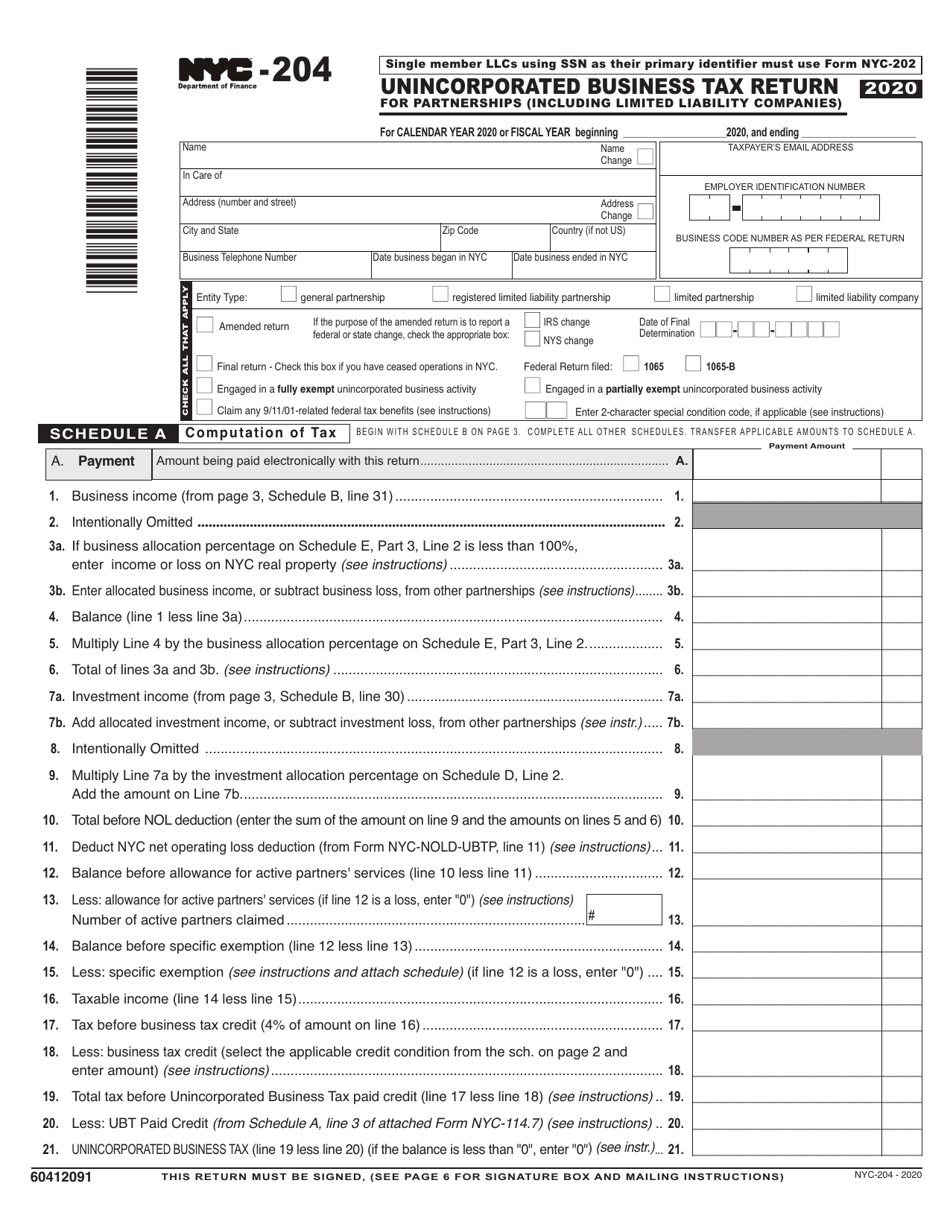

Form Nyc 204

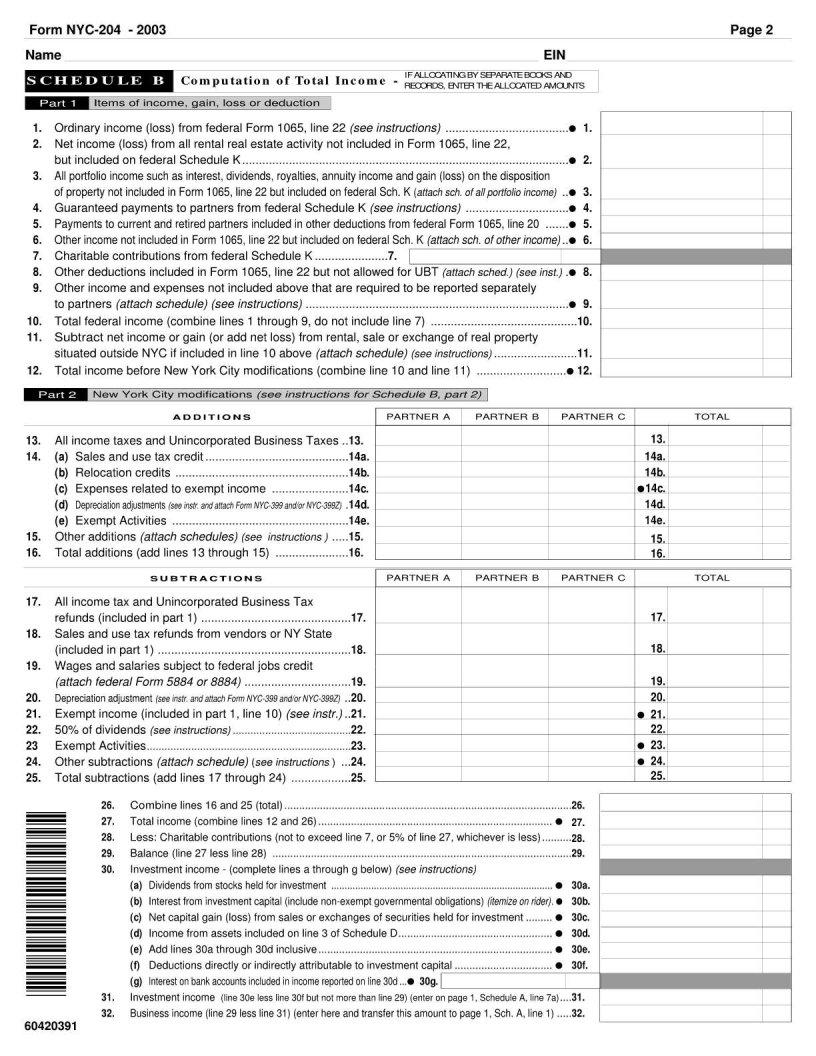

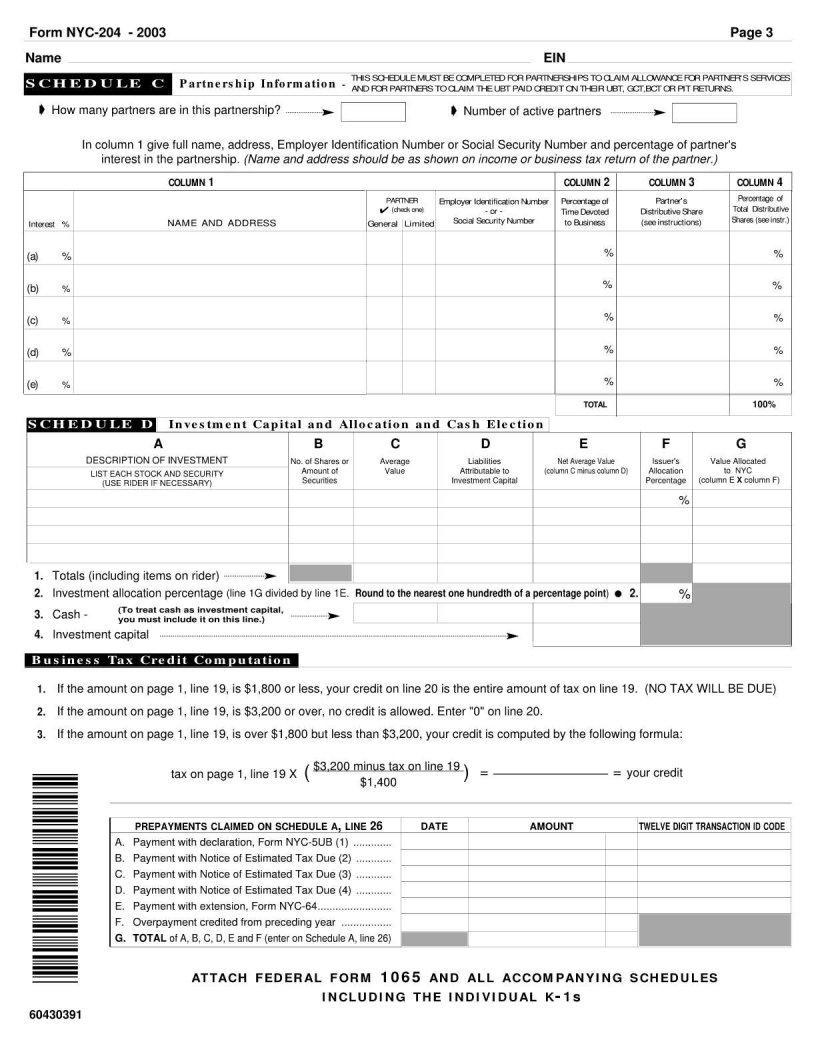

Form Nyc 204 - Web nyc 204 unincorporated business tax return for partnerships (including limited liability companies) a. (if you allocate 100% of your business income. For details on the proper reporting of income. Web nyc 204 unincorporated business tax return for (partnerships includ g l imt ed ab yco p n s) a. For partnerships (including limited liability companies) this form is for certain partnerships,. (if you allocate 100% of your business income. Complete, edit or print tax forms instantly. For partnerships, including limited liability companies 2021. Download unincorporated business tax worksheet. Credit for new york city unincorporated business tax. You allocate total business income within and without nyc. You allocate total business income within and without nyc. Unincorporated business tax return 2021. If the amount on page 1, line 17, is $3,400 or less,. You allocate total business income within and without nyc. Web nyc 204 unincorporated business tax return for (partnerships includ g l imt ed ab yco p n s) a. For partnerships (including limited liability companies) this form is for certain partnerships,. Who needs to file nyc 202? Credit for new york city unincorporated business tax. You allocate total business income within and without nyc. (if you allocate 100% of your business income. Credit for new york city unincorporated business tax. For details on the proper reporting of income. For partnerships, including limited liability companies 2021. You allocate total business income within and without nyc. Web nyc 204 unincorporated business tax return for (partnerships includ g l imt ed ab yco p n s) a. This pdf file contains the form and instructions. (if you allocate 100% of your business income. Unincorporated business tax return 2021. Who needs to file nyc 202? (if you allocate 100% of your business income. Complete, edit or print tax forms instantly. For partnerships, including limited liability companies 2021. Credit for new york city unincorporated business tax. Web nyc 204 unincorporated business tax return for (partnerships includ g l imt ed ab yco p n s) a. You allocate total business income within and without nyc. (if you allocate 100% of your business income. Web nyc 204 unincorporated business tax return for (partnerships includ g l imt ed ab yco p n s) a. For partnerships (including limited liability companies) this form is for certain partnerships,. You allocate total business income within and without nyc. Who needs to file nyc 202? Unincorporated business tax return 2021. (if you allocate 100% of your business income. It contains information about the income, expenses, deductions, and credits of the. For details on the proper reporting of income. For partnerships (including limited liability companies) this form is for certain partnerships,. For partnerships, including limited liability companies 2021. Who needs to file nyc 202? Web nyc 204 unincorporated business tax return for partnerships (including limited liability companies) a. You allocate total business income within and without nyc. Web what is form nyc 204? Who needs to file nyc 202? (if you allocate 100% of your business income. You allocate total business income within and without nyc. For details on the proper reporting of income. (if you allocate 100% of your business income. Web what is form nyc 204? Complete, edit or print tax forms instantly. You allocate total business income within and without nyc. Credit for new york city unincorporated business tax. (if you allocate 100% of your business income. For partnerships, including limited liability companies 2021. You allocate total business income within and without nyc. Complete, edit or print tax forms instantly. This pdf file contains the form and instructions. Credit for new york city unincorporated business tax. For details on the proper reporting of income. It contains information about the income, expenses, deductions, and credits of the. Web department of taxation and finance. Web nyc 204 unincorporated business tax return for partnerships (including limited liability companies) a. (if you allocate 100% of your business income. (if you allocate 100% of your business income. Download unincorporated business tax worksheet. Web nyc 204 unincorporated business tax return for (partnerships includ g l imt ed ab yco p n s) a. If the amount on page 1, line 17, is $3,400 or less,. Web what is form nyc 204? Unincorporated business tax return 2021. You allocate total business income within and without nyc. For partnerships (including limited liability companies) this form is for certain partnerships,. You allocate total business income within and without nyc.Form NYC204 Download Printable PDF or Fill Online Unincorporated

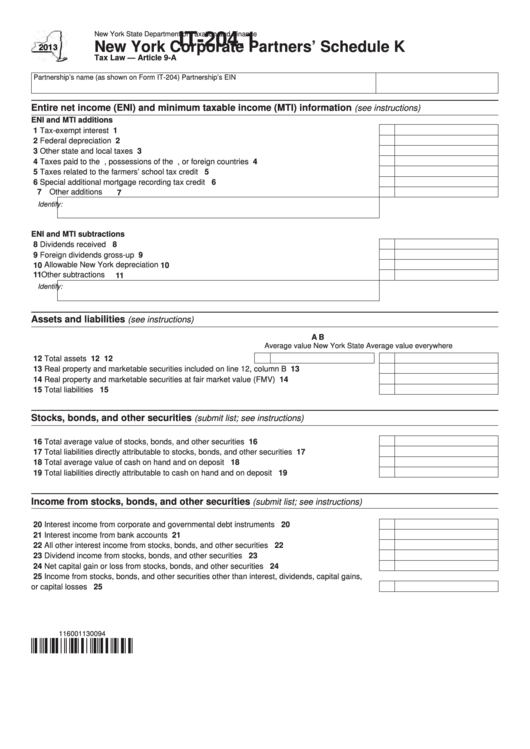

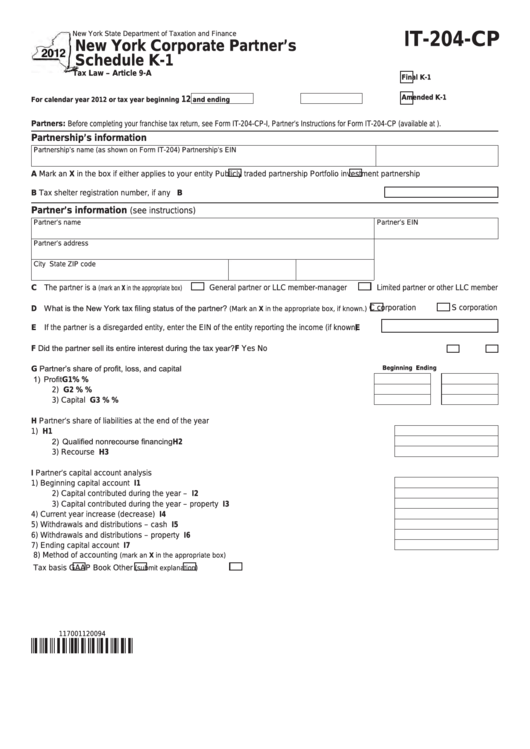

Download Instructions for Form IT204CP New York Corporate Partner's

Fillable Form It204.1 Schedule K New York Corporate Partners

Form Nyc 204 ≡ Fill Out Printable PDF Forms Online

Form Nyc 204 ≡ Fill Out Printable PDF Forms Online

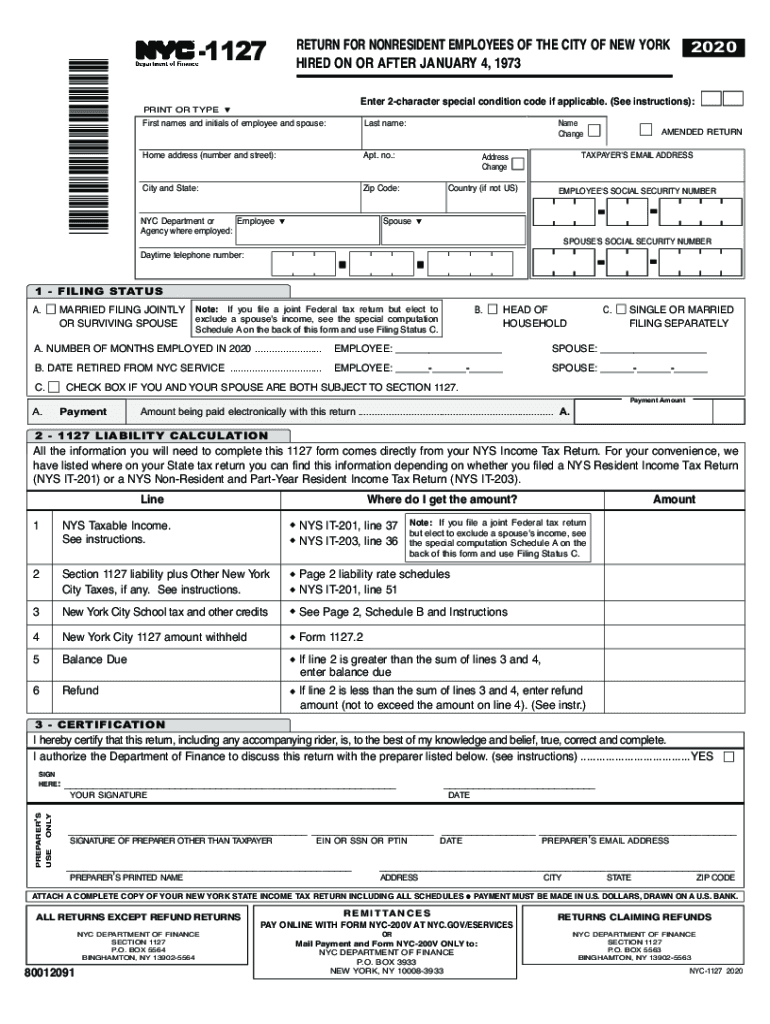

Nyc 1127 form Fill out & sign online DocHub

Fillable Form It204Cp New York Corporate Partner'S Schedule K1

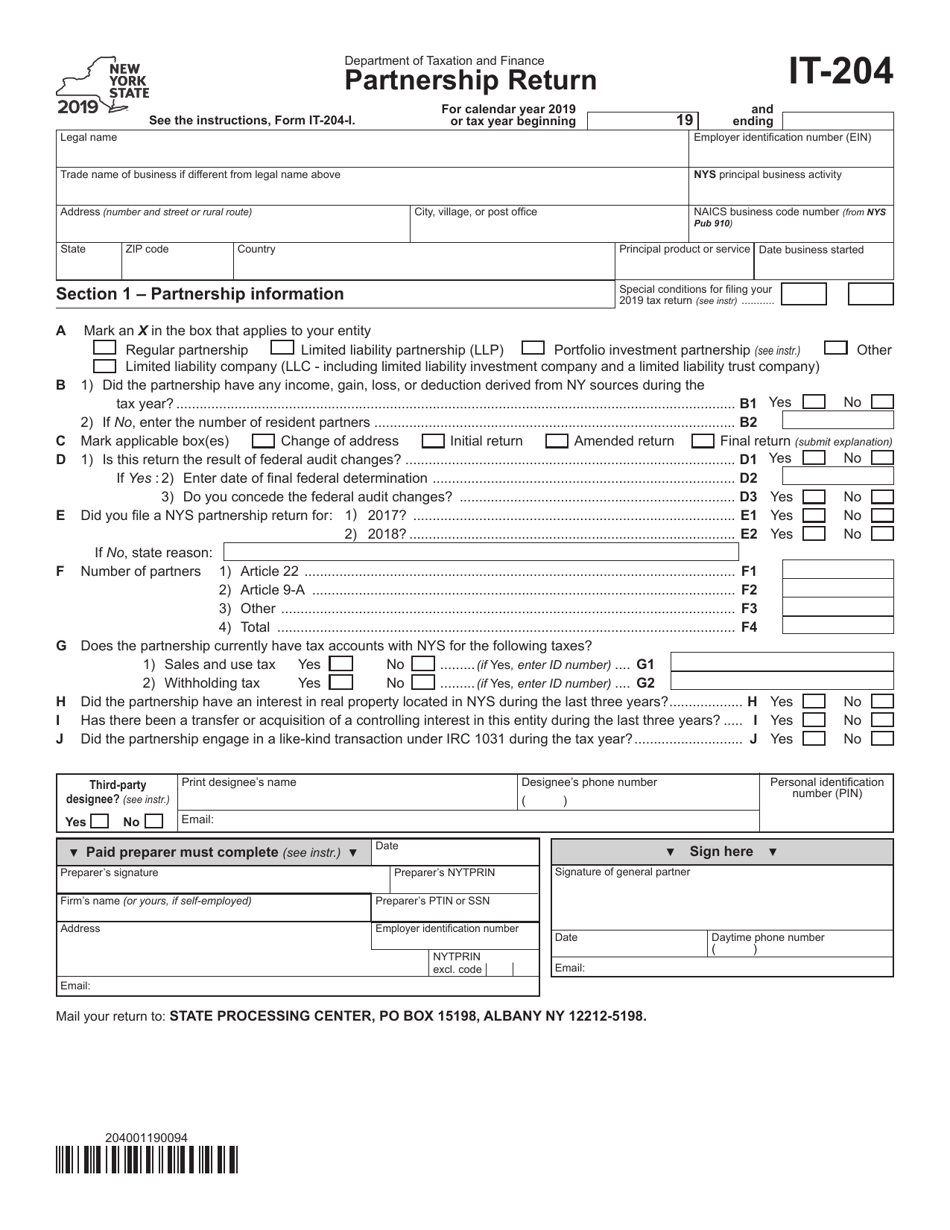

Form IT204 2019 Fill Out, Sign Online and Download Fillable PDF

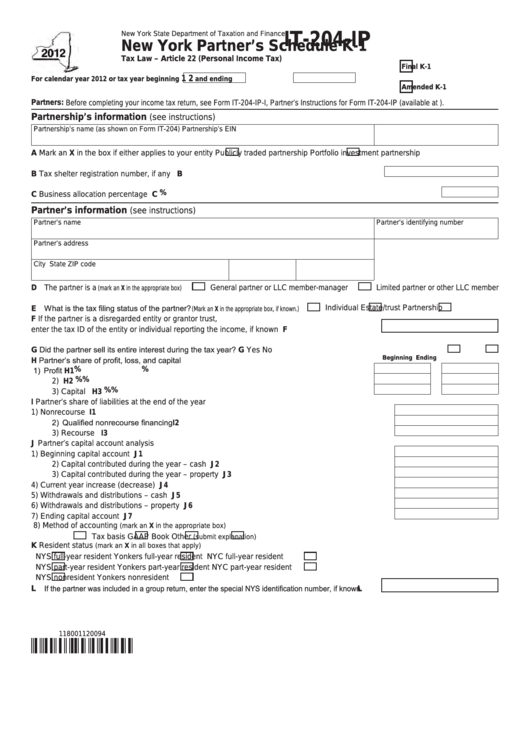

Fillable Form It204Ip New York Partner'S Schedule K1 2012

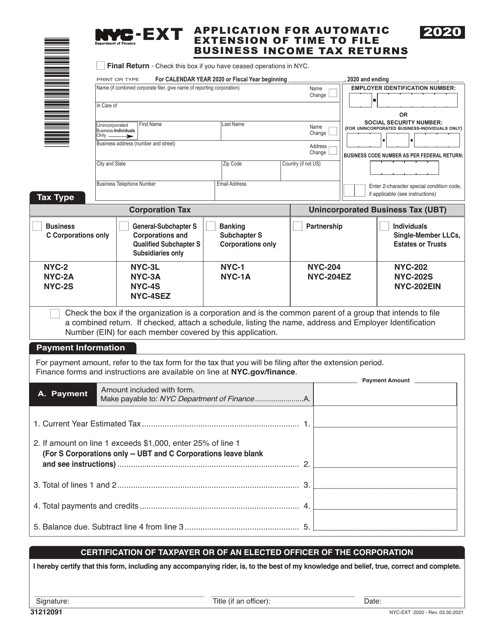

Form NYCEXT Download Printable PDF or Fill Online Application for

Related Post: