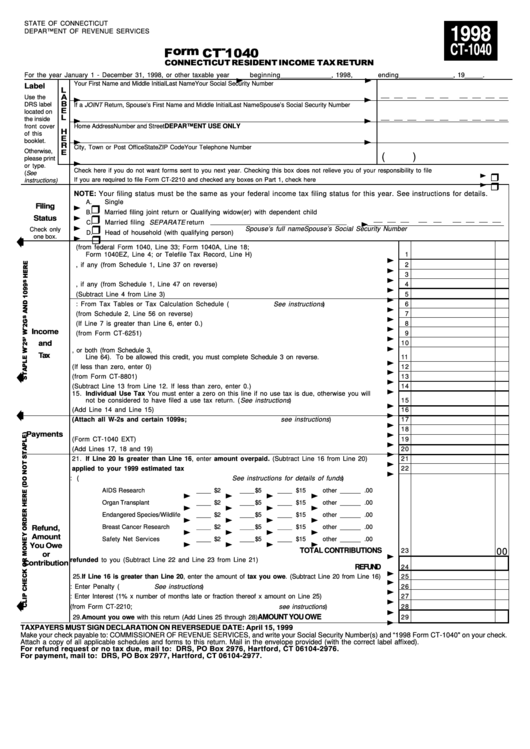

Form Ct 1040

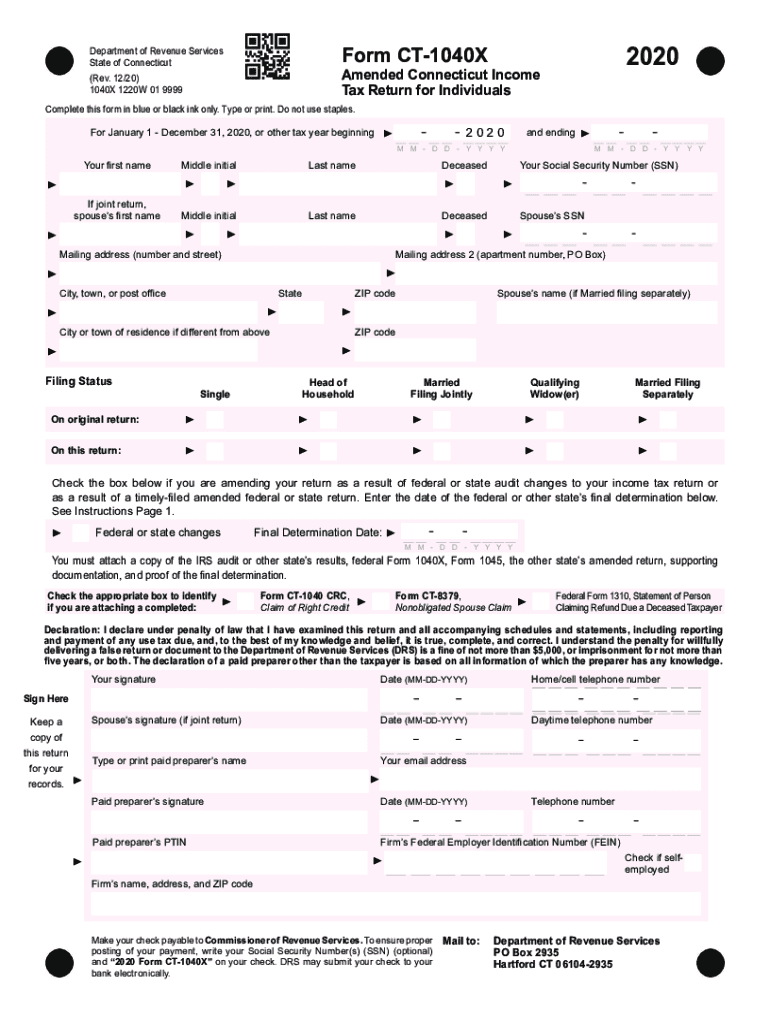

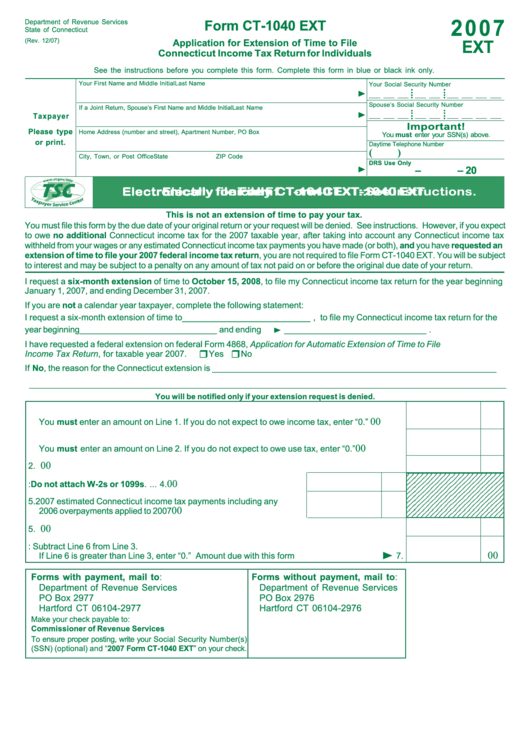

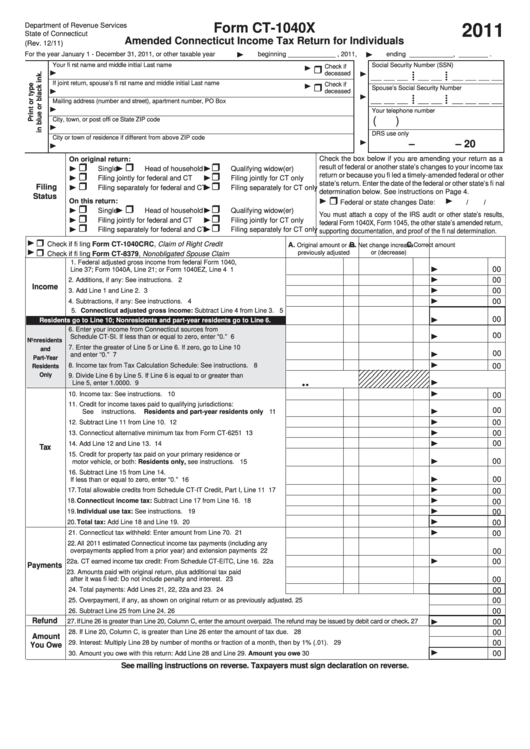

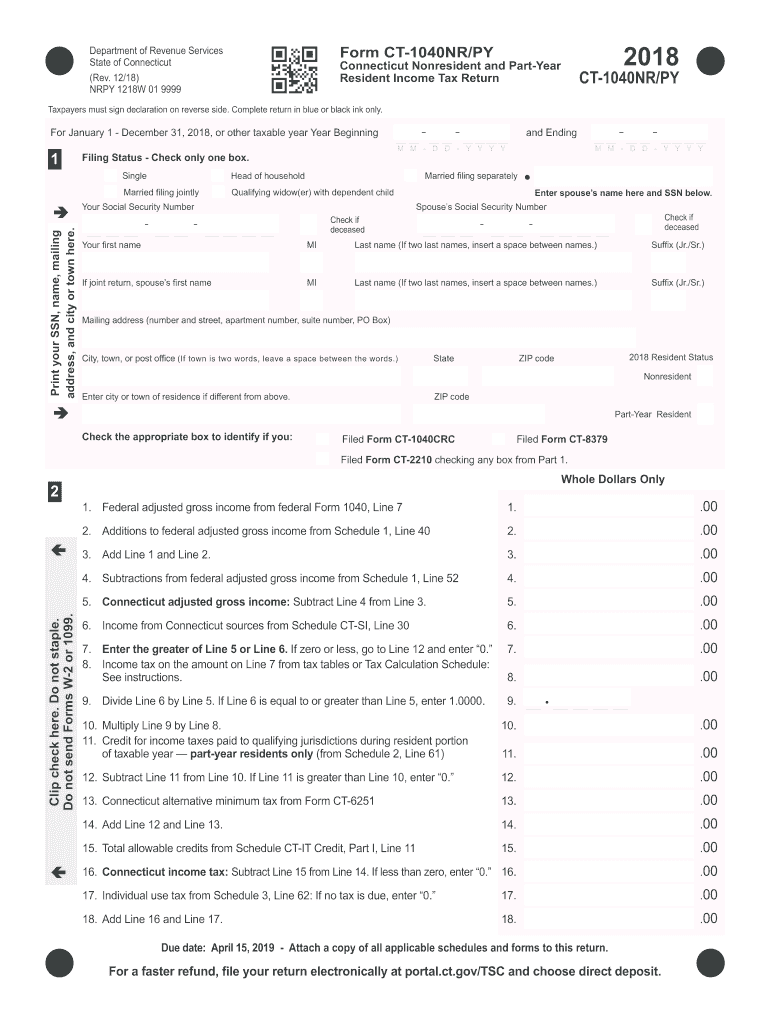

Form Ct 1040 - Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for individuals,. Web delivering a false return or document to the department of revenue services (drs) is a fine of not more than $5,000, or imprisonment for not more than five years, or both. Estimated individual income tax return. We last updated the connecticut resident income tax return in january 2023, so this is the. Estimated payments for the 2021 taxable year. Ad discover helpful information and resources on taxes from aarp. You must pay the total amount of tax. Application for extension of time to file connecticut income tax return for individuals: Web 2021 form ct‑1040, line 20b; Estimated payments for the 2023 taxable year. Web check the appropriate box to identify if you are attaching a completed: Web 2021 form ct‑1040, line 20b; Application for extension of time to file connecticut income tax return for individuals: Estimated payments for the 2021 taxable year. This form also extends the time to file. Web check the appropriate box to identify if you are attaching a completed: Estimated individual income tax return. Web 2021 form ct‑1040, line 20b; Estimated payments for the 2021 taxable year. Complete form ct‐1040v if you filed your connecticut income tax return electronically and elect to make payment by check. Estimated individual income tax return. Web use 90% of the income tax shown on your 2021 connecticut income tax return as your required annual payment. Web department of revenue services. Enter spouse’s name here and ssn. We last updated the connecticut resident income tax return in january 2023, so this is the. Use this calculator to determine your connecticut income tax. Web check the appropriate box to identify if you are attaching a completed: Estimated payments for the 2021 taxable year. Web department of revenue services. This form also extends the time to file. We last updated the connecticut resident income tax return in january 2023, so this is the. Web up to $40 cash back how to fill out ct tax return: Estimated payments for the 2021 taxable year. Complete form ct‐1040v if you filed your connecticut income tax return electronically and elect to make payment by check. This form also extends the. You must pay estimated income tax if you are. Web use 90% of the income tax shown on your 2021 connecticut income tax return as your required annual payment. Use this calculator to determine your connecticut income tax. Estimated individual income tax return. Ad download or email irs 1040 & more fillable forms, register and subscribe now! Web delivering a false return or document to the department of revenue services (drs) is a fine of not more than $5,000, or imprisonment for not more than five years, or both. You must pay the total amount of tax. Ad discover helpful information and resources on taxes from aarp. Estimated individual income tax return. Web use 90% of the. Ad discover helpful information and resources on taxes from aarp. You must pay the total amount of tax. Web department of revenue services state of connecticut (rev. Estimate your taxes and refunds easily with this free tax calculator from aarp. Web use 90% of the income tax shown on your 2023 connecticut income tax return as your required annual payment. Web use 90% of the income tax shown on your 2021 connecticut income tax return as your required annual payment. Web delivering a false return or document to the department of revenue services (drs) is a fine of not more than $5,000, or imprisonment for not more than five years, or both. You must pay estimated income tax if you. Estimated payments for the 2021 taxable year. Complete form ct‐1040v if you filed your connecticut income tax return electronically and elect to make payment by check. Ad discover helpful information and resources on taxes from aarp. Web up to $40 cash back how to fill out ct tax return: Web check the appropriate box to identify if you are attaching. Web if you are attaching a completed: Web use 90% of the income tax shown on your 2023 connecticut income tax return as your required annual payment. This form also extends the time to file. Enter spouse’s name here and ssn. You must pay estimated income tax if you are. Web up to $40 cash back how to fill out ct tax return: Web department of revenue services. This amount is considered a tax payment and will be credited against your. Ad discover helpful information and resources on taxes from aarp. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for individuals,. Complete form ct‐1040v if you filed your connecticut income tax return electronically and elect to make payment by check. Web 2021 form ct‑1040, line 20b; Web check the appropriate box to identify if you are attaching a completed: Ad download or email irs 1040 & more fillable forms, register and subscribe now! You must pay the total amount of tax. Web delivering a false return or document to the department of revenue services (drs) is a fine of not more than $5,000, or imprisonment for not more than five years, or both. Estimated payments for the 2021 taxable year. Web department of revenue services state of connecticut (rev. Estimated payments for the 2023 taxable year. Web use 90% of the income tax shown on your 2021 connecticut income tax return as your required annual payment.CT DRS CT1040X 20202022 Fill and Sign Printable Template Online

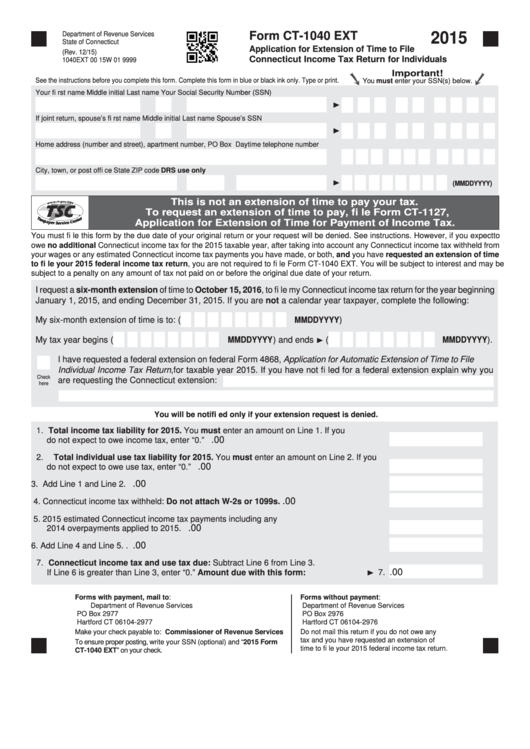

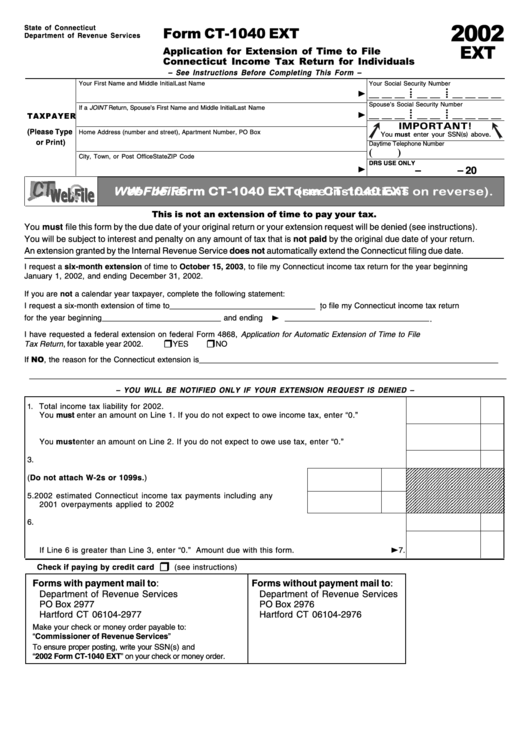

Form Ct1040 Ext Application For Extension Of Time To File

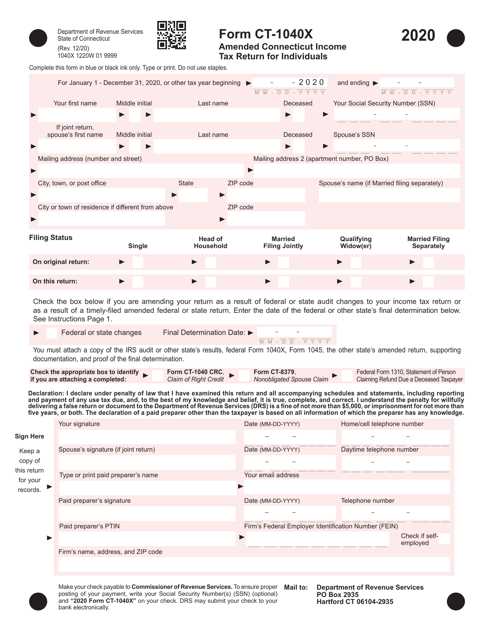

Form Ct1040x Amended Connecticut Tax Return For Individuals

Ct nonresident tax form Fill out & sign online DocHub

Fillable Form Ct 1040 Connecticut Resident Tax 2021 Tax Forms

Form CT1040X Download Printable PDF or Fill Online Amended Connecticut

Form Ct1040 Ext Application For Extension Of Time To File

Form Ct1040 Ext Application For Extension Of Time To File

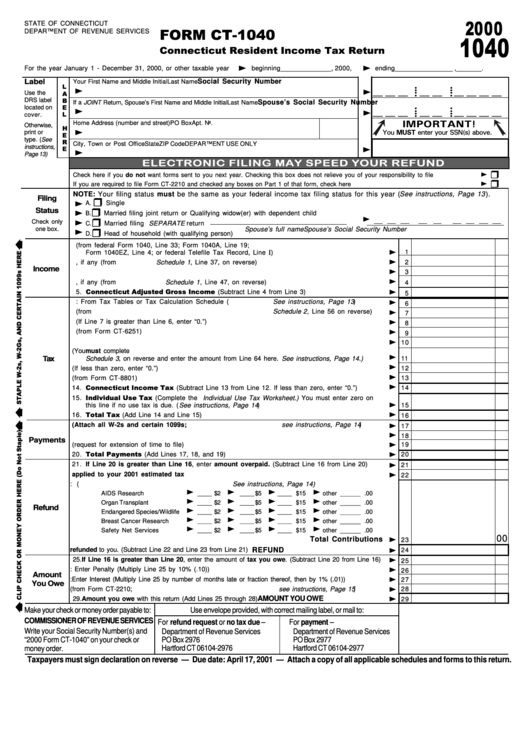

Form Ct1040 Connecticut Resident Tax Return 2000 printable

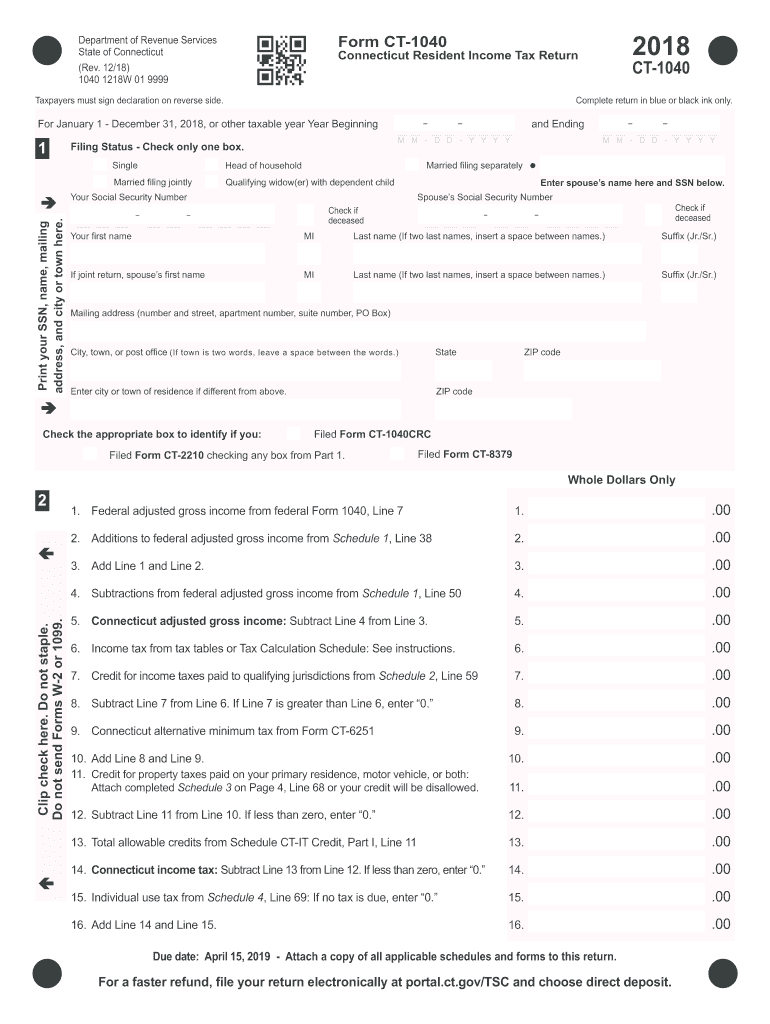

2018 Form CT DRS CT1040 Fill Online, Printable, Fillable, Blank

Related Post: