Form Ct 706 Nt

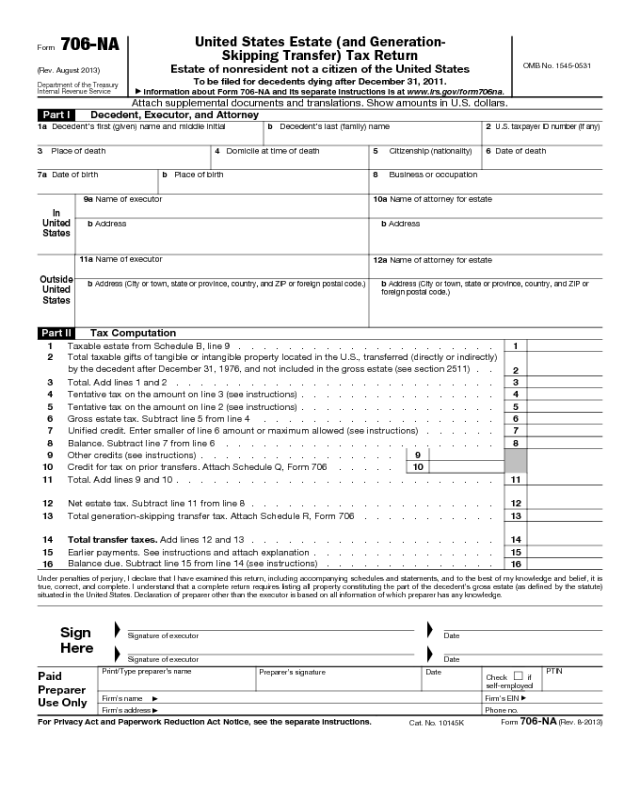

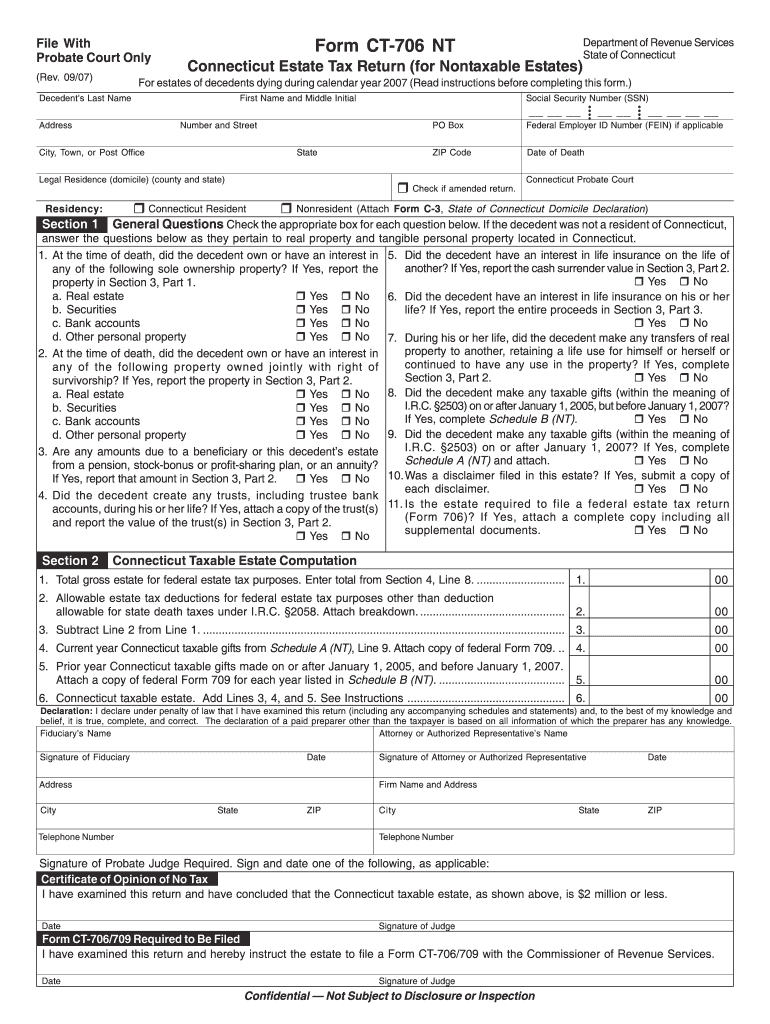

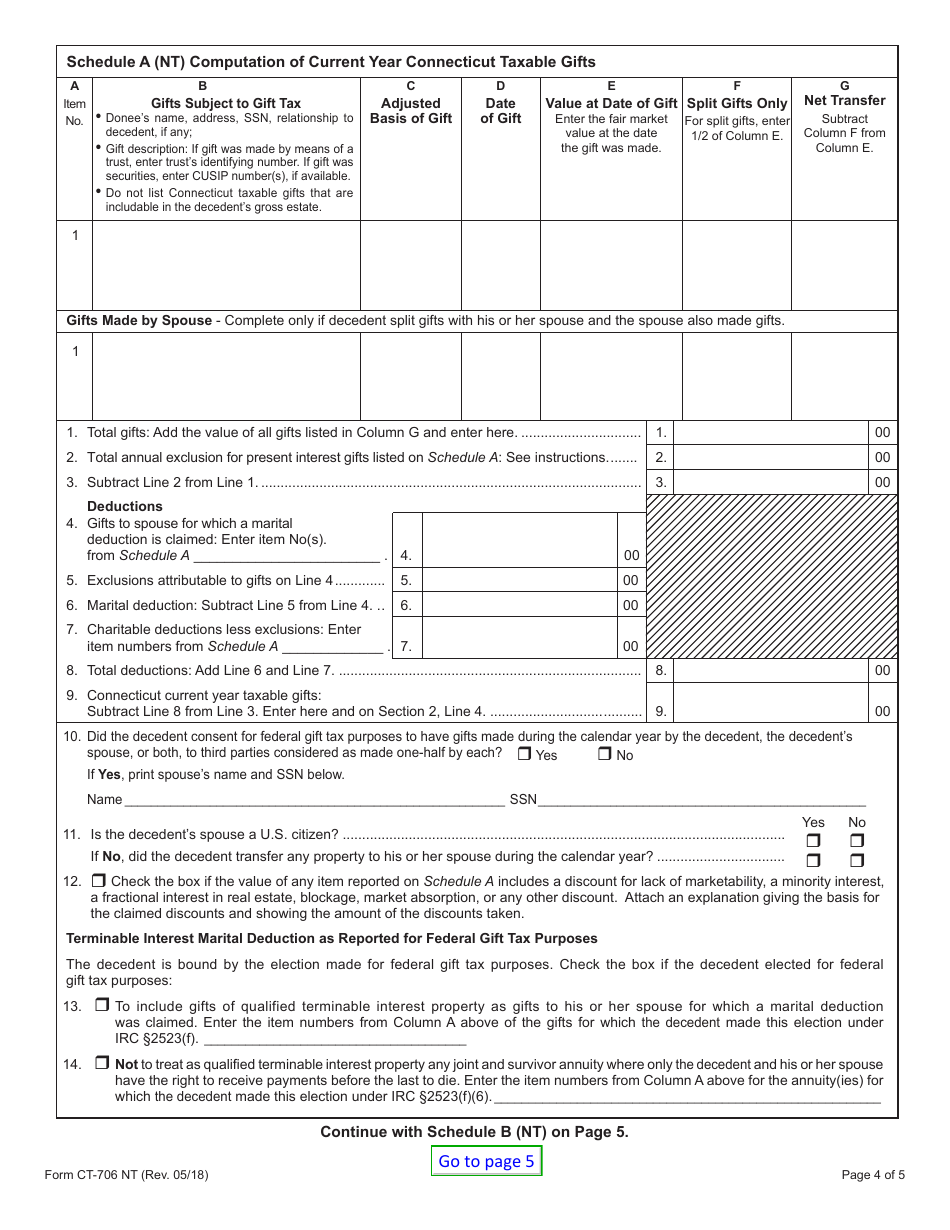

Form Ct 706 Nt - Web form ct‑706 nt nothing to be filed copy of form ct‑706/709 form ct‑706/709 copy of form ct‑706/709 form ct‑706/709 connecticut taxable estate is less than or equal to. Web where applicable, the code will link directly to information on the type of probate matter associated with the form. For each decedent who, at the time of death, was a nonresident of. Each decedent who, at the time of death, was a connecticut resident; Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. Web form ct‐706 nt must be filed for: Life insurance statement (estates must complete and attach federal form 712 to. Save or instantly send your ready documents. Application for certificate releasing connecticut estate tax lien for estates of decedents dying on or after january 1, 2005. Easily fill out pdf blank, edit, and sign them. Each decedent who, at the time of death, was a connecticut resident; Life insurance statement (estates must complete and attach federal form 712 to. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. For each decedent who, at the time of death, was a nonresident of. Web where applicable, the code will link directly to information on the type of probate matter associated with the form. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. Web form ct‐706 nt must be filed for: Save or instantly send your ready documents. Each decedent who, at. Life insurance statement (estates must complete and attach federal form 712 to. Save or instantly send your ready documents. Web where applicable, the code will link directly to information on the type of probate matter associated with the form. For each decedent who, at the time of death, was a nonresident of. Web form ct‑706 nt nothing to be filed. Web form ct‑706 nt nothing to be filed copy of form ct‑706/709 form ct‑706/709 copy of form ct‑706/709 form ct‑706/709 connecticut taxable estate is less than or equal to. Save or instantly send your ready documents. Web where applicable, the code will link directly to information on the type of probate matter associated with the form. Life insurance statement (estates. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. Application for certificate releasing connecticut estate tax lien for estates of decedents dying on or after january 1, 2005. Save or instantly send your ready documents. Life insurance statement (estates must complete and attach federal form 712 to. Easily. Web form ct‑706 nt nothing to be filed copy of form ct‑706/709 form ct‑706/709 copy of form ct‑706/709 form ct‑706/709 connecticut taxable estate is less than or equal to. Save or instantly send your ready documents. Web where applicable, the code will link directly to information on the type of probate matter associated with the form. Application for certificate releasing. Web where applicable, the code will link directly to information on the type of probate matter associated with the form. Each decedent who, at the time of death, was a connecticut resident; Save or instantly send your ready documents. For each decedent who, at the time of death, was a nonresident of. Web form ct‑706 nt nothing to be filed. Web form ct‑706 nt nothing to be filed copy of form ct‑706/709 form ct‑706/709 copy of form ct‑706/709 form ct‑706/709 connecticut taxable estate is less than or equal to. For each decedent who, at the time of death, was a nonresident of. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web form ct‐706 nt must be filed for: Each decedent who, at the time of death, was a connecticut resident; Life insurance statement (estates must complete and attach federal form 712 to. Save or instantly send your ready documents. Each decedent who, at the time of death, was a connecticut resident; Web where applicable, the code will link directly to information on the type of probate matter associated with the form. Easily fill out pdf blank, edit, and sign them. Web form ct‑706 nt nothing to be filed copy of form ct‑706/709. Web where applicable, the code will link directly to information on the type of probate matter associated with the form. Each decedent who, at the time of death, was a connecticut resident; Application for certificate releasing connecticut estate tax lien for estates of decedents dying on or after january 1, 2005. Life insurance statement (estates must complete and attach federal form 712 to. Web form ct‐706 nt must be filed for: Web form ct‑706 nt nothing to be filed copy of form ct‑706/709 form ct‑706/709 copy of form ct‑706/709 form ct‑706/709 connecticut taxable estate is less than or equal to. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. For each decedent who, at the time of death, was a nonresident of.Form 706 Na Instructions

Connecticut ct 706 nt Fill out & sign online DocHub

Ct 706 Nt 20202021 Fill and Sign Printable Template Online US

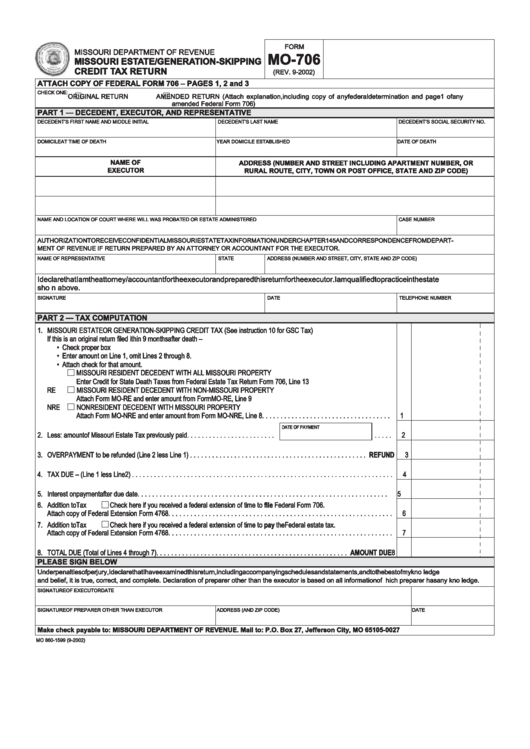

Form Mo706 Missouri Estate/generationSkipping Credit Tax Return

CA MC 706 M (formerly DMV 7061) 2016 Fill and Sign Printable

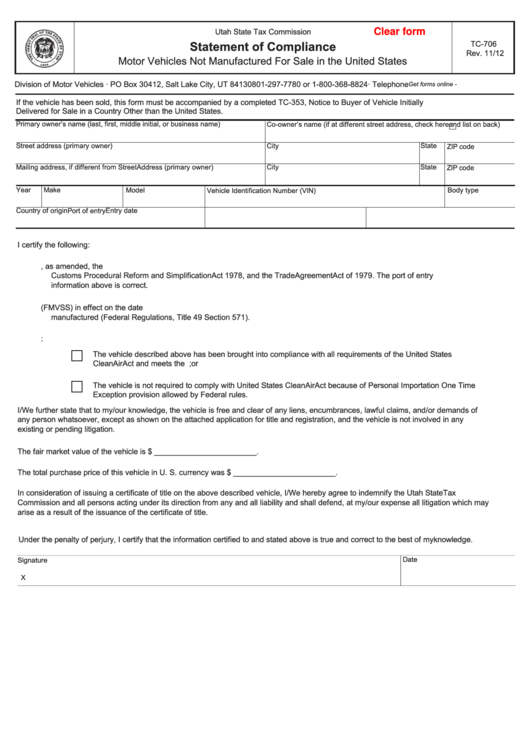

Fillable Form Tc706 Affidavit Of Compliance Motor Vehicles Not

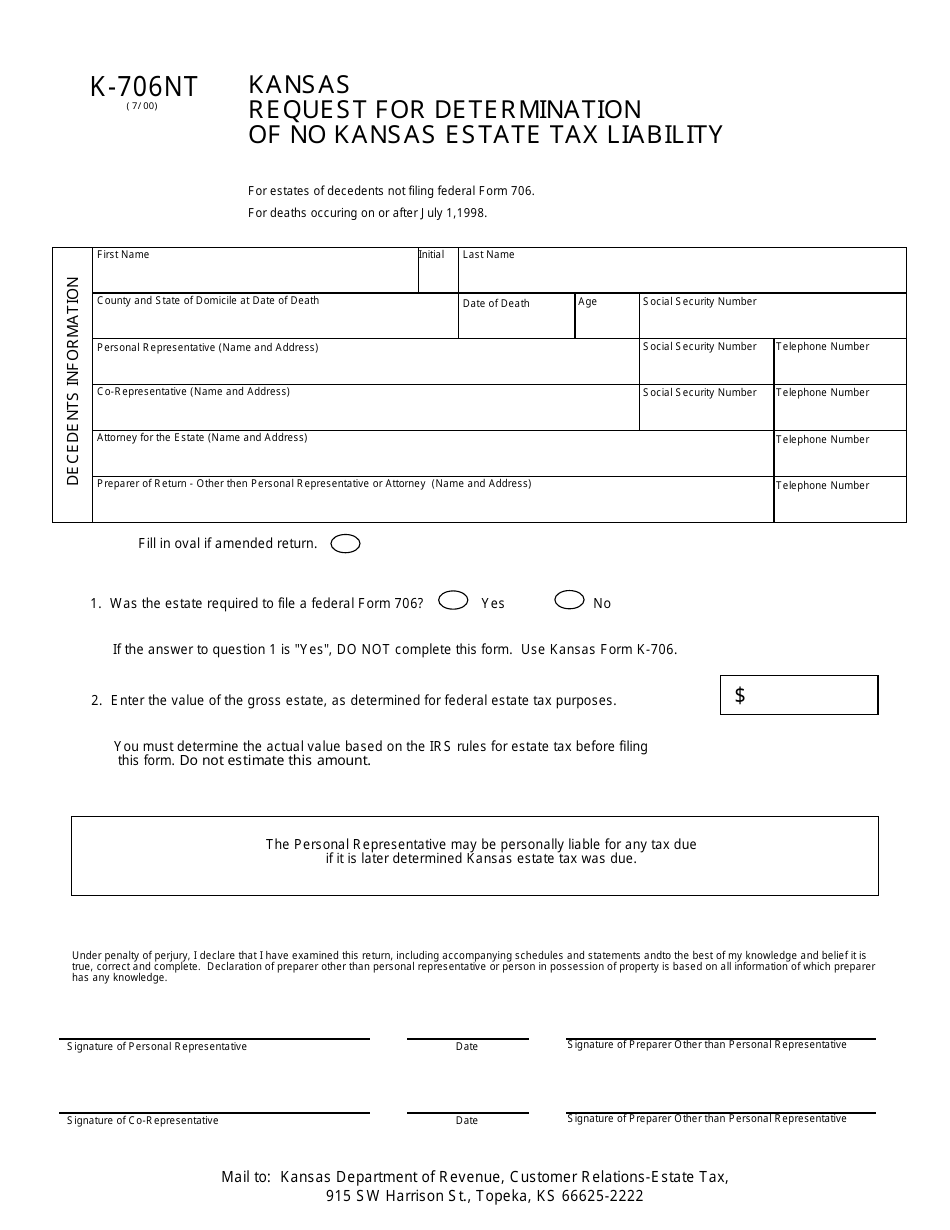

Form K706NT Download Fillable PDF or Fill Online Request for

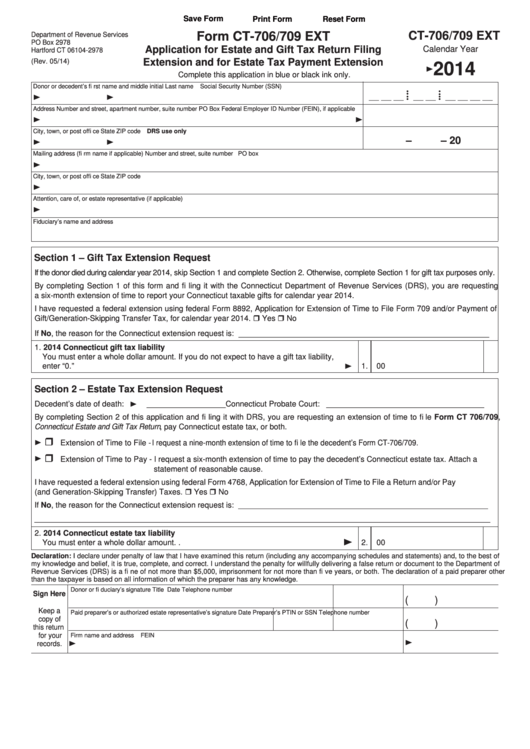

Fillable Form Ct706/709 Ext Connecticut Application For Estate And

2007 ct 706 nt form Fill out & sign online DocHub

Form CT706 NT Fill Out, Sign Online and Download Fillable PDF

Related Post: