Form 8960 Rejection

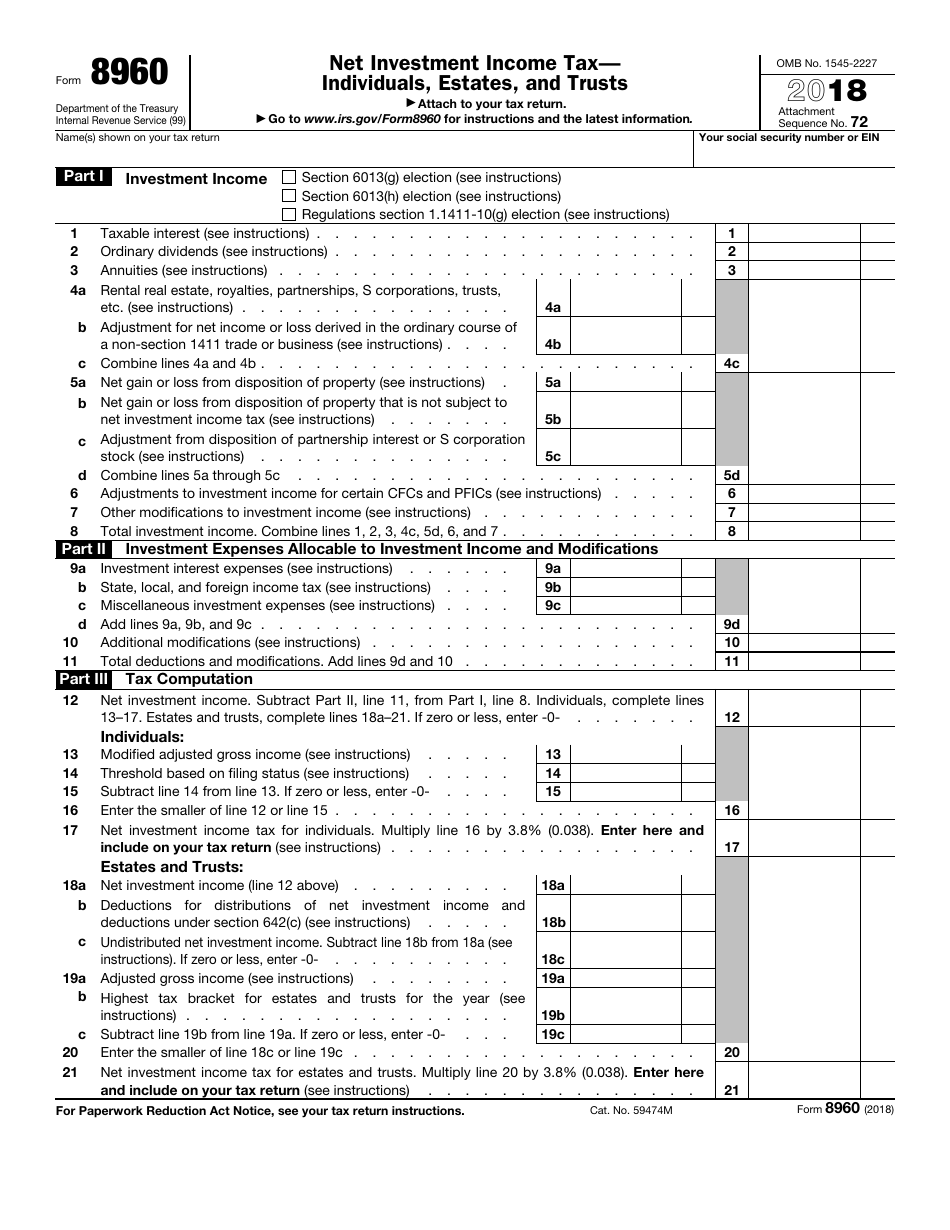

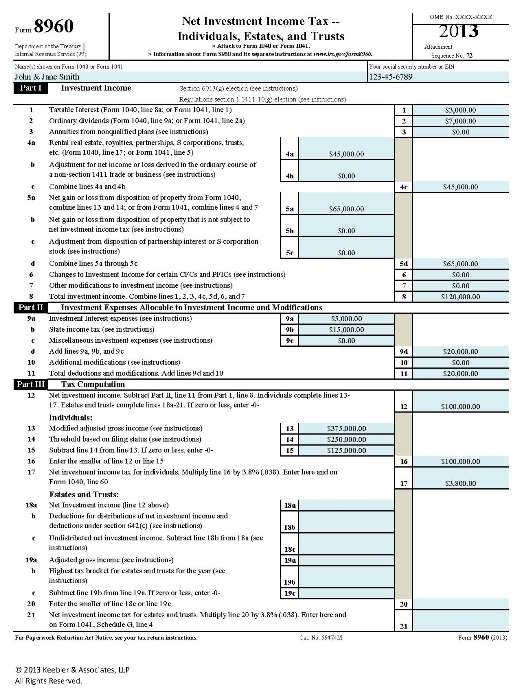

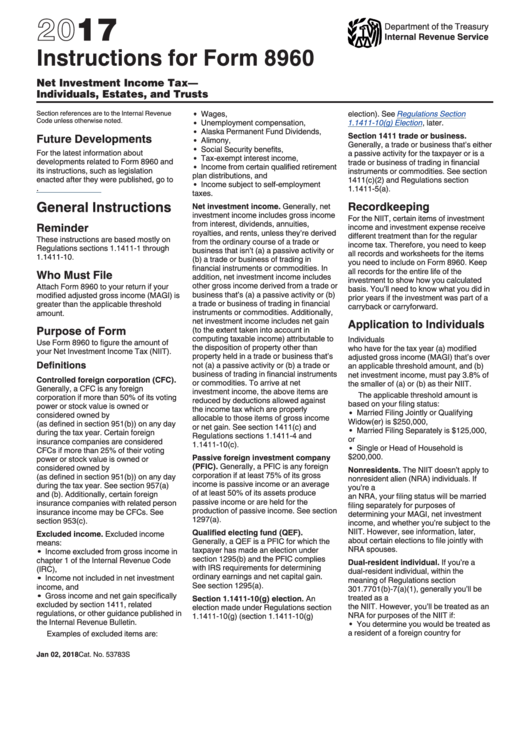

Form 8960 Rejection - Use form 8960 to figure the. Web according to the 2022 form 8960 instructions from the irs (page 1), you are required to file this form if your magi (generally the same as agi, found on line 11. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc). Web form 8960 is the irs form used to calculate your total net investment income (nii) and determine how much of it may be subject to the 3.8% medicare contribution tax. Only sch d and form 8949. If you want to switch to. I've gone back through my entire return. By phinancemd » mon feb 06, 2023 5:14 pm. I did some testing in the 2021 program and put $300000 on a schedule c and it did not flow to 8960. If it turns out that your. There is a program glitch october 10, 2019 5:35 pm. Web according to the 2022 form 8960 instructions from the irs (page 1), you are required to file this form if your magi (generally the same as agi, found on line 11. Web march 14, 2020 4:25 pm. Web upon review, instructions to form 8960 require the inclusion of 1040. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Only sch d and form 8949. Web form 8960 is the irs form used to calculate your total net investment income (nii) and determine how much of it may be subject to the 3.8% medicare contribution tax. By phinancemd. If it turns out that your. Information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates,. Web if your magi is above the threshold amounts mentioned above, you may need to prepare form 8960 to see what your net investment income is. Net investment income tax individuals, estates, and trusts keywords: There is a program. Yes, you can only use the state, local and foreign income taxes on form 8960 if you itemize deductions on for regular tax. If it turns out that your. Community says find the form and enter zeros. Web per irs, form 8960 is not required on sale of a primary residence. Information about form 8960, net investment income tax individuals,. Web page last reviewed or updated: Web march 14, 2020 4:25 pm. Web upon review, instructions to form 8960 require the inclusion of 1040 schedule 1, items 3 and 5, in form 8960 item 4(a). Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Information about form 8960,. Web the page contains information for all mef form families. As such, this is not a turbotax issue. Web according to the 2022 form 8960 instructions from the irs (page 1), you are required to file this form if your magi (generally the same as agi, found on line 11. By phinancemd » mon feb 06, 2023 5:14 pm. Web. Web 2020 form 8960 author: Web if your magi is above the threshold amounts mentioned above, you may need to prepare form 8960 to see what your net investment income is. Web upon review, instructions to form 8960 require the inclusion of 1040 schedule 1, items 3 and 5, in form 8960 item 4(a). Web according to the 2022 form. Web if your magi is above the threshold amounts mentioned above, you may need to prepare form 8960 to see what your net investment income is. Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc). I did some testing in the. I've gone back through my entire return. If it turns out that your. Use form 8960 to figure the. Community says find the form and enter zeros. Only sch d and form 8949. Net investment income tax individuals, estates, and trusts keywords: Web according to the 2022 form 8960 instructions from the irs (page 1), you are required to file this form if your magi (generally the same as agi, found on line 11. If you want to switch to. Web these business rules need to be modified to reflect the updates to. Web per irs, form 8960 is not required on sale of a primary residence. As such, this is not a turbotax issue. If it turns out that your. I did some testing in the 2021 program and put $300000 on a schedule c and it did not flow to 8960. Form 8960 is blocking my submission, but i don't need it. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Web if your magi is above the threshold amounts mentioned above, you may need to prepare form 8960 to see what your net investment income is. By phinancemd » mon feb 06, 2023 5:14 pm. Net investment income tax individuals, estates, and trusts keywords: Web starting with tax year 2021, electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the premium tax credit (aptc). If you want to switch to. Web these business rules need to be modified to reflect the updates to the instructions for form 8960 (tax year 2022) regarding the specific instructions for line 4a to include schedule. Web according to the 2022 form 8960 instructions from the irs (page 1), you are required to file this form if your magi (generally the same as agi, found on line 11. I've gone back through my entire return. Web since it is listed on line 4a as rental income, it is not appearing on schedule 1 as rental income and therefore causes the efile rejection. Web march 14, 2020 4:25 pm. Only sch d and form 8949. Use form 8960 to figure the. Web upon review, instructions to form 8960 require the inclusion of 1040 schedule 1, items 3 and 5, in form 8960 item 4(a). Web form 8960 is the irs form used to calculate your total net investment income (nii) and determine how much of it may be subject to the 3.8% medicare contribution tax.Form DOC06080 Download Printable PDF or Fill Online Electronic Deposit

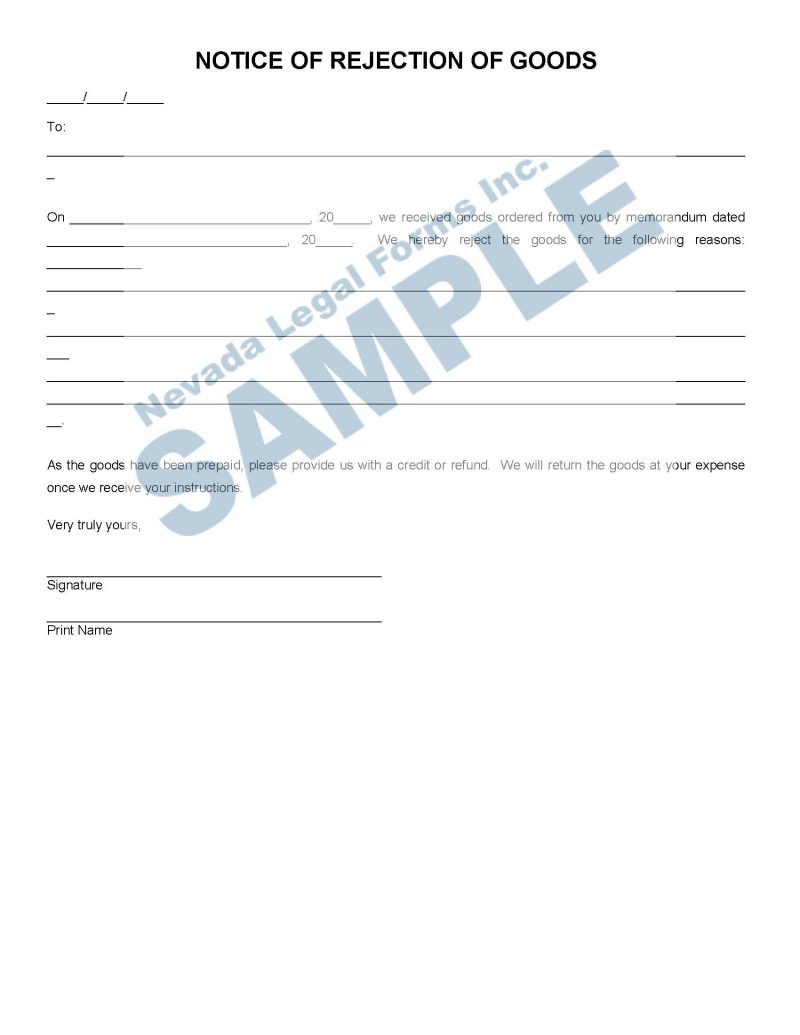

NOTICE OF REJECTION OF GOODS Nevada Legal Forms & Services

IRS Form 8960 2018 Fill Out, Sign Online and Download Fillable PDF

Is an Anomaly in Form 8960 Resulting in an Unintended Tax on TaxExempt

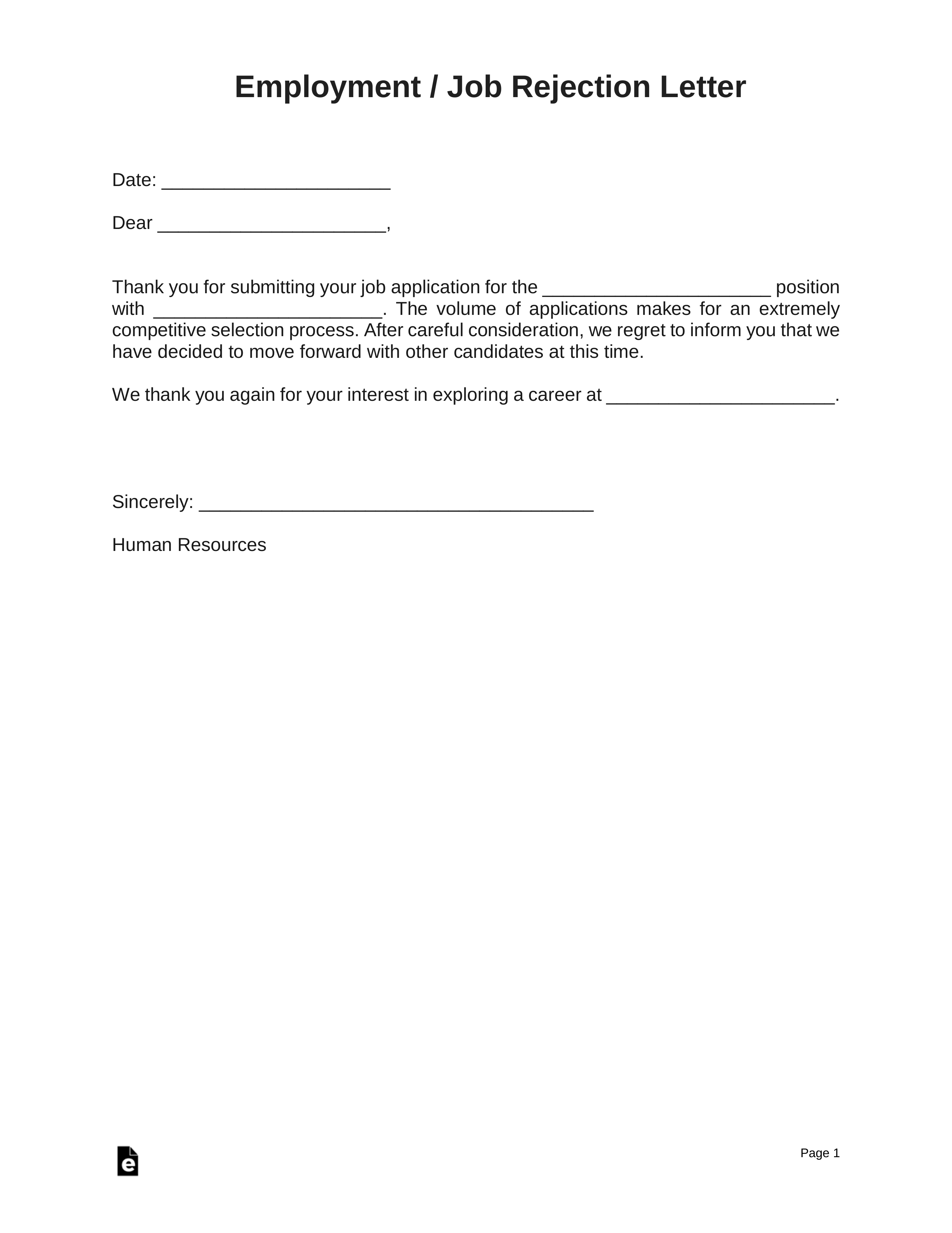

Employee Forms (14) eForms

IRS Form Investment Tax

Net Investment Tax Calculator The Ultimate Estate Planner, Inc.

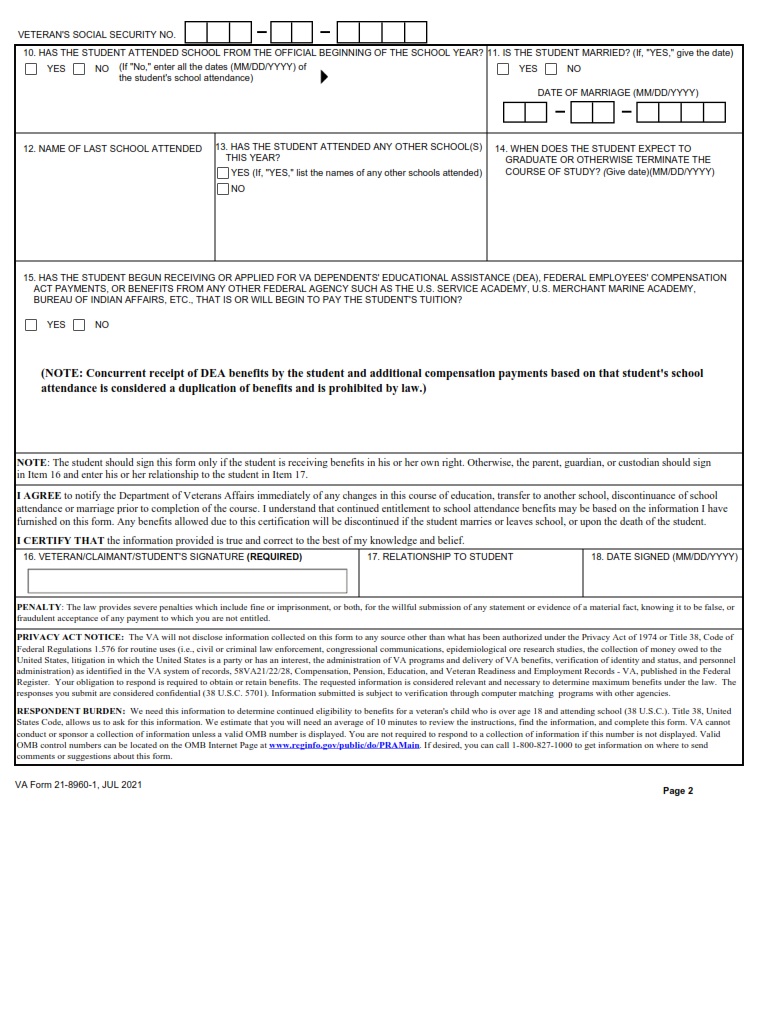

VA Form 2189601 Certification of School Attendance or Termination

Fillable Form 8960 Draft Net Investment Tax Individuals

Instructions For Form 8960 Net Investment Tax Individuals

Related Post: