Form Va-4 Married Filing Jointly

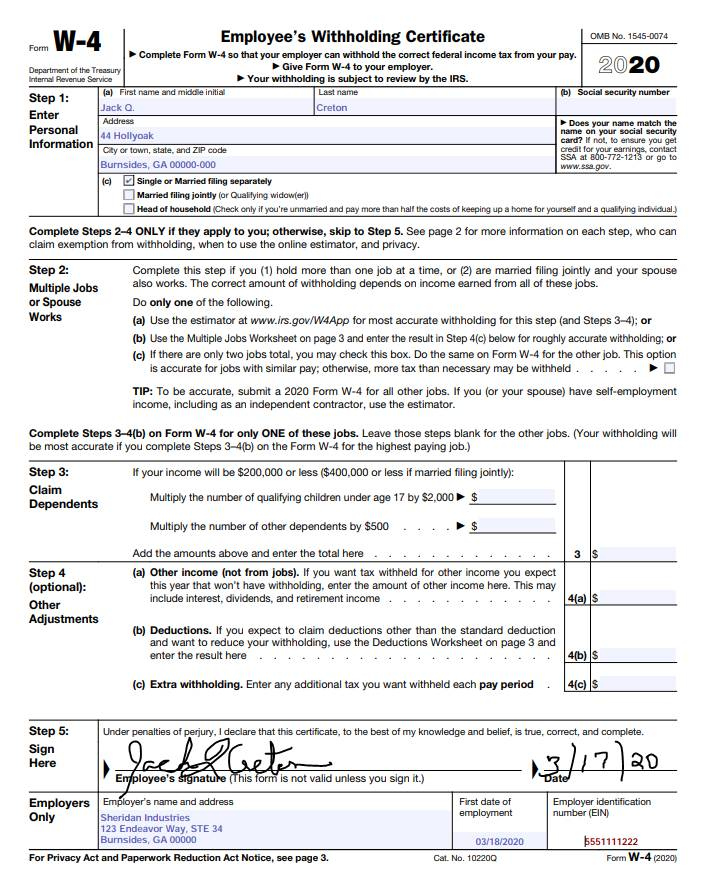

Form Va-4 Married Filing Jointly - Web the 2021 standard deduction allows taxpayers to reduce their taxable income by $4,500 for single filers and $9,000 for married filing jointly filers. Mail the return to the processing center designated for your area. You live in kentucky or the district of columbia and commute daily to your place of employment in virginia. Do any of the following apply to you: Now he's getting threatened with a lien. Sign and date your income tax return. Web what form should i file | married filing jointly. Web the owners of the property my dad's mobile home is on classified his as an employee a few years ago and said they paid him like $80,000. Instead, complete steps 3 through 4b on the form w. Web married filing jointly (or mfj for short) means you and your spouse fill out one tax return together. Web your virginia adjusted gross income (agi) is less than $11,950 if single, $23,900 if married and filing jointly, or $11,950 if married and filing separately. Web virginia — married filing jointly tax brackets. One spouse was a virginia resident during the taxable year; You live in kentucky or the district of columbia and commute daily to your place of. Your spouse must also sign the return. Married filing jointly is the filing type used by. Web virginia no longer allows the filing status, married filing separately (mfs) on a combined return, where you could choose to allocate the standard deduction between spouses in a. You don’t have to file jointly. Web your virginia adjusted gross income (agi) is less. The irs lists each state's. Web your virginia adjusted gross income (agi) is less than $11,950 if single, $23,900 if married and filing jointly, or $11,950 if married and filing separately. Filing status 2 should be used if: Mail the return to the processing center designated for your area. You live in kentucky or the district of columbia and commute. Web the owners of the property my dad's mobile home is on classified his as an employee a few years ago and said they paid him like $80,000. One spouse was a virginia resident during the taxable year; Web virginia — married filing jointly tax brackets. Web married, filing a joint or combined return $8,000 married, filing a joint or. Web virginia no longer allows the filing status, married filing separately (mfs) on a combined return, where you could choose to allocate the standard deduction between spouses in a. Web the owners of the property my dad's mobile home is on classified his as an employee a few years ago and said they paid him like $80,000. Web the 2021. Taxpayers are required to choose one. Web virginia no longer allows the filing status, married filing separately (mfs) on a combined return, where you could choose to allocate the standard deduction between spouses in a. One spouse was a virginia resident during the taxable year; Web married, filing a joint or combined return $8,000 married, filing a joint or combined. Married filing jointly is the filing type used by. I am the spouse of a military service member, living in virginia. Web the credit is available if you earn up to $200,000 as single taxpayer or head of household (or up to $400,000 if you are a married couple filing jointly. Military spouses residency relief act faqs. Web married filing. You live in kentucky or the district of columbia and commute daily to your place of employment in virginia. Taxpayers are required to choose one. Web for virginia state tax, if using a married, filing separately (status 3), but filed a federal married, filing jointly: Mail the return to the processing center designated for your area. Sign and date your. Web virginia — married filing jointly tax brackets. You don’t have to file jointly. Instead, complete steps 3 through 4b on the form w. What is the married filing jointly income tax filing type? Now, don’t get us wrong: Am i exempt from filing virginia. Web married filing jointly is an income tax filing status available to any couple who has wed as of december 31 of the tax year. Web your virginia adjusted gross income (agi) is less than $11,950 if single, $23,900 if married and filing jointly, or $11,950 if married and filing separately. Web married, filing. Your spouse must also sign the return. Now, don’t get us wrong: Web the 2021 standard deduction allows taxpayers to reduce their taxable income by $4,500 for single filers and $9,000 for married filing jointly filers. Do you use just the individuals income? 17, 2023 — as part of larger transformation efforts underway, the internal revenue service announced today key details about the direct file pilot for the 2024. Web the credit is available if you earn up to $200,000 as single taxpayer or head of household (or up to $400,000 if you are a married couple filing jointly. Web married filing jointly is an income tax filing status available to any couple who has wed as of december 31 of the tax year. I am the spouse of a military service member, living in virginia. Web if you filed a joint federal income tax return, but your virginia filing status is married, filing separately, you’ll need to divide your deductions between both spouses. One spouse was a virginia resident during the taxable year; Now he's getting threatened with a lien. The irs lists each state's. Web for virginia state tax, if using a married, filing separately (status 3), but filed a federal married, filing jointly: I do not , nor have i ever held a job , yet.on our tax returns we filed married jointly. Web virginia no longer allows the filing status, married filing separately (mfs) on a combined return, where you could choose to allocate the standard deduction between spouses in a. Taxpayers are required to choose one. Web married, filing a joint or combined return $8,000 married, filing a joint or combined return $14,000 married, filing a separate return $4,000 married, filing a separate return $7,000 Military spouses residency relief act faqs. Married filing jointly is the filing type used by. Mail the return to the processing center designated for your area.How to fill out IRS Form W4 Married Filing Jointly 2021 YouTube

W4 2020 Married Filing Jointly for the same MISTAKE YouTube

W4 for Married filing jointly with dependents. w4 Married filing

How To Fill Out W 4 Form Married Filing Jointly 2023 Printable Forms

How to fill out IRS form w 4 2020 Married Filing Jointly YouTube

How to Fill out the IRS Form W4 2019 Married Filing Jointly + Kids

How To Fill Out W 4 Form Married Filing Jointly 2023 Printable Forms

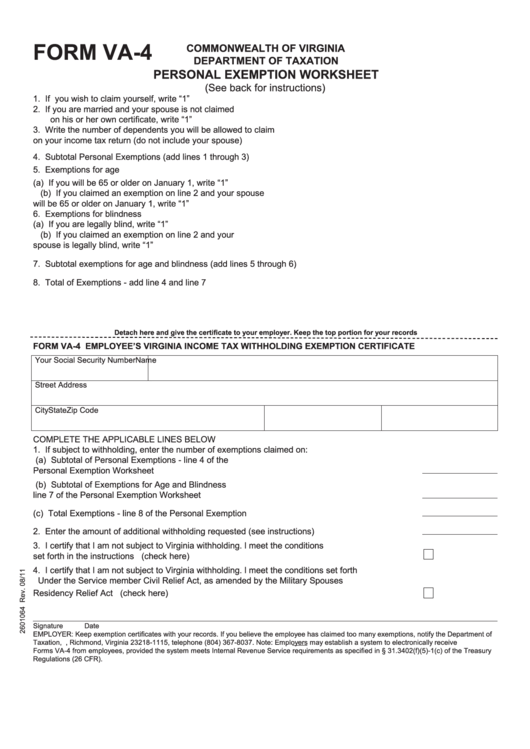

Form Va4 Lingo Staffing printable pdf download

Form va 4 Fill out & sign online DocHub

IRS Form W4 Married Filing Jointly YouTube

Related Post: