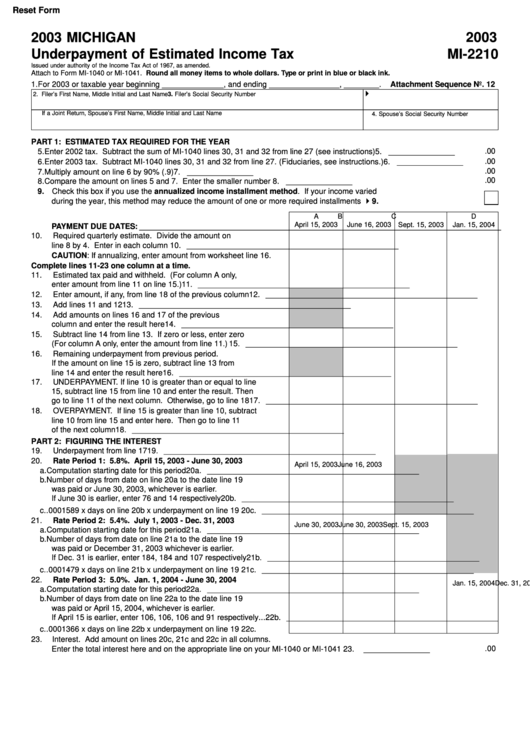

Form Mi-2210

Form Mi-2210 - Easily fill out pdf blank, edit, and sign them. Web file this form if your tax liability is $500 or more after credits and withholding, and you did not pay the required amount of estimated tax prior to the return's due date. Save or instantly send your ready documents. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Please use the link below to. Fill in the empty fields, try features of the editor, and share the file or send it for submitting. The irs will generally figure your penalty for you and you should not file form 2210. Complete, edit or print tax forms instantly. Web michigan — underpayment of estimated income tax download this form print this form it appears you don't have a pdf plugin for this browser. Web instructions included on form. Important notice for tax year 2020. Web file this form if your tax liability is $500 or more after credits and withholding, and you did not pay the required amount of estimated tax prior to the return's due date. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web instructions included on form.. Underpayment of estimated income tax: Individual income tax filers must check the box. Complete, edit or print tax forms instantly. For 2020, taxpayers received an automatic. It serves as one of michigan's. Special rules for farmers, fishermen, and : Easily fill out pdf blank, edit, and sign them. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Underpayment of estimated income tax: It serves as one of michigan's. The michigan mi 2210 form is a crucial tool used to process an entire range of services. Web file this form if your tax liability is $500 or more after credits and withholding, and you did not pay the required amount of estimated tax prior to the return's due date. Fill in the empty. Easily fill out pdf blank, edit, and sign them. Individual income tax filers must check the box. Get everything done in minutes. Form mi 5049, married, filing separately worksheet. The irs will generally figure your penalty for you and you should not file form 2210. Please use the link below to. You can edit these pdf forms online and download them on your computer for free. Easily fill out pdf blank, edit, and sign them. The irs will generally figure your penalty for you and you should not file form 2210. Important notice for tax year 2020. The michigan mi 2210 form is a crucial tool used to process an entire range of services. Get ready for tax season deadlines by completing any required tax forms today. Individual income tax filers must check the box. Fill in the empty fields, try features of the editor, and share the file or send it for submitting. Easily fill out. You can edit these pdf forms online and download them on your computer for free. Underpayment of estimated income tax: It serves as one of michigan's. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Important notice for tax year 2020. Please use the link below to. Complete, edit or print tax forms instantly. Special rules for farmers, fishermen, and : Get everything done in minutes. Web instructions included on form. Web michigan — underpayment of estimated income tax download this form print this form it appears you don't have a pdf plugin for this browser. The irs will generally figure your penalty for you and you should not file form 2210. Easily fill out pdf blank, edit, and sign them. Web instructions included on form. Web cocodoc collected lots of. Underpayment of estimated income tax: It serves as one of michigan's. Web instructions included on form. Special rules for farmers, fishermen, and : Easily fill out pdf blank, edit, and sign them. Form mi 5049, married, filing separately worksheet. Get everything done in minutes. You can edit these pdf forms online and download them on your computer for free. Individual income tax filers must check the box. The irs will generally figure your penalty for you and you should not file form 2210. Fill in the empty fields, try features of the editor, and share the file or send it for submitting. Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today. Web file this form if your tax liability is $500 or more after credits and withholding, and you did not pay the required amount of estimated tax prior to the return's due date. Complete, edit or print tax forms instantly. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. For 2020, taxpayers received an automatic. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web instructions included on form: Web cocodoc collected lots of free michigan forms mi 2210 for our users.Fillable Form Mi2210 Michigan Underpayment Of Estimated Tax

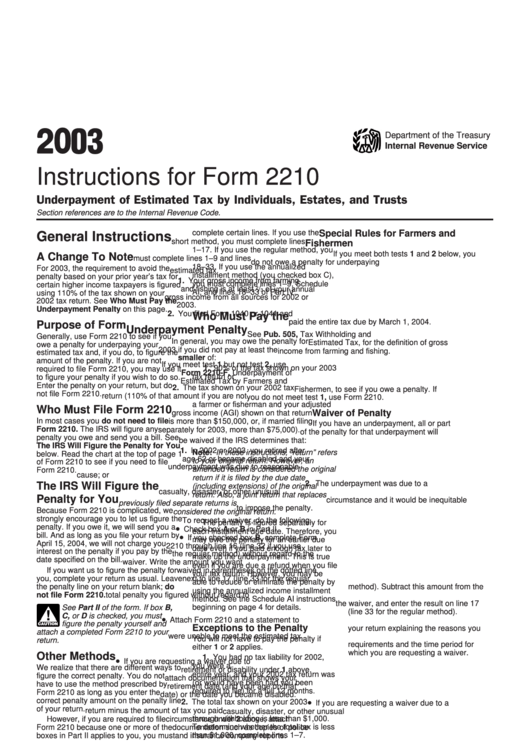

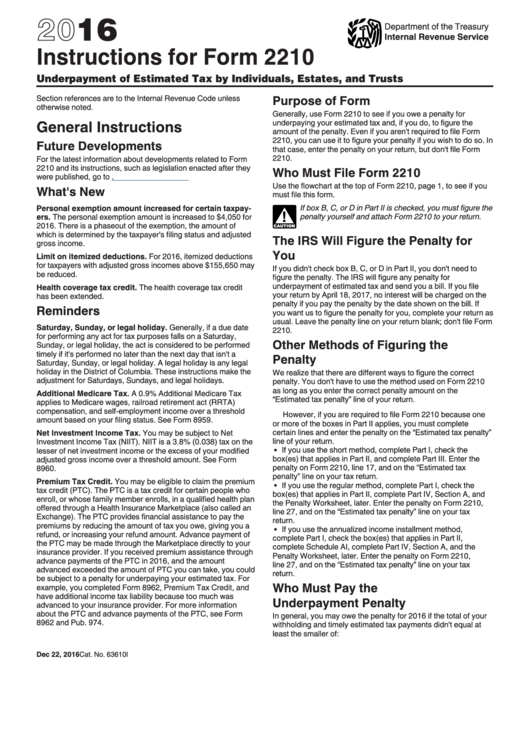

Instructions For Form 2210 Underpayment Of Estimated Tax By

2021 Form MI MI2210 Fill Online, Printable, Fillable, Blank pdfFiller

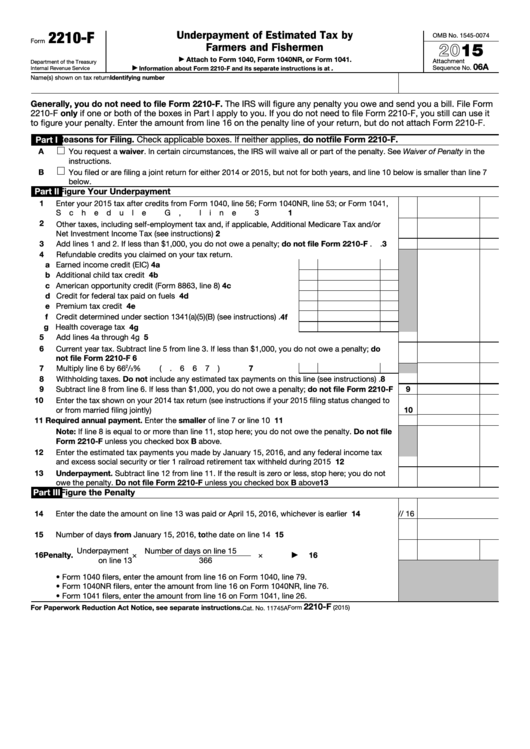

Fillable Form 2210F Underpayment Of Estimated Tax By Farmers And

MI MI1040CR7 2018 Fill and Sign Printable Template Online US

Instructions For Form 2210 Underpayment Of Estimated Tax By

Michigan Mi 2210 Form ≡ Fill Out Printable PDF Forms Online

Ssurvivor Irs Form 2210 Ai Instructions

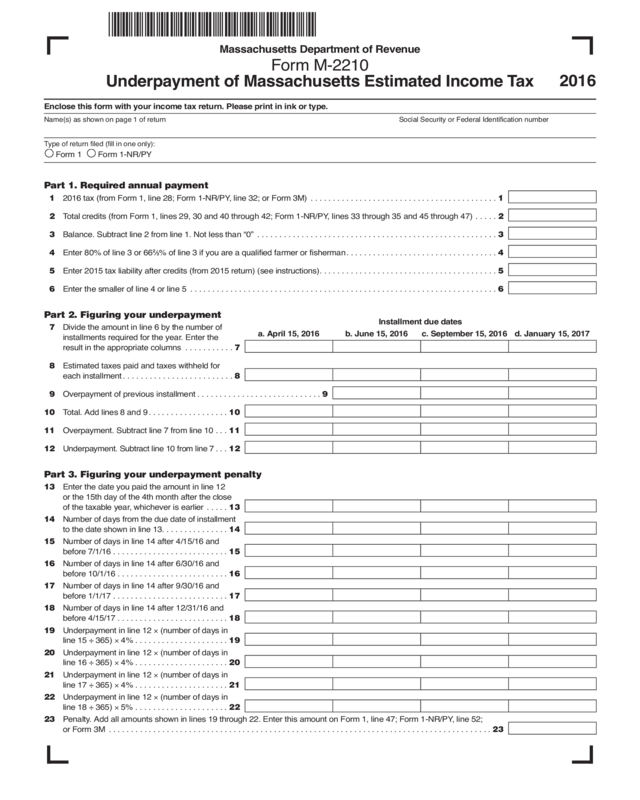

Form M2210 Edit, Fill, Sign Online Handypdf

Instructions For Form 2210 Underpayment Of Estimated Tax By

Related Post: