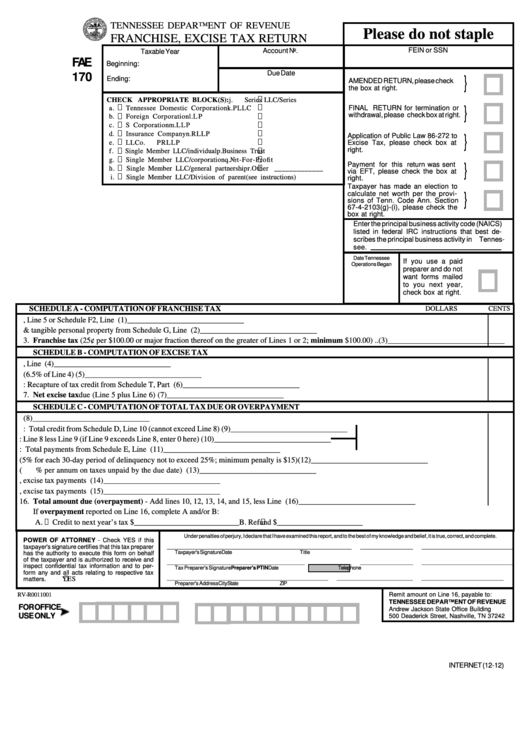

Form Fae 170

Form Fae 170 - Web these taxes are reported and paid with form fae 170, due on april 15th each year, for the preceding year. See the fae 170 instructions for information on how. Total net worth schedule f1, line 5 or schedule f2, line 3. For detailed information on creating llc activities, click the processing 1040 tennessee. Web e) taxpayer has filed the prescribed form to revoke its election made per tenn. Easily fill out pdf blank, edit, and sign them. A return is required for every fiscal closing of the books of each taxpayer and will coincide with each federal return. Web form fae 170 is due 3 1/2 months after the entity’s year end. The franchise and excise tax return is due on the 15th day of the fourth month following. Web fae 170 if this is an amended return, please} check the box at right. Web these taxes are reported and paid with form fae 170, due on april 15th each year, for the preceding year. This form is for income earned in tax year 2022, with tax. Total net worth schedule f1, line 5 or schedule f2, line 3. Web e) taxpayer has filed the prescribed form to revoke its election made per tenn.. Web e) taxpayer has filed the prescribed form to revoke its election made per tenn. Save or instantly send your ready documents. Web the way to fill out the tn form 170 instructions on the internet: Web form fae170 returns, schedules and instructions for prior years for tax years beginning on or after 1/1/21, and ending on or before 12/31/21. See the fae 170 instructions for information on how. To get started on the document, utilize the fill camp; The kit does include financial. Web how to generate an signature for your tn fae 170 fillable form in the online mode. The franchise and excise tax return is due on the 15th day of the fourth month following. Web form fae 170 is due 3 1/2 months after the entity’s year end. Total net worth schedule f1, line 5 or schedule f2, line 3. See the fae 170 instructions for information on how. Web these taxes are reported and paid with form fae 170, due on april 15th each year, for the preceding year. Sign online button or. Web use this screen to enter information for form fae 170, franchise excise tax return. The kit does include financial. Dollars cents tennessee department of revenue franchise, excise tax. Web form fae 172, estimated franchise and excise tax declaration; This form is for income earned in tax year 2022, with tax. Total net worth schedule f1, line 5 or schedule f2, line 3. Web form fae170 returns, schedules and instructions for prior years for tax years beginning on or after 1/1/21, and ending on or before 12/31/21 form fae170. Web form fae 172, estimated franchise and excise tax declaration; Web fae 170 dollars cents tennessee department of revenue franchise, excise tax. Complete, sign, print and send your tax documents easily with us legal forms. Download blank or fill out online in pdf format. Dollars cents tennessee department of revenue franchise, excise tax. Web fae 170 if this is an amended return, please} check the box at right. The kit does include financial. Save or instantly send your ready documents. The franchise and excise tax return is due on the 15th day of the fourth month following. Download blank or fill out online in pdf format. Web e) taxpayer has filed the prescribed form to revoke its election made per tenn. Total net worth schedule f1, line 5 or schedule f2, line 3. Web of $200 or more is requested on line b of an amended return, a report of debts form must be completed and filed with the return. To get started on the document, utilize the fill camp; Web these taxes are reported and paid with form fae 170, due on april 15th each year, for the preceding year. Dollars cents. Complete, sign, print and send your tax documents easily with us legal forms. Web the way to fill out the tn form 170 instructions on the internet: Easily fill out pdf blank, edit, and sign them. Fae 183 return types not accepted: Web form fae170 returns, schedules and instructions for prior years for tax years beginning on or after 1/1/21,. Web how to generate an signature for your tn fae 170 fillable form in the online mode. Web fae 170 if this is an amended return, please} check the box at right. Fae 183 return types not accepted: Web e) taxpayer has filed the prescribed form to revoke its election made per tenn. Web form fae 170 is due 3 1/2 months after the entity’s year end. A return is required for every fiscal closing of the books of each taxpayer and will coincide with each federal return. Web use this screen to enter information for form fae 170, franchise excise tax return. Web fae 170 dollars cents tennessee department of revenue franchise, excise tax return taxable year fein or ssn beginning: Web for individual (1040) returns, form 170 would be potentially filed by smllcs that file schedule c profit or loss from business (sole proprietorship) with their federal 1040. Web form fae170 returns, schedules and instructions for prior years for tax years beginning on or after 1/1/21, and ending on or before 12/31/21 form fae170. To get started on the document, utilize the fill camp; Easily fill out pdf blank, edit, and sign them. Web form fae 172, estimated franchise and excise tax declaration; See the fae 170 instructions for information on how. Web the way to fill out the tn form 170 instructions on the internet: Download blank or fill out online. The franchise and excise tax return is due on the 15th day of the fourth month following. Web these taxes are reported and paid with form fae 170, due on april 15th each year, for the preceding year. The kit does include financial. For detailed information on creating llc activities, click the processing 1040 tennessee.Fae 170 Form ≡ Fill Out Printable PDF Forms Online

USCIS I130 2017 Fill and Sign Printable Template Online US Legal Forms

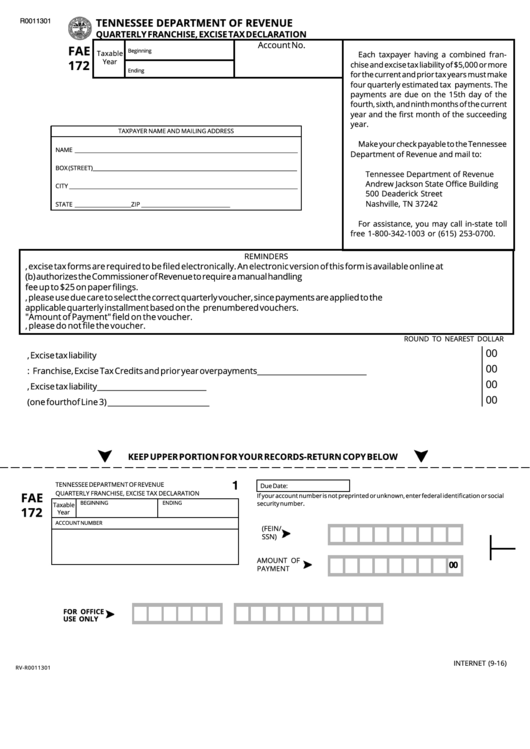

Form Fae 172 Quarterly Franchise, Excise Tax Declaration Tennessee

Form Fae 170 ≡ Fill Out Printable PDF Forms Online

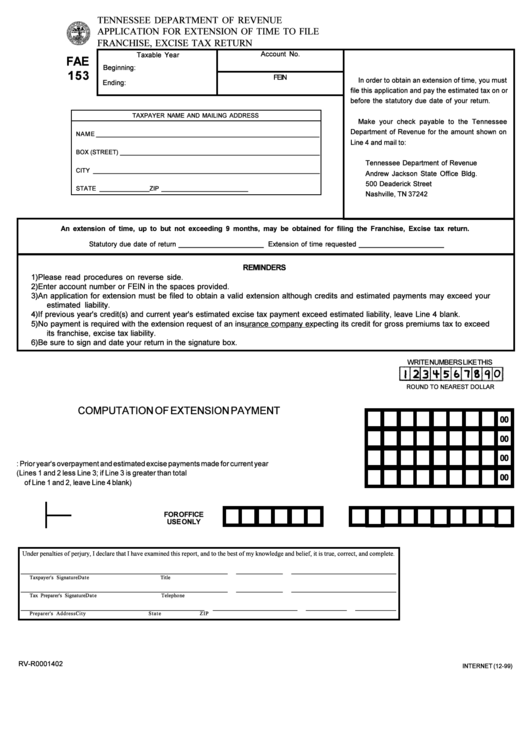

Form Fae 153 Application For Extension Of Time To File Franchise

Fae 170 Form ≡ Fill Out Printable PDF Forms Online

Fae 170 Form ≡ Fill Out Printable PDF Forms Online

Form Fae 170 Franchise, Excise Tax Return printable pdf download

20172020 Form TN DoR FAE 170 Fill Online, Printable, Fillable, Blank

Download Instructions for Form FAE170, RVR0011001 Franchise and Excise

Related Post: