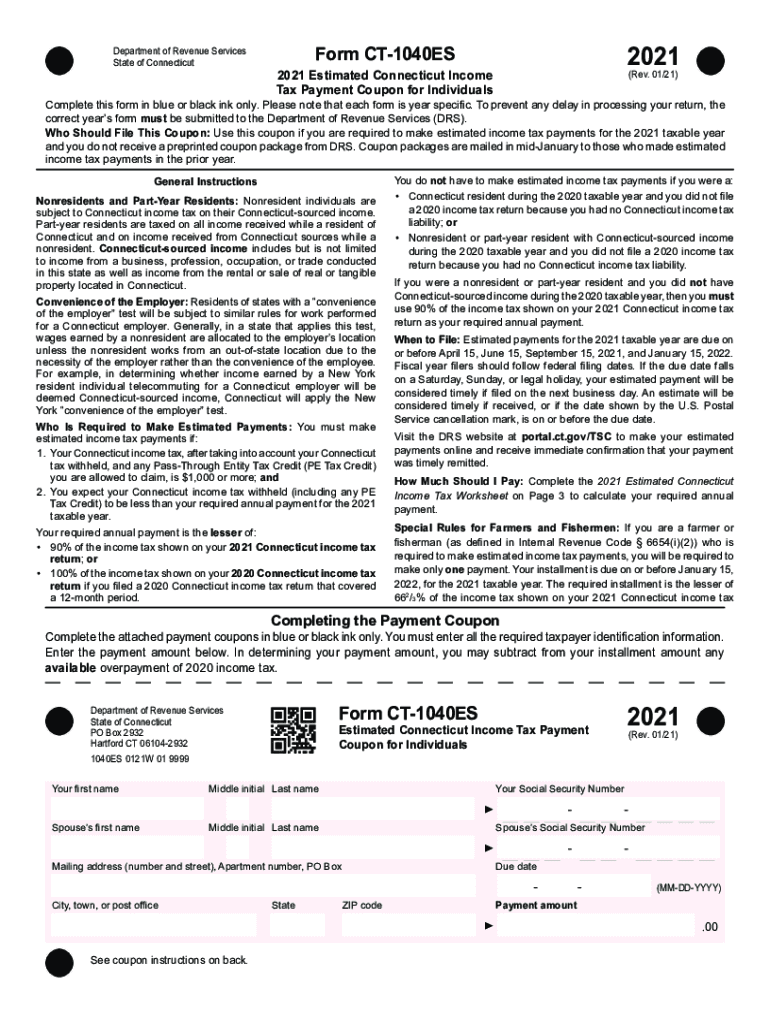

Form Ct 1040Es

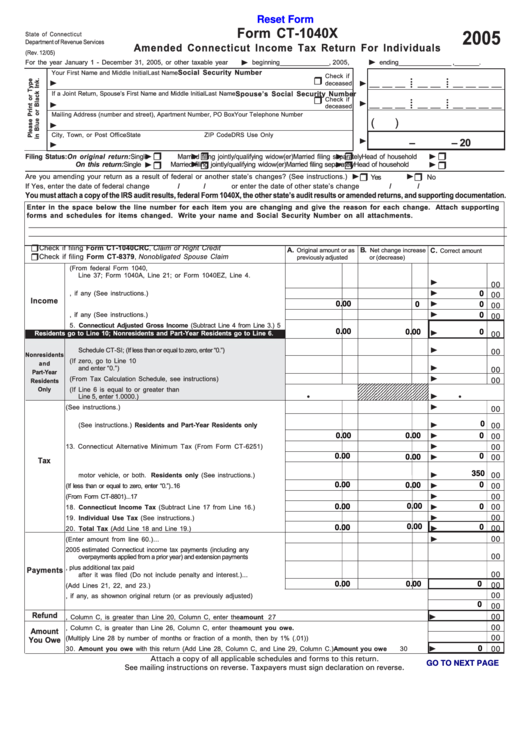

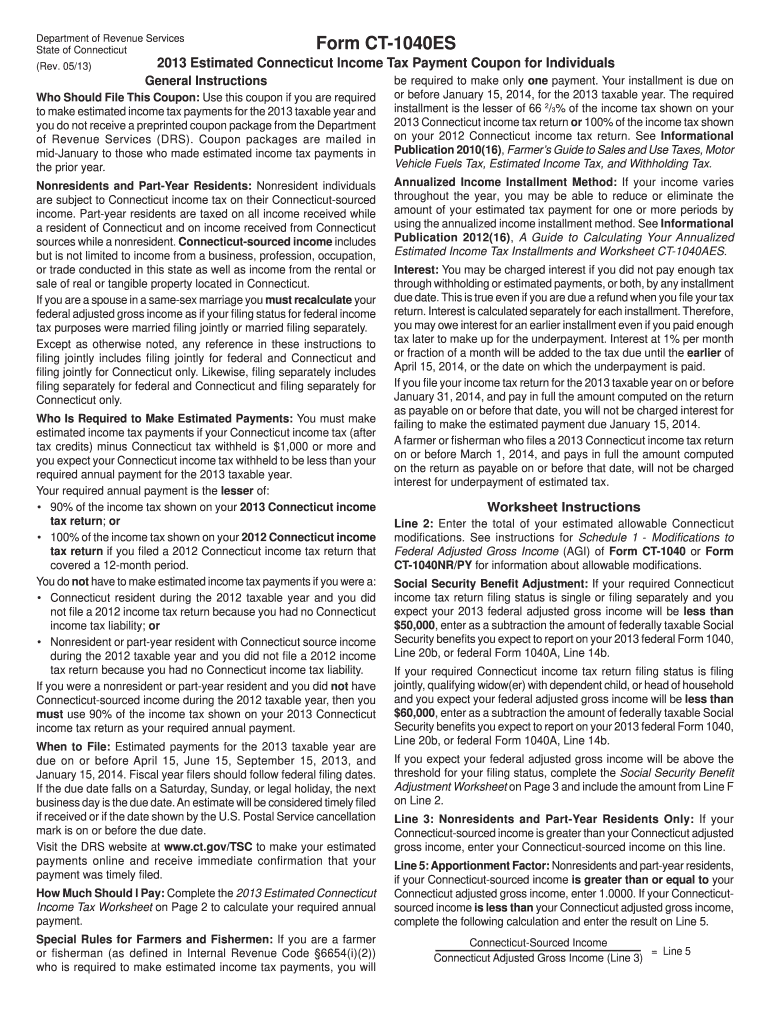

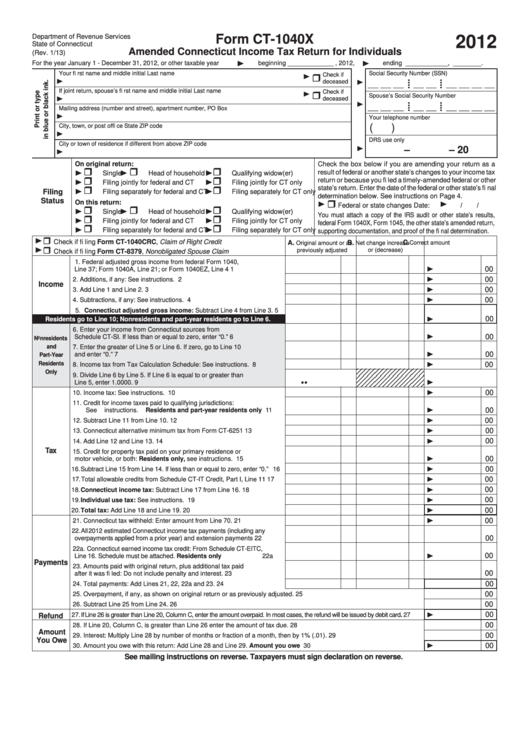

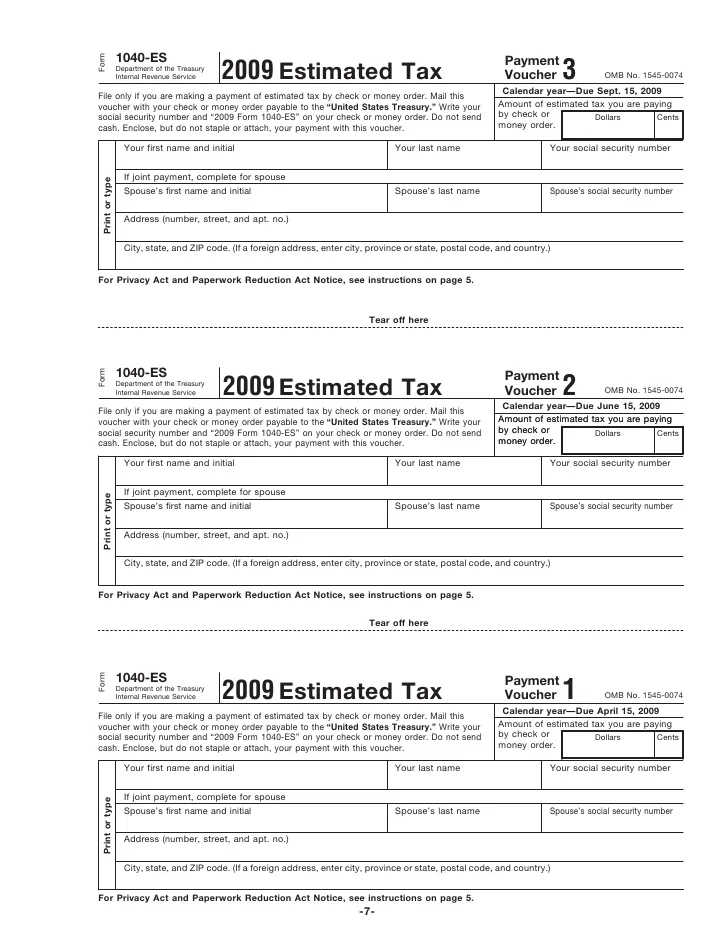

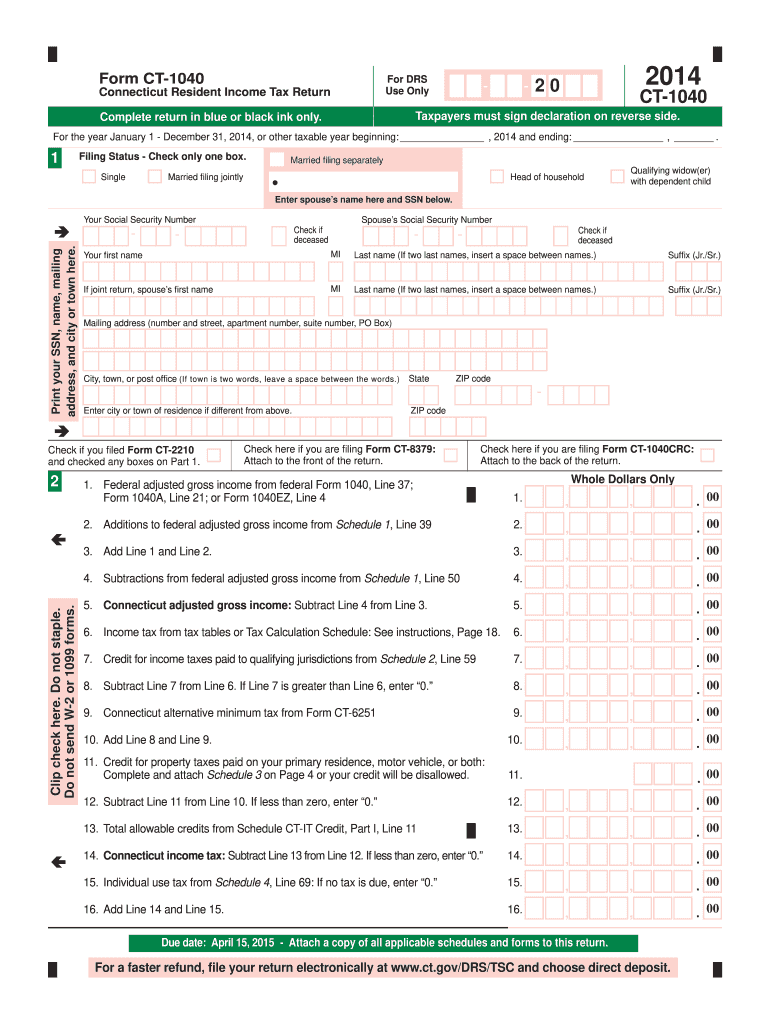

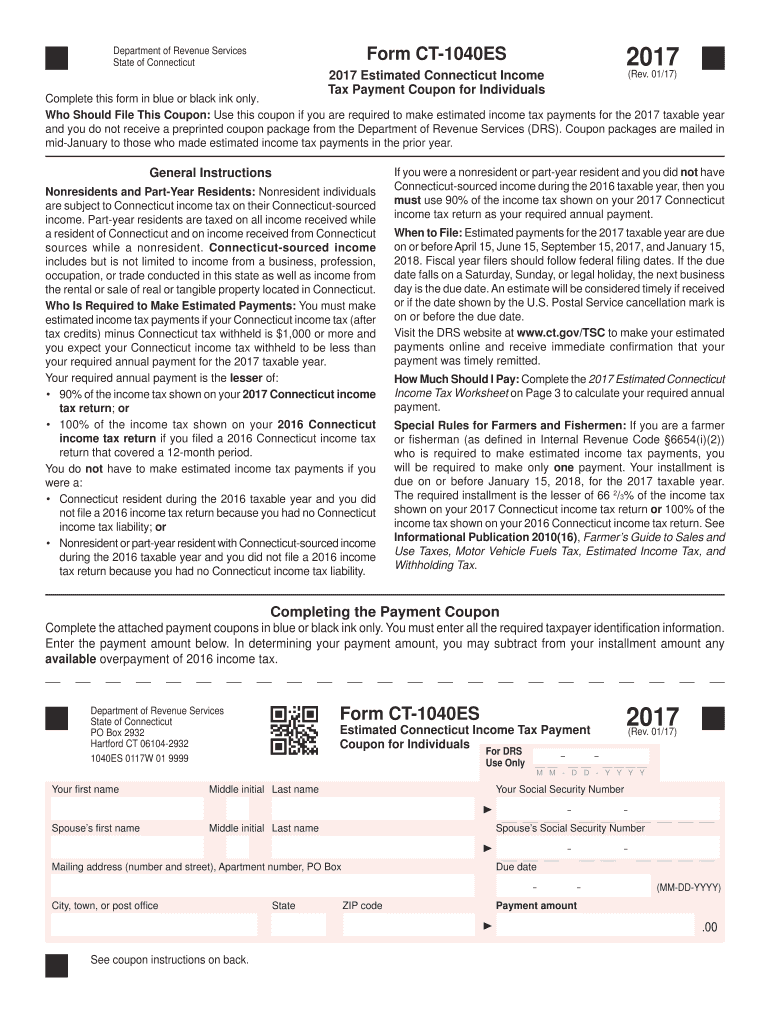

Form Ct 1040Es - 2022 estimated connecticut income tax payment coupon for. Department of the treasury internal revenue service. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. How do i make ct quarterly estimated tax payments? Web department of revenue services state of connecticut. Complete, edit or print tax forms instantly. Ad access irs tax forms. You may also select withholding code “d”. 2023 estimated connecticut income tax payment coupon for individuals: This form is for income earned in tax year 2022, with. Get ready for tax season deadlines by completing any required tax forms today. Web the 2020 form ct‑1041 return or 100% of the connecticut income tax shown on the 2019 form ct‑1041 if a 2019 form ct‑1041 was filed and it covered a 12‑month period. You may also select withholding code “d”. You must pay estimated income tax if you. Web department of revenue services. Web use form ct‑1040es, estimated connecticut income tax payment coupon for individuals, to make estimated connecticut income tax payments for 2023 by mail. You are required to date your. Web connecticut has a state income tax that ranges between 3% and 6.99% , which is administered by the connecticut department of revenue services. 2023 estimated. Connecticut resident income tax return instructions. For additional information on the. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with. Connecticut resident income tax return instructions. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Department of the treasury internal revenue service. Web the 2020 form ct‑1041 return or 100% of the connecticut income tax shown on the 2019 form ct‑1041 if a 2019 form ct‑1041 was filed and it covered. Get ready for tax season deadlines by completing any required tax forms today. For additional information on the. Department of the treasury internal revenue service. Please note that each form is year specific. You may also select withholding code “d”. For additional information on the. Web the 2020 form ct‑1041 return or 100% of the connecticut income tax shown on the 2019 form ct‑1041 if a 2019 form ct‑1041 was filed and it covered a 12‑month period. This form is for income earned in tax year 2022, with. 2023 estimated connecticut income tax payment coupon for individuals: Web connecticut has. 2022 estimated connecticut income tax payment coupon for trusts and estates. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. You may also select withholding code “d”. Web connecticut has a state income tax that ranges between 3% and 6.99% , which is administered by the connecticut department of revenue. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Complete, edit or print tax forms instantly. 2022 estimated connecticut income tax payment coupon for trusts and estates. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Web department of revenue services. Connecticut resident income tax return instructions. How do i make ct quarterly estimated tax payments? You may also select withholding code “d”. 2023 estimated connecticut income tax payment coupon for individuals: Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. 2023 estimated connecticut income tax payment coupon for trusts and estates. Web department of revenue services state of connecticut. 2023 estimated connecticut income tax payment coupon for individuals: What are the filing dates for ct quarterly estimated tax payments? Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Web if you are filing an estimated income tax payment that is due april 15 using form ct‑1040es, estimated connecticut income tax payment coupon for individuals, and. 2022 estimated connecticut income tax payment coupon for. 2023 estimated connecticut income tax payment coupon for individuals: You may also select withholding code “d”. Please note that each form is year specific. Department of the treasury internal revenue service. Web department of revenue services state of connecticut. Connecticut resident income tax return. Web connecticut has a state income tax that ranges between 3% and 6.99% , which is administered by the connecticut department of revenue services. Web use form ct‑1040es, estimated connecticut income tax payment coupon for individuals, to make estimated connecticut income tax payments for 2023 by mail. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. You are required to date your. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. For additional information on the. Web department of revenue services state of connecticut (rev. Web people also ask form ct 1040es. Web the 2020 form ct‑1041 return or 100% of the connecticut income tax shown on the 2019 form ct‑1041 if a 2019 form ct‑1041 was filed and it covered a 12‑month period. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web department of revenue services.Fillable Form Ct1040x Amended Connecticut Tax Return For

Ct 1040es Form Fill Out and Sign Printable PDF Template signNow

Form Ct1040x Amended Connecticut Tax Return For Individuals

Form 1040ES*Estimated Tax for Individuals

Instructions for Ct 1040 Form Fill Out and Sign Printable PDF

Ct 1040 Form Fill Out and Sign Printable PDF Template signNow

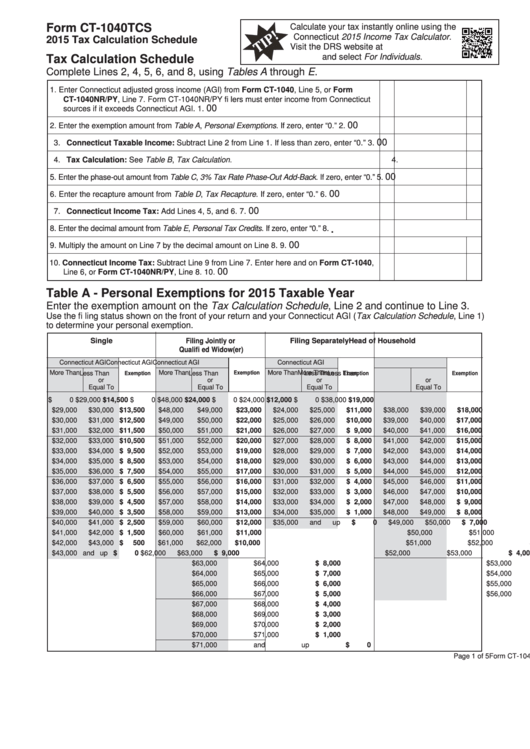

Form Ct1040tcs Tax Calculation Schedule Connecticut 2015

Ct 1040Es Fill Out and Sign Printable PDF Template signNow

Ct 1040Es Fill Out and Sign Printable PDF Template signNow

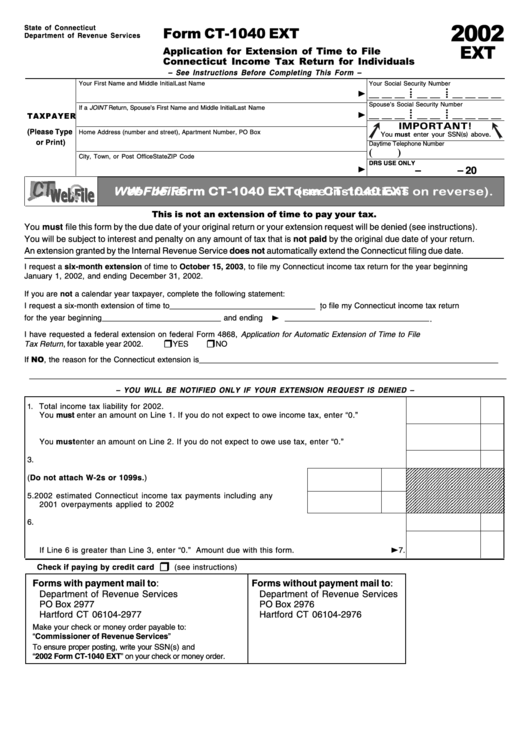

Form Ct1040 Ext Application For Extension Of Time To File

Related Post: