Form 8958 Examples

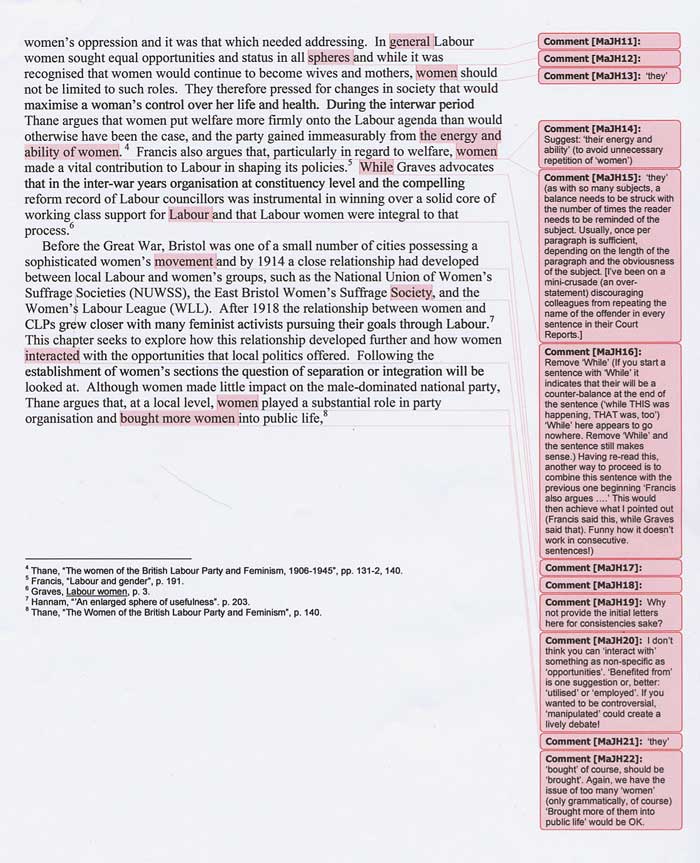

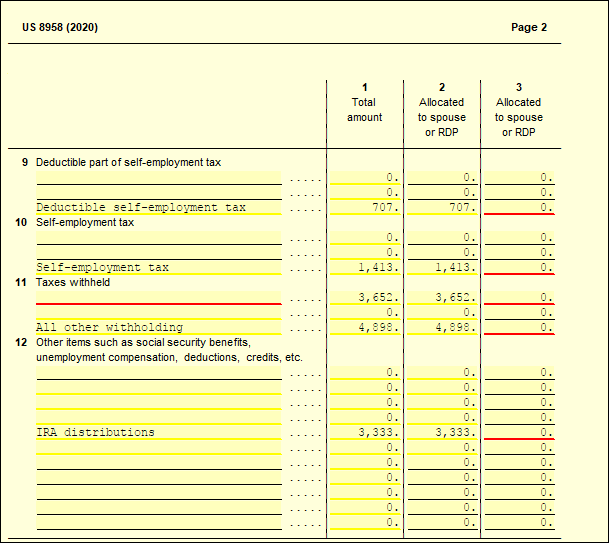

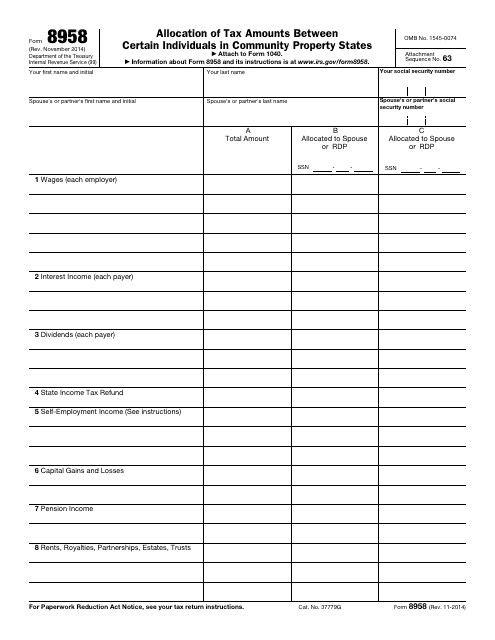

Form 8958 Examples - Form 8958 is also used for registered domestic partners who. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Save or instantly send your ready documents. Per irs publication 555 community property, starting on page 2, you would only complete form. To fulfill the married filing separately requirements, you’ll each report your own income separately. Web common questions about entering form 8958 income for community property allocation in lacerte. Use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Web form 8958 is used for married spouses in community property states who choose to file married filing separately. Solved • by intuit • 20 • updated august 14, 2023. Report all of the taxpayer income on the tax return. However, if you live in a community property state, you must report. Web complete form 8958 examples online with us legal forms. Report all of the taxpayer income on the tax return. Money earned while domiciled in a noncommunity property state is separate income; If you earned income and met the. Per irs publication 555 community property, starting on page 2, you would only complete form. Web form 8958 is used for married spouses in community property states who choose to file married filing separately. Web for example, under certain circumstances, income earned outside the united states is tax exempt. Complete form 8958 (which is an informational worksheet, amounts will not. Web for example, under certain circumstances, income earned outside the united states is tax exempt. Web form 8958 is used for married spouses in community property states who choose to file married filing separately. To complete form 8958, identify your. Web if your resident state is a community property state, and you file a federal tax return separately from your. To complete form 8958, identify your. Per irs publication 555 community property, starting on page 2, you would only complete form. To fulfill the married filing separately requirements, you’ll each report your own income separately. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version. Web common questions about entering form 8958 income for community property allocation in lacerte. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. To fulfill the married filing separately requirements, you’ll each report your own income separately. Web we last updated the allocation of tax amounts. Easily fill out pdf blank, edit, and sign them. Money earned while domiciled in a noncommunity property state is separate income; Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web form 8958 is used for married spouses in community property states who choose to. The form 8958 essentially reconciles the difference. If you earned income and met the. Form 8958 is also used for registered domestic partners who. Form 8958 **say thanks by clicking the thumb icon in a post **mark the post that answers your question by clicking on mark as best answer february 22, 2022 10:39 am. Web form 8958 allocation of. Web common questions about entering form 8958 income for community property allocation in lacerte. Web form 8958 is used for married spouses in community property states who choose to file married filing separately. Money earned while domiciled in a noncommunity property state is separate income; Web form 8958 allocation of tax amounts between certain individuals in community property states allocates. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Per irs publication 555 community property, starting on page 2, you would only complete form. Web form 8958 is used for married spouses in community property states who choose to file married filing separately. The form 8958. To fulfill the married filing separately requirements, you’ll each report your own income separately. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. However, if you live in a community property state, you must report. Web complete form 8958 examples online with us legal forms. Web. Form 8958 **say thanks by clicking the thumb icon in a post **mark the post that answers your question by clicking on mark as best answer february 22, 2022 10:39 am. Web common questions about entering form 8958 income for community property allocation in lacerte. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Per irs publication 555 community property, starting on page 2, you would only complete form. Web for instructions on how to complete form 8958, please check the link: Form 8958 is also used for registered domestic partners who. The form 8958 essentially reconciles the difference. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. If you earned income and met the. Web complete form 8958 examples online with us legal forms. To fulfill the married filing separately requirements, you’ll each report your own income separately. Web form 8958 is used for married spouses in community property states who choose to file married filing separately. To complete form 8958, identify your. Save or instantly send your ready documents. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Property that was owned separately before marriage is considered separate. Web form 8958, allocation of tax amounts between certain individuals in community property states, is an irs form used by married filing separate spouses or registered domestic. The form 8958 is only used when filing as married filing separate (mfs). Report all of the taxpayer income on the tax return. Easily fill out pdf blank, edit, and sign them.3.11.3 Individual Tax Returns Internal Revenue Service

3.24.3 Individual Tax Returns Internal Revenue Service

sample page

Form 8958 Allocation of Tax Amounts between Certain Individuals in

8958 Allocation of Tax Amounts UltimateTax Solution Center

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Form 8958 Example Fill Out and Sign Printable PDF Template signNow

U s individual tax return forms instructions & tax table (f1040a

IRS Form 8958 Fill Out, Sign Online and Download Fillable PDF

Americans forprosperity2007

Related Post: