Form Il-1041

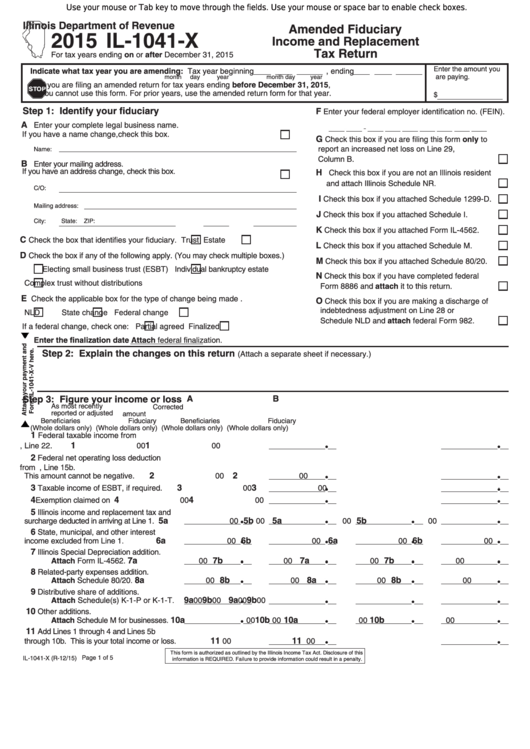

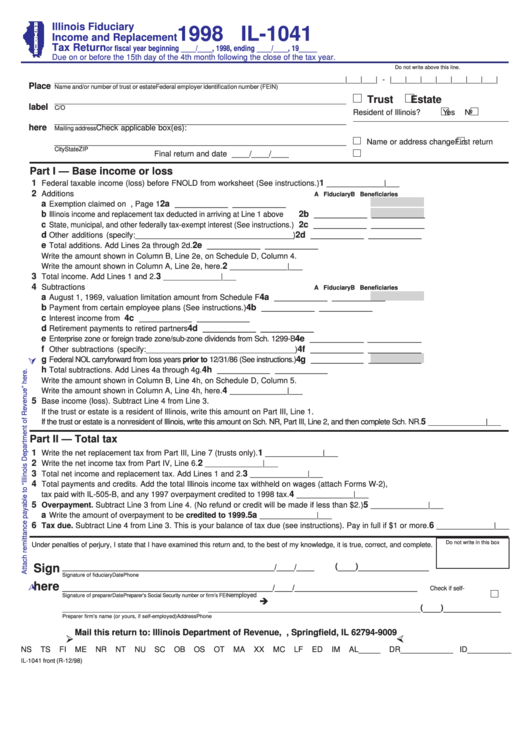

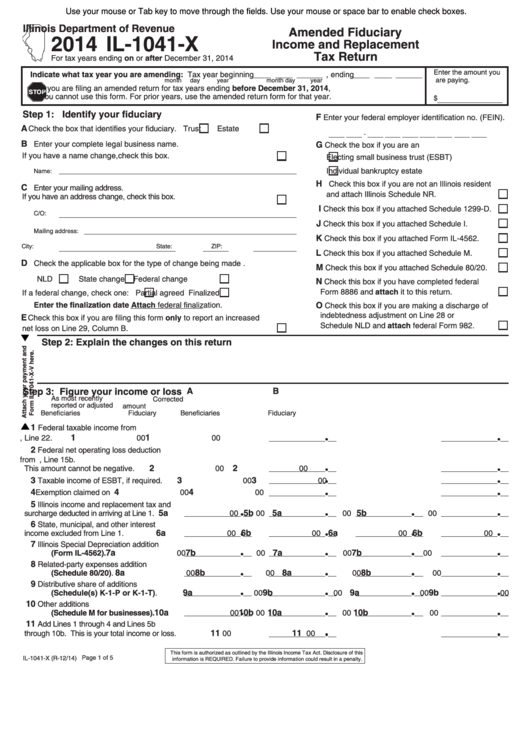

Form Il-1041 - Enter the amount you are paying. Web form 1041 department of the treasury—internal revenue service. Fiduciary income and replacement tax return. Income tax return for estates and trusts. Enter the amount you are paying. Web if this return is not for calendar year 2021, enter your fiscal tax year here. Has net income or loss as. Disclosure of this information is required. The following rules apply to filing form 1041 while the election is in effect. Instructions for form 1041 ( print version pdf) recent developments. This form is for income. This form is for income earned in tax year 2022, with tax returns due in. 01 fill and edit template. Fiduciary income and replacement tax return. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Enter your federal employer identification number (fein). Tax year beginning 20 , ending. (5 / 5) 69 votes. This is not allowed for electronic filing. Has net income or loss as. Illinois has a flat state income tax of 4.95% , which is administered by the illinois department of revenue. Web if this return is not for calendar year 2021, enter your fiscal tax year here. 03 export or print immediately. Enter the amount you are paying. Instructions for form 1041 ( print version pdf) recent developments. Web illinois department of revenue. How do i get form. Income tax return for estates and trusts. For tax year ending on or after december 31, 2021 and before december 31, 2022, use the 2021 form. Enter your name as shown on your tax return. The following rules apply to filing form 1041 while the election is in effect. Line 3 — lloyds plan of operation loss — add back any loss that you included in your federal taxable income. Tax year beginning 20 , ending. Enter your name as shown on your tax return. Using the wrong form will delay the processing. Illinois has a flat state income tax of 4.95% , which is administered by the illinois department of revenue. Department of the treasury—internal revenue service. Using the wrong form will delay the processing. Income tax return for estates and trusts. Enter your name as shown on your tax return. This form is for income. Enter the amount you are paying. Instructions for form 1041 ( print version pdf) recent developments. Line 3 — lloyds plan of operation loss — add back any loss that you included in your federal taxable income. This is not allowed for. Using the wrong form will delay the processing. Instructions for form 1041 ( print version pdf) recent developments. Enter the amount you are paying. Web form 1041 department of the treasury—internal revenue service. Enter your name as shown on your tax return. Fiduciary income and replacement tax return. For tax year ending on or after december 31, 2021 and before december 31, 2022, use the 2021 form. Department of the treasury—internal revenue service. How do i get form. This is not allowed for electronic filing. Using the wrong form will delay the processing. Line 3 — lloyds plan of operation loss — add back any loss that you included in your federal taxable income. Enter your name as shown on your tax return. Web if this return is not for calendar year 2021, enter your fiscal tax year here. Taxformfinder provides printable pdf copies of. Tax year beginning 20 , ending. Enter the amount you are paying. Enter your name as shown on your tax return. Department of the treasury—internal revenue service. Due on or before the 15th day of the 4th month following the close of the tax. Web form 1041 department of the treasury—internal revenue service. Illinois has a flat state income tax of 4.95% , which is administered by the illinois department of revenue. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Instructions for form 1041 ( print version pdf) recent developments. Web if this return is not for calendar year 2021, enter your fiscal tax year here. This form is for income earned in tax year 2022, with tax returns due in. Month day year month day. The following rules apply to filing form 1041 while the election is in effect. Tax year beginning 20 , ending. Web illinois department of revenue. 01 fill and edit template. Fiduciary income and replacement tax return. For tax year ending on or after december 31, 2021 and before december 31, 2022, use the 2021 form. *64112221w* this form is authorized as outlined by the illinois income tax act. Enter the amount you are paying.Fillable Form Il1041X Amended Fiduciary And Replacement Tax

Form Il1041 Illinois Department Of Revenue Edit, Fill, Sign Online

Form Il1041 Illinois Department Of Revenue Edit, Fill, Sign Online

Fillable Form Il1041 Illinois Fiduciary And Replacement Tax

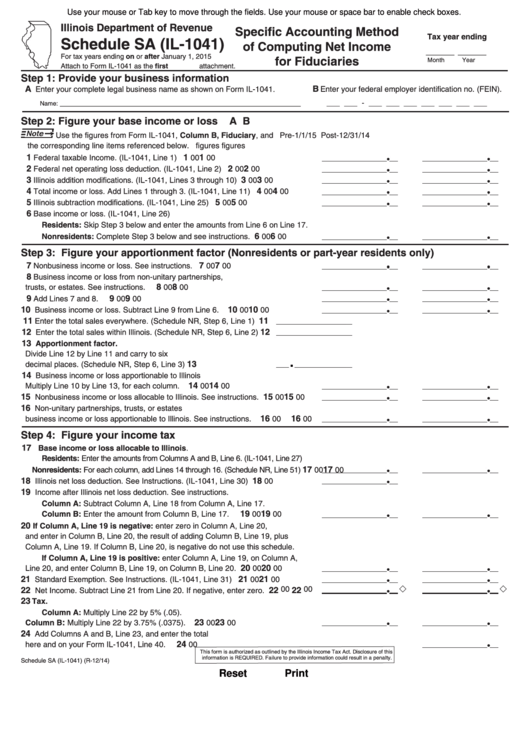

Fillable Schedule Sa (Form Il1041) Specific Accounting Method Of

Form 1041 Fillable Form Printable Forms Free Online

Form 1041 Fill Out and Sign Printable PDF Template signNow

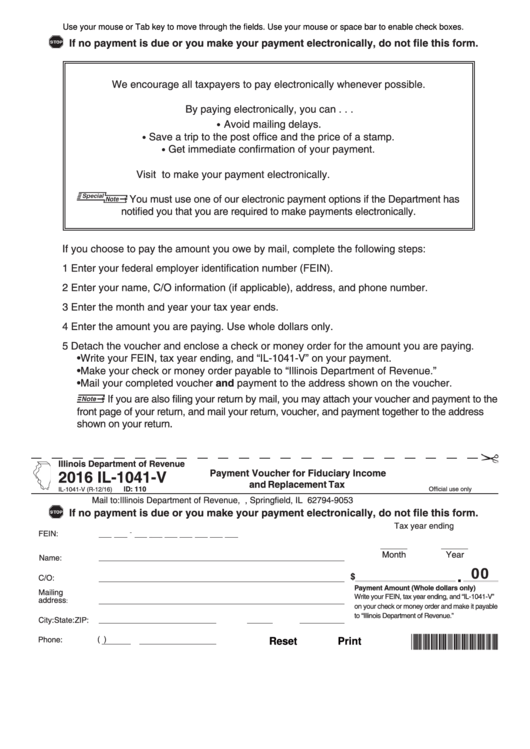

Fillable Form Il1041V Payment Voucher For Fiduciary And

Fillable Form Il1041X Amended Fiduciary And Replacement Tax

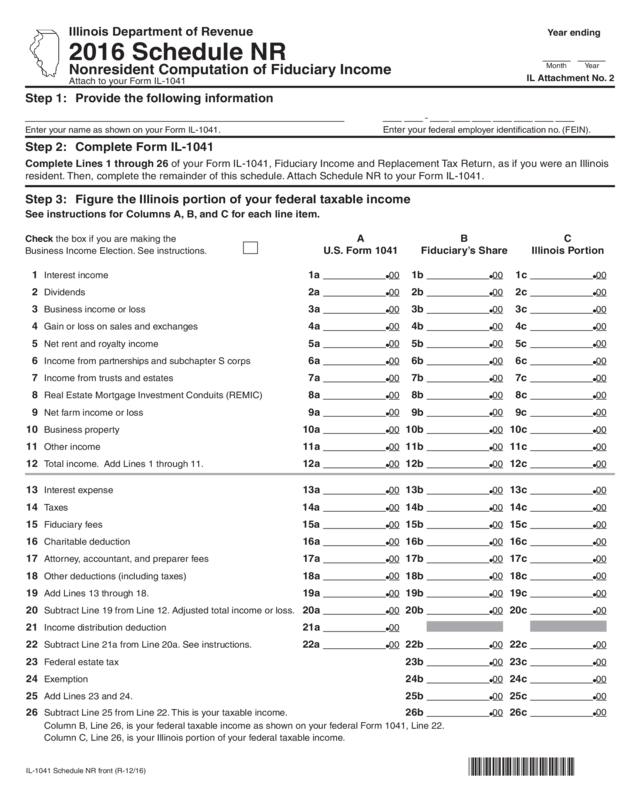

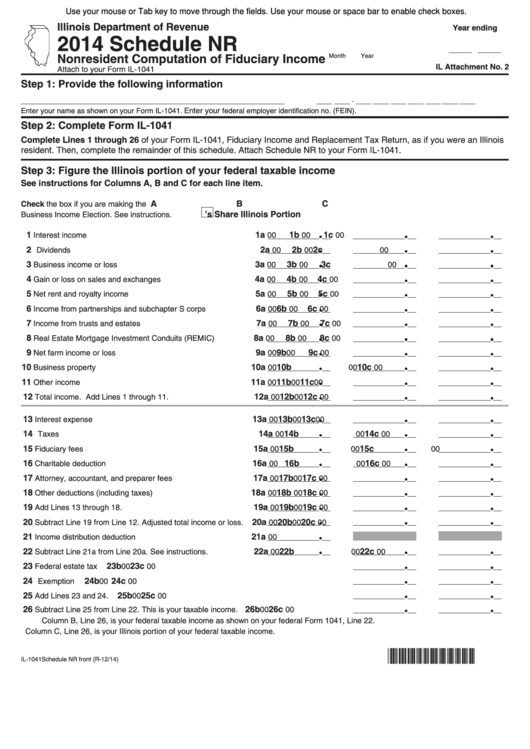

Fillable Form Il1041 Schedule Nr Nonresident Computation Of

Related Post: