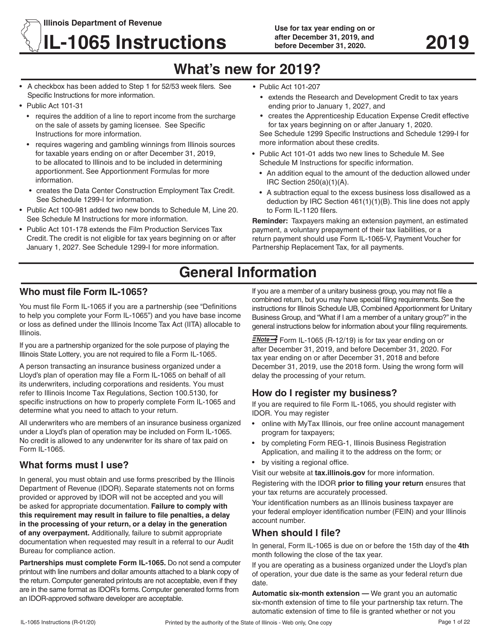

Form Il 1065 Instructions

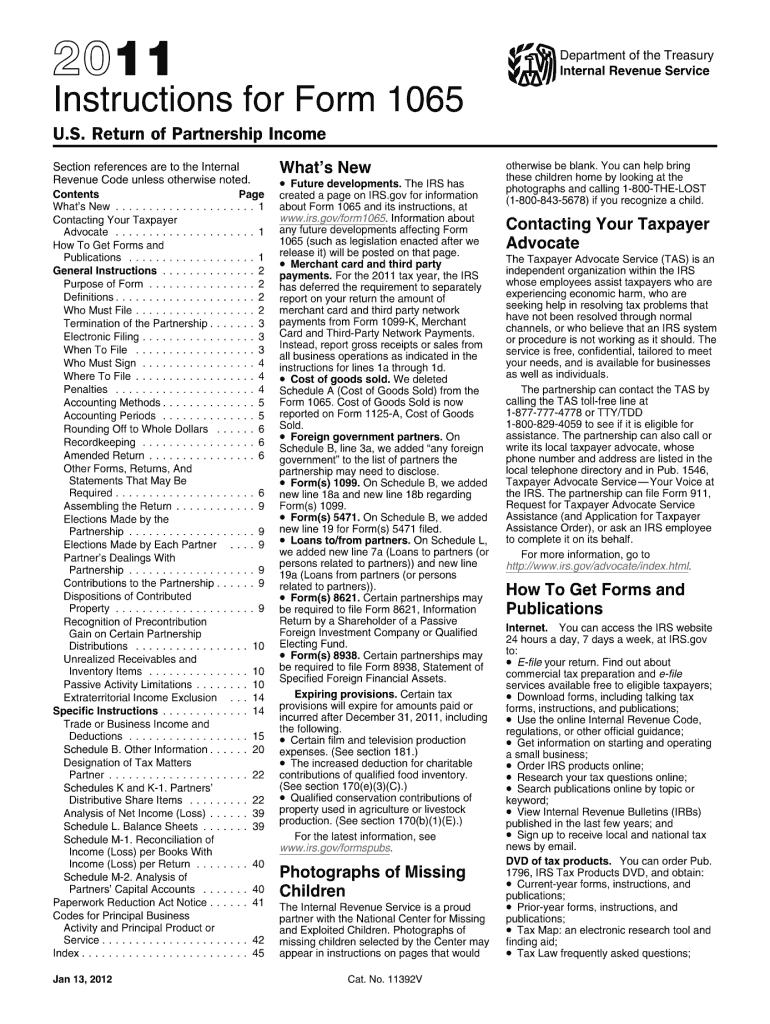

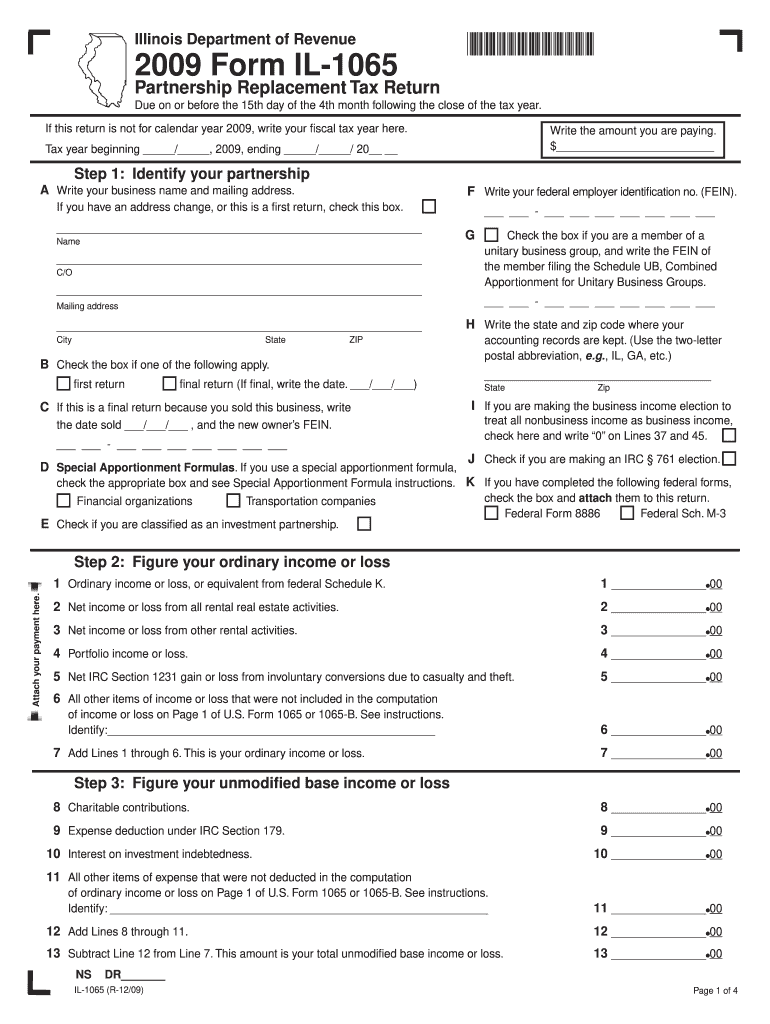

Form Il 1065 Instructions - In addition, complete form 8082, notice of inconsistent treatment or. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. Subtract line 6 from line 5, column a. Upload, modify or create forms. If no payment is due or you make your payment electronically, do not file this form. Multiply line 5, column a, by 90% (.9). For all other situations, see instructions to determine the correct form to use. Try it for free now! All underwriters who are members of an insurance. Ad pay the lowest amount of taxes possible with strategic planning and preparation. Upload, modify or create forms. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Subtract line 6 from line 5, column a. For all other situations, see instructions to determine the correct form to use. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. You must round the dollar. Upload, modify or create forms. Multiply line 5, column a, by 90% (.9). Web this form is for tax years ending on or after december 31, 2020, and before december 31, 2021. Ad get ready for tax season deadlines by completing any required tax forms today. In addition, complete form 8082, notice of inconsistent treatment or. Ad pay the lowest amount of taxes possible with strategic planning and preparation. Upload, modify or create forms. Save time and money with professional tax planning & preparation services For all other situations, see instructions to determine the correct form to use. All underwriters who are members of an insurance. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Web if the aar will be filed electronically, complete form 1065 with the corrected amounts and check box. Web if the aar will be filed electronically, complete form 1065 with the corrected amounts and check box g(5). Web this form is for tax years ending on or after december 31, 2020, and before december 31, 2021. Ad pay the lowest amount of taxes possible with strategic planning and preparation. You must round the dollar. Subtract line 6 from. All underwriters who are members of an insurance. Web if the aar will be filed electronically, complete form 1065 with the corrected amounts and check box g(5). Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions to determine the correct form to use. For. Try it for free now! Subtract line 6 from line 5, column a. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. You must round the dollar. Ad pay the lowest amount of taxes possible with strategic planning and preparation. Subtract line 6 from line 5, column a. Ad pay the lowest amount of taxes possible with strategic planning and preparation. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. You must round the dollar. For all other situations, see. Save time and money with professional tax planning & preparation services Ad get ready for tax season deadlines by completing any required tax forms today. Ad pay the lowest amount of taxes possible with strategic planning and preparation. You must round the dollar. Web if the aar will be filed electronically, complete form 1065 with the corrected amounts and check. You must round the dollar. In addition, complete form 8082, notice of inconsistent treatment or. For all other situations, see instructions to determine the correct form to use. Try it for free now! All underwriters who are members of an insurance. Ad pay the lowest amount of taxes possible with strategic planning and preparation. In addition, complete form 8082, notice of inconsistent treatment or. All underwriters who are members of an insurance. Save time and money with professional tax planning & preparation services Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. For all other situations, see instructions to determine the correct form to use. Web this form is for tax years ending on or after december 31, 2020, and before december 31, 2021. For all other situations, see instructions to determine the correct form to use. Ad get ready for tax season deadlines by completing any required tax forms today. If no payment is due or you make your payment electronically, do not file this form. Web developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065. Subtract line 6 from line 5, column a. Web this form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Try it for free now! You must round the dollar. Multiply line 5, column a, by 90% (.9). Upload, modify or create forms. Web if the aar will be filed electronically, complete form 1065 with the corrected amounts and check box g(5).Il 1065 Instructions Form Fill Out and Sign Printable PDF Template

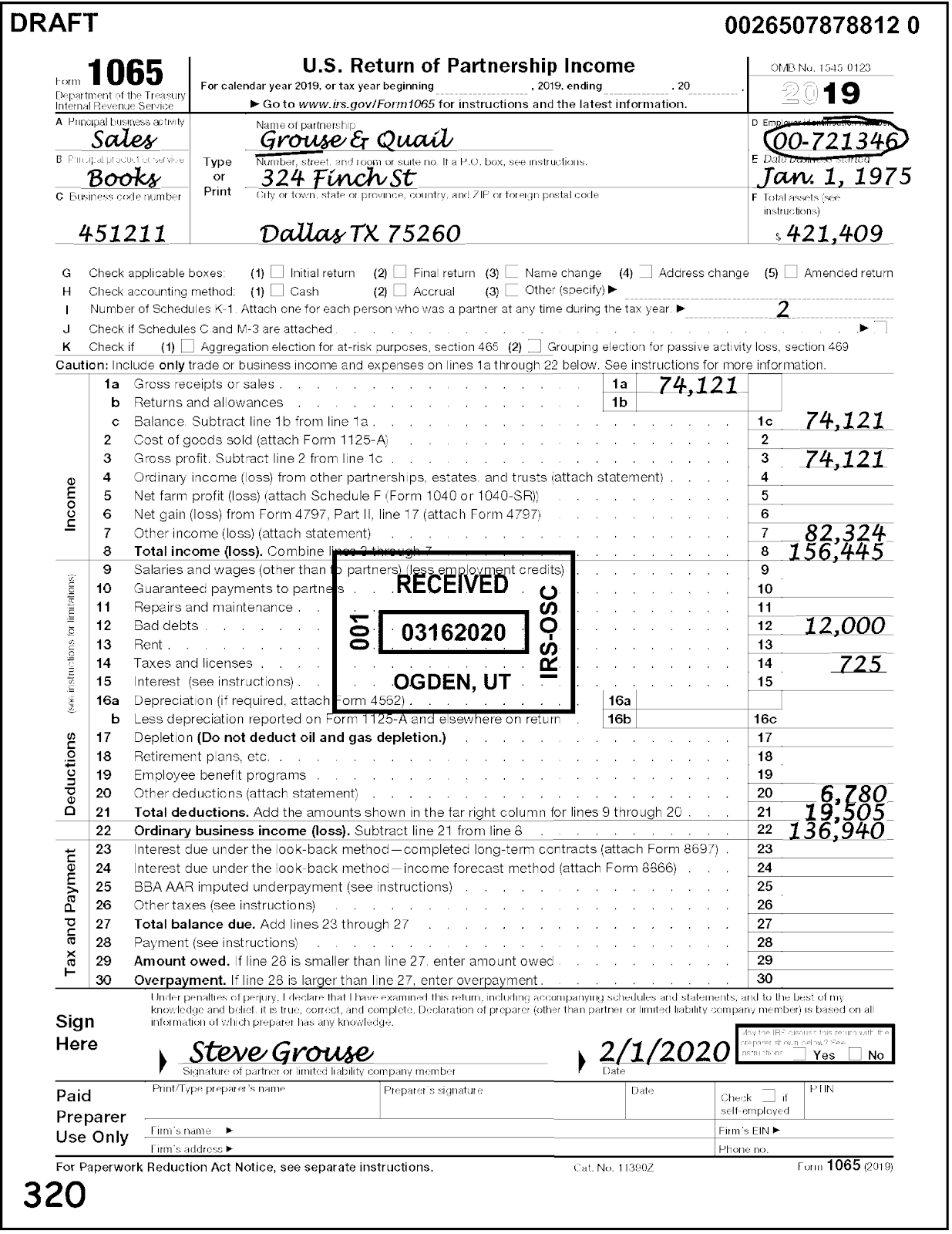

U.S Tax Return for Partnership , Form 1065 Meru Accounting

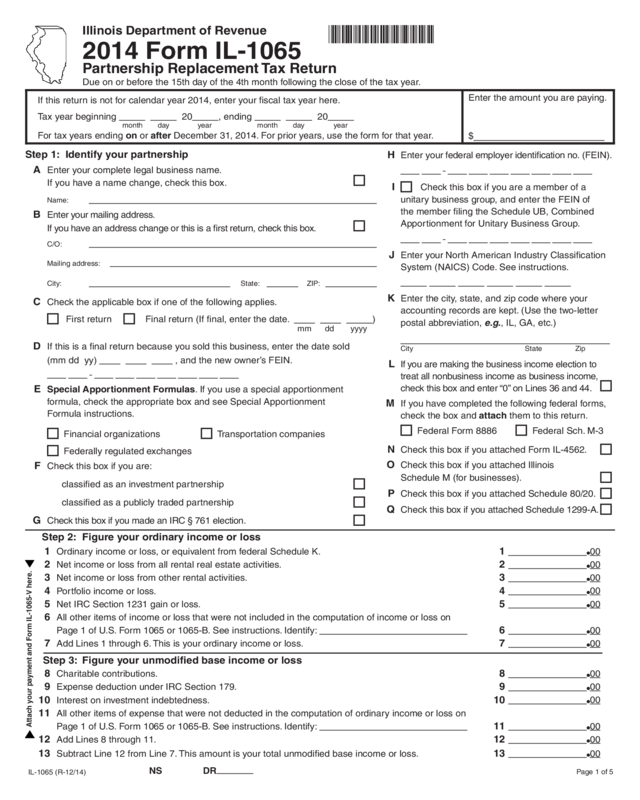

2014 Form Il1065, Partnership Replacement Tax Return Edit, Fill

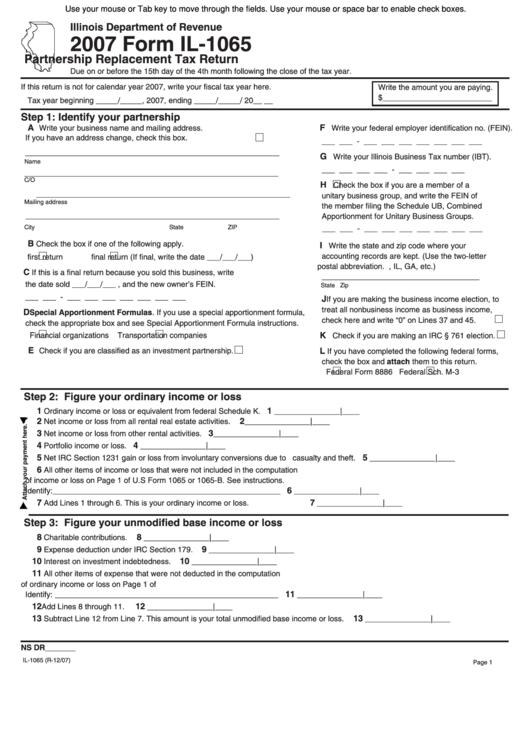

Fillable Form Il1065 Partnership Replacement Tax Return 2007

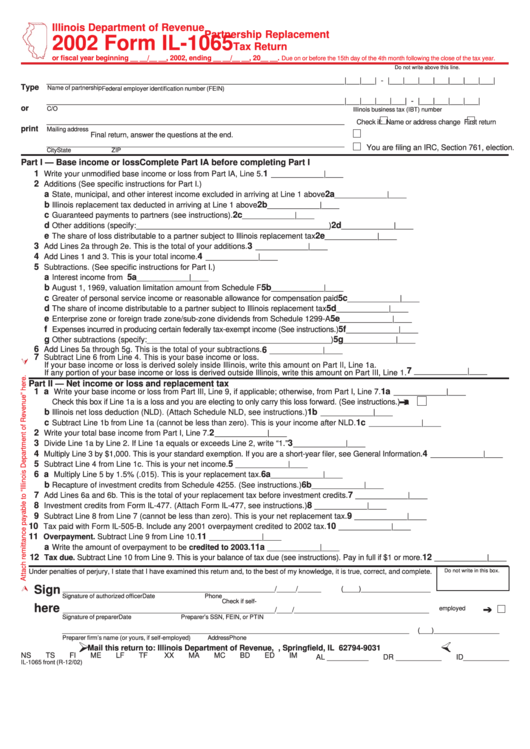

Form Il1065 Partnership Replacement Tax Return 2002 printable pdf

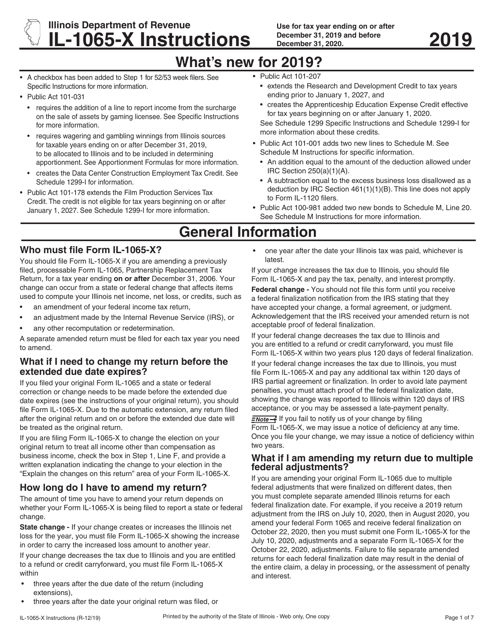

Download Instructions for Form IL1065X ' amended Partnership

How to Prepare Form 1065 in 8 Steps [+ Free Checklist]

Download Instructions for Form IL1065 Partnership Replacement Tax

IRS Form 1065 Instructions StepbyStep Guide NerdWallet (2022)

Form 1065 Instructions Fill Out and Sign Printable PDF Template signNow

Related Post:

![How to Prepare Form 1065 in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/02/form-1065-income-and-expenses-section.png)