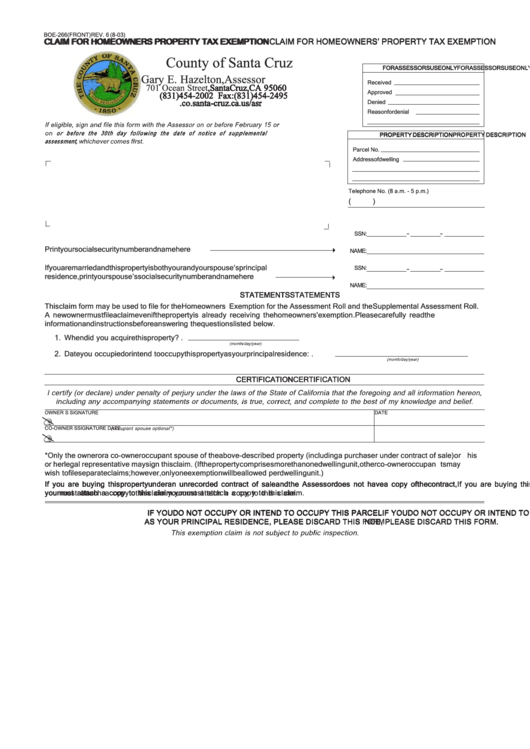

Form Boe-266

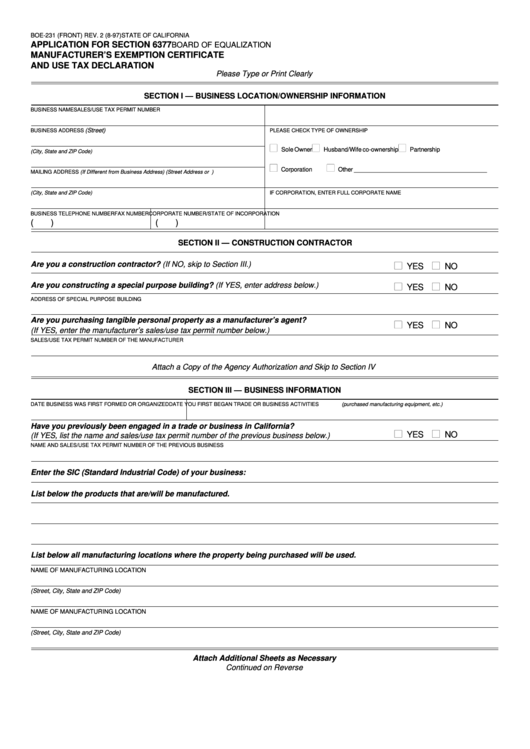

Form Boe-266 - To receive the full value of the exemption ($7,000 off your assessed value for an annual savings of approximately $70. 1302, 3301, 3304, 3328 & 8716 optional form 306 revised october 2011 previous. Homeowners' property tax exemption (claim for) 13: If not, please discard this form. Si reúne los requisitos, firme y. A person filing for the first time on a property may file anytime. If eligible, sign and file this form with theassessor on or before february. Web obtain forms from either the county assessor or the clerk of the board in the county where the property is located). Fill out the claim for homeowners' Pdfview forms in pdf format. Web obtain forms from either the county assessor or the clerk of the board in the county where the property is located). Fill out the claim for homeowners' Pdfview forms in pdf format. Web forms videos homeowners' exemption if you own a home and it is your principal place of residence on january 1, you may apply for an exemption. If eligible, sign and file this form with theassessor on or before february. Fill out the claim for homeowners' Pdfview forms in pdf format. 1302, 3301, 3304, 3328 & 8716 optional form 306 revised october 2011 previous. Web obtain forms from either the county assessor or the clerk of the board in the county where the property is located). Web obtain forms from either the county assessor or the clerk of the board in the county where the property is located). If eligible, sign and file this form with theassessor on or before february. Fill out the claim for homeowners' Pdfview forms in pdf format. 1302, 3301, 3304, 3328 & 8716 optional form 306 revised october 2011 previous. 1302, 3301, 3304, 3328 & 8716 optional form 306 revised october 2011 previous. If eligible, sign and file this form with theassessor on or before february. If eligible, sign and file this form with theassessor on or before february. Homeowners' property tax exemption (claim for) 13: Si reúne los requisitos, firme y. A person filing for the first time on a property may file anytime. Web forms videos homeowners' exemption if you own a home and it is your principal place of residence on january 1, you may apply for an exemption of $7,000. Homeowners' property tax exemption (claim for) 13: Pdfview forms in pdf format. If eligible, sign and file this. Si reúne los requisitos, firme y. Web obtain forms from either the county assessor or the clerk of the board in the county where the property is located). Web forms videos homeowners' exemption if you own a home and it is your principal place of residence on january 1, you may apply for an exemption of $7,000. To receive the. Fill out the claim for homeowners' 1302, 3301, 3304, 3328 & 8716 optional form 306 revised october 2011 previous. Pdfview forms in pdf format. Web obtain forms from either the county assessor or the clerk of the board in the county where the property is located). Homeowners' property tax exemption (claim for) 13: 1302, 3301, 3304, 3328 & 8716 optional form 306 revised october 2011 previous. If eligible, sign and file this form with theassessor on or before february. If not, please discard this form. Web forms videos homeowners' exemption if you own a home and it is your principal place of residence on january 1, you may apply for an exemption of. To receive the full value of the exemption ($7,000 off your assessed value for an annual savings of approximately $70. A person filing for the first time on a property may file anytime. Pdfview forms in pdf format. Web obtain forms from either the county assessor or the clerk of the board in the county where the property is located).. To receive the full value of the exemption ($7,000 off your assessed value for an annual savings of approximately $70. If eligible, sign and file this form with theassessor on or before february. Fill out the claim for homeowners' A person filing for the first time on a property may file anytime. 1302, 3301, 3304, 3328 & 8716 optional form. Pdfview forms in pdf format. If eligible, sign and file this form with theassessor on or before february. Web obtain forms from either the county assessor or the clerk of the board in the county where the property is located). Web forms videos homeowners' exemption if you own a home and it is your principal place of residence on january 1, you may apply for an exemption of $7,000. Homeowners' property tax exemption (claim for) 13: 1302, 3301, 3304, 3328 & 8716 optional form 306 revised october 2011 previous. A person filing for the first time on a property may file anytime. Si reúne los requisitos, firme y. If not, please discard this form. Boe forms that pertain to state assessments. Fill out the claim for homeowners' To receive the full value of the exemption ($7,000 off your assessed value for an annual savings of approximately $70. If eligible, sign and file this form with theassessor on or before february.Fillable Form Boe231 Application For Section 6377 Manufacturer'S

2015 Form CA BOE266 / ASSR515 Los Angeles County Fill Online

Form Boe 267 Fill Online, Printable, Fillable, Blank pdfFiller

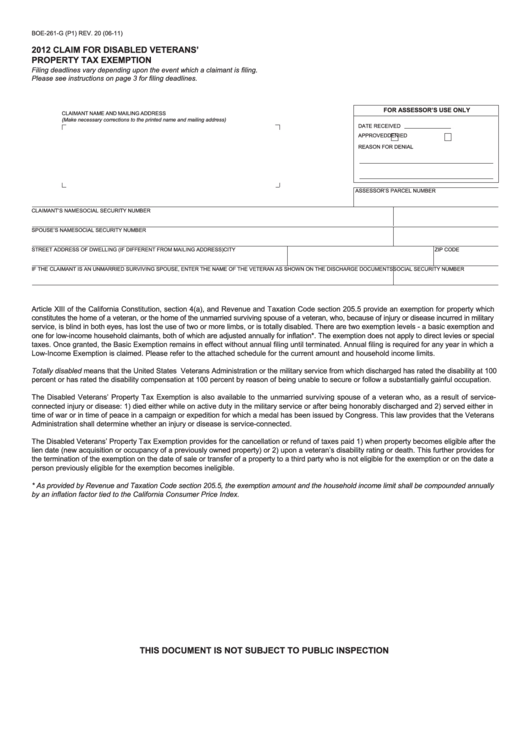

Fillable Form Boe261G (P1) Claim For Disabled Veteran'S Property

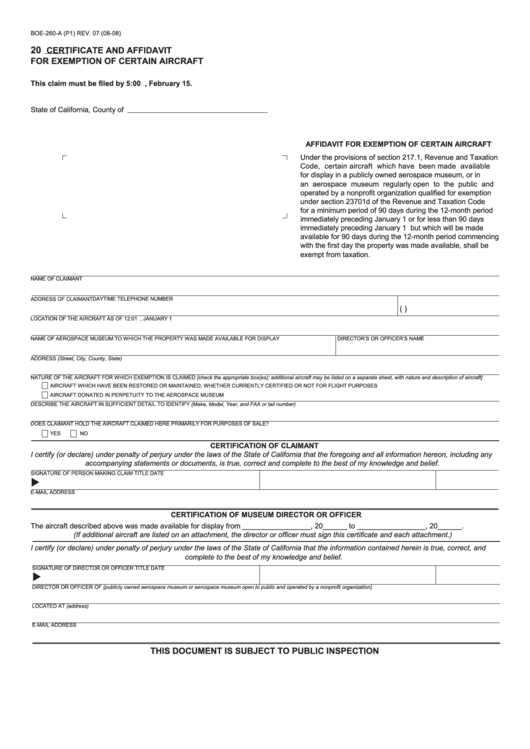

Fillable Form Boe260A Certificate And Affidavit For Exemption Of

CA BOE571L (P1) 2015 Fill and Sign Printable Template Online US

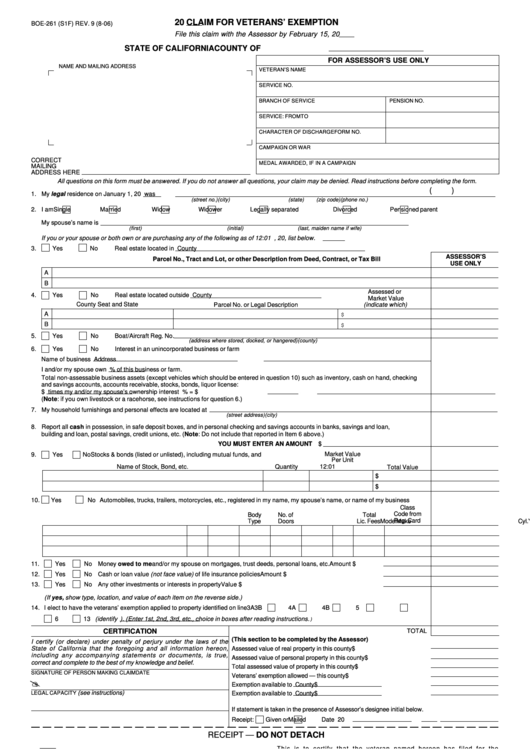

Form Boe261 Claim For Veterans' Exemption printable pdf download

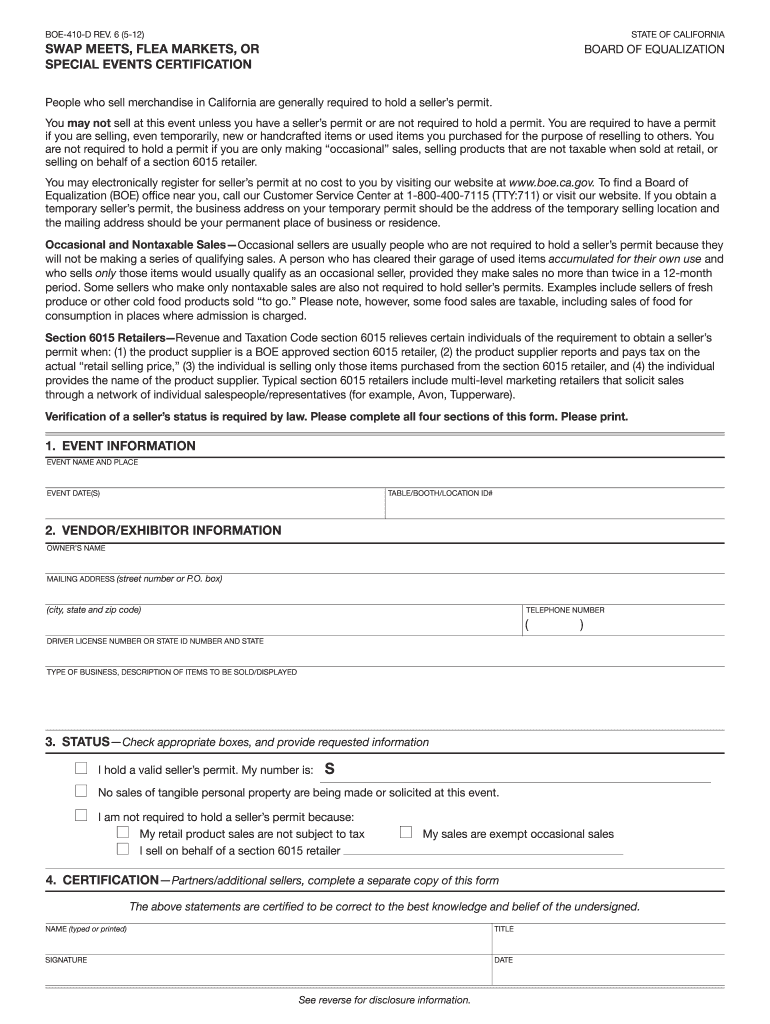

Board of equalization form 410 d Fill out & sign online DocHub

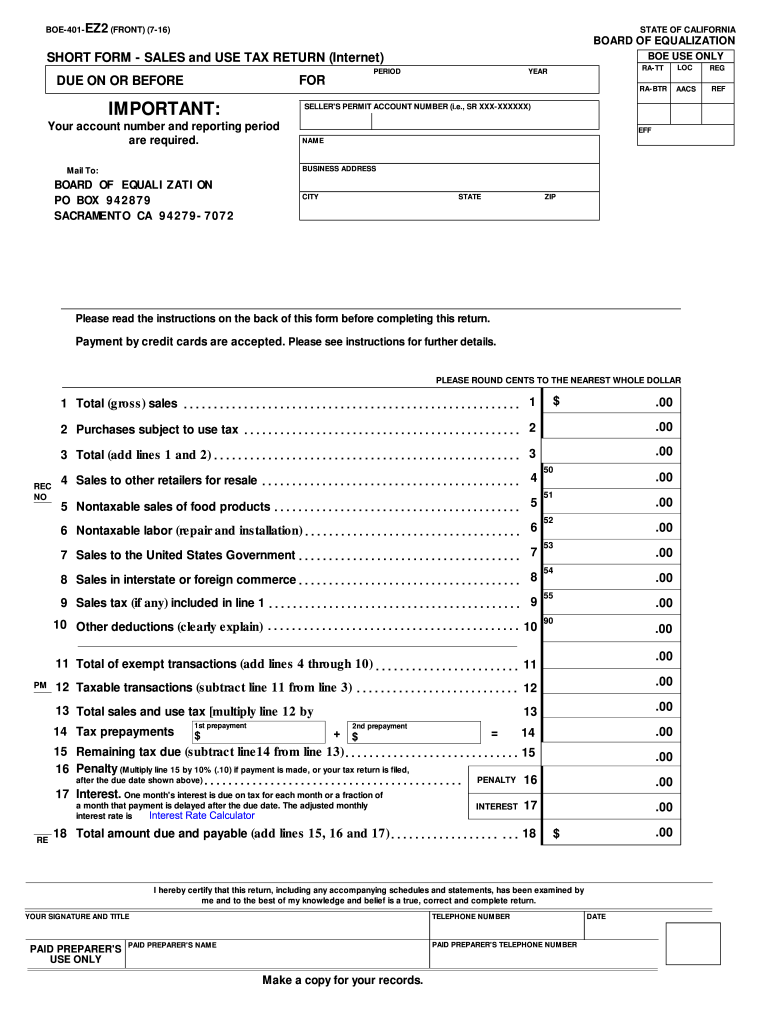

Form Boe Sales Tax Return Fill Out and Sign Printable PDF Template

Form Boe266 Claim For Homeowners' Property Tax Exemption County Of

Related Post: