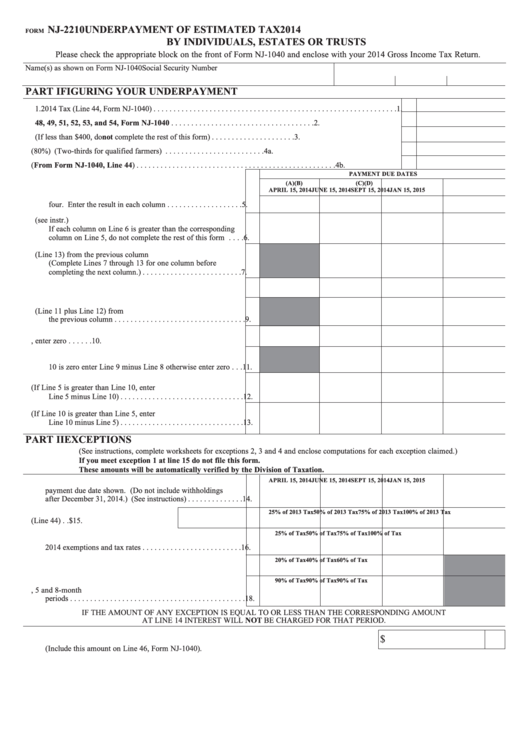

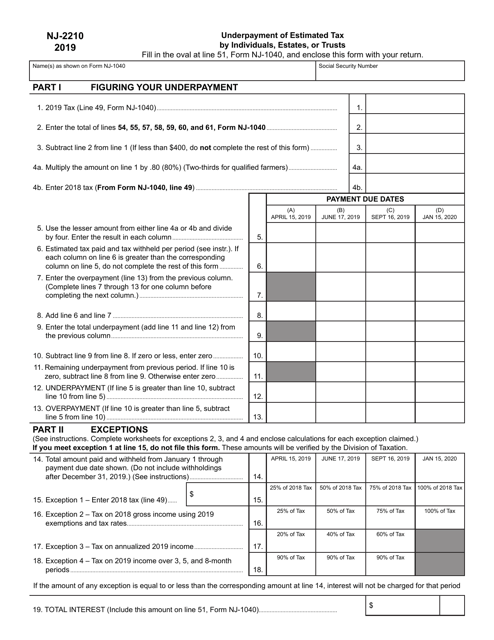

Form Nj 2210

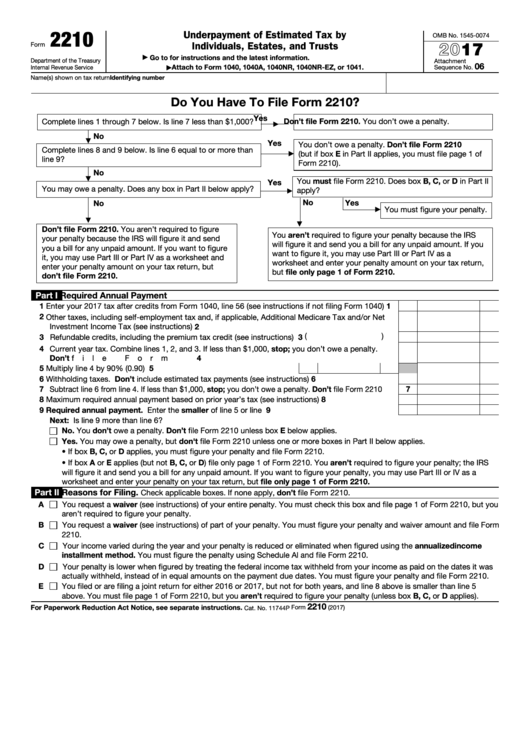

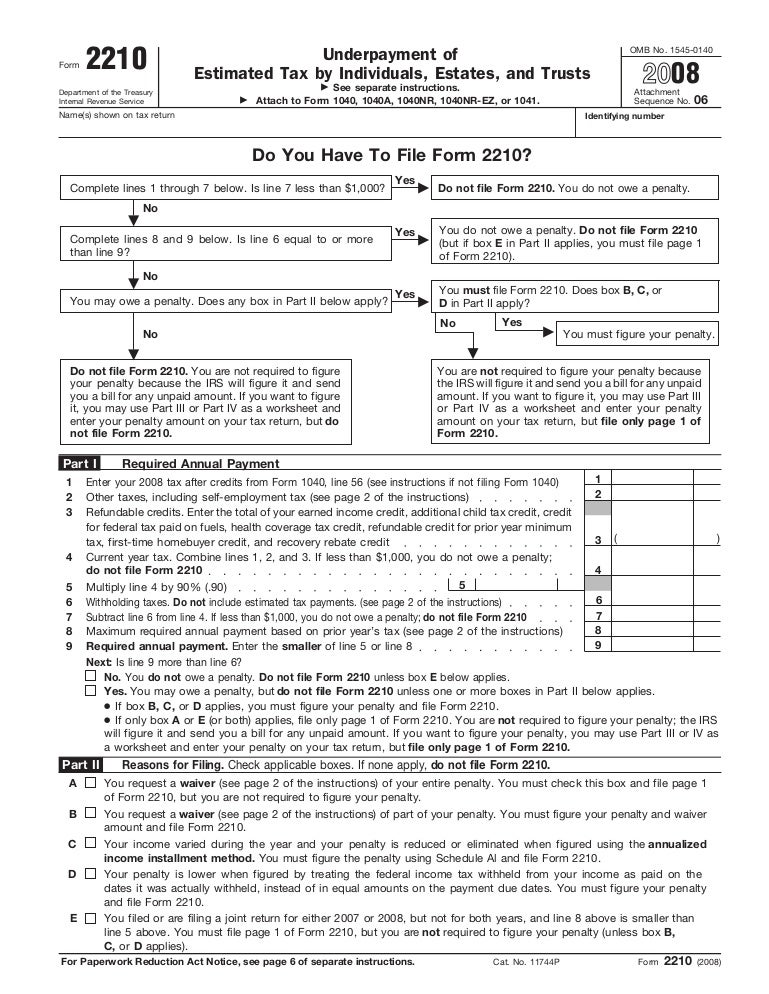

Form Nj 2210 - Complete part i, figuring your underpayment, to determine if you have. Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. Complete part i, figuring your underpayment, to determine if you have. The forms and worksheets here are for illustration only. The irs will generally figure your penalty for you and you should not file form 2210. Date return filed if the date entered in this field is later than. Estimated income tax payment voucher for 2023. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web application for extension of time to file income tax return. Save or instantly send your ready documents. Estates and trusts are subject to interest on underpayment of estimated. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. Estimated income tax payment voucher for 2023. Form. Easily fill out pdf blank, edit, and sign them. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save nj nj 2210 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8. Complete part i, figuring your underpayment, to determine. Easily fill out pdf blank, edit, and sign them. The forms and worksheets here are for illustration only. Complete part i, figuring your underpayment, to determine if you have. The irs will generally figure your penalty for you and you should not file form 2210. Estimated income tax payment voucher for 2023. Easily fill out pdf blank, edit, and sign them. Form 2210 is typically used by. The irs will generally figure your penalty for you and you should not file form 2210. Date return filed if the date entered in this field is later than. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Save or instantly send your ready documents. The forms and worksheets here are for illustration only. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save nj nj 2210 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8. Easily. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Easily fill out pdf blank, edit, and sign them. Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. The forms and worksheets here are for illustration only. Estimated. Easily fill out pdf blank, edit, and sign them. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Estates and trusts are subject to interest on underpayment of estimated. Complete part i, figuring your underpayment, to determine if you have. Form 2210 is typically used by. Easily fill out pdf blank, edit, and sign them. Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Complete part i, figuring your underpayment, to determine if you. Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. The forms and worksheets here are for illustration only. Web application for extension of time to file income tax return. The irs will generally figure your penalty for you and you should not file form. Complete part i, figuring your underpayment, to determine if you have. Easily fill out pdf blank, edit, and sign them. The forms and worksheets here are for illustration only. Date return filed if the date entered in this field is later than. Save or instantly send your ready documents. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Save or instantly send your ready documents. Estimated income tax payment voucher for 2023. Date return filed if the date entered in this field is later than. The irs will generally figure your penalty for you and you should not file form 2210. Complete part i, figuring your underpayment, to determine if you have. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save nj nj 2210 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8. Web form 2210 underpayment of estimated tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. The forms and worksheets here are for illustration only. Complete part i, figuring your underpayment, to determine if you have. Easily fill out pdf blank, edit, and sign them. Form 2210 is typically used by. Web application for extension of time to file income tax return. Estates and trusts are subject to interest on underpayment of estimated.Fillable Form Nj2210 Underpayment Of Estimated Tax By Individuals

Top 18 Form 2210 Templates free to download in PDF format

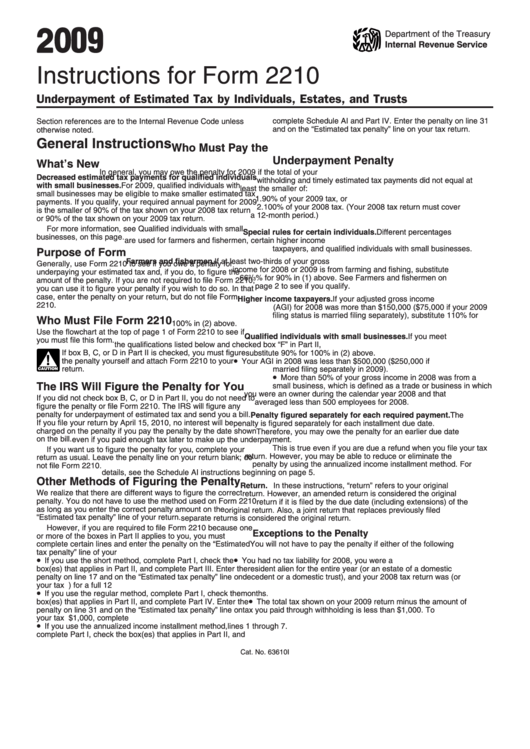

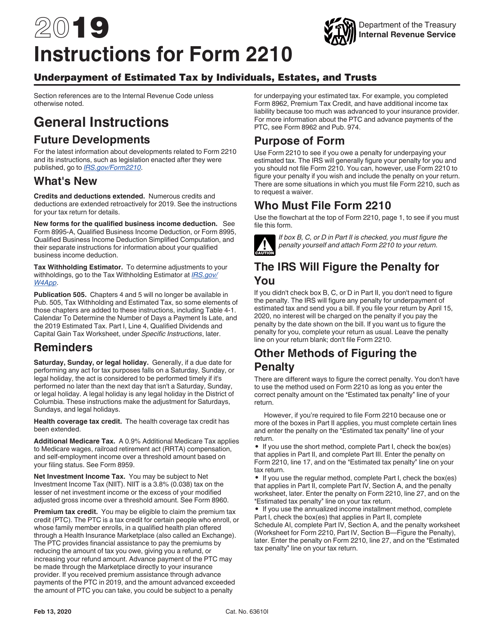

Instructions For Form 2210 Underpayment Of Estimated Tax By

Form 2210Underpayment of Estimated Tax

2210 Form 2022 2023

Form 2210Underpayment of Estimated Tax

Form NJ2210 Download Fillable PDF or Fill Online Underpayment of

Instructions For Form 2210 Underpayment Of Estimated Tax By

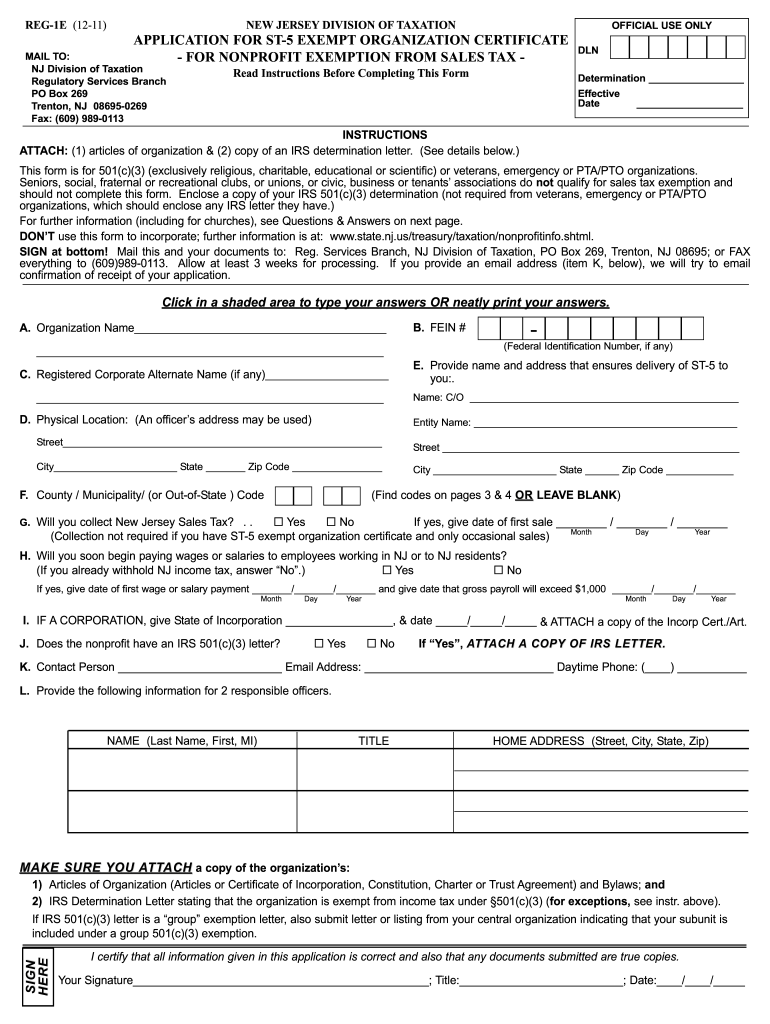

NJ Tax Form St 5 Fill Out and Sign Printable PDF Template signNow

Download Instructions for IRS Form 2210 Underpayment of Estimated Tax

Related Post: