Form 990T Instructions

Form 990T Instructions - Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web review a list of form 990 schedules with instructions. Complete, edit or print tax forms instantly. A responder must explicitly list all exceptions to state’s terms and conditions, if any (including those found in the attached sample contract). Supports current & prior year filings. Web instructions for the form 990 schedules are published separately from these instructions. Supports current & prior year filings. Web mail completed forms to: Every year nonprofits and private foundations need to. An organization must pay estimated tax if. Web instructions for the form 990 schedules are published separately from these instructions. A responder must explicitly list all exceptions to state’s terms and conditions, if any (including those found in the attached sample contract). Supports current & prior year filings. Complete, edit or print tax forms instantly. For paperwork reduction act notice, see instructions. Web instructions for form 990. For paperwork reduction act notice, see instructions. See when, where, and how to file, later, for more information. Web review a list of form 990 schedules with instructions. Supports current & prior year filings. For paperwork reduction act notice, see instructions. Organizations that have $1,000 or more for the tax year of total gross income from all. The following schedules to form 990, return of organization exempt from income tax, do not have. An organization must pay estimated tax if. Supports current & prior year filings. Web review a list of form 990 schedules with instructions. An organization must pay estimated tax if. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. For paperwork reduction act notice, see instructions. A line by line instructions. Web instructions for the form 990 schedules are published separately from these instructions. A responder must explicitly list all exceptions to state’s terms and conditions, if any (including those found in the attached sample contract). The following schedules to form 990, return of organization exempt from income tax, do not have. Every year nonprofits and. Organizations that have $1,000 or more for the tax year of total gross income from all. A line by line instructions. Supports current & prior year filings. Web instructions for the form 990 schedules are published separately from these instructions. Web instructions for form 990. A responder must explicitly list all exceptions to state’s terms and conditions, if any (including those found in the attached sample contract). Web instructions for the form 990 schedules are published separately from these instructions. Web instructions for form 990. Web review a list of form 990 schedules with instructions. See when, where, and how to file, later, for more. Supports current & prior year filings. Complete, edit or print tax forms instantly. Every year nonprofits and private foundations need to. A responder must explicitly list all exceptions to state’s terms and conditions, if any (including those found in the attached sample contract). Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. The following schedules to form 990, return of organization exempt from income tax, do not have. Get ready for tax season deadlines by completing any required tax forms today. Supports current & prior year filings. Web review a list of form 990 schedules with instructions. A line by line instructions. The following schedules to form 990, return of organization exempt from income tax, do not have. Every year nonprofits and private foundations need to. Web mail completed forms to: See when, where, and how to file, later, for more information. Every year nonprofits and private foundations need to. See when, where, and how to file, later, for more information. Web review a list of form 990 schedules with instructions. For paperwork reduction act notice, see instructions. The following schedules to form 990, return of organization exempt from income tax, do not have. Web mail completed forms to: Complete, edit or print tax forms instantly. A line by line instructions. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web instructions for form 990. Get ready for tax season deadlines by completing any required tax forms today. Web instructions for the form 990 schedules are published separately from these instructions. An organization must pay estimated tax if. Supports current & prior year filings. Organizations that have $1,000 or more for the tax year of total gross income from all. A responder must explicitly list all exceptions to state’s terms and conditions, if any (including those found in the attached sample contract). Supports current & prior year filings.Instructions for IRS Form 990t Exempt Organization Business

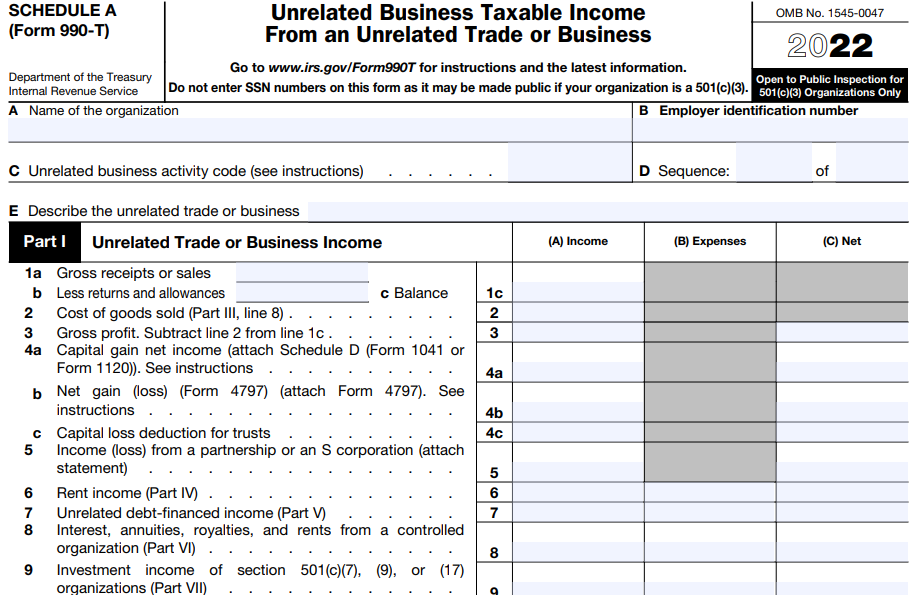

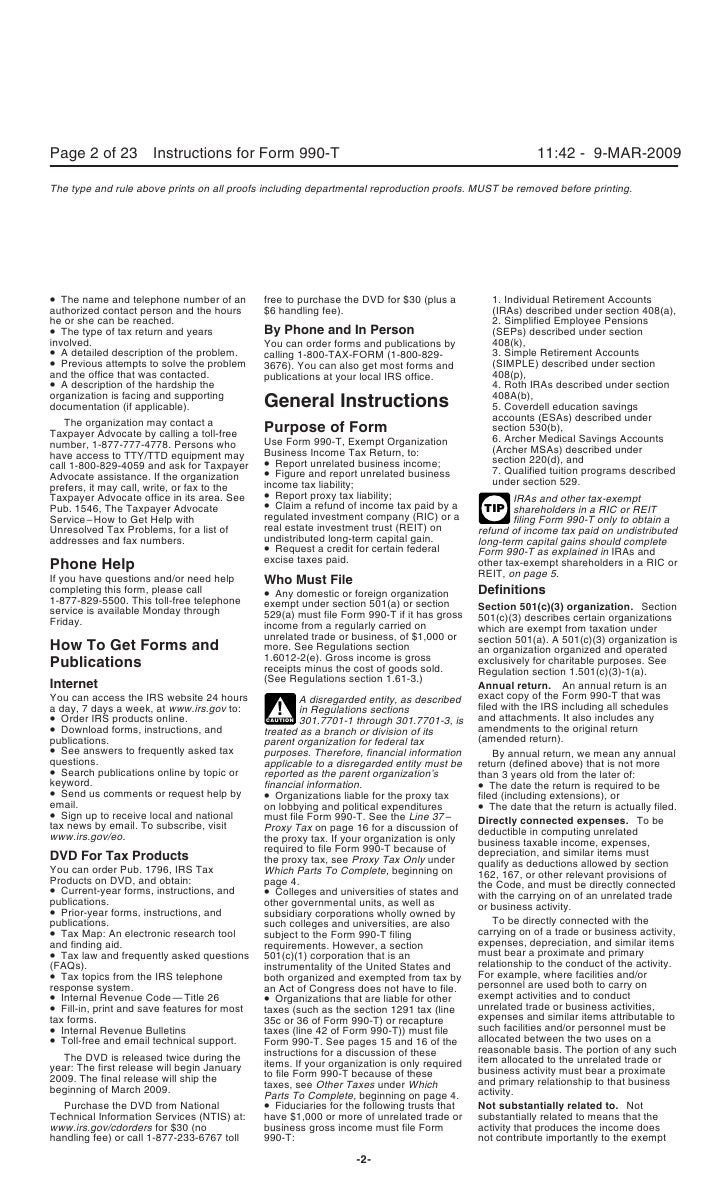

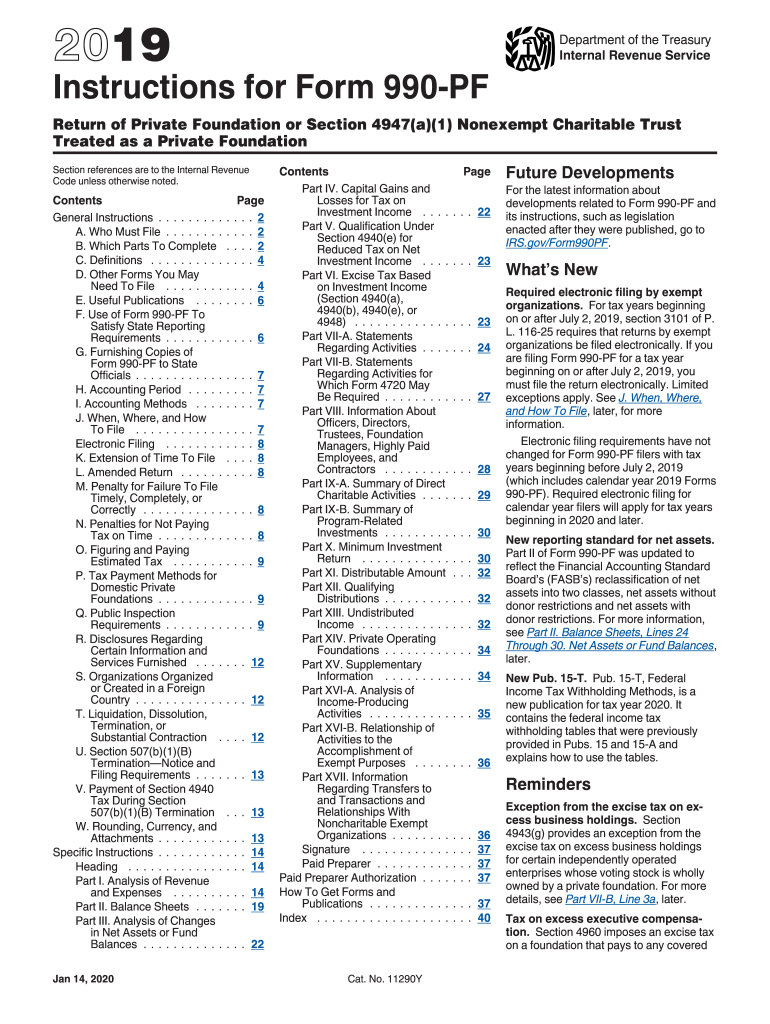

Instructions for Form 990T, Exempt Organization Business Tax

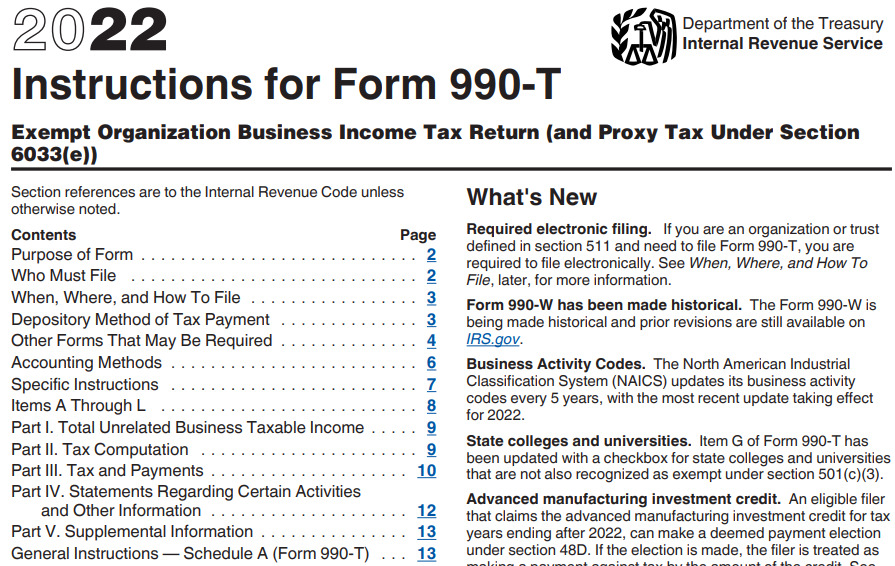

2022 IRS Form 990T Instructions ┃ How to fill out 990T?

2020 Form IRS Instructions Schedule A (990 or 990EZ) Fill Online

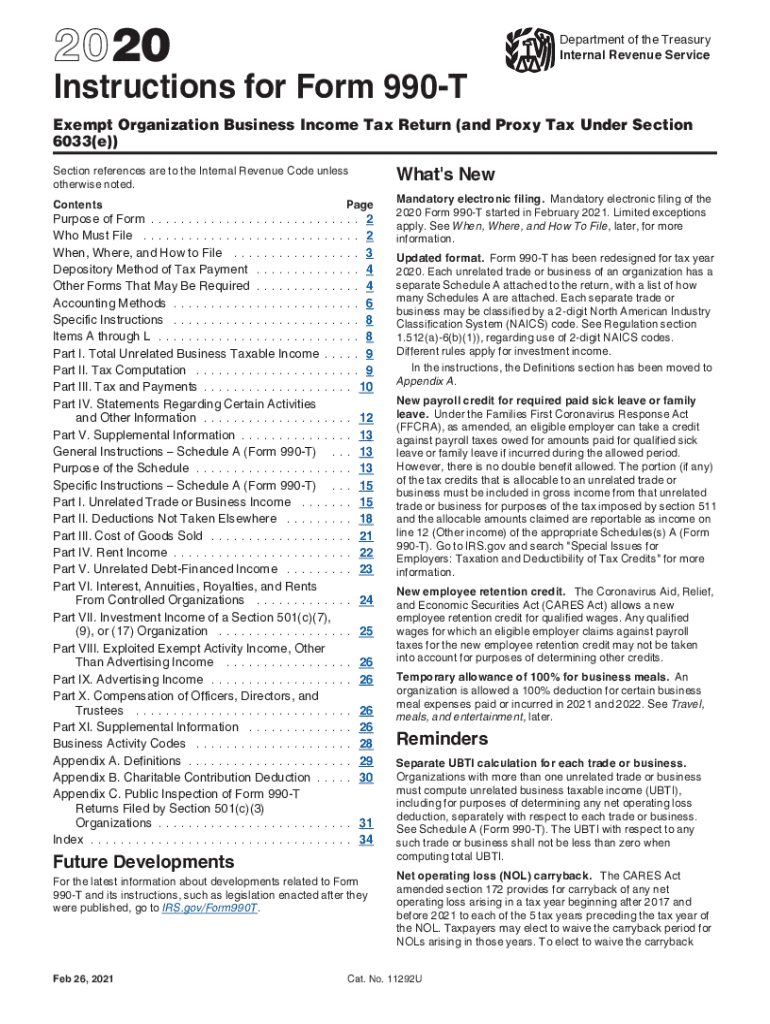

2020 Form IRS Instructions 990T Fill Online, Printable, Fillable

Efile 990T File 2021 IRS Form 990T online

Form 990T Exempt Organization Business Tax Return Form (2014

Instructions for Form 990T, Exempt Organization Business Tax

Form 990 Filing Instructions Fill Out and Sign Printable PDF Template

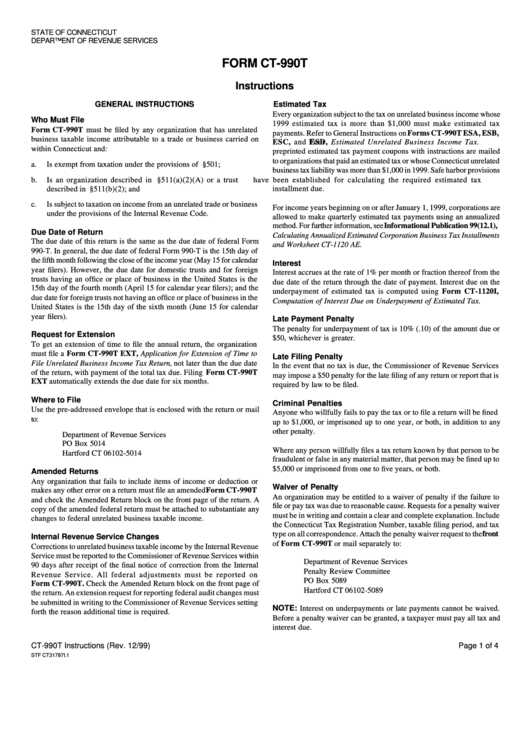

Instructions For Form Ct990t Connecticut Department Of Revenue

Related Post: