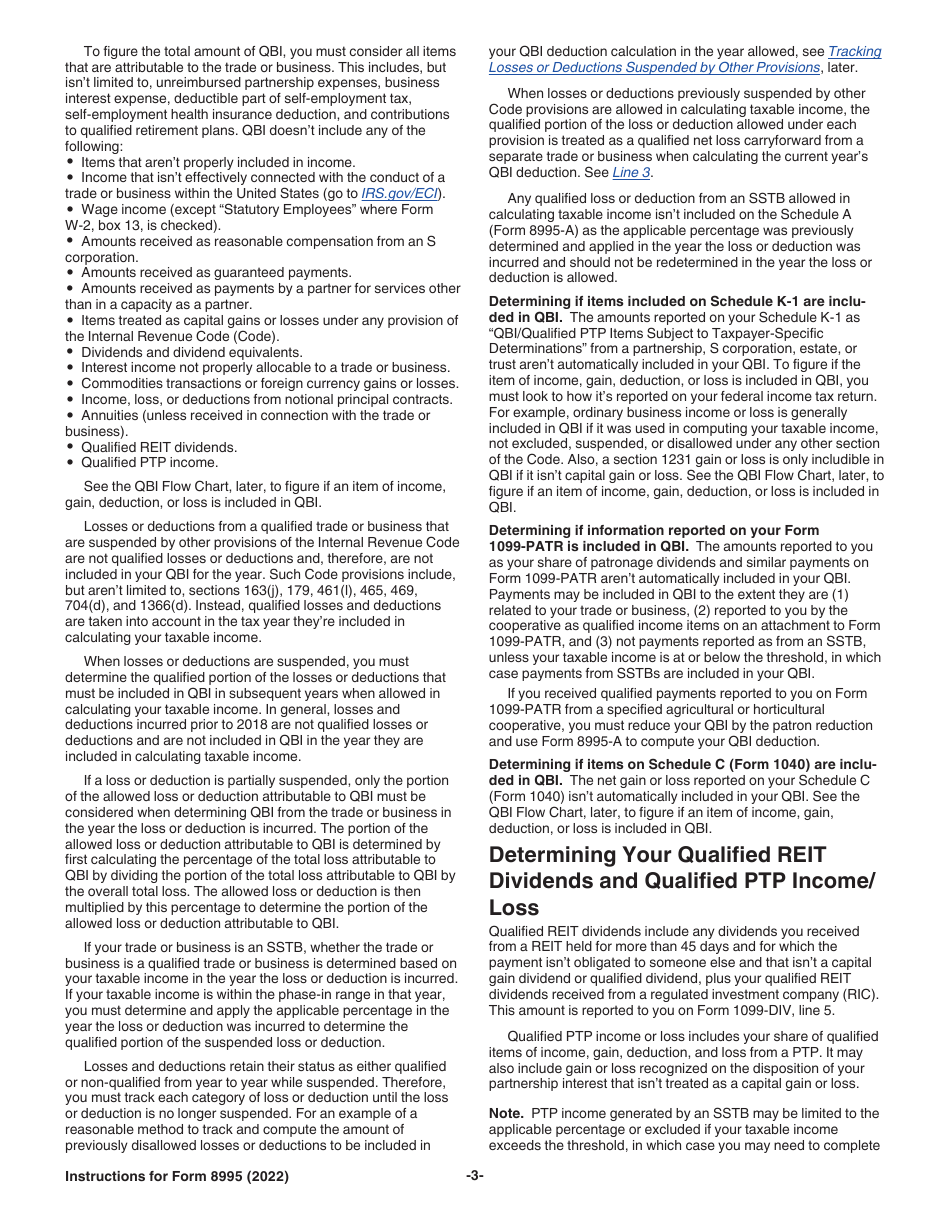

Form 8995-A Instructions

Form 8995-A Instructions - Try it for free now! Web for instructions and the latest information. As with most tax issues, the. Web page last reviewed or updated: Include the following schedules (their specific instructions are shown later), as appropriate:. A taxpayer with qualified business income (qbi) can use the simplified form 8995 if both of the following are true: Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Click to expand key takeaways • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability. Table of contents the qualified business. The qbi deduction will flow to line 10 of form. Include the following schedules (their specific instructions are shown later), as appropriate: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing jointly), and you aren’t a patron of. To complete the qualified business. Table of contents the qualified business. Web page last reviewed or updated: Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. The qbi deduction will flow to line 10 of form. Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Try it for free now! Table of contents the qualified business. When losses or deductions from a ptp are suspended in the year incurred,. To complete the qualified business. Include the following schedules (their specific instructions are shown later), as appropriate: Go to www.irs.gov/form8995a for instructions and. Complete, edit or print tax forms instantly. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related. Attach to your tax return. Include the following schedules (their specific instructions are shown later), as appropriate: Include the following schedules (their specific instructions are shown later), as appropriate:. Try it for free now! Information about form 8995, qualified business income deduction simplified computation, including recent updates, related. Web for instructions and the latest information. As with most tax issues, the. Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Attach to your tax return. Include the following schedules (their specific instructions are shown later), as appropriate: Department of the treasury internal revenue service. The qbi deduction will flow to line 10 of form. Include the following schedules (their specific instructions are shown later), as appropriate: Include the following schedules (their specific instructions are shown later), as appropriate:. Information about form 8995, qualified business income deduction simplified computation, including recent updates, related. Department of the treasury internal revenue service. Click to expand key takeaways • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability. Include the following schedules (their specific instructions are shown later), as appropriate: Include the following schedules (their specific instructions are shown later), as appropriate:. Complete, edit or print tax forms instantly. To complete the qualified. Complete, edit or print tax forms instantly. Include the following schedules (their specific instructions are shown later), as appropriate: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Information about form 8995, qualified business income deduction simplified computation, including recent updates, related. Try it for free now! Attach to your tax return. Click to expand key takeaways • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability. Include the following schedules (their specific instructions are shown later), as appropriate:. As with most tax issues, the. Try it for free now! Click to expand key takeaways • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability. Attach to your tax return. Include the following schedules (their specific instructions are shown later), as appropriate:. Department of the treasury internal revenue service. Table of contents the qualified business. A taxpayer with qualified business income (qbi) can use the simplified form 8995 if both of the following are true: As with most tax issues, the. When losses or deductions from a ptp are suspended in the year incurred,. To complete the qualified business. The qbi deduction will flow to line 10 of form. Web page last reviewed or updated: Web for instructions and the latest information. Include the following schedules (their specific instructions are shown later), as appropriate: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Information about form 8995, qualified business income deduction simplified computation, including recent updates, related. Use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600. Complete, edit or print tax forms instantly. Upload, modify or create forms. Web use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing jointly), and you aren’t a patron of an. Try it for free now!8995 Form Updates Patch Notes fo 8995 Form Product Blog

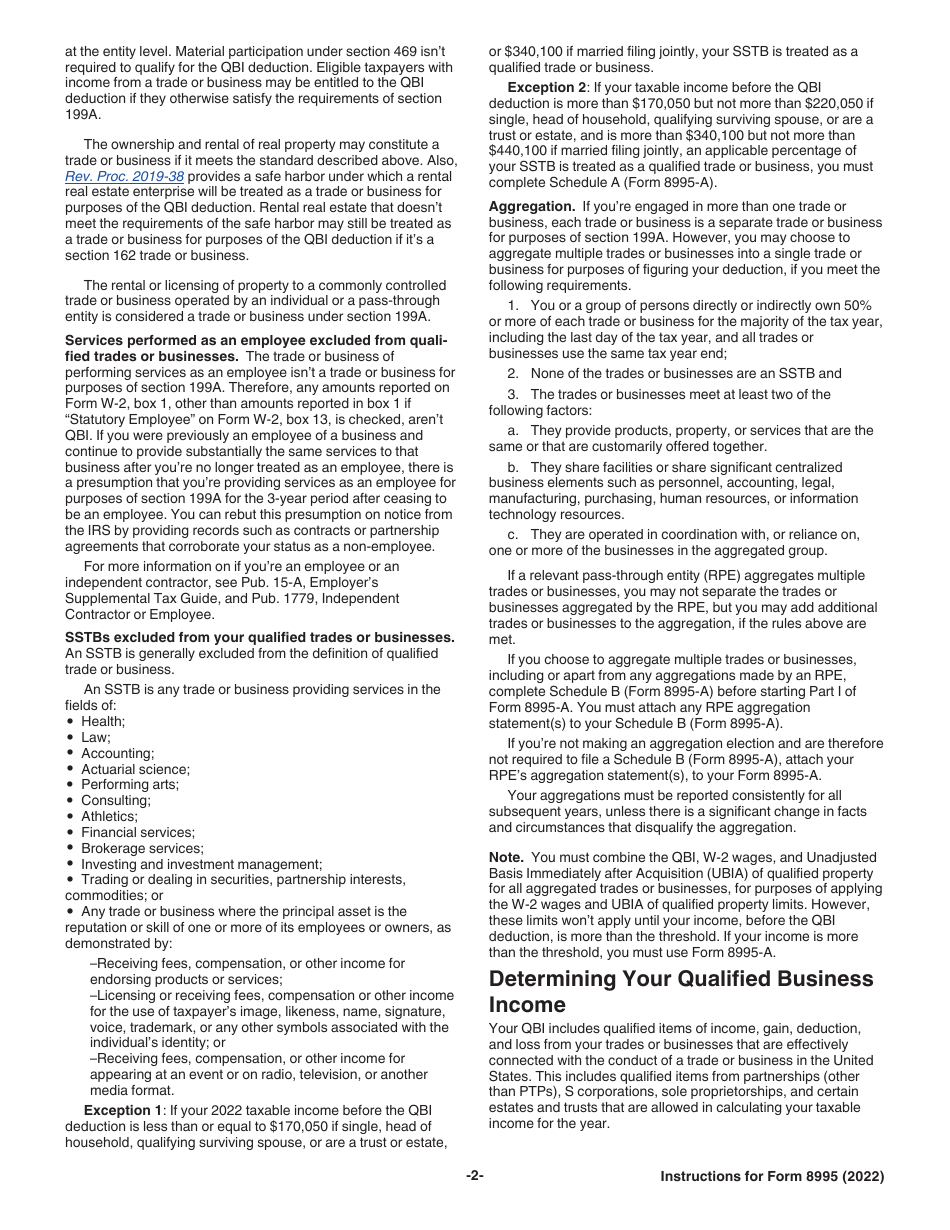

Download Instructions for IRS Form 8995 Qualified Business

Instructions for Form 8995 Fill Out and Sign Printable PDF Template

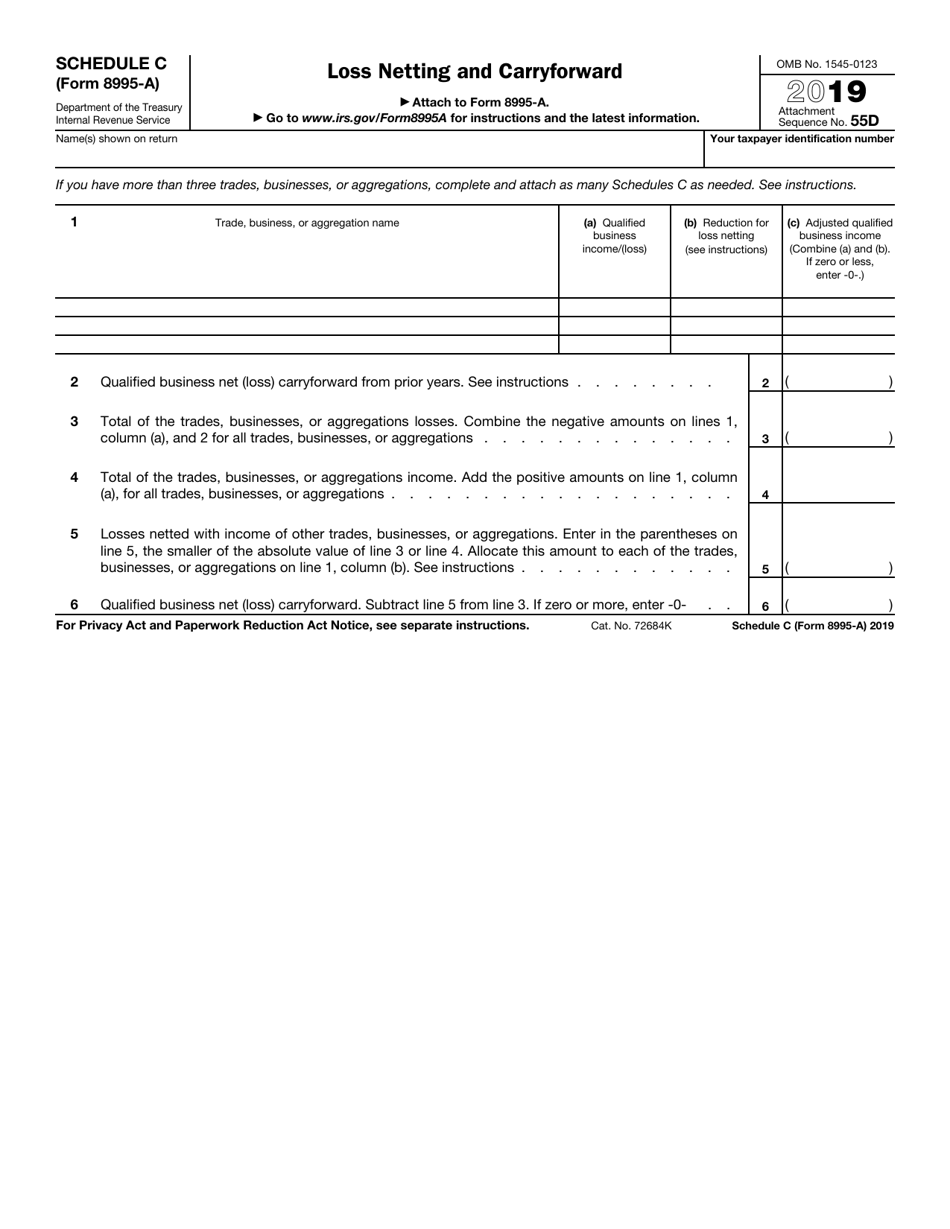

IRS Form 8995A Schedule C Download Fillable PDF or Fill Online Loss

Other Version Form 8995A 8995 Form Product Blog

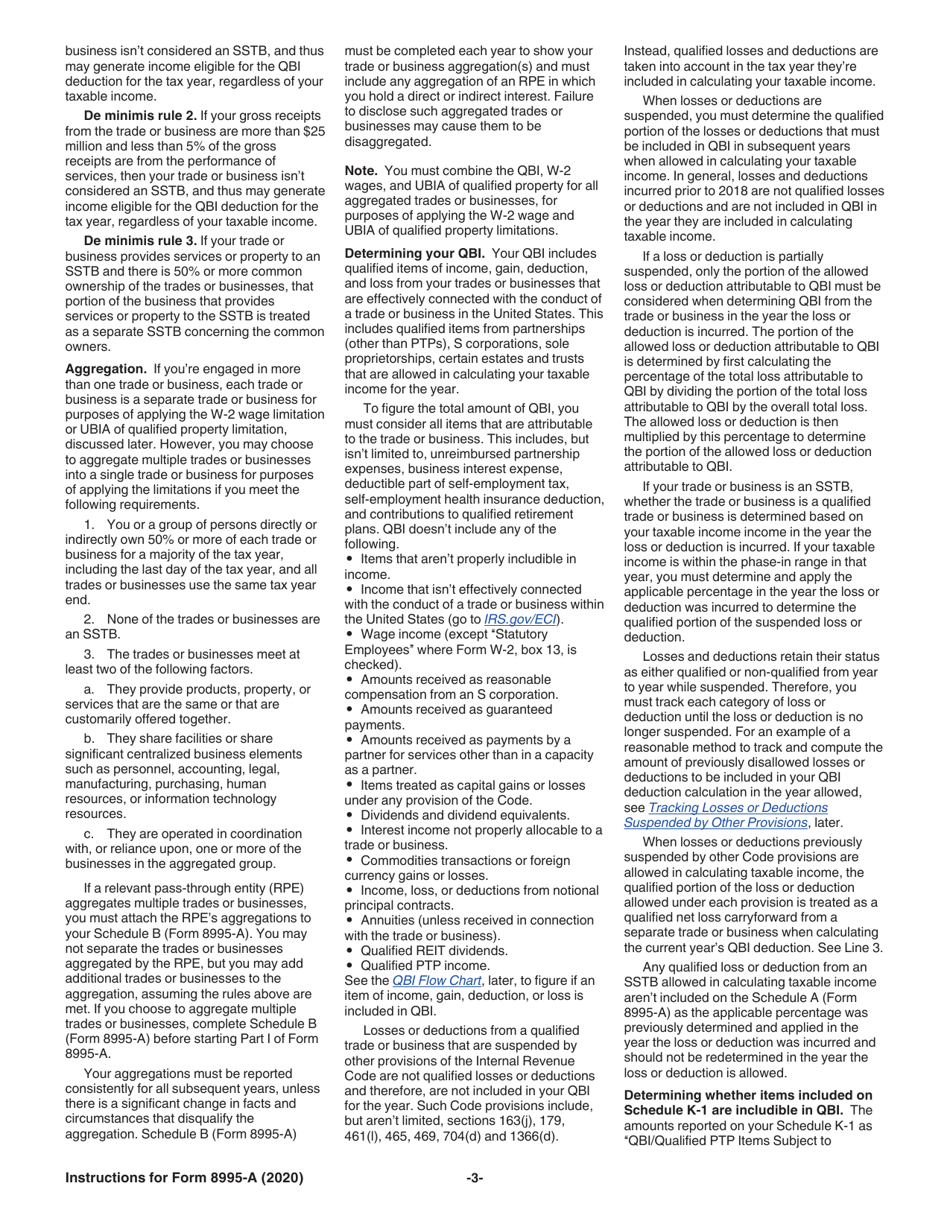

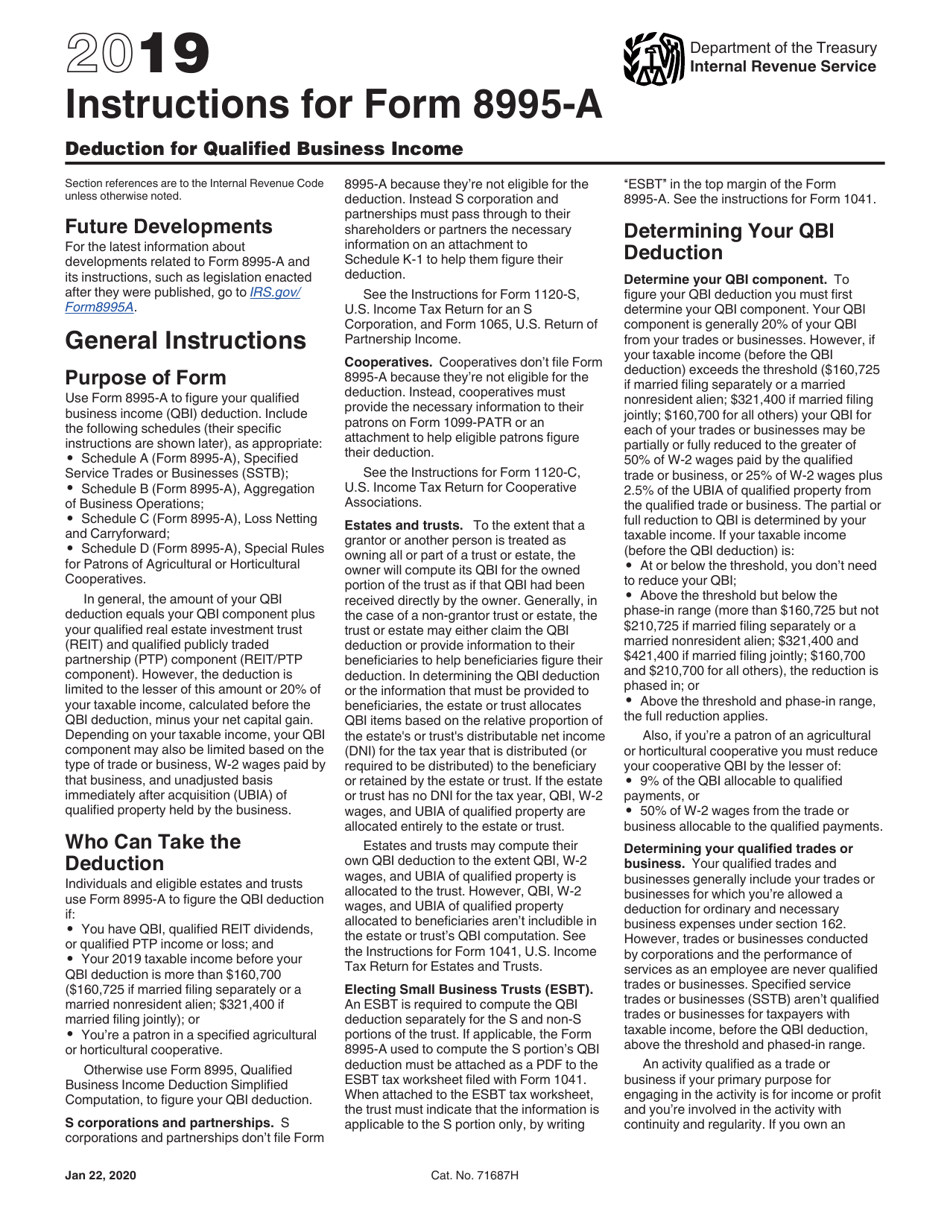

Download Instructions for IRS Form 8995A Qualified Business

Download Instructions for IRS Form 8995 Qualified Business

IRS Form 8995A Your Guide to the QBI Deduction

Download Instructions for IRS Form 8995A Deduction for Qualified

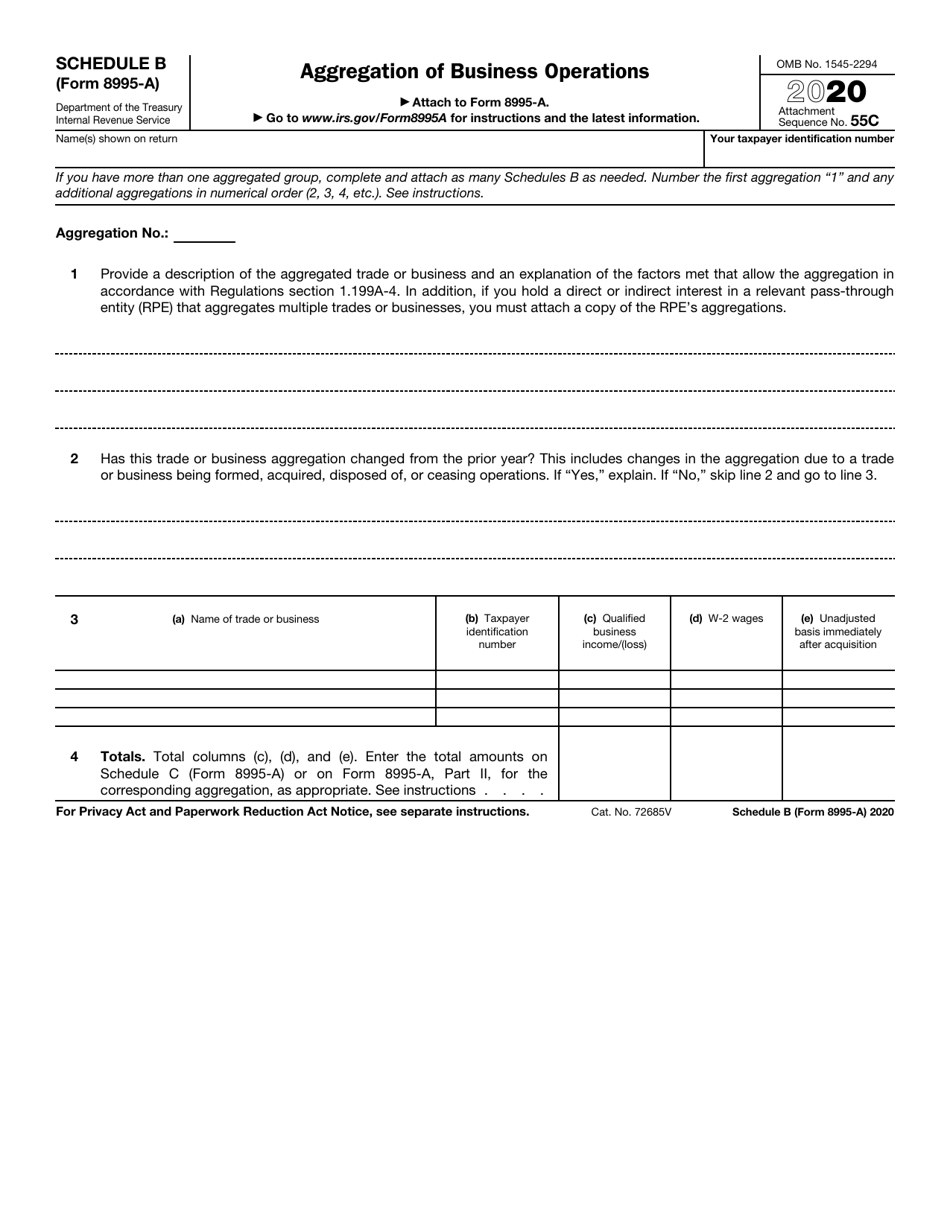

Irs Form 8995a Schedule B Download Fillable Pdf Or Fill Online

Related Post: