Form Se Instructions

Form Se Instructions - Web for more details on completing schedule se, see the irs instructions for this form. Web on line 29a through 29e, subtract line 28e from line 27e to get your total income or loss from schedule e. If you had church employee. Go to www.irs.gov/schedulese for instructions and the latest. See the instructions for form 7202 for more information. Ad upload, modify or create forms. General instructions who must file schedule se you must file schedule se if: Web page last reviewed or updated: Get ready for tax season deadlines by completing any required tax forms today. For 2020 taxes and the deferral calculation, make sure you have the 2020. Find out what’s on it, how to fill it out, and when to file it. Ad access irs tax forms. Web if the total of lines 1a and 2 is less than $434, don’t use schedule se unless you choose an optional method to figure your se tax. Get ready for tax season deadlines by completing any required tax forms. For 2020 taxes and the deferral calculation, make sure you have the 2020. Do not file draft forms. Try it for free now! You can download or print current. Ad upload, modify or create forms. Get ready for tax season deadlines by completing any required tax forms today. Try it for free now! See the instructions for form 7202 for more information. Web file taxes online in just 5 minutes. Complete, edit or print tax forms instantly. And, you can fill out & download a schedule se form right here! Web file taxes online in just 5 minutes. Learn how to complete schedule se on your tax returns. Ad upload, modify or create forms. Complete, edit or print tax forms instantly. Web file taxes online in just 5 minutes. For 2020 taxes and the deferral calculation, make sure you have the 2020. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Your net earnings from self. Freelancers pay 15.3% seca tax on net income over $400. Web page last reviewed or updated: Your net earnings from self. Web from page 1 of the 2022 schedule se instructions: Learn how to complete schedule se on your tax returns. Get ready for tax season deadlines by completing any required tax forms today. Go to www.irs.gov/schedulese for instructions and the latest. Complete, edit or print tax forms instantly. Web file taxes online in just 5 minutes. If you had church employee. Your net earnings from self. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. And, you can fill out & download a schedule se form right here! Web page last reviewed or updated: Find out what’s on it, how to fill it out, and when to. Complete, edit or print tax forms instantly. Web for more details on completing schedule se, see the irs instructions for this form. Ad upload, modify or create forms. Learn how to complete schedule se on your tax returns. Web page last reviewed or updated: Complete, edit or print tax forms instantly. Web if the total of lines 1a and 2 is less than $434, don’t use schedule se unless you choose an optional method to figure your se tax. Web from page 1 of the 2022 schedule se instructions: You can download or print current. Go to www.irs.gov/schedulese for instructions and the latest information. Try it for free now! You can download or print current. Get ready for tax season deadlines by completing any required tax forms today. Web for more details on completing schedule se, see the irs instructions for this form. Web on line 29a through 29e, subtract line 28e from line 27e to get your total income or loss from schedule e. Web this is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information. Web need to file schedule se? See the instructions for form 7202 for more information. Freelancers pay 15.3% seca tax on net income over $400. Find out what’s on it, how to fill it out, and when to file it. Enter this amount on schedule 1, line 5 of your form. Learn how to complete schedule se on your tax returns. If you had church employee. For 2020 taxes and the deferral calculation, make sure you have the 2020. Go to www.irs.gov/schedulese for instructions and the latest. General instructions who must file schedule se you must file schedule se if: Your net earnings from self. Get ready for tax season deadlines by completing any required tax forms today. Go to www.irs.gov/schedulese for instructions and the latest information. Ad access irs tax forms.Free Site Instruction template (Better than word doc or excel)

Form 1040 (Schedule SE) SelfEmployment Tax Form (2015) Free Download

Shipping Instruction Format Fill Online, Printable, Fillable, Blank

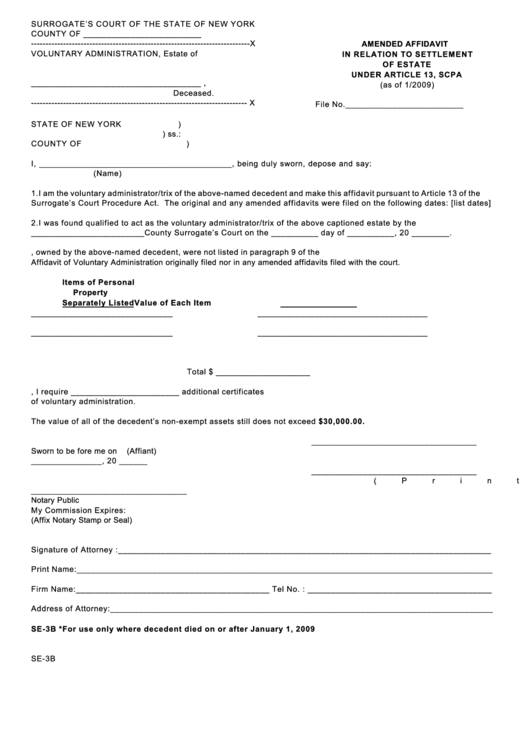

Fillable Form Se3b Amended Affidavit Form In Relation To Settlement

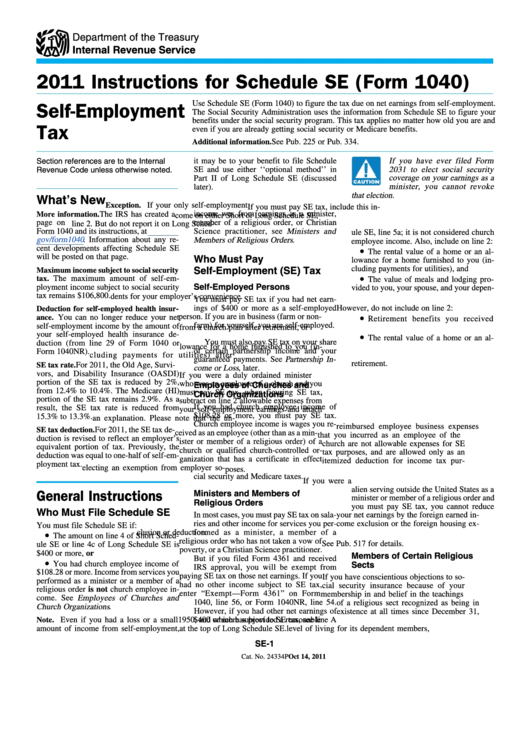

IRS Instructions 1040 (Schedule SE) 2019 Printable & Fillable Sample

Instructions For Schedule Se (Form 1040) 2011 printable pdf download

Selfemployment Tax Form Se Instructions Employment Form

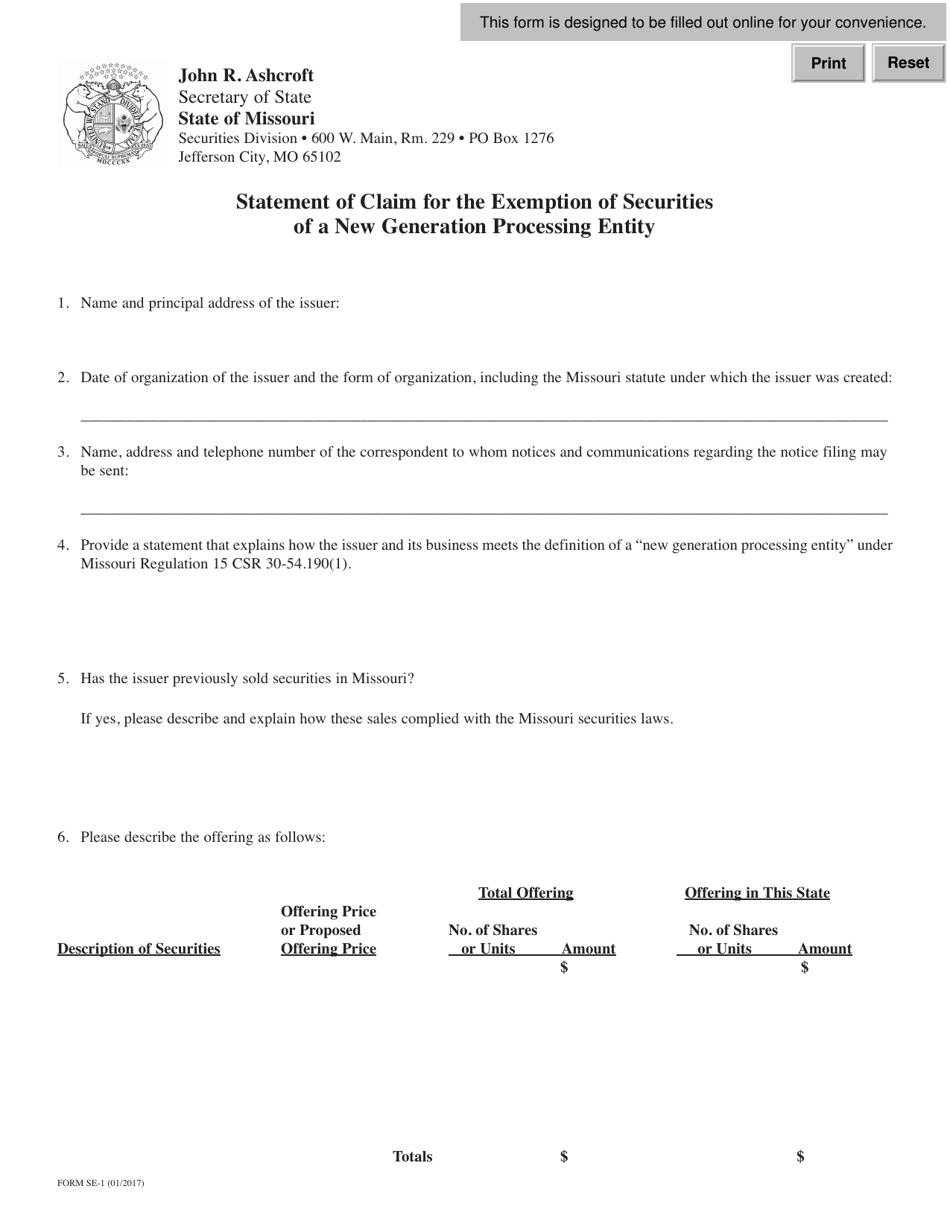

Form SE1 Fill Out, Sign Online and Download Fillable PDF, Missouri

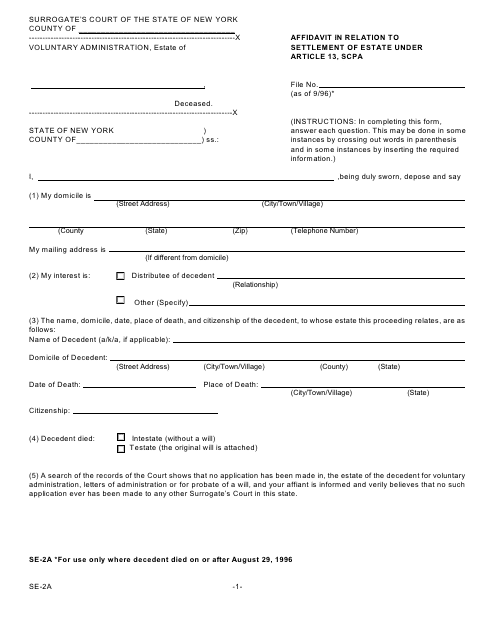

Form SE2A Fill Out, Sign Online and Download Fillable PDF, New York

Download Sample Instruction Template for Free FormTemplate

Related Post: