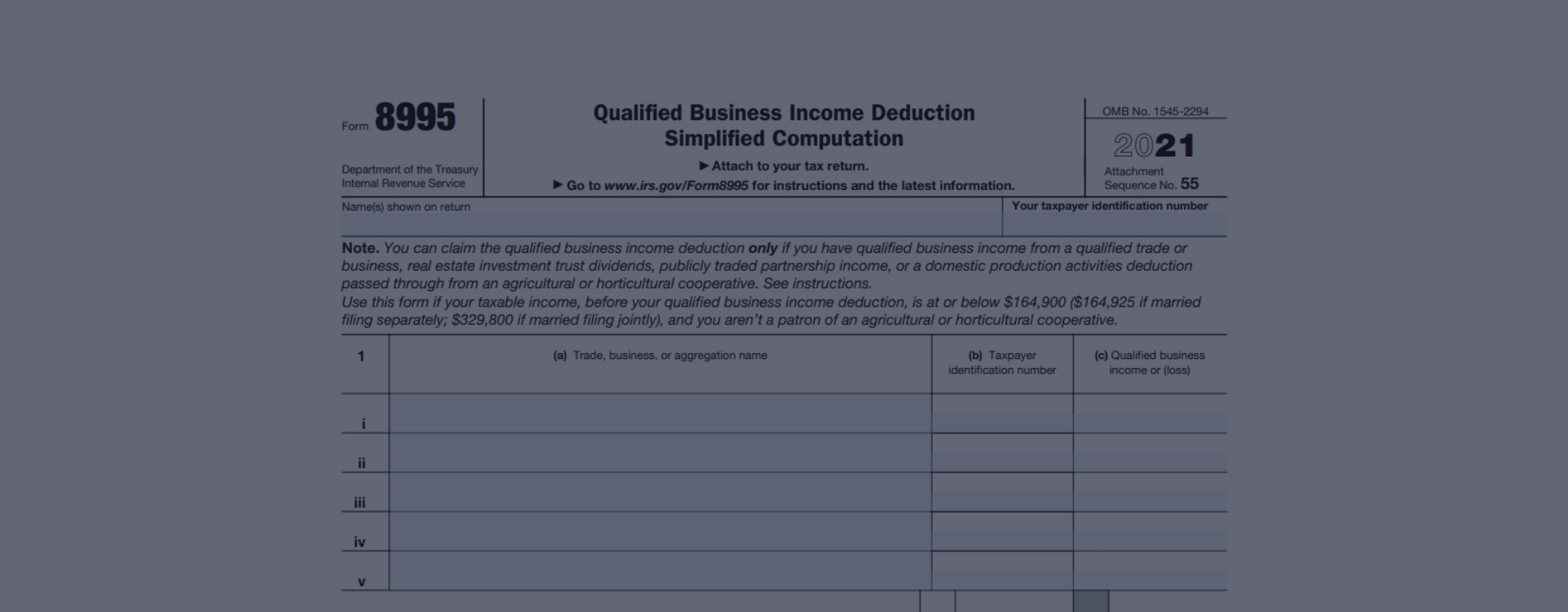

Form 8995 Instruction

Form 8995 Instruction - Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax. By familiarizing yourself with the form's. If you have a sole proprietorship, partnership, s. Attach to your tax return. Create legally binding electronic signatures on any device. Use this form if your taxable income, before your qualified business income deduction, is above. Qualified business income deduction simplified. Qualified business income deduction simplified. Department of the treasury internal revenue service. Ad register and subscribe now to work on your irs instructions 8995 & more fillable forms. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business income deduction calculation for the year allowed. Qualified business income deduction simplified. Web correction to the 2022 instructions for form 8995. Save or instantly send your ready documents. Create legally binding electronic signatures. Department of the treasury internal revenue service. Ad register and subscribe now to work on your irs instructions 8995 & more fillable forms. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Web correction to the 2022 instructions for form 8995. Use this form if your taxable income, before your qualified business. Ad register and subscribe now to work on your irs instructions 8995 & more fillable forms. Web passed through from an agricultural or horticultural cooperative. Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and ensuring accurate tax filings. Use separate schedules a, b, c, and/or d, as. To complete the qualified business. Web correction to the 2022 instructions for form 8995. Department of the treasury internal revenue service. Web qualified business income deduction simplified computation. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business income deduction calculation for the year allowed. Ad register and. When losses or deductions from a ptp are suspended in the year incurred,. Use this form to figure your qualified business income deduction. If you have a sole proprietorship, partnership, s. Web qualified business income deduction simplified computation. Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and ensuring accurate tax filings. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Department of the treasury internal revenue service. Attach to your tax return. Use this form to figure your qualified business income deduction. A new row has been. A new row has been. Use this form if your taxable income, before your qualified business income deduction, is above. Attach to your tax return. If you downloaded or printed the 2022 instructions for form 8995 between january 12 and march 10, 2023,. Use separate schedules a, b, c, and/or d, as. Web irs form 8995 for 2022 must be filed by individuals, partnerships, s corporations, and trusts or estates that have qualified business income (qbi) from a qualified trade or. Department of the treasury internal revenue service. Qualified business income deduction simplified computation. Use this form to figure your qualified business income deduction. Save or instantly send your ready documents. Use separate schedules a, b, c, and/or d, as. Use this form to figure your qualified business income deduction. Ad register and subscribe now to work on your irs instructions 8995 & more fillable forms. Include the following schedules (their specific instructions are. Attach to your tax return. To complete the qualified business. Department of the treasury internal revenue service. Use this form if your taxable income, before your qualified business income deduction, is above. Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and ensuring accurate tax filings. When losses or deductions from a ptp are suspended in the year incurred,. Attach to your tax return. Use this form if your taxable income, before your qualified business income deduction, is above. Include the following schedules (their specific instructions are. Individual taxpayers and some trusts and. If you have a sole proprietorship, partnership, s. By familiarizing yourself with the form's. Web correction to the 2022 instructions for form 8995. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax. A new row has been. Department of the treasury internal revenue service. Web qualified business income deduction simplified computation. Department of the treasury internal revenue service. To complete the qualified business. Easily fill out pdf blank, edit, and sign them. Web passed through from an agricultural or horticultural cooperative. Create legally binding electronic signatures on any device. Use separate schedules a, b, c, and/or d, as. When losses or deductions from a ptp are suspended in the year incurred,. Use this form to figure your qualified business income deduction. Qualified business income deduction simplified.IRS Form 8995a Instructions PDF Jay J Holmes Page 1 Flip PDF

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

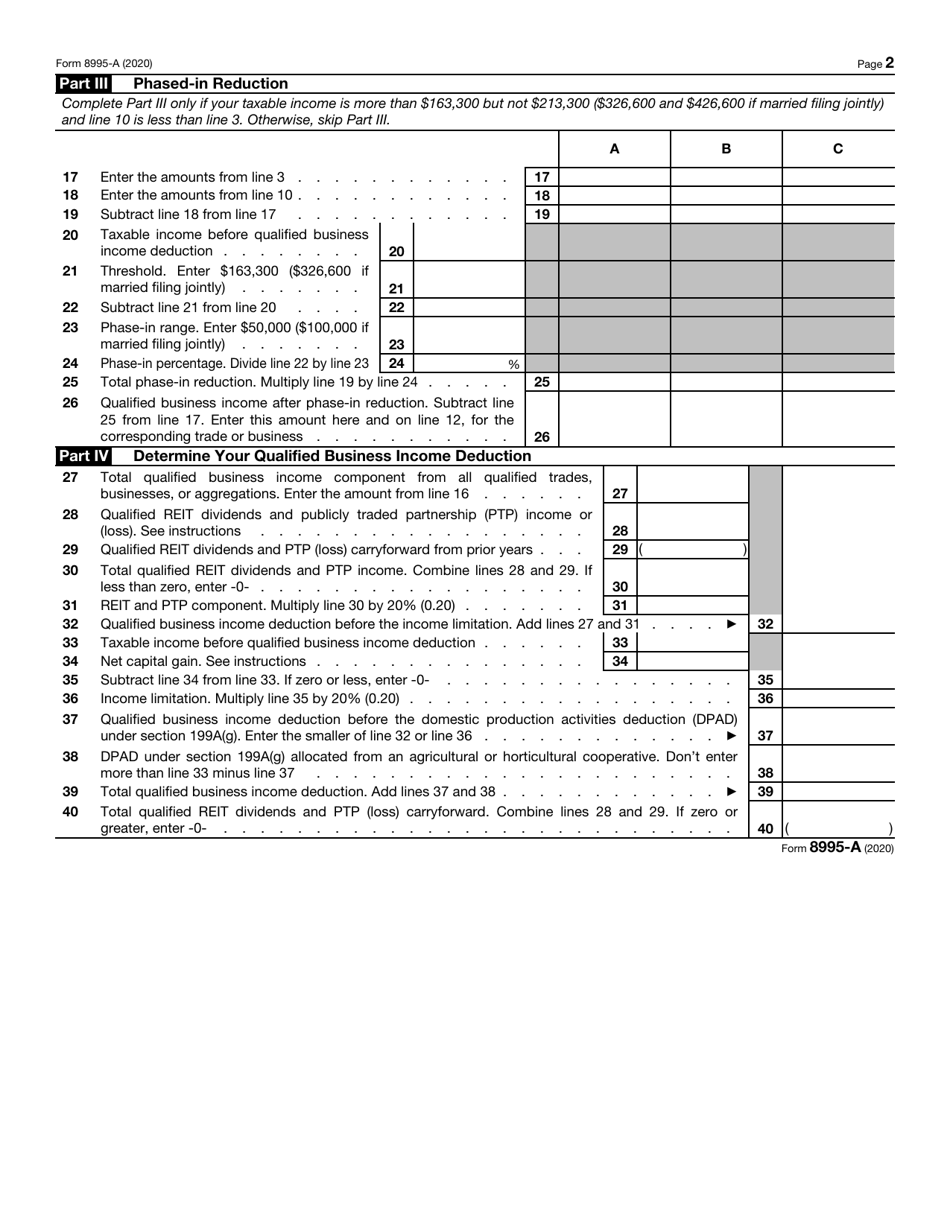

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

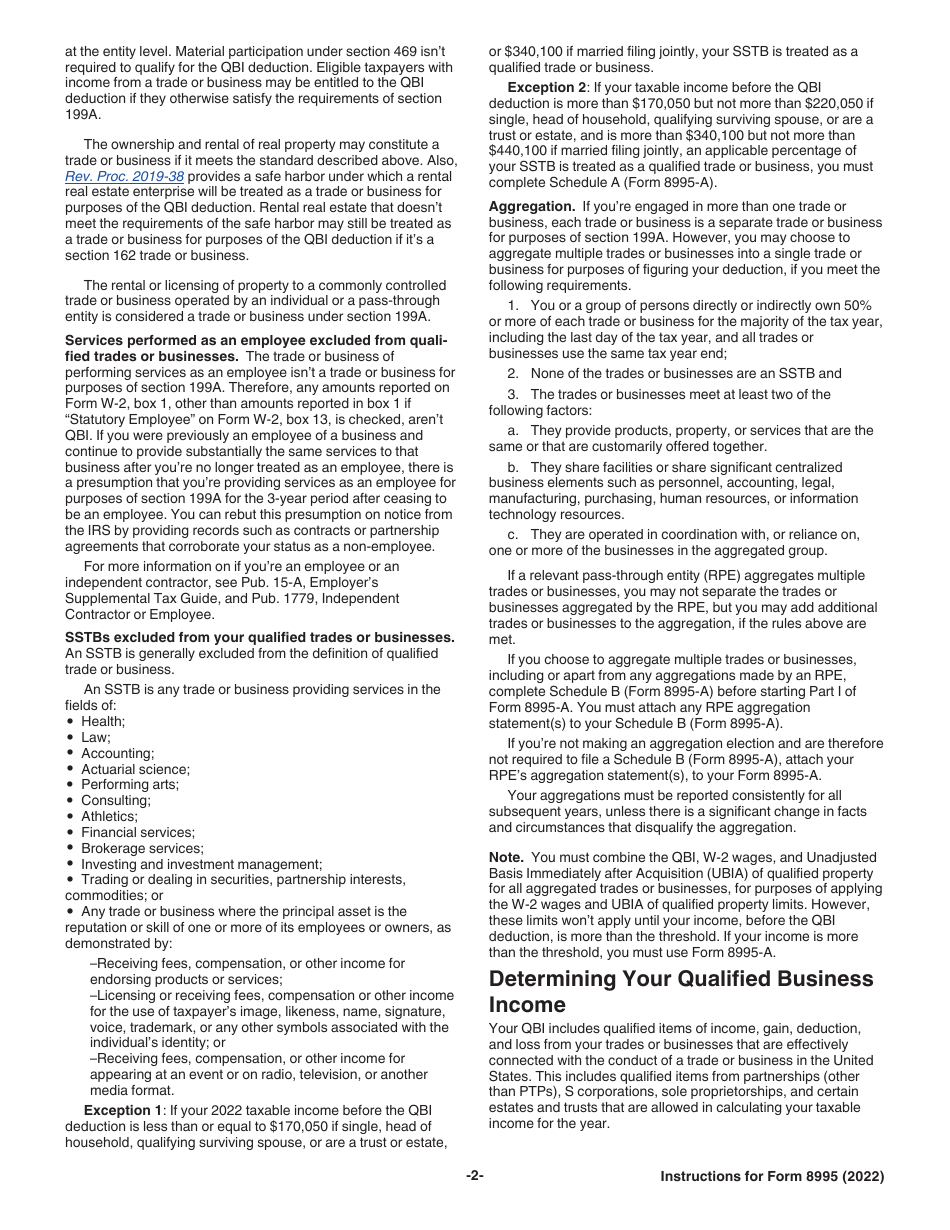

Instructions for Form 8995 (2022) Internal Revenue Service

Download Instructions for IRS Form 8995 Qualified Business

Download Instructions for IRS Form 8995A Deduction for Qualified

IRS Form 8995A Your Guide to the QBI Deduction

Instructions for Form 8995 Fill Out and Sign Printable PDF Template

Tax Form 8995 ⮚ 2022 IRS 8995 Form PDF Printable & Instructions to Fill

What Is Form 8995 And 8995a Ethel Hernandez's Templates

Related Post: