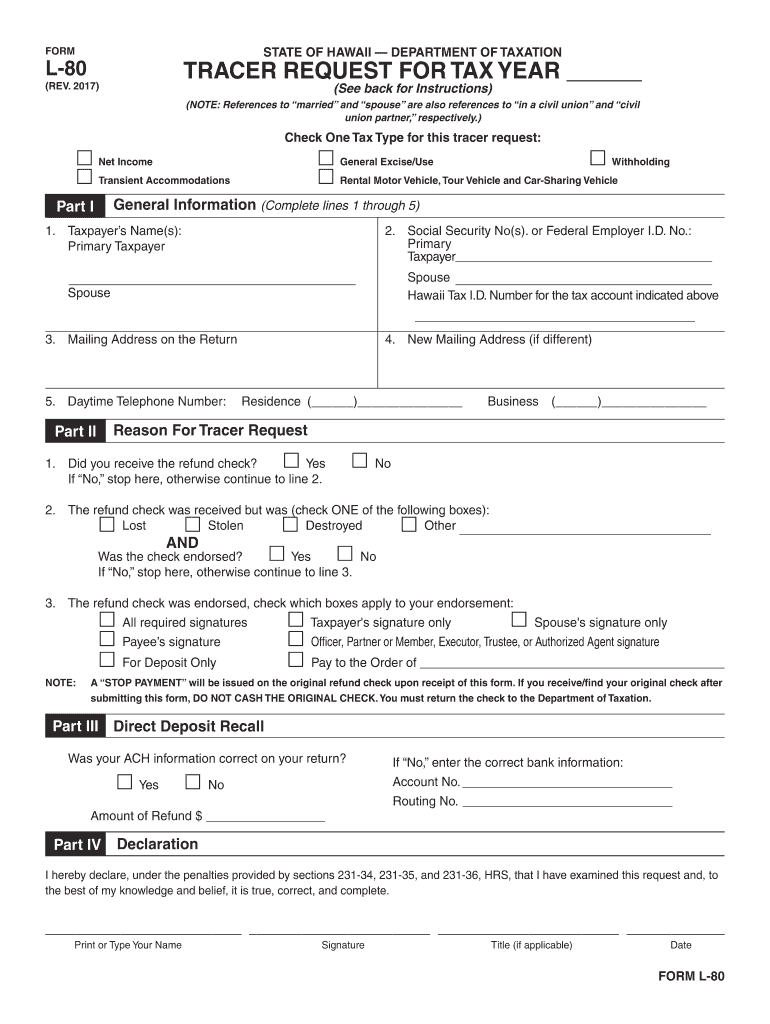

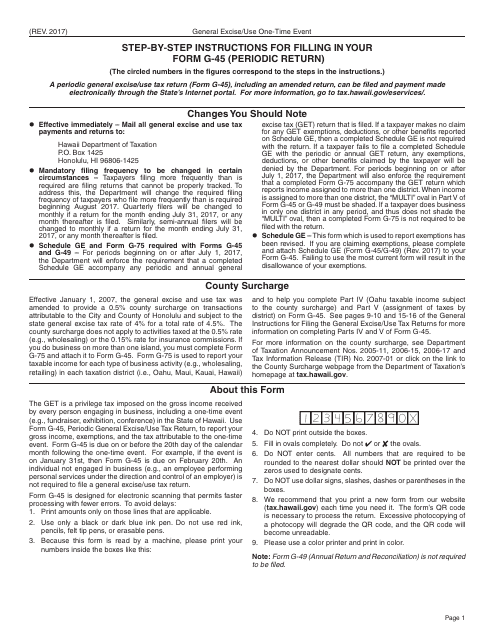

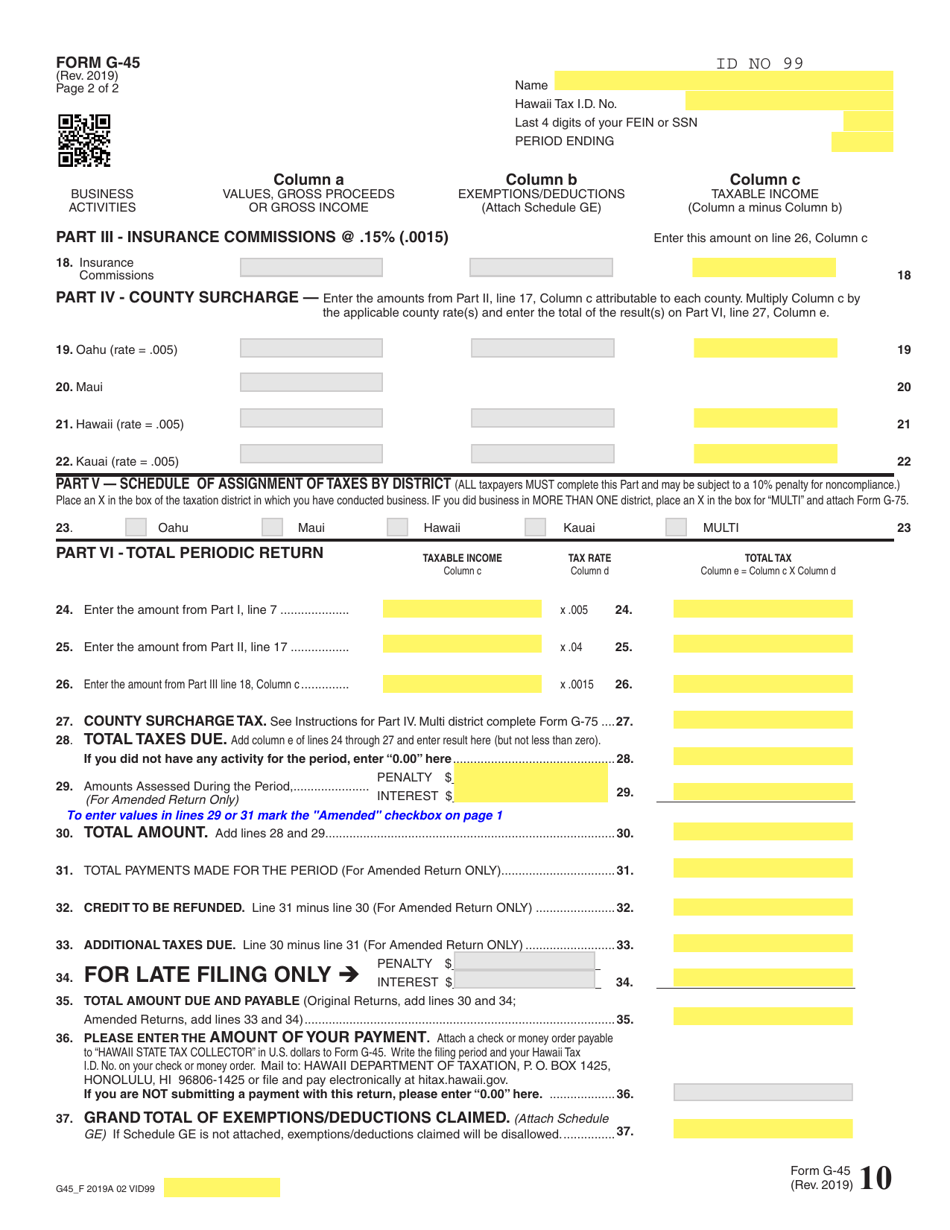

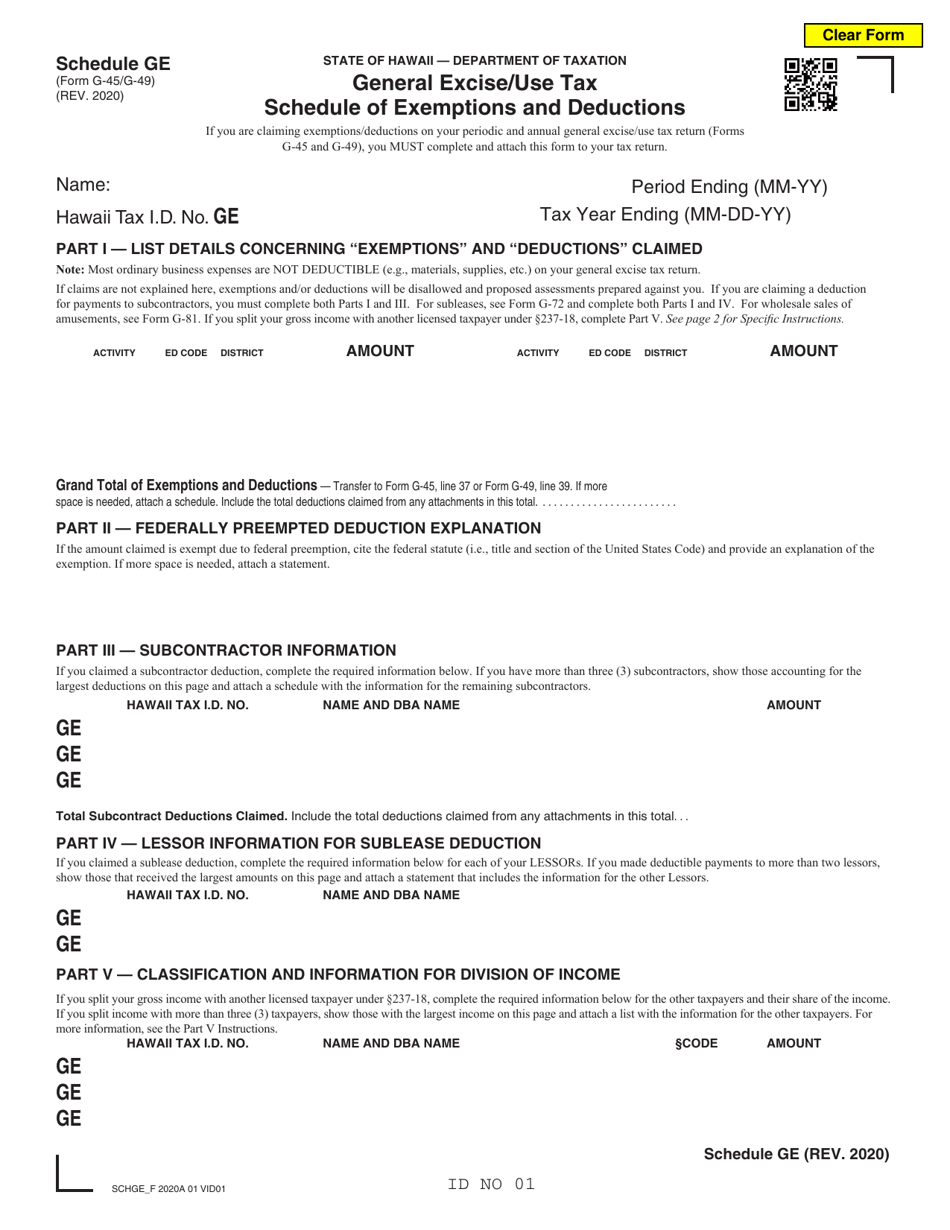

Form G 45 Hawaii General Excise Tax

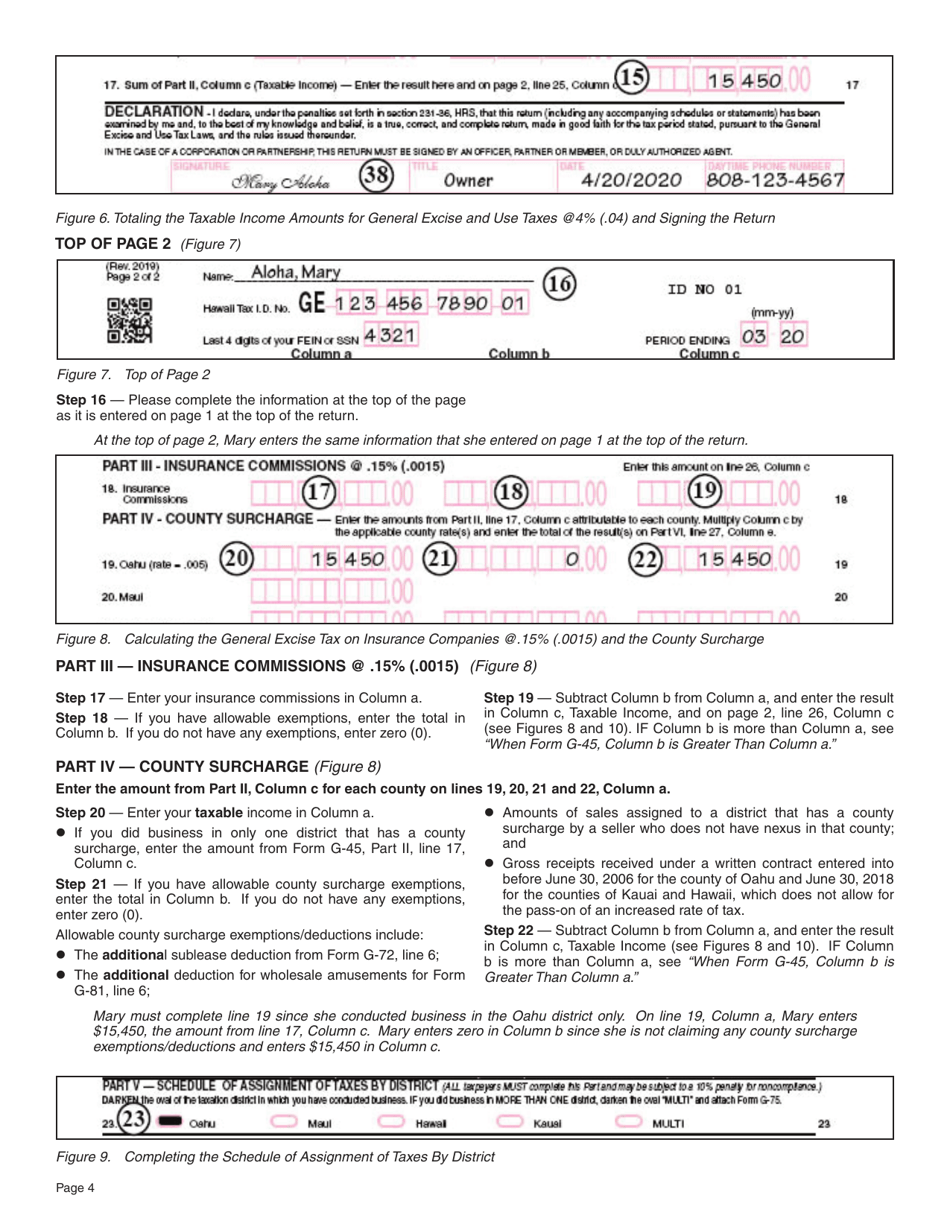

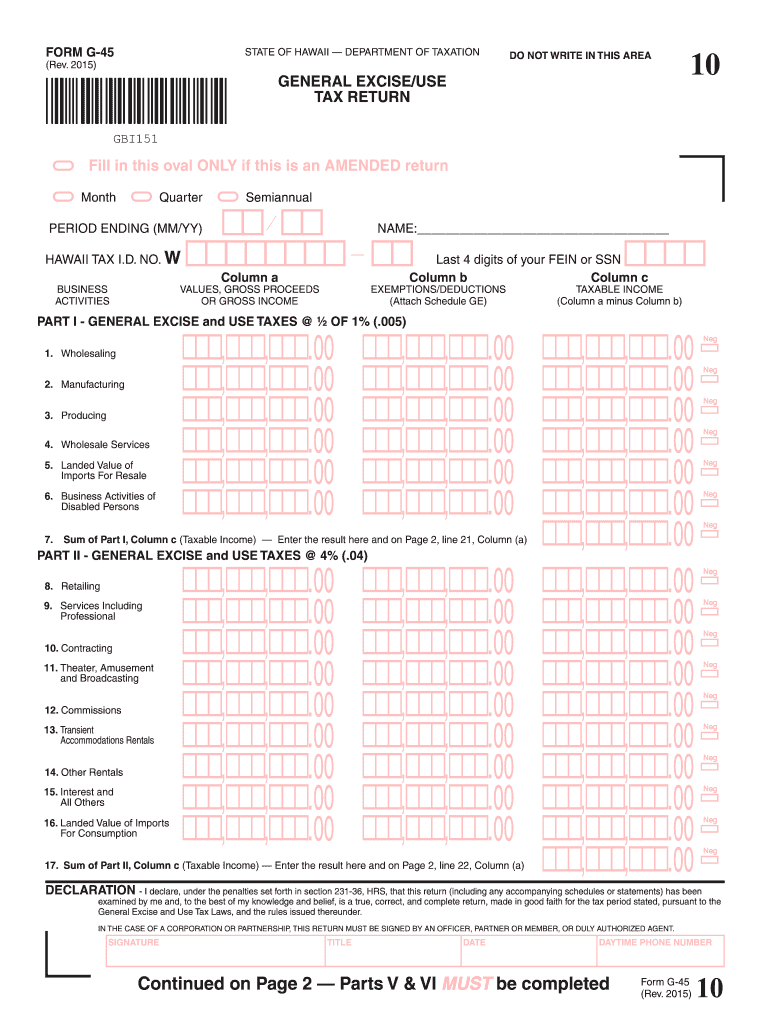

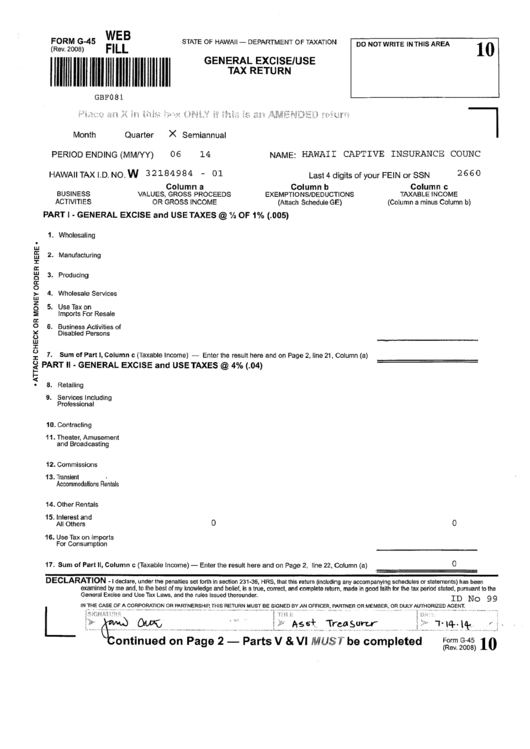

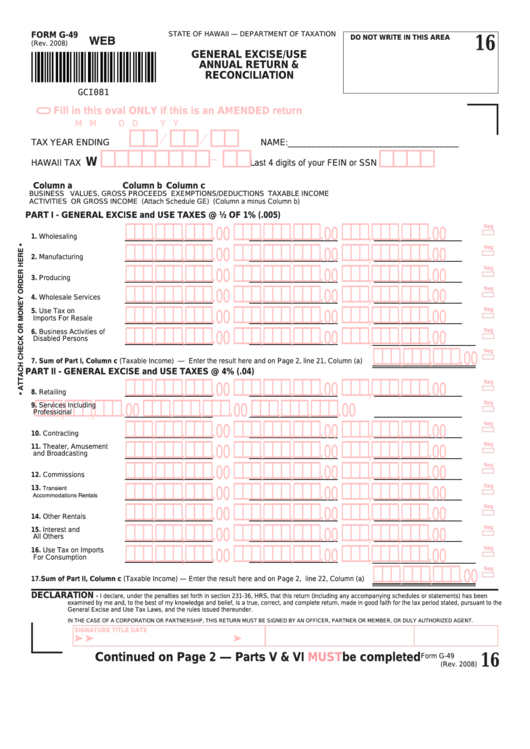

Form G 45 Hawaii General Excise Tax - The get is a privilege tax imposed on business activity in the state of hawaii. General excise/use tax schedule of exemptions and deductions. These activities include wholesale sales and sales of. Ad pdffiller.com has been visited by 1m+ users in the past month Web the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale services, and use tax on imports for resale, and. Get your online template and fill it in using progressive features. 2020) state of hawaii — department of taxation. How to fill out and sign g45 hawaii online? The statewide normal tax rate is 4%. Complete, edit or print tax forms instantly. How to fill out and sign g45 hawaii online? General excise/use tax schedule of exemptions and deductions. The statewide normal tax rate is 4%. Enjoy smart fillable fields and interactivity. Place an x in this. Get your online template and fill it in using progressive features. In this walkthrough video, i show you how to file a g45 general excise tax return online with revenue and 1 deduction for both 1 island. Instructions for filing a one time use general excise. Web how much is hawaii ge tax? Do not write in this area 10. But on oahu, kauai, and the big island there is a 0.5% surcharge. Do not write in this area 10. The statewide normal tax rate is 4%. Web the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale services, and use tax on imports for resale, and. How to fill out and sign g45 hawaii online? Do not write in this area 10. = fill in this oval. The tax is imposed on the gross income received by the person engaging in the. General excise / use tax return. Place an x in this. Instructions for filing a one time use general excise. Do not write in this area 10. 2021) state of hawaii — department of taxation. These activities include wholesale sales and sales of. Web how much is hawaii ge tax? 3.7k views 3 years ago. Web the general excise tax is imposed on business and applies different rates to gross (sales) from business activities in hawaii. Get your online template and fill it in using progressive features. 2018) state of hawaii — department of taxation. General excise/use tax schedule of exemptions and deductions. 2019) state of hawaii — department of taxation. 2008) 10 state of hawaii — department of taxation do not write in this area. Place an x in this. State of hawaii — department of taxation. But on oahu, kauai, and the big island there is a 0.5% surcharge. In this walkthrough video, i show you how to file a g45 general excise tax return online with revenue and 1 deduction for both 1 island. Do not write in this area. General excise / use tax return. County surcharge on general excise and use tax. Complete, edit or print tax forms instantly. 2020) state of hawaii — department of taxation. General excise/use tax schedule of exemptions and deductions. Periodic general excise / use tax return: How to fill out and sign g45 hawaii online? Do not write in this area 10. 2020) state of hawaii — department of taxation. County surcharge on general excise and use tax. The get is a privilege tax imposed on business activity in the state of hawaii. General excise/use tax schedule of exemptions and deductions. 2018) state of hawaii — department of taxation. Enjoy smart fillable fields and interactivity. General excise/use tax schedule of exemptions and deductions. 3.7k views 3 years ago. General excise/use tax schedule of exemptions and deductions. Web the general excise tax is imposed on business and applies different rates to gross (sales) from business activities in hawaii. Web the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale services, and use tax on imports for resale, and. Periodic general excise / use tax return: But on oahu, kauai, and the big island there is a 0.5% surcharge. 2008) 10 state of hawaii — department of taxation do not write in this area. Instructions for filing a one time use general excise. = fill in this oval. The statewide normal tax rate is 4%. County surcharge on general excise and use tax. In this walkthrough video, i show you how to file a g45 general excise tax return online with revenue and 1 deduction for both 1 island. Do not write in this area. 2019 form for taxable periods beginning on. General excise / use tax return. The get is a privilege tax imposed on business activity in the state of hawaii. 2018) state of hawaii — department of taxation. The tax is imposed on the gross income received by the person engaging in the.Hawaii Form G 45 Fillable Printable Forms Free Online

Download Instructions for Form G45 General Excise/Use Tax Return PDF

Hawaii General Excise/Use Tax Return Form G45 DocHub

Hawaii Tax Form G45 printable pdf download

Ge 45 Form Fillable Printable Forms Free Online

General Excise and Use Tax Department of Taxation Hawaii Gov Fill Out

Form G 45 Hawaii General Excise Tax Tax Walls

Form G45 Fill Out, Sign Online and Download Fillable PDF, Hawaii

Form G45 (G49) Schedule GE Download Fillable PDF or Fill Online

Hawaii General Excise Tax Id Number

Related Post: