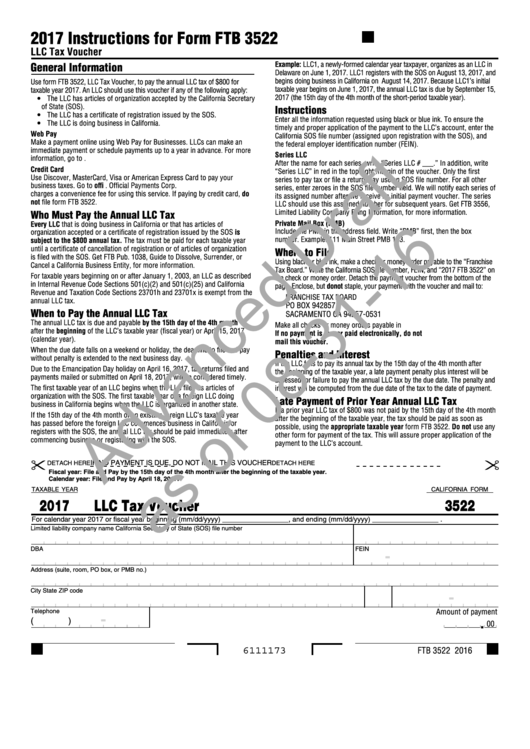

Ftb Form 3522

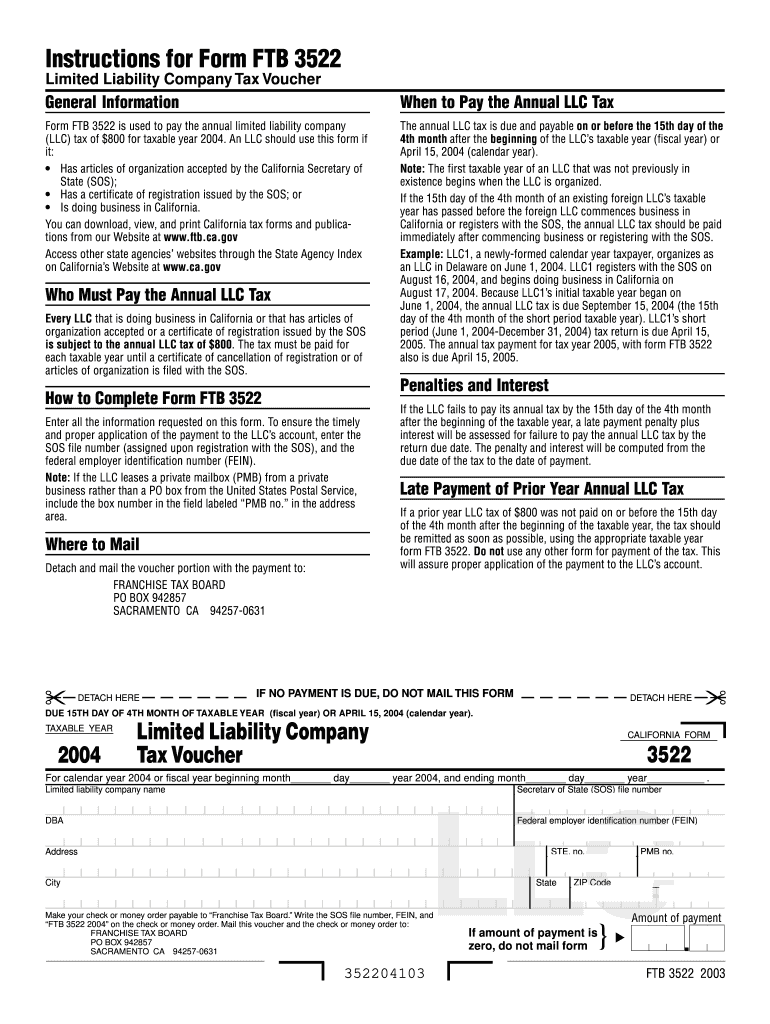

Ftb Form 3522 - Web we last updated california form 3522 in january 2023 from the california franchise tax board. Web it is not possible to efile the 3522 with the extension. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Repeating information will be added. The purpose of this form is to. Select “limited liability companies” click “get forms” look for. Web you need to submit form 3522 with the california ftb yearly, but you can also do it any time before the june 30 due date. The undersigned certify that, as of july 1, 2023, the website of the. Form 3522 payment is due on the same date as the 568 (generally april 15) and in the tax preparation software. Go to the ftb forms page; Web it is not possible to efile the 3522 with the extension. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Web we last updated california form 3522 in january 2023 from the california franchise tax board. Web form 3522 is a form used by llcs. Web you need to submit form 3522 with the california ftb yearly, but you can also do it any time before the june 30 due date. No matter your llc’s revenue, the annual tax is $800.you can. (llc) tax of $800 for taxable year 2022. Form 3522 will need to be filed in the 2nd. 2023, the website of the. Web fill in the info required in ca ftb 3522, making use of fillable lines. Web up to $40 cash back california form ftb 3522 is a tax form used by certain california taxpayers to report estimated tax payments. Form 3536 only needs to be filed if your income is $250,000. The purpose of this form is to. (llc) tax. Web up to $40 cash back form 3522 is a tax form used in the united states by limited liability companies (llcs) to pay the annual minimum franchise tax. All llcs in the state are required to pay this annual tax to stay compliant. The undersigned certify that, as of july 1, 2023, the website of the. Form 3522 will. Go to the ftb forms page; Form 3536 only needs to be filed if your income is $250,000. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2021. This form is for income earned in tax year 2022, with tax returns due in april. Web up to $40. Web the annual franchise tax form, called the llc tax voucher, is filed and paid using form ftb 3522. Web it is not possible to efile the 3522 with the extension. Include pictures, crosses, check and text boxes, if you need. Repeating information will be added. Web fill in the info required in ca ftb 3522, making use of fillable. Web download form 3522: Form 3522 will need to be filed in the 2nd. Web this form explains who is required to pay the annual llc tax, when to make the payment, how to file the application, and where to file it. Beginning november 2010, limited liability companies (llcs) can make payments electronically at the franchise tax board’s (ftb’s) website. Include pictures, crosses, check and text boxes, if you need. An llc should use this voucher if any of the following. This form is for income earned in tax year 2022, with tax returns due in april. Select “limited liability companies” click “get forms” look for. Click “online” select the appropriate tax year; Web you need to submit form 3522 with the california ftb yearly, but you can also do it any time before the june 30 due date. Click “online” select the appropriate tax year; An llc should use this. 2023, the website of the franchise tax board is designed, developed, and maintained to be accessible. Form 3536 only needs to be. We last updated the limited liability. This form is for income earned in tax year 2022, with tax returns due in april. Select “limited liability companies” click “get forms” look for. Web the annual franchise tax form, called the llc tax voucher, is filed and paid using form ftb 3522. No matter your llc’s revenue, the annual tax is $800.you. This form is for income earned in tax year 2022, with tax returns due in april. Form 3536 only needs to be filed if your income is $250,000. No matter your llc’s revenue, the annual tax is $800.you can. Form 3522 will need to be filed in the 2nd. This form is used to report income from sources. Web fill in the info required in ca ftb 3522, making use of fillable lines. Web this form explains who is required to pay the annual llc tax, when to make the payment, how to file the application, and where to file it. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Click “online” select the appropriate tax year; Web the annual franchise tax form, called the llc tax voucher, is filed and paid using form ftb 3522. The undersigned certify that, as of july 1, 2023, the website of the. An llc should use this. Web california franchise tax board certification date july 1, 2023 contact accessible technology program. Select “limited liability companies” click “get forms” look for. 2023, the website of the franchise tax board is designed, developed, and maintained to be accessible. Form 3522 payment is due on the same date as the 568 (generally april 15) and in the tax preparation software. Beginning november 2010, limited liability companies (llcs) can make payments electronically at the franchise tax board’s (ftb’s) website using web pay. Web it is not possible to efile the 3522 with the extension. Web 2022 instructions for form 593. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800.California Form 3522 (Draft) Llc Tax Voucher 2017 printable pdf

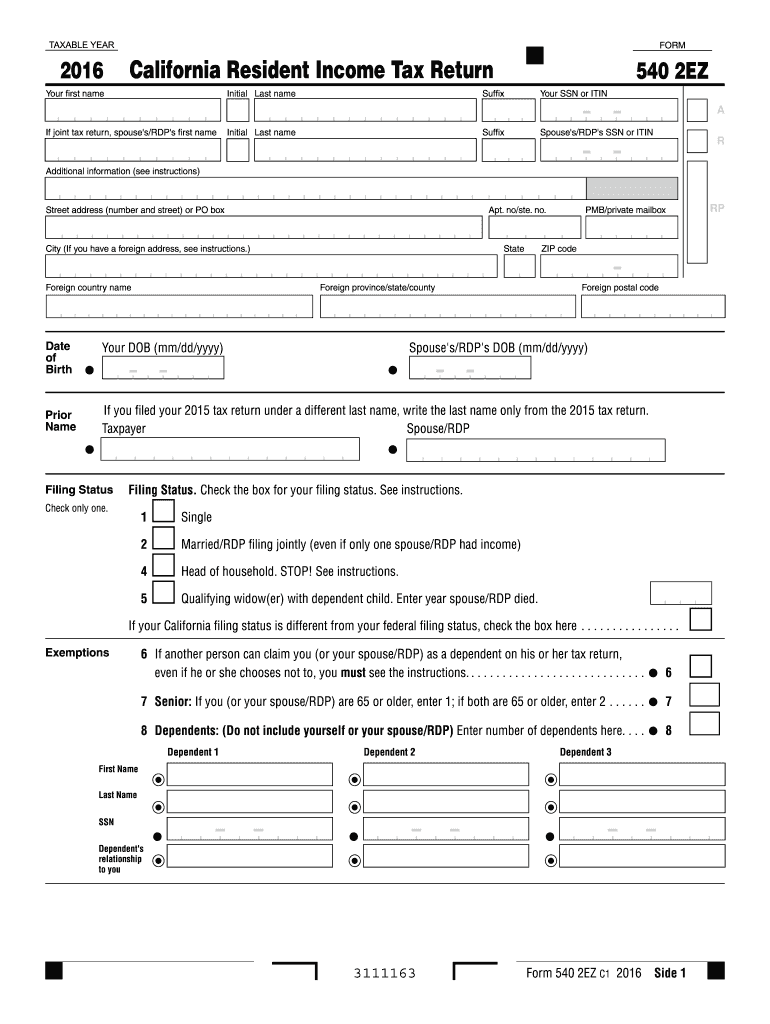

CA FTB 540 2EZ 2016 Fill out Tax Template Online US Legal Forms

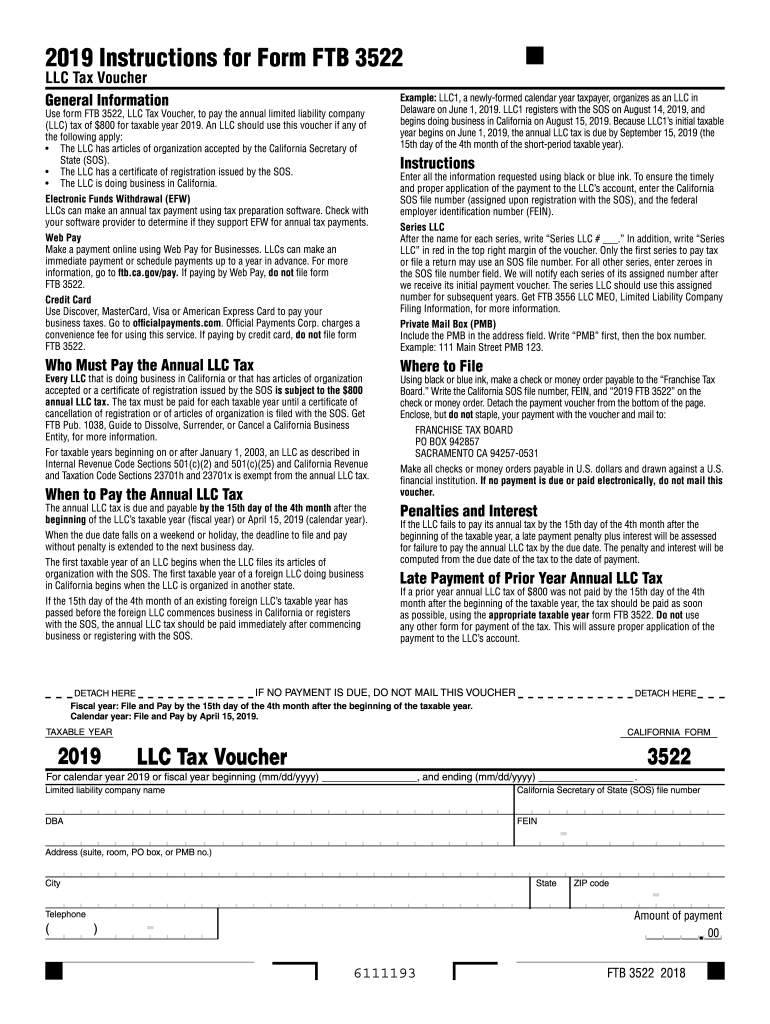

2019 Form CA FTB 3522 Fill Online, Printable, Fillable, Blank pdfFiller

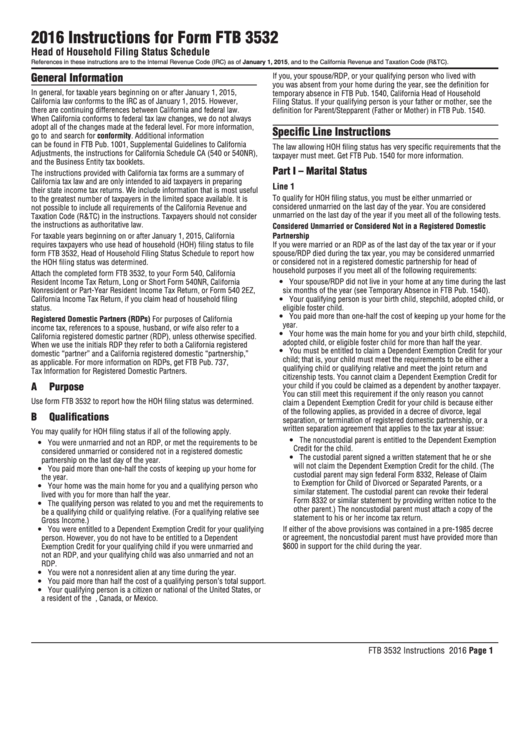

Instructions For Form Ftb 3532 Head Of Household Filing Status

Form Ft 3522 Fill Out and Sign Printable PDF Template signNow

2015 Form Ftb 3522 Llc Tax Voucher Tax Walls

3522 Fill Out and Sign Printable PDF Template signNow

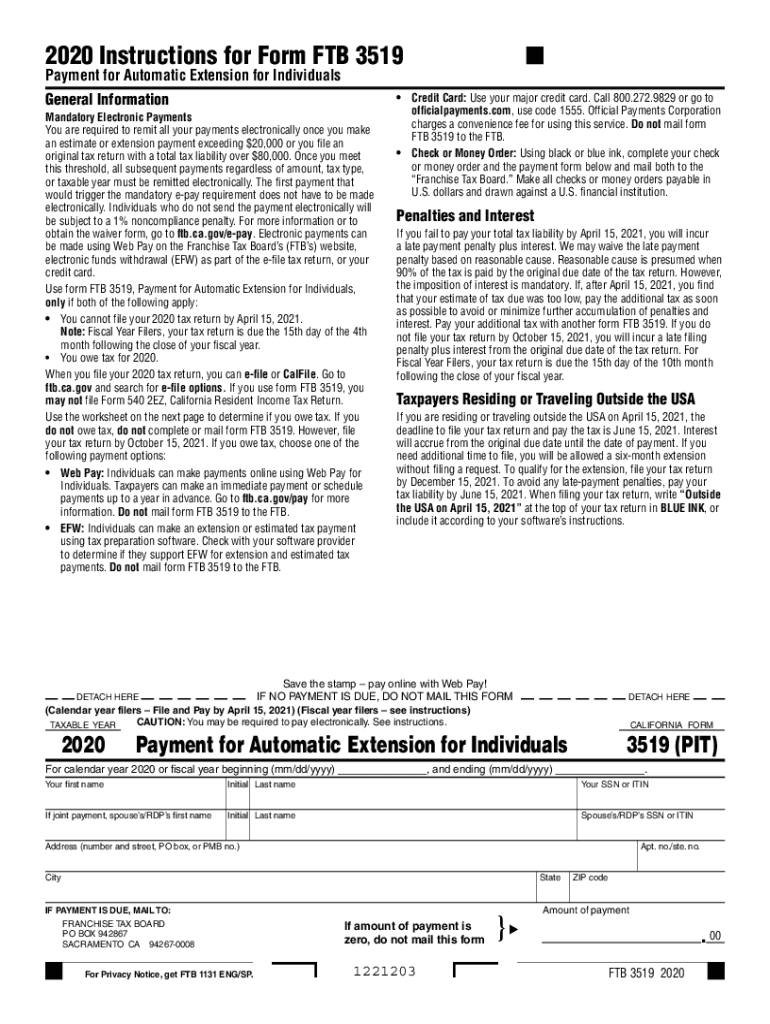

ftb form 3519 Fill out & sign online DocHub

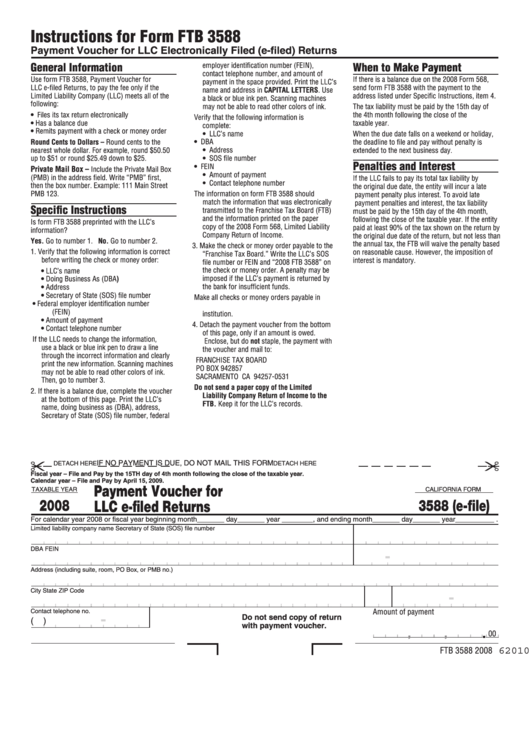

Fillable California Form Ftb 3588 Payment Voucher For Llc EFiled

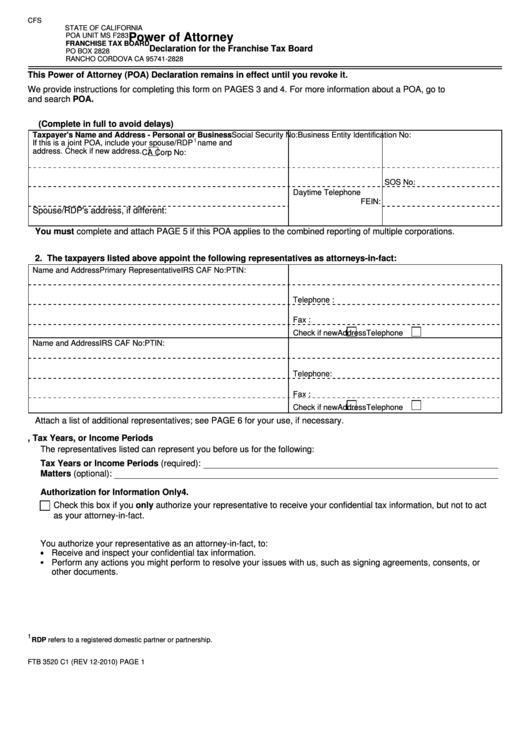

Ftb 3520 C1 Power Of Attorney Declaration For The Franchise Tax

Related Post: