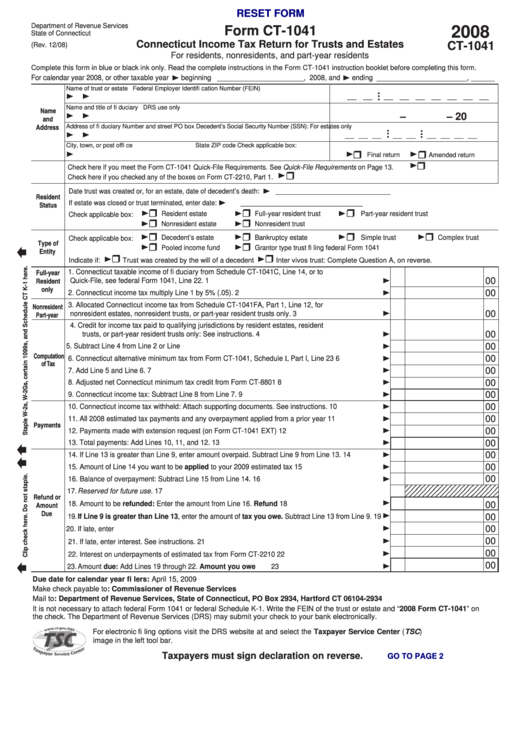

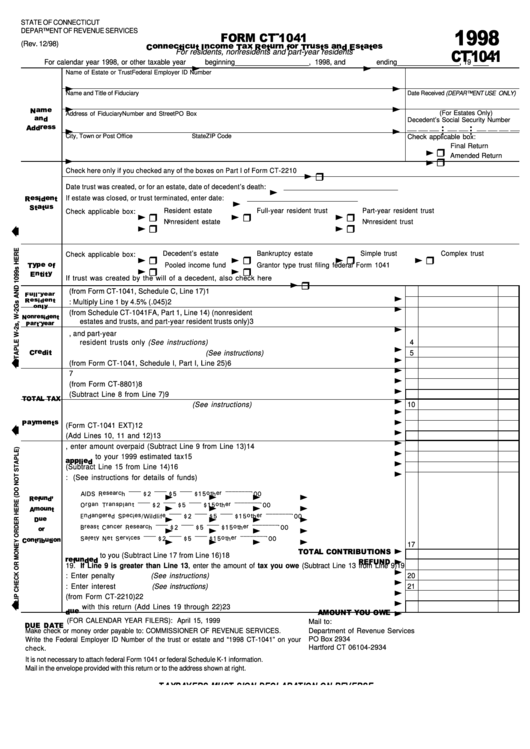

Form Ct 1041

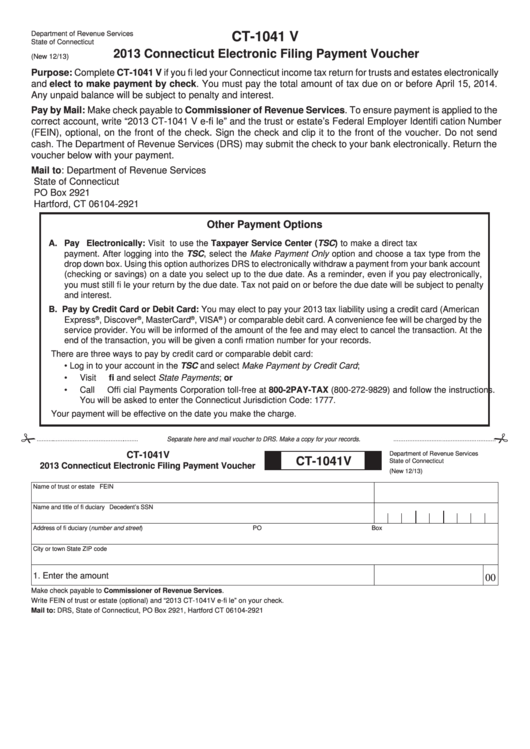

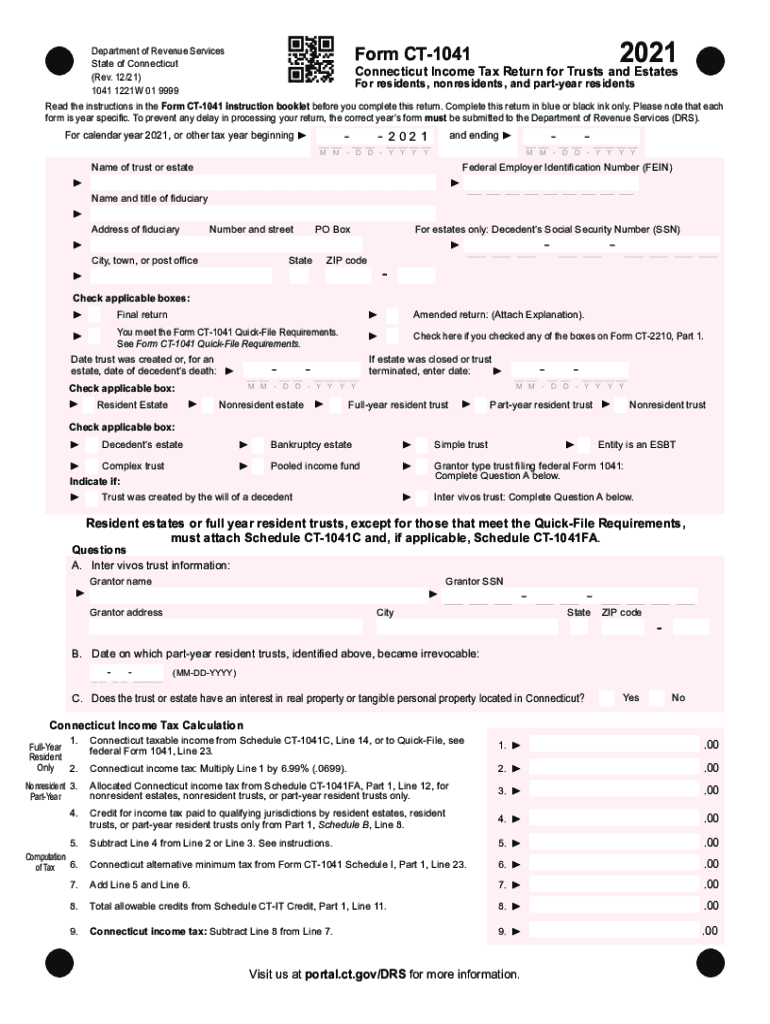

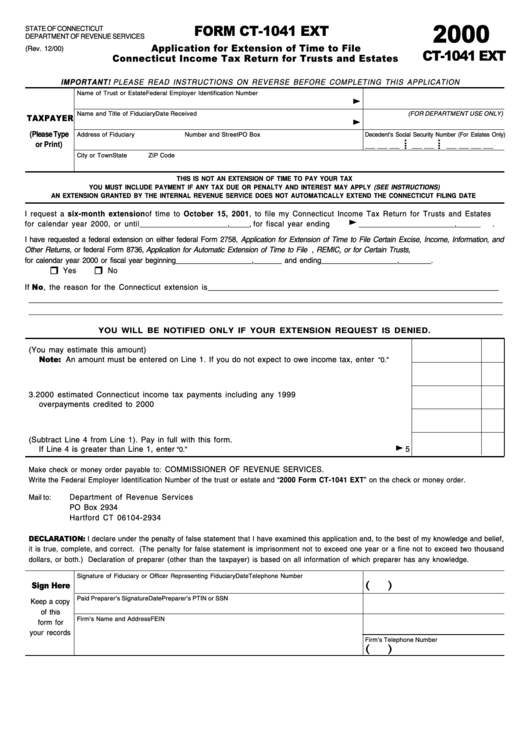

Form Ct 1041 - Please note that each form is year specific. See form ct‑1041 quick‑file requirements. You must pay the total. Web form ct‑1041 schedule i (rev. Type of trust or estate: Name of trust or estate federal employer id number. 12/20) page 3 of 4 instructions for form ct‑1041 schedule i purpose: Web form ct 1041 ext, application for extension of time to file connecticut income tax return for trusts and estates, through the electronic tsc. Check here if you checked any of the boxes on form ct‑2210, part 1. Complete this schedule in blue or black ink only. Web fiduciary allocation 2022 schedule ct‐1041fa can be filed electronically. Type of trust or estate: Please note that each form is year specific. You must pay the total. See form ct‑1041 quick‑file requirements. Pay the amount shown on line 5. Complete form ct‑1041v if you filed your connecticut income tax return for trusts and estates electronically and elect to make payment by check. The tsc is an interactive tool. Web form ct 1041 ext, application for extension of time to file connecticut income tax return for trusts and estates, through the electronic tsc.. 12/21) application for extension of time to file 1041ext 1221w 01 9999 connecticut income tax return for trusts and estates. 12/20) page 3 of 4 instructions for form ct‑1041 schedule i purpose: Certain agricultural employers may request permission to file one. File it on or before the due date of the return; Web fiduciary allocation 2022 schedule ct‐1041fa can be. Type of trust or estate: Drs will notify you only if your request is. File it on or before the due date of the return; You must pay the total. 2022 connecticut income tax return for trusts and estates. Web department of revenue services state of connecticut form ct‐1041es 2022 estimated connecticut income tax payment coupon for trusts and estates 2022 (rev. Please note that each form is year specific. 12/21) application for extension of time to file 1041ext 1221w 01 9999 connecticut income tax return for trusts and estates. The tsc is an interactive tool. Check here if. Complete form ct‑1041 ext in its entirety; Pay the amount shown on line 5. See form ct‑1041 quick‑file requirements. Web form ct‑1041 schedule i (rev. Type of trust or estate: Web fiduciary allocation 2022 schedule ct‐1041fa can be filed electronically. Complete form ct‑1041v if you filed your connecticut income tax return for trusts and estates electronically and elect to make payment by check. Web form ct 1041 ext, application for extension of time to file connecticut income tax return for trusts and estates, through the electronic tsc. Federal taxable income. Complete form ct‑1041 ext in its entirety; Web fiduciary allocation 2022 schedule ct‐1041fa can be filed electronically. File it on or before the due date of the return; Name of trust or estate federal employer id number. You must pay the total. Pay the amount shown on line 5. File it on or before the due date of the return; Web form ct‑1041 schedule i (rev. 12/21) application for extension of time to file 1041ext 1221w 01 9999 connecticut income tax return for trusts and estates. The tsc is an interactive tool. 2022 connecticut income tax return for trusts and estates. Web you meet the form ct‑1041 quick‑file requirements. Web form ct 1041 ext, application for extension of time to file connecticut income tax return for trusts and estates, through the electronic tsc. Complete this schedule in blue or black ink only. Trusts or estates subject to and required to pay the. Complete form ct‑1041 ext in its entirety; Web department of revenue services state of connecticut form ct‐1041es 2022 estimated connecticut income tax payment coupon for trusts and estates 2022 (rev. Name of trust or estate federal employer id number. Complete form ct‑1041v if you filed your connecticut income tax return for trusts and estates electronically and elect to make payment by check. 12/20) page 3 of 4 instructions for form ct‑1041 schedule i purpose: Federal taxable income of trust or estate from federal form 1041, line. Web you meet the form ct‑1041 quick‑file requirements. Web form ct 1041 ext, application for extension of time to file connecticut income tax return for trusts and estates, through the electronic tsc. Type of trust or estate: You must pay the total. 12/21) application for extension of time to file 1041ext 1221w 01 9999 connecticut income tax return for trusts and estates. Complete this schedule in blue or black ink only. Certain agricultural employers may request permission to file one. Please note that each form is year specific. Type of trust or estate: Pay the amount shown on line 5. Web fiduciary allocation 2022 schedule ct‐1041fa can be filed electronically. Complete form ct‑1041v if you filed your connecticut income tax return for trusts and estates electronically and elect to make payment by check. Web form ct‑1041 schedule i (rev. Trusts or estates subject to and required to pay the federal.Form Ct1041 V Connecticut Electronic Filing Payment Voucher 2013

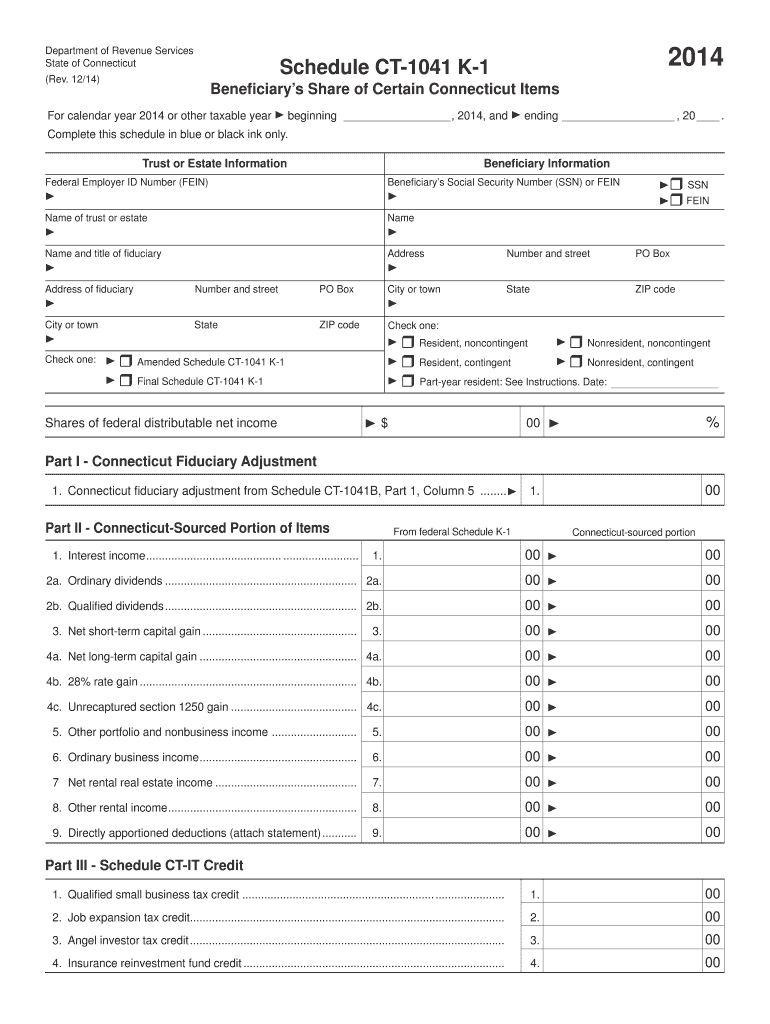

Form Ct 1041 K 1t Fill Out and Sign Printable PDF Template signNow

Ct 1041 Fill Out and Sign Printable PDF Template signNow

Form Ct1041 Ext Application For Extension Of Time To File

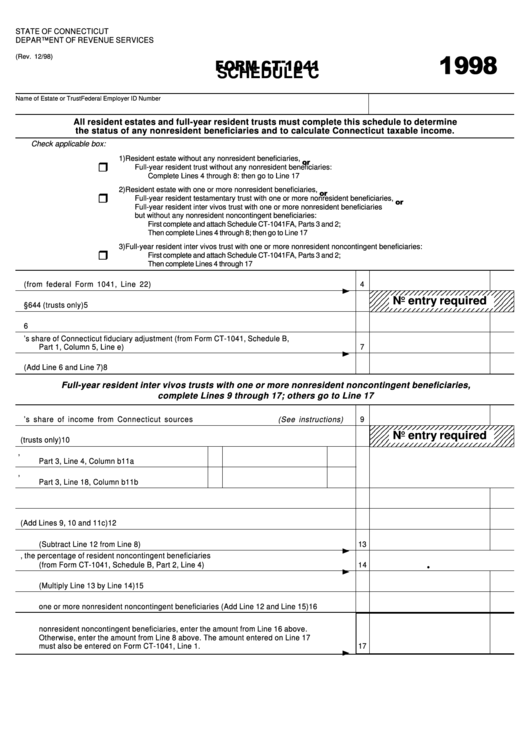

Fillable Form Ct1041 Schedule C Calculation Of Connecticut Taxable

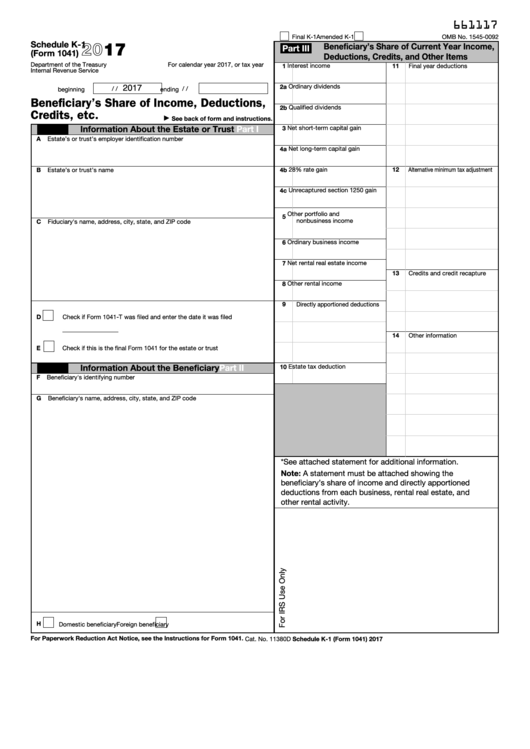

Fillable Schedule K1 (Form 1041) Beneficiary'S Share Of

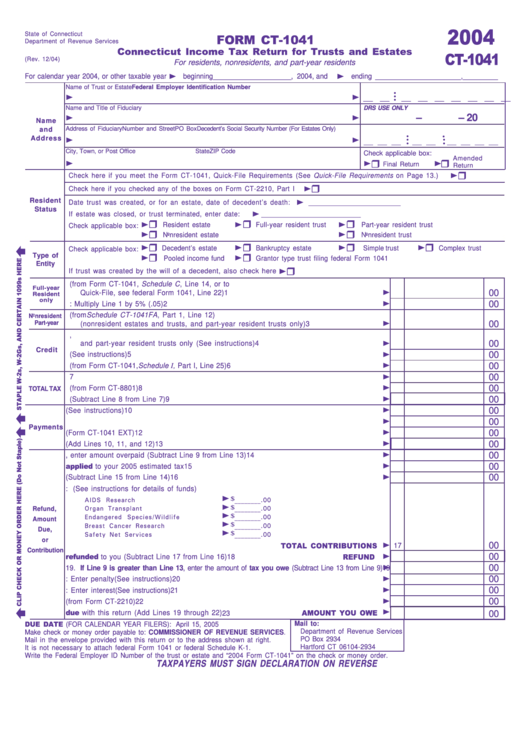

Form Ct1041 Connecticut Tax Return For Trusts And Estates

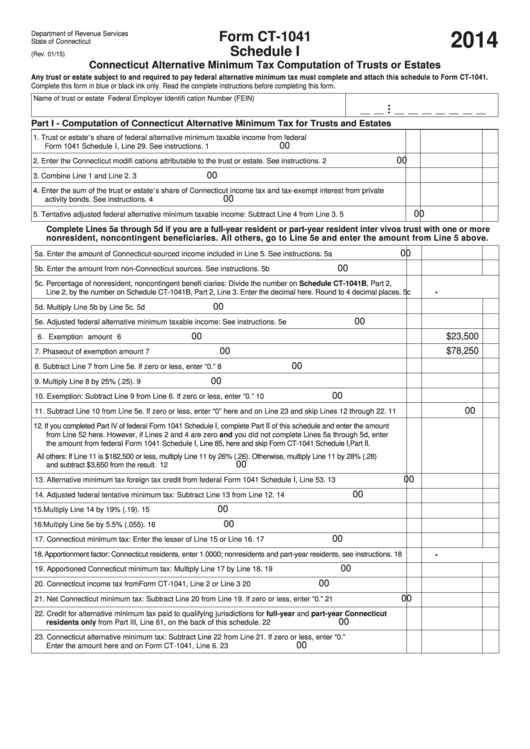

Form Ct1041 Schedule I Connecticut Alternative Minimum Tax

Fillable Form Ct1041 Connecticut Tax Return For Trusts And

Fillable Form Ct1041 Connecticut Tax Return For Trusts And

Related Post: