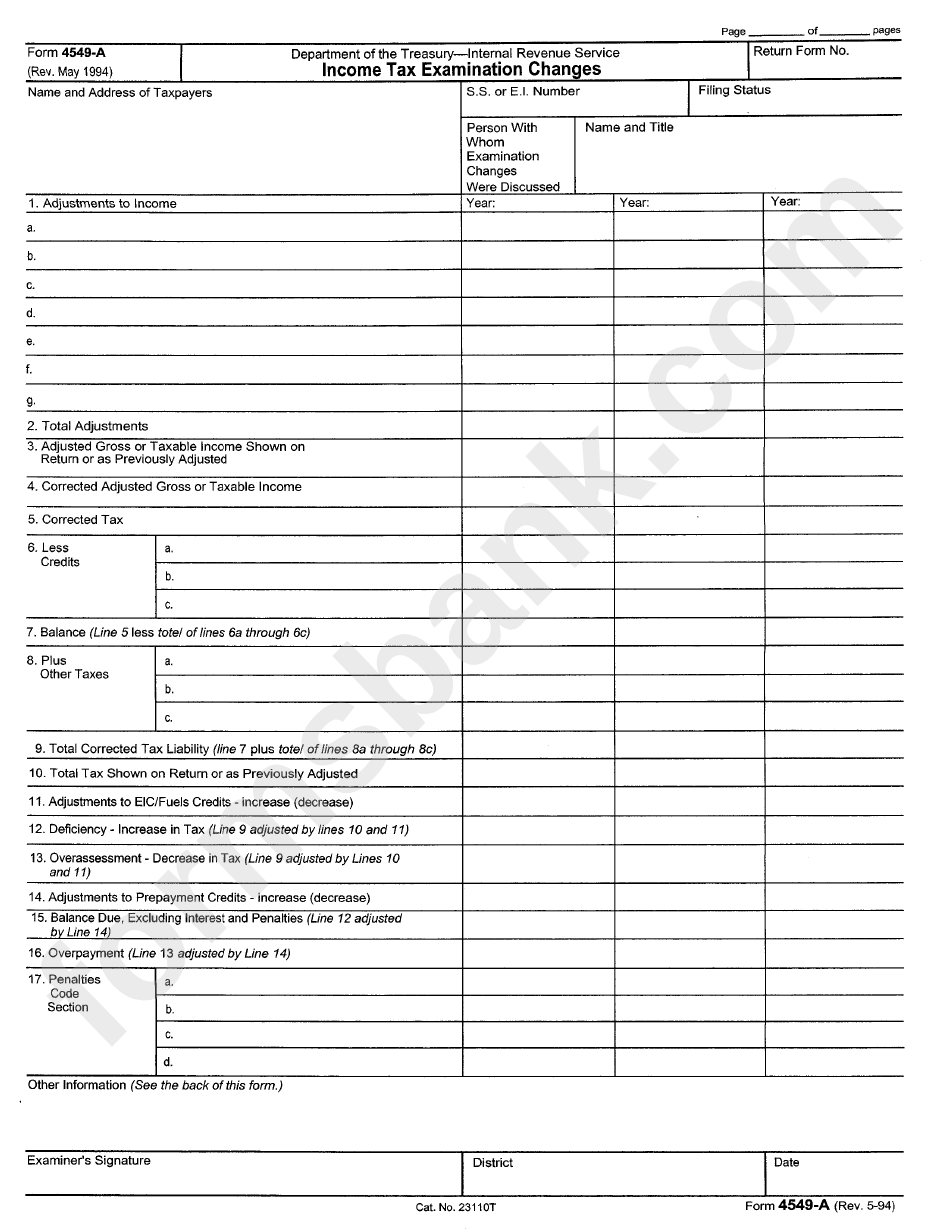

Form 4549A Tax Examination Changes printable pdf download

Form 4549A Tax Examination Changes printable pdf download

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

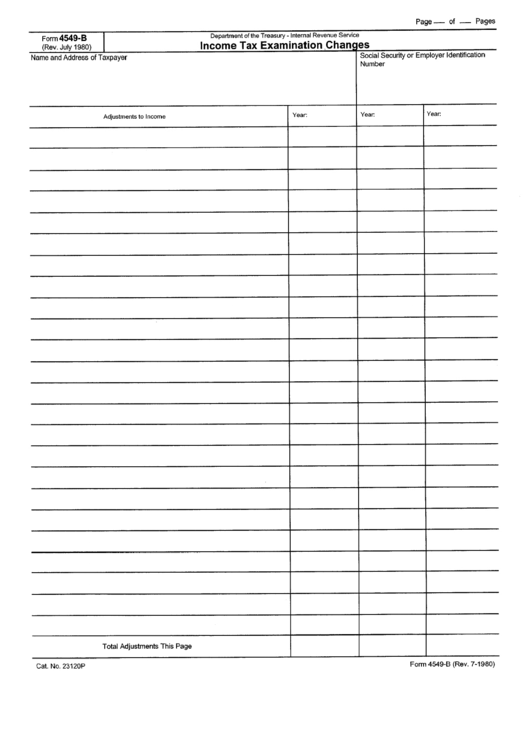

Form 4549B Tax Examitation Changes printable pdf download

Form 4549A Tax Discrepancy Adjustments printable pdf download

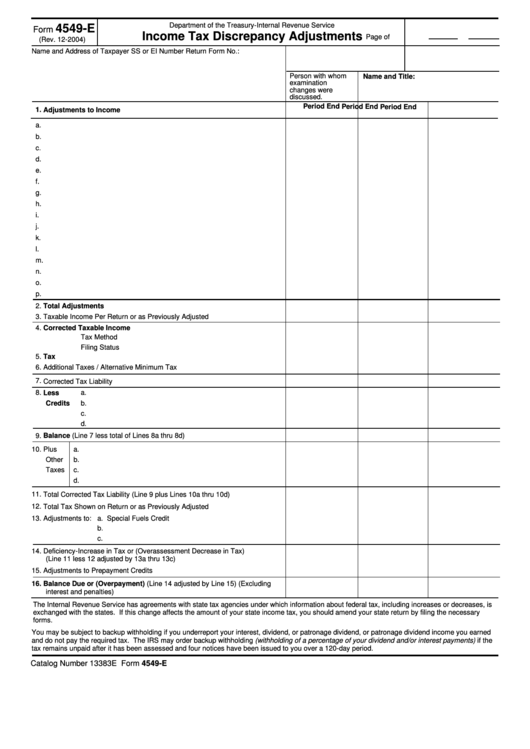

Fillable Form 4549E Tax Discrepancy Adjustments Internal

Related Post: